Into The Wild

Into The Wild

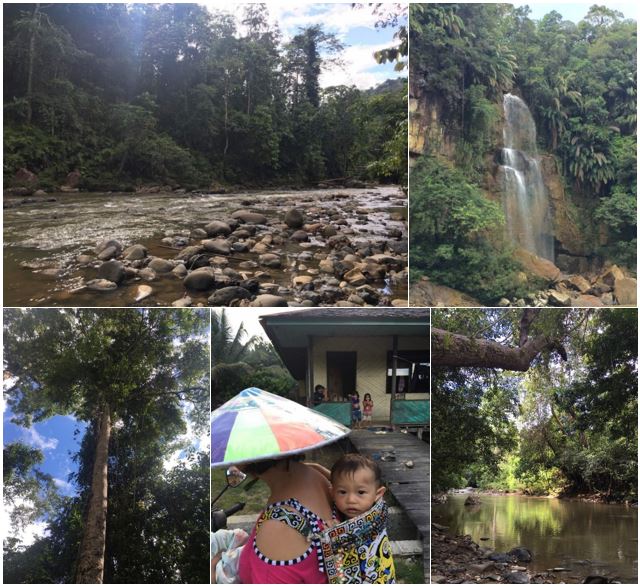

Jungle night trekking, from anxiety to serenity

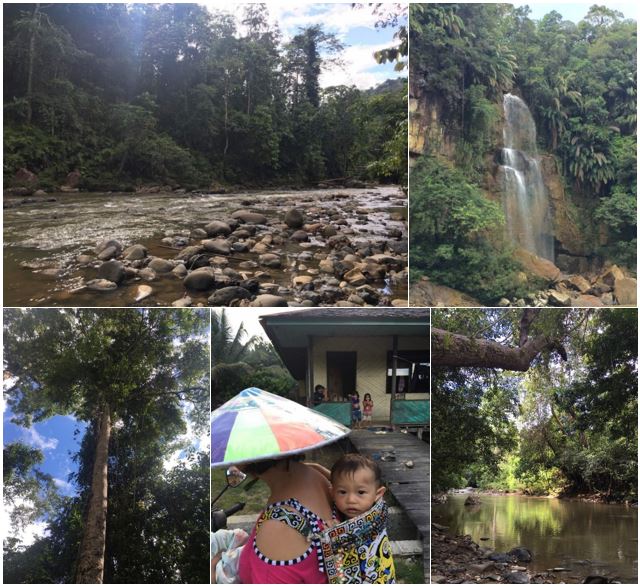

Mud-drenched clothes, legs covered by leeches, it didn’t seem to matter anymore after the darkness fell in the jungle. It was pitch black, and only where we pointed our flashlights could we anxiously try figure out what we were seeing. We heard cracking sounds in the dense vegetation around us. Was it coming for us? One thing is for sure, in the dark our mind is impeccable at seeing things that are not there. This didn’t seem to apply to our Dayak guide though, who effortlessly led us over slippery mud paths and deep canyons.

How much longer? We asked him. Oh, it’s just a cigarette smoke away now, he replied. Good, good… Three (!) hours later, we made it to the waters. It was then, when we reached the center of the serene, that we realized the Kalimantan Jungle was like a treasure in the deep sea, a beauty in the darkness…

Spending a lot of time in cities and farmlands, Heyokha team thought it was time to take it to the next level: we made a trip to the virgin forest area of Mahakam Hulu in East Kalimantan, Borneo.

Besides the things we learned during the trip that are relevant for our business, we witnessed wild life in its purest form: we believe we saw the awesome Malayan Porcupine, Rhinoceros Hornbill, Oriental Pied Hornbill, Black Spitting Cobra, Brahminy Kite and, to less high profile – but nevertheless as fascinating – stick insects, giant ants, leeches (sticking to our legs), loudly buzzing insects, and many type of frogs.

While the whole experience was astonishing, it was also very exhausting as most of the trip was made over bumpy muddy paths, either by four-wheel-drive or on foot… We think that if the infrastructure was better developed, this rain forest trip could easily be one of the most popular excursion trips in the world.

Anyway, on a more serious note, the trip enabled us to confirm with locals that the government’s objective to redistribute idle land to the people is already in progress. In addition, we came across the vast assets of a forestry company that may be interesting to look at. We will elaborate more below.

Land redistribution started

As we wrote earlier in this report and in our blog “No title No glory”, the size of idle state-owned company land that is to be redistributed to Indonesian farmers is staggering. Currently, the Environment and Forestry Ministry and the National Land Agency have each earmarked 12.7 million and 9 million hectares respectively to be redistributed.

We further wrote that, to support the redistribution of the land, the government planned to introduce the draft land bill (the first bill to support the Agrarian Law) into the House of Representative in the first week of June 2017 for deliberation. The bill would provide legal certainty on land rights such as the right to use (HGU) and rights to build (HGB) and to introduce new concepts such as rights to the earth below a plot of land called subterranean rights.

June has passed and the bill is still under review. Although no passed yet, it is still expected to be passed later this year. In practice however, the government is already redistributing land, we found out.

During the long trip through Borneo, all the way up to the Malaysian border we met military personnel who were being deployed to watch the border between Indonesia and Malaysia. They were telling us that in the border area, farmland is actively being converted to prevent loss of land to Malaysia as happened in two small islands. A win-win solution that strengthens boarder protection and creates income for farmers.

Can the most distressed asset in Indonesia stage a comeback?

Part of our exiting trip was hosted by SLJ Global (SULI IJ), Indonesia’s largest integrated forestry company. This allowed us to visit their 800,000 ha natural forestry concession area and to stay in their humble camp in the middle of the Borneo rainforest.

Other than enjoying the astonishing view, we also learned about how the company – active in a heavily regulated industry – managed to survive amid a bombardment of export bans, declining timber prices and hundreds of social and environmental issue cases.

The strongest blow to the company was the log and lumber export ban imposed by the government in 2004. This forced the company to locally process the logs into plywood and medium density fiberboard (MDF), a lower margin business with larger working capital requirements. It was only a matter of time before debt covenants were breached and production facilities were seized by its bankers. At the brink of being decimated, the recovery of plywood prices allowed a great escape, enabling the company to renegotiate with its bankers and restructure its loans in 2014 and early 2017.

With production facilities being back in operation again, the company could generate cash flow that is sufficient to service its debt and interest obligation and fund its working capital expansion.

There are some further upsides that may play out in the future. First of all, the architecture trend moving back towards wooden materials as reported by FT. For practical reasons: timber is beautiful, lightweight, and (learning from our trip to Kalimantan) actually sustainable.

Cross laminated timber (CLT) is expected to stage a comeback for timber as a building material for construction.

Secondly, the plans of the U.S. government to impose import duty on Chinese and Canadian exports (the largest timber exporters in the world) is expected to increase timber prices in the U.S. With the U.S being SULI’s main market, we believe it will boost the company’s profitability.

Thirdly, based on our conversations with Indonesian timber companies, there is the expectation that the government will at some point appreciate that the export bans – that are aimed at increasing value adding activities on Indonesian soil – are actually destroying value in the timber industry.

The thing is that the quality of Indonesian logs and lumber are internationally considered to be of premium quality. Processing it into lower grade products is seen by some as an equivalent to making bakso (meatballs) from Kobe beef. Therefore, industry insiders would not be surprised if the government will lift the export bans at some point. This would propel profits as the logs are now selling at massive discounts in the domestic market.

Lastly, the international scheme for carbon credit trading seems to be lucrative for forestry companies, who can earn money for reducing logging activities. If the Indonesian government was to adopt carbon credit trading, this could be a major upside to the firm’s profitability.

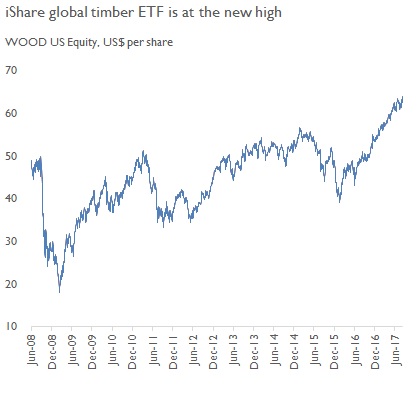

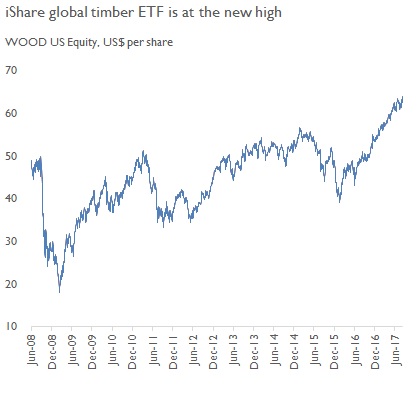

Global timber ETF making a new high as it becomes a popular choice for inflation-hedged

With such upside potential, and current depressed valuation, this company may be worth to be given a second look especially with iShare global timber ETF making a new high.

Share

Jungle night trekking, from anxiety to serenity

Mud-drenched clothes, legs covered by leeches, it didn’t seem to matter anymore after the darkness fell in the jungle. It was pitch black, and only where we pointed our flashlights could we anxiously try figure out what we were seeing. We heard cracking sounds in the dense vegetation around us. Was it coming for us? One thing is for sure, in the dark our mind is impeccable at seeing things that are not there. This didn’t seem to apply to our Dayak guide though, who effortlessly led us over slippery mud paths and deep canyons.

How much longer? We asked him. Oh, it’s just a cigarette smoke away now, he replied. Good, good… Three (!) hours later, we made it to the waters. It was then, when we reached the center of the serene, that we realized the Kalimantan Jungle was like a treasure in the deep sea, a beauty in the darkness…

Spending a lot of time in cities and farmlands, Heyokha team thought it was time to take it to the next level: we made a trip to the virgin forest area of Mahakam Hulu in East Kalimantan, Borneo.

Besides the things we learned during the trip that are relevant for our business, we witnessed wild life in its purest form: we believe we saw the awesome Malayan Porcupine, Rhinoceros Hornbill, Oriental Pied Hornbill, Black Spitting Cobra, Brahminy Kite and, to less high profile – but nevertheless as fascinating – stick insects, giant ants, leeches (sticking to our legs), loudly buzzing insects, and many type of frogs.

While the whole experience was astonishing, it was also very exhausting as most of the trip was made over bumpy muddy paths, either by four-wheel-drive or on foot… We think that if the infrastructure was better developed, this rain forest trip could easily be one of the most popular excursion trips in the world.

Anyway, on a more serious note, the trip enabled us to confirm with locals that the government’s objective to redistribute idle land to the people is already in progress. In addition, we came across the vast assets of a forestry company that may be interesting to look at. We will elaborate more below.

Land redistribution started

As we wrote earlier in this report and in our blog “No title No glory”, the size of idle state-owned company land that is to be redistributed to Indonesian farmers is staggering. Currently, the Environment and Forestry Ministry and the National Land Agency have each earmarked 12.7 million and 9 million hectares respectively to be redistributed.

We further wrote that, to support the redistribution of the land, the government planned to introduce the draft land bill (the first bill to support the Agrarian Law) into the House of Representative in the first week of June 2017 for deliberation. The bill would provide legal certainty on land rights such as the right to use (HGU) and rights to build (HGB) and to introduce new concepts such as rights to the earth below a plot of land called subterranean rights.

June has passed and the bill is still under review. Although no passed yet, it is still expected to be passed later this year. In practice however, the government is already redistributing land, we found out.

During the long trip through Borneo, all the way up to the Malaysian border we met military personnel who were being deployed to watch the border between Indonesia and Malaysia. They were telling us that in the border area, farmland is actively being converted to prevent loss of land to Malaysia as happened in two small islands. A win-win solution that strengthens boarder protection and creates income for farmers.

Can the most distressed asset in Indonesia stage a comeback?

Part of our exiting trip was hosted by SLJ Global (SULI IJ), Indonesia’s largest integrated forestry company. This allowed us to visit their 800,000 ha natural forestry concession area and to stay in their humble camp in the middle of the Borneo rainforest.

Other than enjoying the astonishing view, we also learned about how the company – active in a heavily regulated industry – managed to survive amid a bombardment of export bans, declining timber prices and hundreds of social and environmental issue cases.

The strongest blow to the company was the log and lumber export ban imposed by the government in 2004. This forced the company to locally process the logs into plywood and medium density fiberboard (MDF), a lower margin business with larger working capital requirements. It was only a matter of time before debt covenants were breached and production facilities were seized by its bankers. At the brink of being decimated, the recovery of plywood prices allowed a great escape, enabling the company to renegotiate with its bankers and restructure its loans in 2014 and early 2017.

With production facilities being back in operation again, the company could generate cash flow that is sufficient to service its debt and interest obligation and fund its working capital expansion.

There are some further upsides that may play out in the future. First of all, the architecture trend moving back towards wooden materials as reported by FT. For practical reasons: timber is beautiful, lightweight, and (learning from our trip to Kalimantan) actually sustainable.

Cross laminated timber (CLT) is expected to stage a comeback for timber as a building material for construction.

Secondly, the plans of the U.S. government to impose import duty on Chinese and Canadian exports (the largest timber exporters in the world) is expected to increase timber prices in the U.S. With the U.S being SULI’s main market, we believe it will boost the company’s profitability.

Thirdly, based on our conversations with Indonesian timber companies, there is the expectation that the government will at some point appreciate that the export bans – that are aimed at increasing value adding activities on Indonesian soil – are actually destroying value in the timber industry.

The thing is that the quality of Indonesian logs and lumber are internationally considered to be of premium quality. Processing it into lower grade products is seen by some as an equivalent to making bakso (meatballs) from Kobe beef. Therefore, industry insiders would not be surprised if the government will lift the export bans at some point. This would propel profits as the logs are now selling at massive discounts in the domestic market.

Lastly, the international scheme for carbon credit trading seems to be lucrative for forestry companies, who can earn money for reducing logging activities. If the Indonesian government was to adopt carbon credit trading, this could be a major upside to the firm’s profitability.

Global timber ETF making a new high as it becomes a popular choice for inflation-hedged

With such upside potential, and current depressed valuation, this company may be worth to be given a second look especially with iShare global timber ETF making a new high.

Share