[Special Reports] Gold – The Return of Real Money

Gold has always been the ultimate hedge against uncertainty, and today's crises—currency debasement, soaring debt, and geopolitical risks—reinforce its value. Despite a rally, gold remains undervalued and under-owned, with miners lagging even further, offering significant upside. As central bank...

[Special Reports] De-dollarization: The Fall of the American Empire?

The global dominance of the U.S. dollar is facing a mounting challenge as nations increasingly turn to alternatives like gold, cryptocurrencies, and Central Bank Digital Currencies (CBDCs). This report explores the forces behind the accelerating trend of de-dollarization, drawing parallels to the hi...

[Emerging Trends Report] The Truth Behind Indonesia’s Nickel Boom: Fact or Fiction?

Amidst a surge of negative headlines in the Western press, Indonesia's nickel revolution is transforming the global EV supply chain. This comprehensive report delves into whether these criticisms hold any truth or if they are simply tactics by competitors to undermine Indonesia's growth. By examin...

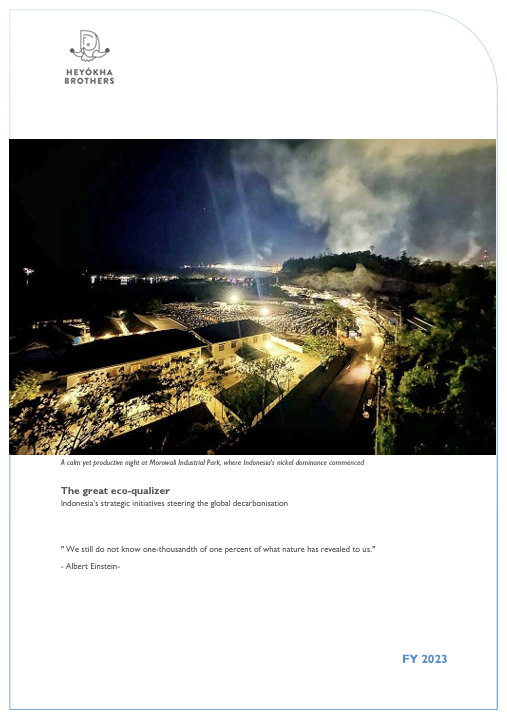

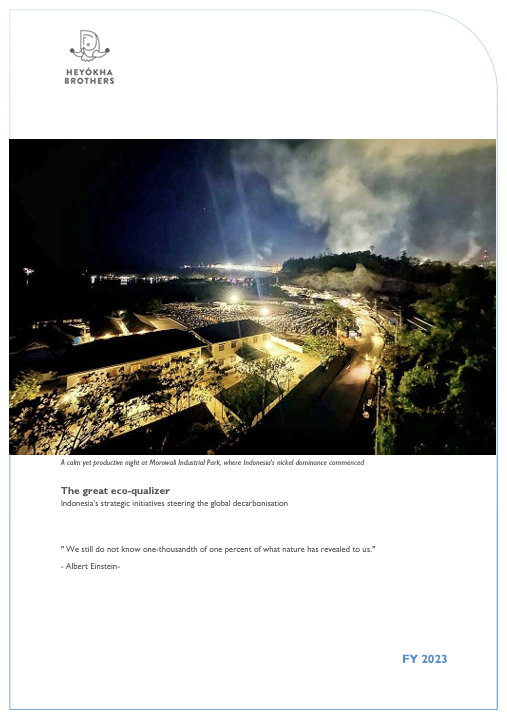

FY 2023 – The great eco-qualizer: Indonesia’s strategic initiatives steering global decarbonisation

Dive into this special report and you'll find yourself on an informative journey through Indonesia's green ambitions. Indonesia is not just an archipelago of stunning landscapes but a rising star in the global decarbonization effort. From the buzzing industrial hive of Morowali, where nicke...

Gold has always been the ultimate hedge against uncertainty, and today's crises—currency debasement, soaring debt, and geopolitical risks—reinforc...

The global dominance of the U.S. dollar is facing a mounting challenge as nations increasingly turn to alternatives like gold, cryptocurrencies, and C...

Amidst a surge of negative headlines in the Western press, Indonesia's nickel revolution is transforming the global EV supply chain. This comprehens...

Dive into this special report and you'll find yourself on an informative journey through Indonesia's green ambitions. Indonesia is not just an archi...

We drive our mission with an exceptional culture through applying a growth mindset where holistic and on the ground research is at our core.

You must read the following information before proceeding. By accessing this website and any pages thereof, you acknowledge that you have read the following information and accept the terms and conditions set out below and agree to be bound by such terms and conditions. If you do not agree to such terms and conditions, please do not access this website or any pages thereof.

The website has been prepared by Heyokha Brothers Limited and is solely intended for informational purposes and should not be construed as an inducement to purchase or sell any security, product, service, or investment. The Site does not solicit an offer to buy or sell any financial instrument or enter into any agreement. It is important to note that the opinions expressed on the Site are not considered investment advice, and it is recommended that individuals seek independent advice as needed to address their specific objectives, financial situation, or needs. It is the responsibility of the persons who access this website to observe all applicable laws and regulations.

The Site offers general information exclusively and does not consider the individual circumstances of any person. The data, opinions, and estimates presented on the Site are current as of the publication date and are subject to changes without notice. Additionally, it is possible that such information may become obsolete with time.

The content presented on this website is exclusively intended for authorized intermediaries and qualified investors within Hong Kong, such as institutional investors, professional investors, and accredited investors (as defined under the SFO). It is not intended for retail investors or individuals located outside of Hong Kong.

The products and services mentioned on this website may or may not be authorized or registered for distribution in a particular jurisdiction and may not be suitable for all investor types. It is important to note that this website is not intended to constitute an offer or solicitation, nor is it directed toward individuals if the provider of the information is prohibited by any law of any jurisdiction from making the information available. Moreover, the website is not intended for any use that would violate local laws or regulations. The provider of the information is not permitted to promote any products or services mentioned on this website in jurisdictions where such promotion would be prohibited.

If you are not a qualified investor or licensed intermediary in Hong Kong, you should not proceed any further.

The information provided on this Website is for informational purposes only and should not be considered as investment advice or a recommendation to buy, sell, hold, or transact in any investment. It is strongly recommended that individuals seek professional investment advice before making any investment decisions.

The information presented on this Website does not consider the investment objectives, specific needs, or financial situations of any investor. It is important to note that nothing on this Website is intended to constitute financial, legal, accounting, or tax advice.

Before making any investment decision, individuals should carefully consider whether an investment aligns with their investment objectives, specific needs, and financial situation. This should also include informing oneself of any potential tax implications, legal requirements, foreign exchange restrictions, or exchange control requirements that may be relevant to an investment based on the laws of one’s citizenship, residence, or domicile. If there is any doubt regarding the information on this Website, it is recommended that individuals seek independent professional financial advice.

It is important to note that any opinion, comment, article, financial analysis, market forecast, market commentary, or other information published on the Website is not binding on Heyokha or its affiliates, and they are not responsible for the information, opinions, or ideas presented.

Users are solely responsible for protecting and backing up their data and equipment, as well as taking reasonable precautions against any computer virus or other destructive elements. Additionally, users must ensure that their access to the Site is adequately secured against unauthorized access.

Users are prohibited from using the Site for any unlawful, defamatory, offensive, abusive, indecent, menacing, or threatening purposes, or in any way that infringes upon intellectual property rights or confidentiality obligations. Furthermore, users may not use the Site to cause annoyance, inconvenience, or anxiety to others, or in any way that violates any applicable laws or regulations.

Users must comply with any terms notified to them by third-party suppliers of data or services to the Site. This may include entering into a direct agreement with such third parties in respect of their use of the dat

This website may contain Third Party Content or links to websites maintained by third parties that are not affiliated with Heyokha. Heyokha does not participate in the preparation, adoption, or editing of such third-party materials and does not endorse or approve such content, either explicitly or implicitly. Any opinions or recommendations expressed on third party materials are solely those of the independent providers and not of Heyokha. Heyokha is not responsible for any errors or omissions relating to specific information provided by any third party.

Although Heyokha aims to provide accurate and timely information to users, neither Heyokha nor the Third-Party Content providers guarantee on the accuracy, timeliness, completeness, usefulness, or any other aspect of the information presented. Heyokha is not responsible or liable for any content, including advertising, products, or other materials on or available from third party sites. Users access and use Third Party content is at their own risk, and it is provided for informational purposes only. Both Heyokha and the Third-Party shall not be liable for any loss or damage arising from users’ reliance upon such information.

The content of this website is subject to copyright and other intellectual property laws. All trademarks, service marks, logos, and brand features displayed on the website are owned by their respective owners, except as explicitly noted. Users may use the information on this website and reproduce it for personal reference only. However, reproduction, distribution, transmission, incorporation in any other database, document, or material, and sale or distribution of any part of the contents of the website is strictly prohibited. Users may download or print individual sections of the website for personal use and information only, provided they are legally entitled to access the material and retain all copyright and other proprietary notices.

Any unauthorized use of the content, trademarks, service marks, or logos displayed on the website may violate copyright, trademark, or other intellectual property laws, as well as laws of privacy and publicity and communications. Any reference or link to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favouring by our company.

We provide such references or links solely for the convenience of our users and to provide additional information. Our company is not responsible for the accuracy, legality, or content of any external website or resource linked to or referenced from our website. Users are solely responsible for complying with the terms and conditions of any external websites or resources.

In order to enhance user experience and simplify future visits, this website may utilize cookies to track your activity. However, if you do not want to store cookies on your device, you can disable them by adjusting your browser’s security settings.

Please read our Privacy Statement before providing Heyokha with any personal information on this website. By providing any personal information on this website, you will be deemed to have read and accepted our Privacy Statement.

The information contained on the website is accurate only as of the date of publication and does not constitute investment advice or recommendations. While certain tools available on the website may provide general investment or financial analyses based upon personalized input, such results are for information purposes only, and users should refer to the assumptions and limitations relevant to the use of such tools as set out on the website. Users are solely responsible for determining whether any investment, security or strategy, or any other product or service is appropriate or suitable for them based on their investment objectives and personal and financial situation. Users should consult their independent professional advisers if they have any questions. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment.

Disclaimer of Liability Heyokha makes no warranty as to the accuracy, completeness, security, and confidentiality of information available through the website. Heyokha, its affiliates, directors, officers, or employees accept no liability for any errors or omissions relating to information available through the website or for any damages, losses or expenses arising in connection with the website, whether direct or indirect, arising from the use of the website or its contents. Heyokha also reserves the right to modify, suspend, or discontinue the website at any time without notice. Heyokha shall not be liable for any such modification, suspension, or discontinuance.

Pursuant to the Personal Data (Privacy) Ordinance (the ‘Ordinance’), Heyokha Brothers Limited is fully committed to safeguarding the privacy and security of personal information in compliance with all relevant laws and regulations. This statement outlines how we collect, use, and protect personal information provided to us.

We collect and maintain personal information, in a manner consistent with all relevant laws and regulations. We take necessary measures to ensure that personal information is correct and up to date. Personal information will only be used for the purpose of utilization and will not be disclosed to third parties (except our related parties e.g.: Administrators) without consent from the individual, except for justifiable grounds as required by laws and regulations.

We may collect various types of personal data from or about you, including:

The Company may automatically collect information about you from computer or internet browser through the use of cookies, pixel tags, and other similar technologies to enhance the user experience on its websites. Third parties may be used to collect personal data and information indirectly through monitoring activities conducted by the Company or on its behalf.

Company does not knowingly collect personal data from anyone under the age of 18 and does not seek to collect or process sensitive information unless required or permitted by law and with express consent.

We may use your personal data for the purposes it was provided and in connection with our services as described below:

We provide thorough training to our officers and employees to prevent the leakage or inappropriate use of personal information and provide information on a need-to-know basis. Managers in charge for controls and inspections are appointed, and appropriate control systems are established to ensure the privacy and security of personal information.

In the event that personal information is provided to an external contractor (e.g.: Administrator), we take responsibility for ensuring that the external contractor has proper systems in place to protect the privacy of personal information.

Personal information held by us relating to an individual will be kept confidential but may be provided to third parties the following purpose:

Disclosure, correction and termination of usage shall be carried out upon request of an individual in accordance with relevant laws and regulations.

Personal information collected will be retained for no longer than is necessary for the fulfilment of the purposes for which it was collected as per applicable laws and regulations.

Under relevant laws and regulations, any individual has the right to request access to any of the personal data that we hold by submitting a written request. Individuals are also entitled to request to correct, cancel or delete any of the personal data we hold if they believe such information is inaccurate, out of date or we no longer have a legitimate interest or lawful justification to retain or process.

Heyokha Brothers Limited is the issuer of this website and holds Type 4 (advising on securities) and Type 9 (asset management) licenses issued by the Securities and Futures Commission in Hong Kong.

The information provided on this website has been prepared solely for licensed intermediaries and qualified investors in Hong Kong, including professional investors, institutional investors, and accredited investors (as defined under the Securities and Futures Ordinance). The information provided on this website is for informational purposes only and should not be construed as investment advice, nor an offer to sell or a solicitation of an offer to buy any security, investment product, or service.

Investment involves risk and investors may lose their entire investment. Investors are advised to seek professional advice before making any investment decisions. Past performance is not indicative of future performance and the value of investments may fluctuate. Please refer to the offering document(s) for details, including the investment objectives, risk factors, and fees and charges.

Heyokha Brothers Limited reserves the right to amend, update, or remove any information on this website at any time without notice. By accessing and using this website, you agree to be bound by the above terms and conditions.

We drive our mission with an exceptional culture through applying a growth mindset where holistic and on the ground research is at our core.

You must read the following information before proceeding. By accessing this website and any pages thereof, you acknowledge that you have read the following information and accept the terms and conditions set out below and agree to be bound by such terms and conditions. If you do not agree to such terms and conditions, please do not access this website or any pages thereof.

The website has been prepared by Heyokha Brothers Limited and is solely intended for informational purposes and should not be construed as an inducement to purchase or sell any security, product, service, or investment. The Site does not solicit an offer to buy or sell any financial instrument or enter into any agreement. It is important to note that the opinions expressed on the Site are not considered investment advice, and it is recommended that individuals seek independent advice as needed to address their specific objectives, financial situation, or needs. It is the responsibility of the persons who access this website to observe all applicable laws and regulations.

The Site offers general information exclusively and does not consider the individual circumstances of any person. The data, opinions, and estimates presented on the Site are current as of the publication date and are subject to changes without notice. Additionally, it is possible that such information may become obsolete with time.

The content presented on this website is exclusively intended for authorized intermediaries and qualified investors within Hong Kong, such as institutional investors, professional investors, and accredited investors (as defined under the SFO). It is not intended for retail investors or individuals located outside of Hong Kong.

The products and services mentioned on this website may or may not be authorized or registered for distribution in a particular jurisdiction and may not be suitable for all investor types. It is important to note that this website is not intended to constitute an offer or solicitation, nor is it directed toward individuals if the provider of the information is prohibited by any law of any jurisdiction from making the information available. Moreover, the website is not intended for any use that would violate local laws or regulations. The provider of the information is not permitted to promote any products or services mentioned on this website in jurisdictions where such promotion would be prohibited.

If you are not a qualified investor or licensed intermediary in Hong Kong, you should not proceed any further.

The information provided on this Website is for informational purposes only and should not be considered as investment advice or a recommendation to buy, sell, hold, or transact in any investment. It is strongly recommended that individuals seek professional investment advice before making any investment decisions.

The information presented on this Website does not consider the investment objectives, specific needs, or financial situations of any investor. It is important to note that nothing on this Website is intended to constitute financial, legal, accounting, or tax advice.

Before making any investment decision, individuals should carefully consider whether an investment aligns with their investment objectives, specific needs, and financial situation. This should also include informing oneself of any potential tax implications, legal requirements, foreign exchange restrictions, or exchange control requirements that may be relevant to an investment based on the laws of one’s citizenship, residence, or domicile. If there is any doubt regarding the information on this Website, it is recommended that individuals seek independent professional financial advice.

It is important to note that any opinion, comment, article, financial analysis, market forecast, market commentary, or other information published on the Website is not binding on Heyokha or its affiliates, and they are not responsible for the information, opinions, or ideas presented.

Users are solely responsible for protecting and backing up their data and equipment, as well as taking reasonable precautions against any computer virus or other destructive elements. Additionally, users must ensure that their access to the Site is adequately secured against unauthorized access.

Users are prohibited from using the Site for any unlawful, defamatory, offensive, abusive, indecent, menacing, or threatening purposes, or in any way that infringes upon intellectual property rights or confidentiality obligations. Furthermore, users may not use the Site to cause annoyance, inconvenience, or anxiety to others, or in any way that violates any applicable laws or regulations.

Users must comply with any terms notified to them by third-party suppliers of data or services to the Site. This may include entering into a direct agreement with such third parties in respect of their use of the dat

This website may contain Third Party Content or links to websites maintained by third parties that are not affiliated with Heyokha. Heyokha does not participate in the preparation, adoption, or editing of such third-party materials and does not endorse or approve such content, either explicitly or implicitly. Any opinions or recommendations expressed on third party materials are solely those of the independent providers and not of Heyokha. Heyokha is not responsible for any errors or omissions relating to specific information provided by any third party.

Although Heyokha aims to provide accurate and timely information to users, neither Heyokha nor the Third-Party Content providers guarantee on the accuracy, timeliness, completeness, usefulness, or any other aspect of the information presented. Heyokha is not responsible or liable for any content, including advertising, products, or other materials on or available from third party sites. Users access and use Third Party content is at their own risk, and it is provided for informational purposes only. Both Heyokha and the Third-Party shall not be liable for any loss or damage arising from users’ reliance upon such information.

The content of this website is subject to copyright and other intellectual property laws. All trademarks, service marks, logos, and brand features displayed on the website are owned by their respective owners, except as explicitly noted. Users may use the information on this website and reproduce it for personal reference only. However, reproduction, distribution, transmission, incorporation in any other database, document, or material, and sale or distribution of any part of the contents of the website is strictly prohibited. Users may download or print individual sections of the website for personal use and information only, provided they are legally entitled to access the material and retain all copyright and other proprietary notices.

Any unauthorized use of the content, trademarks, service marks, or logos displayed on the website may violate copyright, trademark, or other intellectual property laws, as well as laws of privacy and publicity and communications. Any reference or link to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favouring by our company.

We provide such references or links solely for the convenience of our users and to provide additional information. Our company is not responsible for the accuracy, legality, or content of any external website or resource linked to or referenced from our website. Users are solely responsible for complying with the terms and conditions of any external websites or resources.

In order to enhance user experience and simplify future visits, this website may utilize cookies to track your activity. However, if you do not want to store cookies on your device, you can disable them by adjusting your browser’s security settings.

Please read our Privacy Statement before providing Heyokha with any personal information on this website. By providing any personal information on this website, you will be deemed to have read and accepted our Privacy Statement.

The information contained on the website is accurate only as of the date of publication and does not constitute investment advice or recommendations. While certain tools available on the website may provide general investment or financial analyses based upon personalized input, such results are for information purposes only, and users should refer to the assumptions and limitations relevant to the use of such tools as set out on the website. Users are solely responsible for determining whether any investment, security or strategy, or any other product or service is appropriate or suitable for them based on their investment objectives and personal and financial situation. Users should consult their independent professional advisers if they have any questions. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment.

Disclaimer of Liability Heyokha makes no warranty as to the accuracy, completeness, security, and confidentiality of information available through the website. Heyokha, its affiliates, directors, officers, or employees accept no liability for any errors or omissions relating to information available through the website or for any damages, losses or expenses arising in connection with the website, whether direct or indirect, arising from the use of the website or its contents. Heyokha also reserves the right to modify, suspend, or discontinue the website at any time without notice. Heyokha shall not be liable for any such modification, suspension, or discontinuance.

Pursuant to the Personal Data (Privacy) Ordinance (the ‘Ordinance’), Heyokha Brothers Limited is fully committed to safeguarding the privacy and security of personal information in compliance with all relevant laws and regulations. This statement outlines how we collect, use, and protect personal information provided to us.

We collect and maintain personal information, in a manner consistent with all relevant laws and regulations. We take necessary measures to ensure that personal information is correct and up to date. Personal information will only be used for the purpose of utilization and will not be disclosed to third parties (except our related parties e.g.: Administrators) without consent from the individual, except for justifiable grounds as required by laws and regulations.

We may collect various types of personal data from or about you, including:

The Company may automatically collect information about you from computer or internet browser through the use of cookies, pixel tags, and other similar technologies to enhance the user experience on its websites. Third parties may be used to collect personal data and information indirectly through monitoring activities conducted by the Company or on its behalf.

Company does not knowingly collect personal data from anyone under the age of 18 and does not seek to collect or process sensitive information unless required or permitted by law and with express consent.

We may use your personal data for the purposes it was provided and in connection with our services as described below:

We provide thorough training to our officers and employees to prevent the leakage or inappropriate use of personal information and provide information on a need-to-know basis. Managers in charge for controls and inspections are appointed, and appropriate control systems are established to ensure the privacy and security of personal information.

In the event that personal information is provided to an external contractor (e.g.: Administrator), we take responsibility for ensuring that the external contractor has proper systems in place to protect the privacy of personal information.

Personal information held by us relating to an individual will be kept confidential but may be provided to third parties the following purpose:

Disclosure, correction and termination of usage shall be carried out upon request of an individual in accordance with relevant laws and regulations.

Personal information collected will be retained for no longer than is necessary for the fulfilment of the purposes for which it was collected as per applicable laws and regulations.

Under relevant laws and regulations, any individual has the right to request access to any of the personal data that we hold by submitting a written request. Individuals are also entitled to request to correct, cancel or delete any of the personal data we hold if they believe such information is inaccurate, out of date or we no longer have a legitimate interest or lawful justification to retain or process.

Heyokha Brothers Limited is the issuer of this website and holds Type 4 (advising on securities) and Type 9 (asset management) licenses issued by the Securities and Futures Commission in Hong Kong.

The information provided on this website has been prepared solely for licensed intermediaries and qualified investors in Hong Kong, including professional investors, institutional investors, and accredited investors (as defined under the Securities and Futures Ordinance). The information provided on this website is for informational purposes only and should not be construed as investment advice, nor an offer to sell or a solicitation of an offer to buy any security, investment product, or service.

Investment involves risk and investors may lose their entire investment. Investors are advised to seek professional advice before making any investment decisions. Past performance is not indicative of future performance and the value of investments may fluctuate. Please refer to the offering document(s) for details, including the investment objectives, risk factors, and fees and charges.

Heyokha Brothers Limited reserves the right to amend, update, or remove any information on this website at any time without notice. By accessing and using this website, you agree to be bound by the above terms and conditions.