With Inflation brewing, value stocks might outperform growth stocks

With Inflation brewing, value stocks might outperform growth stocks

For the last fifteen years, value stocks have been underperforming growth stocks. As such, many investors think that either value investing is dead or reversion to the mean is imminent.

With the brewing inflation as the catalyst, we are of the view that second scenario is more likely. We are of the view that the return of the glory days of value investing are near and its outperformance will begin with the closing of the unprecedented relative valuation gap between growth and value stocks.

Growth stocks have outperformed value stocks over the last fifteen years

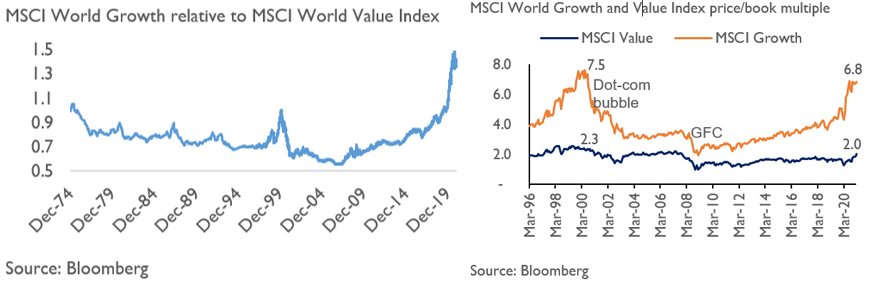

Value investing had worked well in the past, such as in the post-dot-com bubble era. However, for more than adecade, value has underperformed growth and the valuation gap has been widening instead of narrowing.

As of February 2021, value stocks valuation multiple gaps relative to growth stocks is nearly as high as during the dot-com bubble. MSCI Growth Index P/B multiple is at 240% premium to value P/B multiple. This is compared to around 60% premium a decade ago.

The rising inflation expectations and yields could be the potential catalyst for a reversal in growth-value performance

During the high CPI inflation era in the U.S in the 1970s, with CPI registered at around 7.25% per annum, value stocks significantly outperformed growth stocks by 9 percentage points per annum. Value stocks had earned 6.6%, meanwhile, growth stocks had lost 2.4% annually in real terms (i.e adjusted for inflation rate). Compounded annually, it translated to a 136% cumulative real return difference for the decade. How could such outperformance be explained?

In the previous blog, we have discussed the brewing inflation and its driving factors as US April 2021 CPI inflation hit 4.2% YoY. Inflation causes real asset value to decline. As a result, investors will demand a higher yield on their investment to compensate for this. Hence, the (expectations of a) rising inflation rate will create an upward pressure on interest rates.

The inflationary force and rising interest rates explain how value stocks could outperform growth stocks:

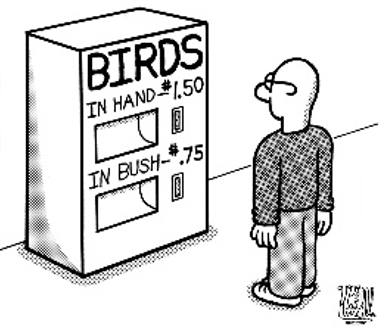

A bird in the hand worth two in the bush – The rise of nominal interest rates hurts high-multiple growth stocks more than value stocks. It reduces the present value of projected future cash flows. The more distant the cash flow is, the more severe the impacts will be. This means that growth stocks, which have a higher cashflow duration than value stocks, will experience stronger downward pressure on valuations as result of rising interest rates.

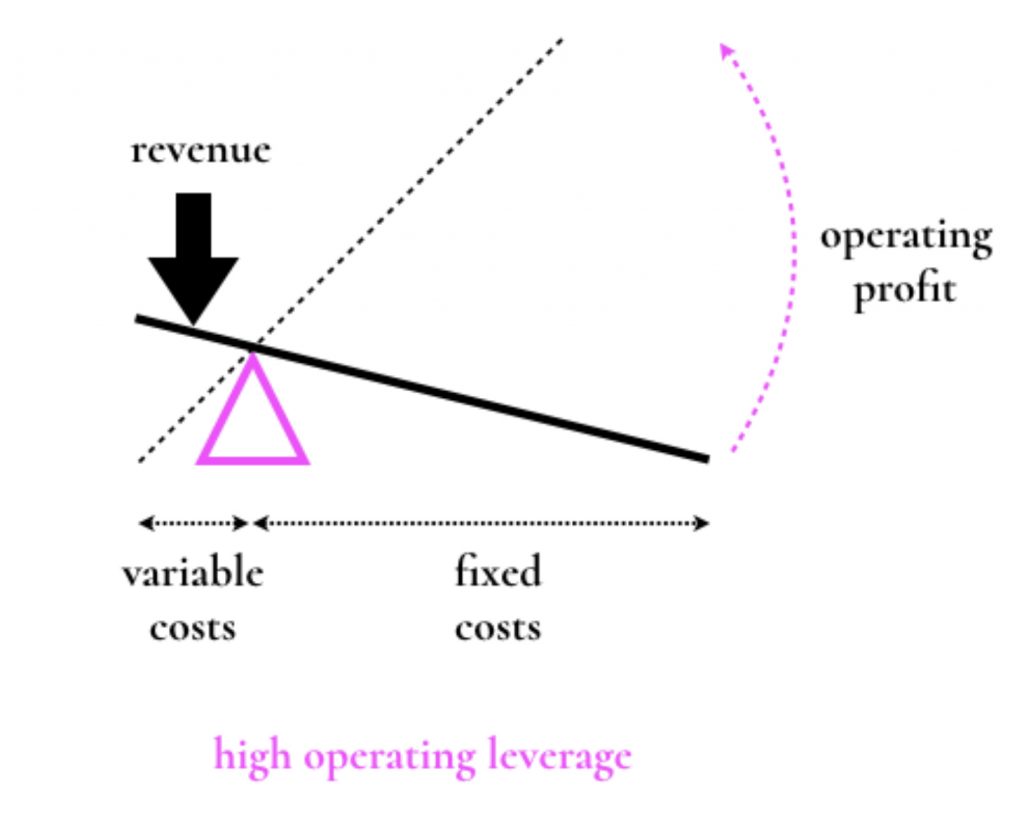

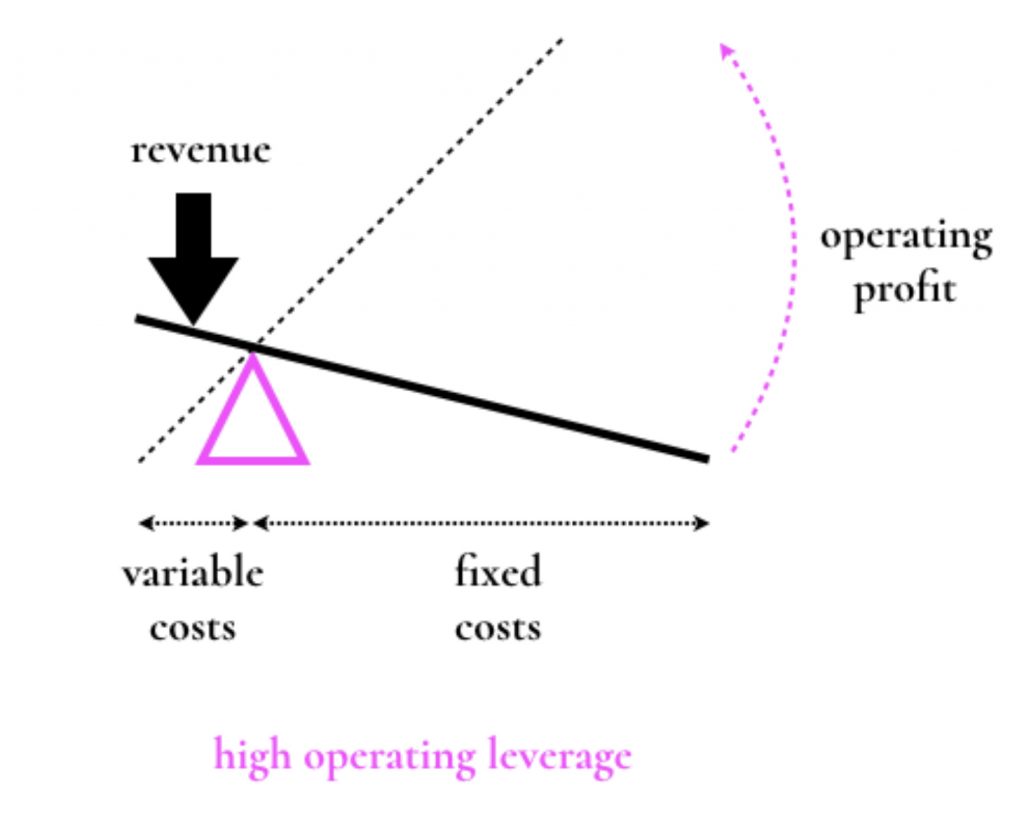

Being asset-heavy comes in handy given the operating leverage impact – Value stocks tend to be more asset-heavy. As such, during a period of high inflation, their cost structure is less volatile. A big component of their cost is fixed, so less sensitive to inflation. This trait is the opposite of growth stocks.

Investors should consider adding value stocks DNA to their portfolio

Inflation is the kryptonite for growth stocks. Therefore, investors should consider owning value stocks. The brewing inflation favours the out-of-favour value stocks in general.

In the context of today’s inflationary environment, value-commodity stocks would be on the top of the list. Inflation enhances their earning power and they are currently trading at low multiples of book value. Furthermore, some forces drive commodity prices to sustain at higher prices or to push them even higher.

What forces would that be? Stay tuned to our blog.

“Be still like a mountain and flow like a great river“

-Lao Tzu-

Share

For the last fifteen years, value stocks have been underperforming growth stocks. As such, many investors think that either value investing is dead or reversion to the mean is imminent.

With the brewing inflation as the catalyst, we are of the view that second scenario is more likely. We are of the view that the return of the glory days of value investing are near and its outperformance will begin with the closing of the unprecedented relative valuation gap between growth and value stocks.

Growth stocks have outperformed value stocks over the last fifteen years

Value investing had worked well in the past, such as in the post-dot-com bubble era. However, for more than adecade, value has underperformed growth and the valuation gap has been widening instead of narrowing.

As of February 2021, value stocks valuation multiple gaps relative to growth stocks is nearly as high as during the dot-com bubble. MSCI Growth Index P/B multiple is at 240% premium to value P/B multiple. This is compared to around 60% premium a decade ago.

The rising inflation expectations and yields could be the potential catalyst for a reversal in growth-value performance

During the high CPI inflation era in the U.S in the 1970s, with CPI registered at around 7.25% per annum, value stocks significantly outperformed growth stocks by 9 percentage points per annum. Value stocks had earned 6.6%, meanwhile, growth stocks had lost 2.4% annually in real terms (i.e adjusted for inflation rate). Compounded annually, it translated to a 136% cumulative real return difference for the decade. How could such outperformance be explained?

In the previous blog, we have discussed the brewing inflation and its driving factors as US April 2021 CPI inflation hit 4.2% YoY. Inflation causes real asset value to decline. As a result, investors will demand a higher yield on their investment to compensate for this. Hence, the (expectations of a) rising inflation rate will create an upward pressure on interest rates.

The inflationary force and rising interest rates explain how value stocks could outperform growth stocks:

A bird in the hand worth two in the bush – The rise of nominal interest rates hurts high-multiple growth stocks more than value stocks. It reduces the present value of projected future cash flows. The more distant the cash flow is, the more severe the impacts will be. This means that growth stocks, which have a higher cashflow duration than value stocks, will experience stronger downward pressure on valuations as result of rising interest rates.

Being asset-heavy comes in handy given the operating leverage impact – Value stocks tend to be more asset-heavy. As such, during a period of high inflation, their cost structure is less volatile. A big component of their cost is fixed, so less sensitive to inflation. This trait is the opposite of growth stocks.

Investors should consider adding value stocks DNA to their portfolio

Inflation is the kryptonite for growth stocks. Therefore, investors should consider owning value stocks. The brewing inflation favours the out-of-favour value stocks in general.

In the context of today’s inflationary environment, value-commodity stocks would be on the top of the list. Inflation enhances their earning power and they are currently trading at low multiples of book value. Furthermore, some forces drive commodity prices to sustain at higher prices or to push them even higher.

What forces would that be? Stay tuned to our blog.

“Be still like a mountain and flow like a great river“

-Lao Tzu-

Share