The Case for Copper: When the World Runs on Wires, Not Wishes

The Case for Copper: When the World Runs on Wires, Not Wishes

When most people think of copper, they picture something painfully mundane, whether it’s the loose change in their pocket, a rusty pipe under the sink, or those aesthetically pleasing heavy frying pans that’s always hanging in fancy restaurants.

But copper has quietly graduated from plumbing and pennies to something far more vital: the wiring behind the world’s biggest transformations. It’s in the electric car you’re eyeing. It’s in the AI data center streaming your kid’s favorite cartoon. It’s even in the defense systems supposedly protecting us from everything except inflation.

In a world of speculative bubbles and digital promises, copper is refreshingly real.

If gold reflects fear and silver mirrors doubt, copper is the metal of action. This is seen with shovels in dirt, cables in trenches, and electrons flowing through everything from EVs to AI data centers. It doesn’t glitter. It conducts.

Lately, that conductor is buzzing. Prices hovered near US$10,500 per ton in Q3, just shy of record highs, as the copper market reminded us how fragile its foundations really are.

A Market One Mudslide Away

The Grasberg mine has one of the largest reserves of gold and copper in the world, located in Mimika Regency, Central Papua

Source: Mining.com

Start in Indonesia. In September, Freeport-McMoRan’s massive Grasberg mine declared force majeure after a mudslide tragically halted ore shipments. The loss? Around 250,000 tons, enough to rattle global balances.

Next, over to the DRC, where Ivanhoe’s Kamoa-Kakula mine, touted as one of the world’s most important new producers, faced repeated power disruptions.

In Chile, state-owned Codelco can’t catch a break. Its El Teniente mine continues to battle geotechnical issues, with broader output targets repeatedly revised down.

Add it all up, and more than 500,000 tons of copper concentrate evaporated in months. That’s more than a week of global demand, and we’ve only talked about three sites.

Annual mine disruptions are now running at 6 percent of total global output, or about 1.3 million tons. That’s not a rounding error. It’s systemic stress.

At Heyokha, we’ve long argued that price-setting power arises when fragility meets indispensability. Copper now sits at that intersection.

Structural Demand, Not a Supercycle

While the supply side buckles, the demand story is shifting into overdrive.

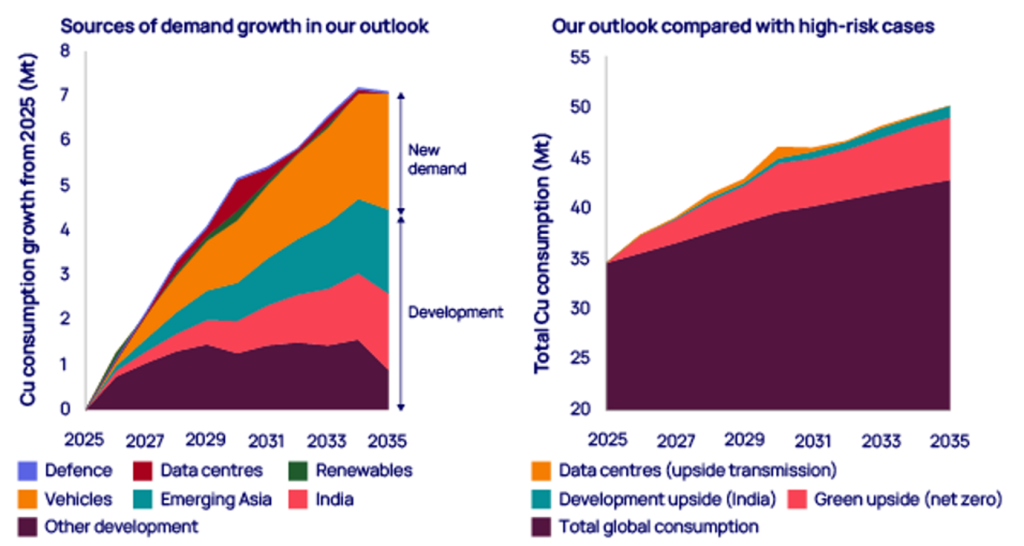

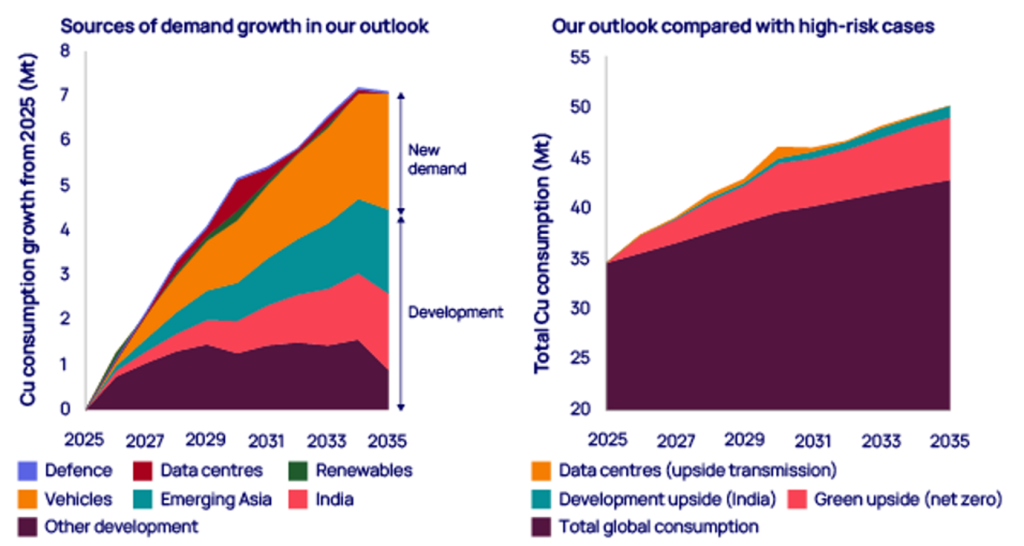

Between now and 2035, copper demand is projected to rise 24 percent, hitting 43 million tons. And this time, it’s not the old industrial cycle. It’s the future coming online.

- Grid electrification will require about 3 million tons per year by 2035

- Defense and industrial reshoring? Add another 4 to 5 million tons

- Clean energy? Even the IEA’s conservative estimates say copper demand from clean tech will double by 2030

Copper demand in multiple sectors are seeing multi-year growth

Source: Wood Mackenzie

And let’s not forget the most quietly copper-hungry sector of all: data centers.

Every ChatGPT query, every AI model training run, every cloud-stored selfie you forgot to delete — these are all powered by backend infrastructure that’s wired wall-to-wall with copper. Each megawatt of AI data center capacity requires 20 to 40 tons of it. Multiply that by trillions in projected AI infrastructure and you have a demand curve that doesn’t blink.

This is not a hype cycle. This is embedded, durable, electrified demand.

A Supply Chain That Can’t Keep Up

So where’s all the new copper coming from?

It’s not that easy. Global ore grades have fallen 40 percent since 1990. Capital intensity is up 65 percent since 2020. And permitting a new copper mine? You’re looking at a decade, if you’re lucky.

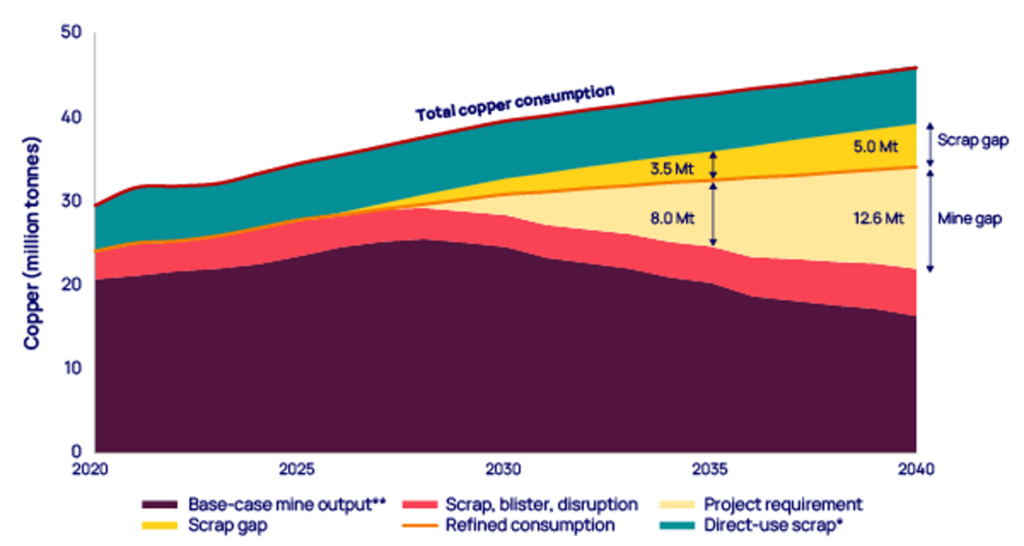

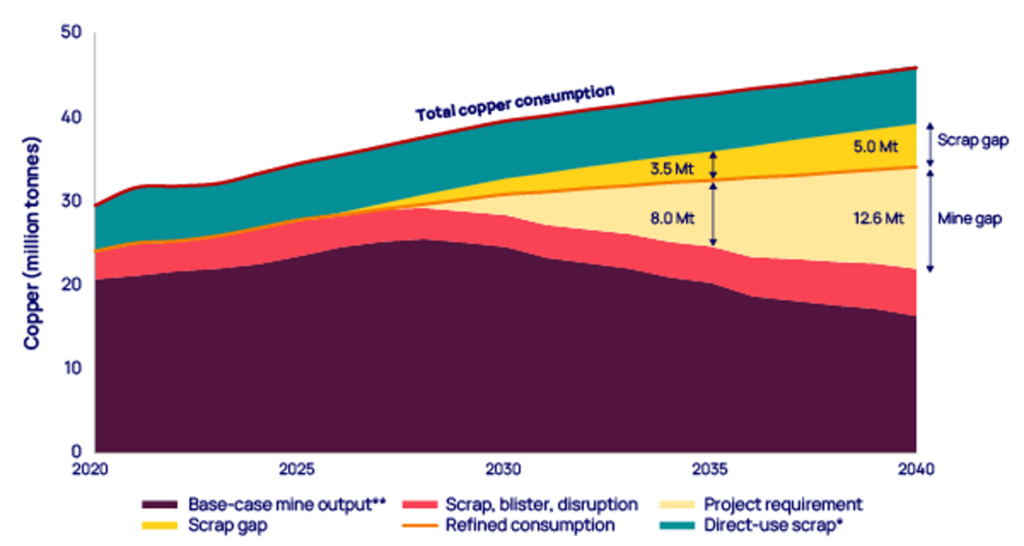

Rising copper shortage signals long terms risk ahead

Source: Wood Mackenzie

To stay balanced, the world needs:

- 8 million tons of new mine capacity annually

- 3 to 4 million tons from recycling

- Roughly 900,000 tons of new projects brought online each year, double the historical average

But the pipeline is thin, and investors know it.

That’s why we’re seeing consolidation instead of exploration. Anglo American’s US$53 billion merger with Teck isn’t just about synergies. It’s about locking in long-life assets before scarcity goes systemic.

Glencore, too, keeps sniffing around for scale. Because in a tight copper world, it’s not who finds the next deposit. It’s who controls the infrastructure to extract and ship it.

The Currency of Scarcity

With incentive prices creeping above US$11,000 per ton and marginal production costs approaching US$3 per pound, the copper market is entering new territory.

Not because demand is spiking suddenly, but because it’s changing shape. When copper demand is driven by nation-state priorities such as energy security, defense, and technological sovereignty, it’s no longer elastic.

This isn’t a boom. It’s a recalibration.

And the world may soon learn that it takes more than capital to produce copper. It takes patience, political coordination, and power grids that don’t collapse under strain.

Final Thoughts: The Copper Thread in Every Grand Vision

Copper might not be the headline-grabber in your portfolio. It hasn’t been memed to the moon or pumped on Reddit chats, but it will quietly underwrite every grand vision of a rewired, electrified, AI-enhanced future.

In an era obsessed with what’s virtual, copper reminds us that none of it works without something real.

Yes, the path to US$11,000 copper may be volatile. But volatility isn’t the enemy. Unpreparedness is.

When the lights go on, in factories, data centers, electric grids, and defense systems, copper will be there, humming in the background.

Conducting reality.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

When most people think of copper, they picture something painfully mundane, whether it’s the loose change in their pocket, a rusty pipe under the sink, or those aesthetically pleasing heavy frying pans that’s always hanging in fancy restaurants.

But copper has quietly graduated from plumbing and pennies to something far more vital: the wiring behind the world’s biggest transformations. It’s in the electric car you’re eyeing. It’s in the AI data center streaming your kid’s favorite cartoon. It’s even in the defense systems supposedly protecting us from everything except inflation.

In a world of speculative bubbles and digital promises, copper is refreshingly real.

If gold reflects fear and silver mirrors doubt, copper is the metal of action. This is seen with shovels in dirt, cables in trenches, and electrons flowing through everything from EVs to AI data centers. It doesn’t glitter. It conducts.

Lately, that conductor is buzzing. Prices hovered near US$10,500 per ton in Q3, just shy of record highs, as the copper market reminded us how fragile its foundations really are.

A Market One Mudslide Away

The Grasberg mine has one of the largest reserves of gold and copper in the world, located in Mimika Regency, Central Papua

Source: Mining.com

Start in Indonesia. In September, Freeport-McMoRan’s massive Grasberg mine declared force majeure after a mudslide tragically halted ore shipments. The loss? Around 250,000 tons, enough to rattle global balances.

Next, over to the DRC, where Ivanhoe’s Kamoa-Kakula mine, touted as one of the world’s most important new producers, faced repeated power disruptions.

In Chile, state-owned Codelco can’t catch a break. Its El Teniente mine continues to battle geotechnical issues, with broader output targets repeatedly revised down.

Add it all up, and more than 500,000 tons of copper concentrate evaporated in months. That’s more than a week of global demand, and we’ve only talked about three sites.

Annual mine disruptions are now running at 6 percent of total global output, or about 1.3 million tons. That’s not a rounding error. It’s systemic stress.

At Heyokha, we’ve long argued that price-setting power arises when fragility meets indispensability. Copper now sits at that intersection.

Structural Demand, Not a Supercycle

While the supply side buckles, the demand story is shifting into overdrive.

Between now and 2035, copper demand is projected to rise 24 percent, hitting 43 million tons. And this time, it’s not the old industrial cycle. It’s the future coming online.

- Grid electrification will require about 3 million tons per year by 2035

- Defense and industrial reshoring? Add another 4 to 5 million tons

- Clean energy? Even the IEA’s conservative estimates say copper demand from clean tech will double by 2030

Copper demand in multiple sectors are seeing multi-year growth

Source: Wood Mackenzie

And let’s not forget the most quietly copper-hungry sector of all: data centers.

Every ChatGPT query, every AI model training run, every cloud-stored selfie you forgot to delete — these are all powered by backend infrastructure that’s wired wall-to-wall with copper. Each megawatt of AI data center capacity requires 20 to 40 tons of it. Multiply that by trillions in projected AI infrastructure and you have a demand curve that doesn’t blink.

This is not a hype cycle. This is embedded, durable, electrified demand.

A Supply Chain That Can’t Keep Up

So where’s all the new copper coming from?

It’s not that easy. Global ore grades have fallen 40 percent since 1990. Capital intensity is up 65 percent since 2020. And permitting a new copper mine? You’re looking at a decade, if you’re lucky.

Rising copper shortage signals long terms risk ahead

Source: Wood Mackenzie

To stay balanced, the world needs:

- 8 million tons of new mine capacity annually

- 3 to 4 million tons from recycling

- Roughly 900,000 tons of new projects brought online each year, double the historical average

But the pipeline is thin, and investors know it.

That’s why we’re seeing consolidation instead of exploration. Anglo American’s US$53 billion merger with Teck isn’t just about synergies. It’s about locking in long-life assets before scarcity goes systemic.

Glencore, too, keeps sniffing around for scale. Because in a tight copper world, it’s not who finds the next deposit. It’s who controls the infrastructure to extract and ship it.

The Currency of Scarcity

With incentive prices creeping above US$11,000 per ton and marginal production costs approaching US$3 per pound, the copper market is entering new territory.

Not because demand is spiking suddenly, but because it’s changing shape. When copper demand is driven by nation-state priorities such as energy security, defense, and technological sovereignty, it’s no longer elastic.

This isn’t a boom. It’s a recalibration.

And the world may soon learn that it takes more than capital to produce copper. It takes patience, political coordination, and power grids that don’t collapse under strain.

Final Thoughts: The Copper Thread in Every Grand Vision

Copper might not be the headline-grabber in your portfolio. It hasn’t been memed to the moon or pumped on Reddit chats, but it will quietly underwrite every grand vision of a rewired, electrified, AI-enhanced future.

In an era obsessed with what’s virtual, copper reminds us that none of it works without something real.

Yes, the path to US$11,000 copper may be volatile. But volatility isn’t the enemy. Unpreparedness is.

When the lights go on, in factories, data centers, electric grids, and defense systems, copper will be there, humming in the background.

Conducting reality.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share