China in the Fast Lane: How New Consumer Favorites Are Reshaping Indonesia’s Market

China in the Fast Lane: How New Consumer Favorites Are Reshaping Indonesia’s Market

On a recent stroll through Senayan City mall, I saw something that perfectly captured the current consumer moment in Indonesia: a small, blink-and-you-miss-it booth by Chinese EV maker Xpeng.

But despite its humble exhibition, the hype was real. Their X9 model? Completely sold out. Next batch? Not until June 2026.

XPeng exhibition in Senayan City mall.

Despite its small booth, crowds were forming to see inside the cars

Go towards West Jakarta and Chagee, a Chinese tea brand, launched with a bang. One of their newest branch in West Jakarta in Puri Indah Mall resulted in three-hour lines, just to get a sip of their viral cheese-topped tea drinks. It was less of a store opening and more of a cultural event.

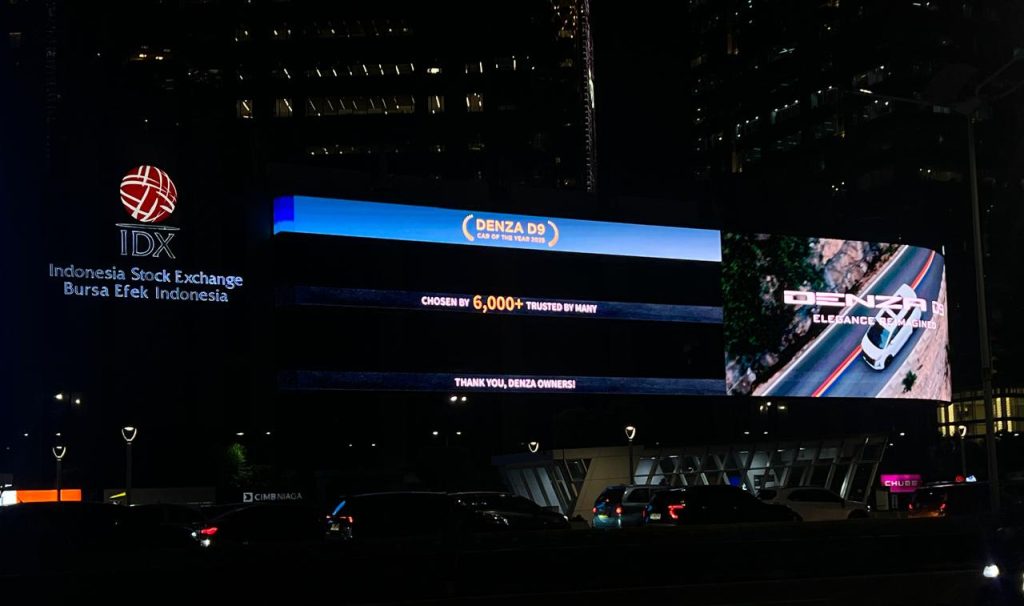

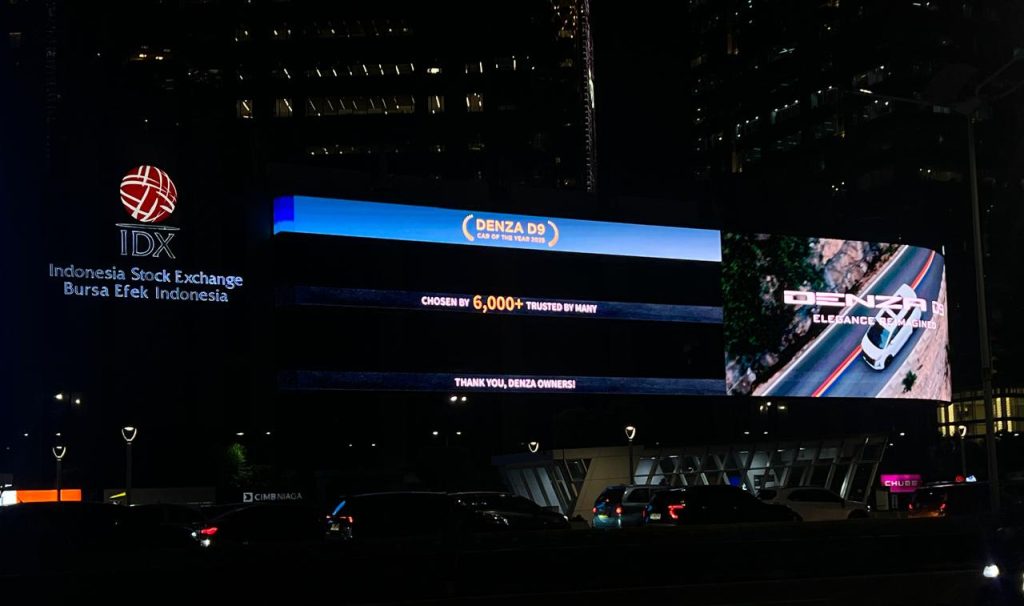

At the same time, the Denza D9 (from BYD) took over the Indonesia Stock Exchange billboard with a bold message: Car of the Year, 2025.

Rather than a “takeover,” these moments show how quickly Indonesian consumers embrace products that match their lifestyle — whether they come from Japan, Korea, or China. And for local malls, dealerships, and marketing agencies, that means more traffic, more deals, and more commissions.

The BYD Denza Flex

Let’s talk about Denza for a second. Their D9 electric MPV didn’t just quietly enter the market. It announced its arrival in ALL CAPS.

- Giant billboards outside the IDX and along main roads

- Crowned Car of the Year and Best High MPV EV by Otomotif 2025

- More advertisements on one of the busiest roads people commute on

We weren’t kidding about the advertisements everywhere

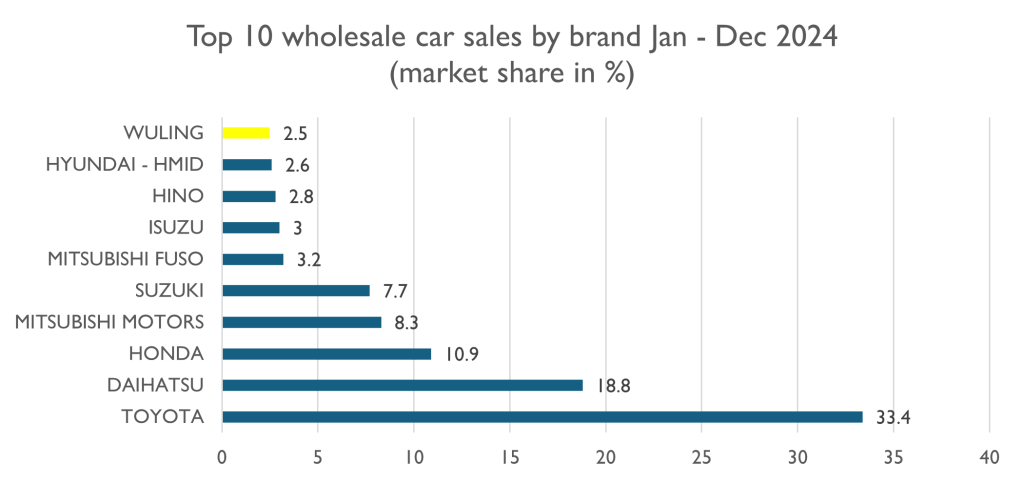

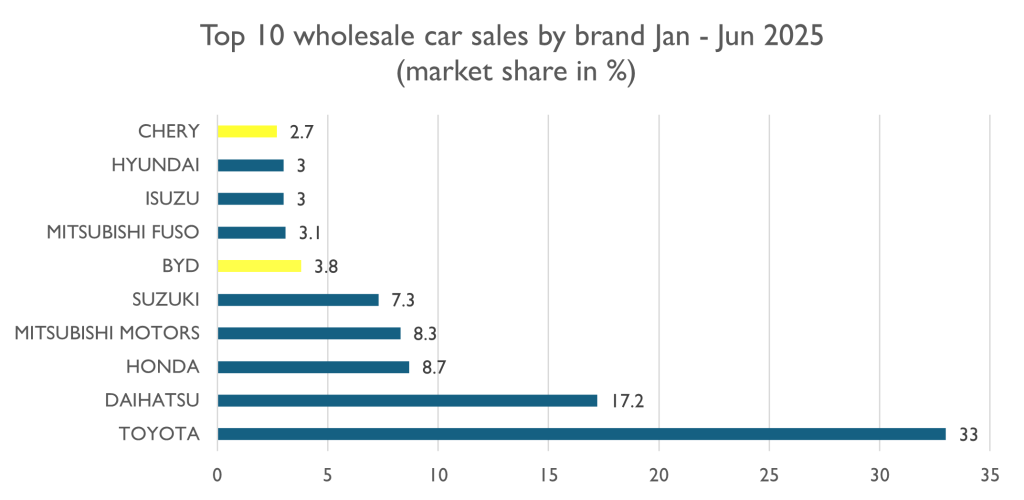

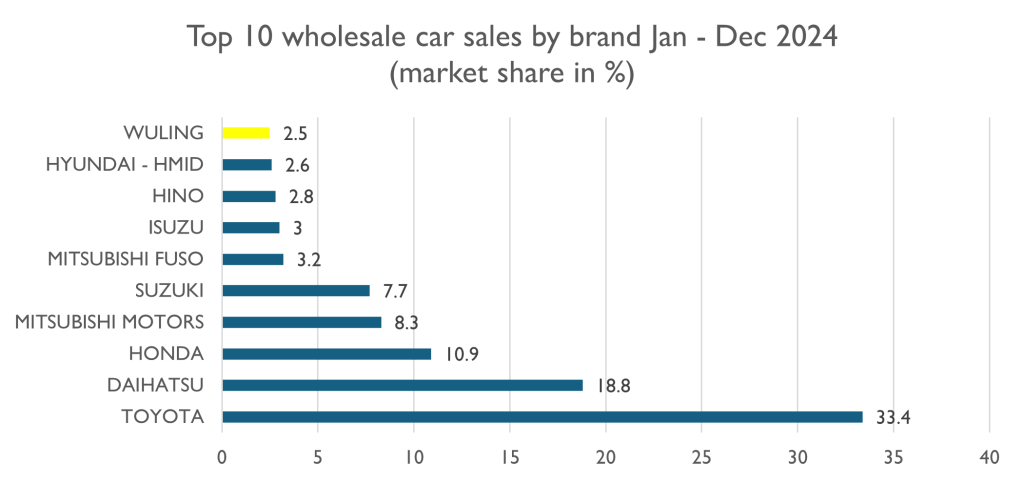

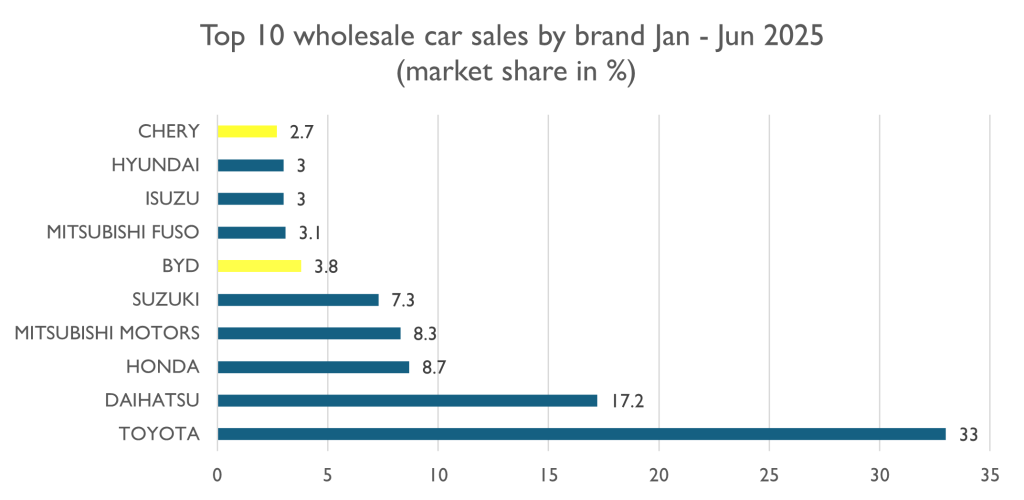

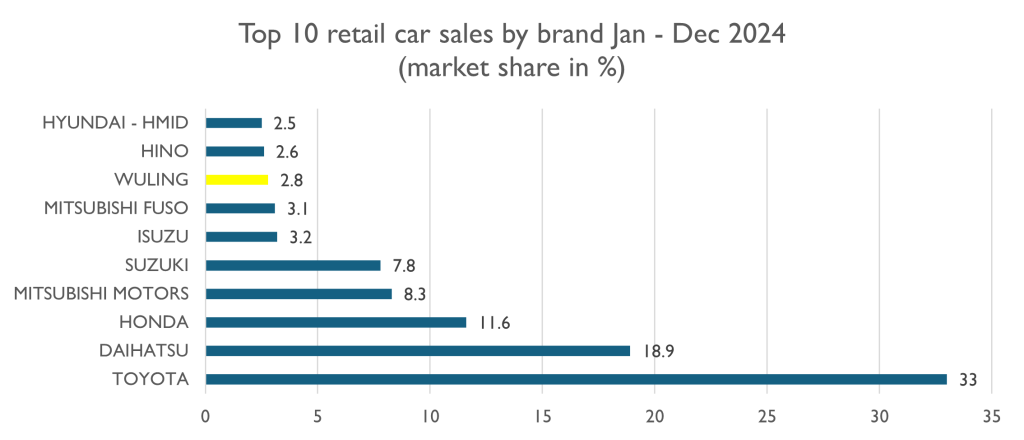

In the luxury EV category, BYD is increasingly catching up, and by mid-2025, its wholesale market share climbed to 3.8%, overtaking brands like Wuling and closing in on Hyundai and Suzuki.

Chinese brands are no longer side quests. They are contenders

Source: GAIKINDO

For context, this growth also means more work for Indonesian distributors and service providers who partner with these brands — showing how the value chain doesn’t stop at the factory gate.

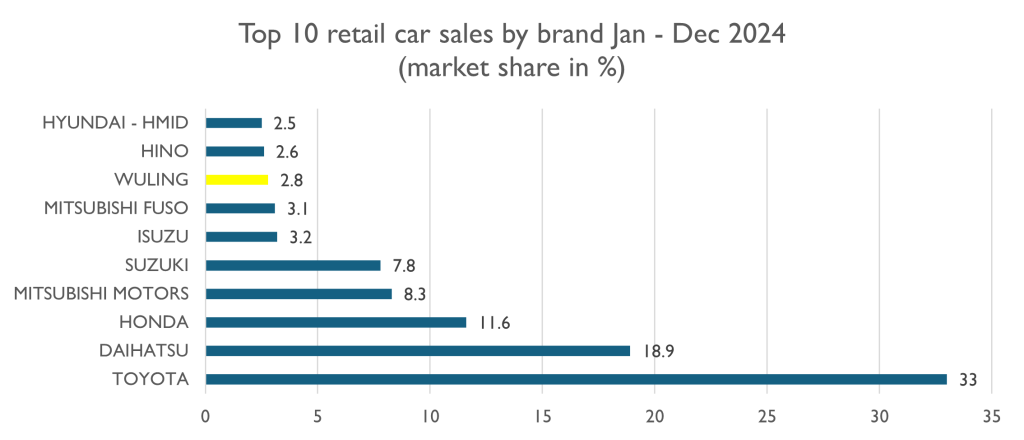

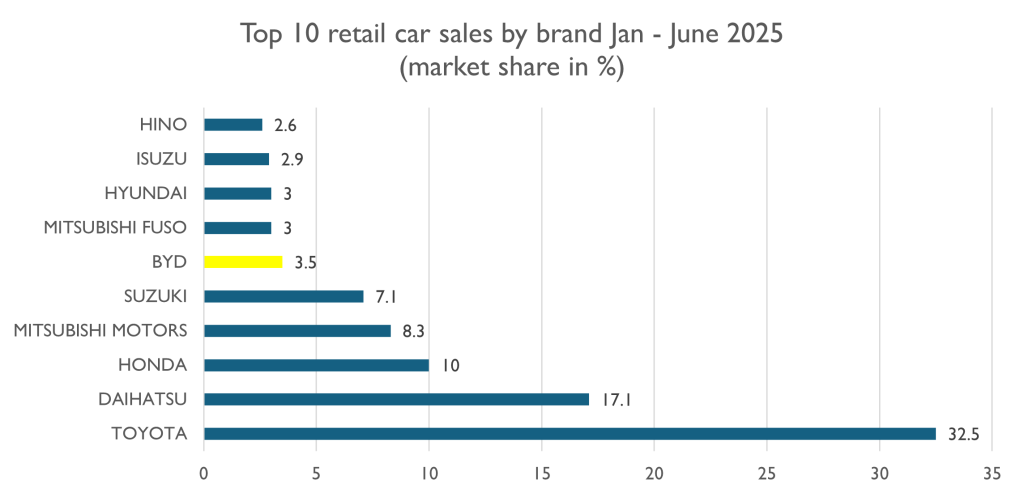

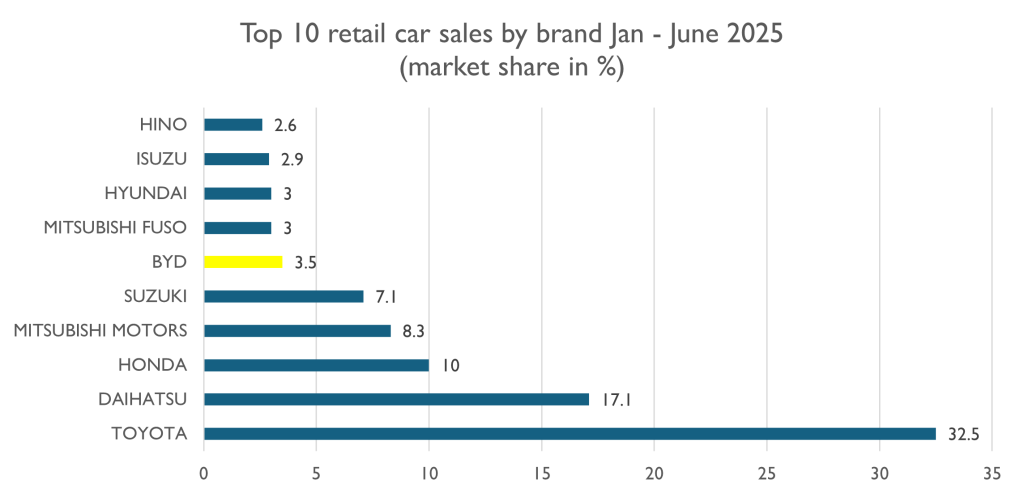

In retail terms, the shift is even more telling:

BYD entered the top 10 by mid-2025, reaching 3.5% retail share in just 18 months. That means these cars aren’t just being stocked—they’re being driven.

Source: GAIKINDO

XPeng, while not as loud in its marketing, is just as methodical. At the 2025 GIIAS auto show, they made waves with:

- Local production of the X9, their flagship MPV

- A rollout plan to reach 70% of cities in Indonesia

- A smart cockpit experience powered by Snapdragon chips and AI

It’s the equivalent of launching a Tesla Model X, but priced and tailored for Southeast Asian sensibilities: luxury feel, family space, and tech bells without the Western price tag.

Oh, and they’re sold out. Did we mention that already?

The Real Engine: Taste

Here’s the thing: Indonesia isn’t falling for gimmicks. The success of these brands comes down to one simple fact:

They understand what the Indonesian consumer wants.

- Spacious family MPVs (check)

- Luxury interiors with massage chairs, a fridge, and screens (check)

- Price points that sit just under their Japanese counterparts (double check)

Why does this work so well?

According to BPS (Central Bureau of Statistics) data, over 60% of Indonesian households are multi-generational, making MPVs the preferred format over sedans or hatchbacks.

Add to that Jakarta’s infamous car-centric infrastructure — in 2022, Google Mobility data showed Jakartans walk 50% less than the global urban average. So when you go out, you go in comfort.

And when comparing prices:

- The Denza D9 starts at around IDR 1.3B, while the Toyota Alphard goes for IDR 1.5–1.7B.

- The XPeng X9 undercuts the Hyundai Staria by nearly 20%, with more features.

So yes, comfort + prestige + a price cut = a winning formula.

Us simulating ultra luxe living whilst beating Jakarta traffic

️ Other Case Studies of the Vibe-Market Fit: Pop Mart, Skintific, Chagee, and Oh!Some

Pop Mart: Limited Editions, Unlimited Hype

Pop Mart officially entered Indonesia in 2023, but its real breakout moment came in 2024 when it launched stores in Grand Indonesia, Kota Kasablanka, and Summarecon Mall. At key launches, queues reportedly lasted 2–3 hours, just to enter the store and secure a blind box collectible.

Social media exploded with unboxing videos, and resale values of some figurines hit 3x original price on local marketplaces.

Today, Pop Mart operates over 10 stores and pop-ups across Greater Jakarta and Surabaya, with more coming.

Chagee: When milk tea goes luxe

Chagee, a Chinese premium tea chain backed by Gen Z hype and minimalist aesthetics, launched in Indonesia in April 2025 at PIK Avenue. The opening weekend saw lines stretching up to three hours.

They now operate 5+ locations and are expanding aggressively — pairing high-end product quality with mall-center real estate.

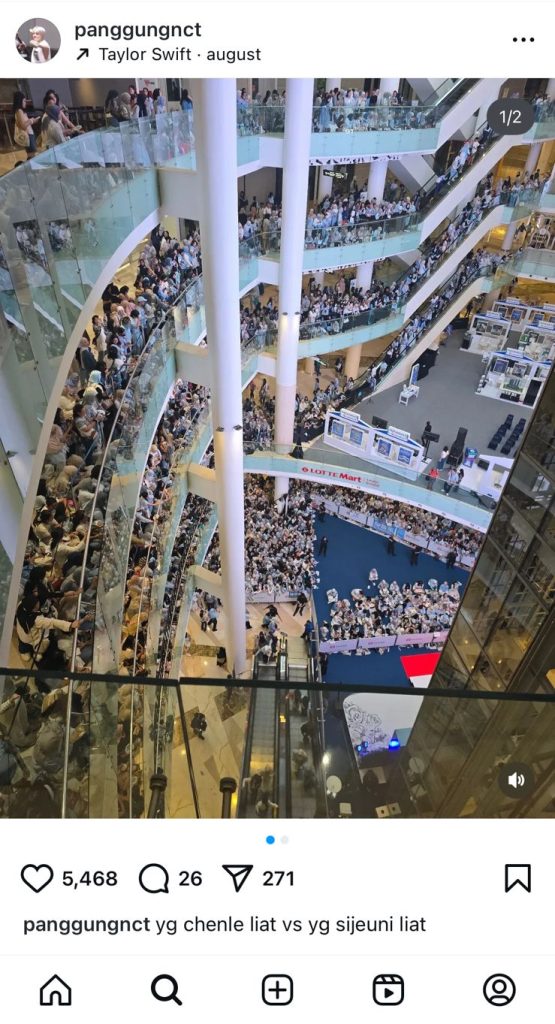

3 hour long wait times during the grand opening of Chagee at Puri Indah Mall. Families were seen eager to take photos of the opening day goody bags and cups that looks very reminiscent of Dior’s luxury packaging – another tactic of selling “attainable luxury”

Chagee is less “hangout spot” and more “Apple Store for tea.” With drinks priced from IDR 40–50k, they hit the sweet spot between aspirational and affordable. Now present in 7+ major malls—including fX Sudirman, Puri Indah, MOI, Lotte Mall, and Epiwalk—the brand has entered with a bang.

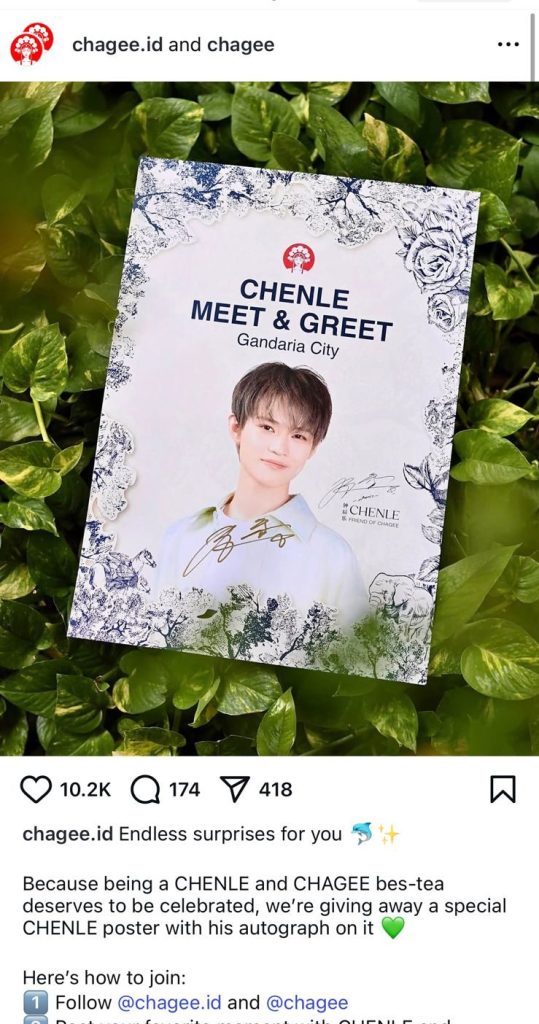

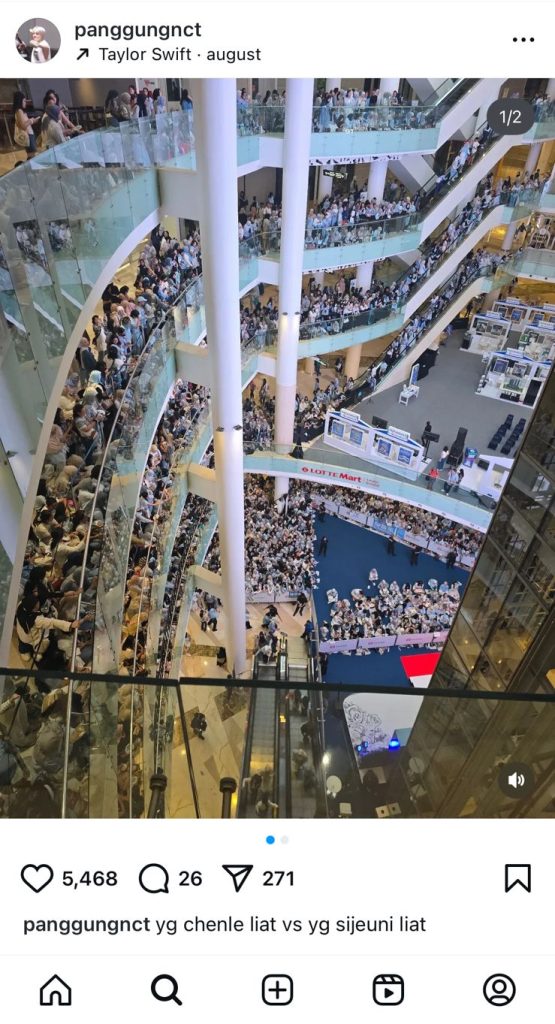

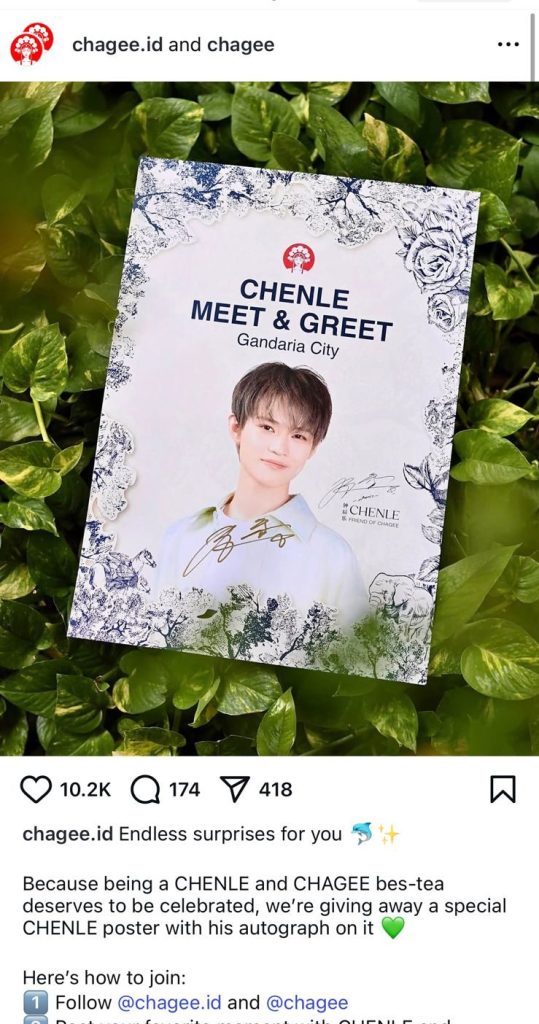

Chagee created a whole campaign promoting another store opening in Gandaria City mall. Created hype by inviting prominent Kpop singer Chen le from NCT. Hundreds flocked to see him and Chagee is now associated with celebrity

Skintific: Skincare, Simplified

Skintific, the Chinese skincare brand with science-led formulas and minimalist branding, has quietly dominated Shopee’s skincare rankings, consistently appearing in the top 5 since early 2024. It has become the #1 retinol cream on the platform.

Their local growth strategy?

- Collaborations with Indonesian KOLs

- Smart TikTok-style reels

- Skin-analyzing vending machines in malls

They’ve opened 20+ offline counters in Watsons and Guardian stores this year, and have plans for dedicated brand stores in 2025.

According to Compas, a Business Intelligence research firm, Skintific has reigned as the #1 brand with the highest marketshare of 4.1% in skincare

Oh!Some & Miniso: Affordable Aesthetic

Miniso now has over 150 stores across Indonesia, but its newer rival Oh!Some is quickly catching up — reportedly opening 25 stores in the past 12 months, many of them in second-tier malls where Gen Z foot traffic thrives.

They’ve taken the Muji formula and added K-pop flash sales, Squid Game notebooks, and skincare fridges. It’s millennial minimalism meets Gen Z maximalism — and it’s working.

So What?

As investors, here’s what we’re watching:

- Can Japanese incumbents keep up, or will they lose premium market share?

- Are local dealerships and service networks ready to support the surge in Chinese brands?

- Could this be a blueprint for China’s playbook in other emerging markets?

Final Thought:

This isn’t just about one country’s brands gaining ground — it’s about a more competitive marketplace that’s forcing everyone to up their game.

For Indonesian consumers, it means more choice, better pricing, and products that fit how they actually live.

For local businesses, it’s a signal to double down on efficiency, strengthen supply chains, and build brand loyalty — because the competition is only getting sharper.

Luxury is no longer about badge status. It’s about smart pricing, high comfort, and a little TikTok clout.

And the brands — local or foreign — that read that brief well will be the ones in the fast lane.

Tara Mulia

Admin heyokha

Share

On a recent stroll through Senayan City mall, I saw something that perfectly captured the current consumer moment in Indonesia: a small, blink-and-you-miss-it booth by Chinese EV maker Xpeng.

But despite its humble exhibition, the hype was real. Their X9 model? Completely sold out. Next batch? Not until June 2026.

XPeng exhibition in Senayan City mall.

Despite its small booth, crowds were forming to see inside the cars

Go towards West Jakarta and Chagee, a Chinese tea brand, launched with a bang. One of their newest branch in West Jakarta in Puri Indah Mall resulted in three-hour lines, just to get a sip of their viral cheese-topped tea drinks. It was less of a store opening and more of a cultural event.

At the same time, the Denza D9 (from BYD) took over the Indonesia Stock Exchange billboard with a bold message: Car of the Year, 2025.

Rather than a “takeover,” these moments show how quickly Indonesian consumers embrace products that match their lifestyle — whether they come from Japan, Korea, or China. And for local malls, dealerships, and marketing agencies, that means more traffic, more deals, and more commissions.

The BYD Denza Flex

Let’s talk about Denza for a second. Their D9 electric MPV didn’t just quietly enter the market. It announced its arrival in ALL CAPS.

- Giant billboards outside the IDX and along main roads

- Crowned Car of the Year and Best High MPV EV by Otomotif 2025

- More advertisements on one of the busiest roads people commute on

We weren’t kidding about the advertisements everywhere

In the luxury EV category, BYD is increasingly catching up, and by mid-2025, its wholesale market share climbed to 3.8%, overtaking brands like Wuling and closing in on Hyundai and Suzuki.

Chinese brands are no longer side quests. They are contenders

Source: GAIKINDO

For context, this growth also means more work for Indonesian distributors and service providers who partner with these brands — showing how the value chain doesn’t stop at the factory gate.

In retail terms, the shift is even more telling:

BYD entered the top 10 by mid-2025, reaching 3.5% retail share in just 18 months. That means these cars aren’t just being stocked—they’re being driven.

Source: GAIKINDO

XPeng, while not as loud in its marketing, is just as methodical. At the 2025 GIIAS auto show, they made waves with:

- Local production of the X9, their flagship MPV

- A rollout plan to reach 70% of cities in Indonesia

- A smart cockpit experience powered by Snapdragon chips and AI

It’s the equivalent of launching a Tesla Model X, but priced and tailored for Southeast Asian sensibilities: luxury feel, family space, and tech bells without the Western price tag.

Oh, and they’re sold out. Did we mention that already?

The Real Engine: Taste

Here’s the thing: Indonesia isn’t falling for gimmicks. The success of these brands comes down to one simple fact:

They understand what the Indonesian consumer wants.

- Spacious family MPVs (check)

- Luxury interiors with massage chairs, a fridge, and screens (check)

- Price points that sit just under their Japanese counterparts (double check)

Why does this work so well?

According to BPS (Central Bureau of Statistics) data, over 60% of Indonesian households are multi-generational, making MPVs the preferred format over sedans or hatchbacks.

Add to that Jakarta’s infamous car-centric infrastructure — in 2022, Google Mobility data showed Jakartans walk 50% less than the global urban average. So when you go out, you go in comfort.

And when comparing prices:

- The Denza D9 starts at around IDR 1.3B, while the Toyota Alphard goes for IDR 1.5–1.7B.

- The XPeng X9 undercuts the Hyundai Staria by nearly 20%, with more features.

So yes, comfort + prestige + a price cut = a winning formula.

Us simulating ultra luxe living whilst beating Jakarta traffic

️ Other Case Studies of the Vibe-Market Fit: Pop Mart, Skintific, Chagee, and Oh!Some

Pop Mart: Limited Editions, Unlimited Hype

Pop Mart officially entered Indonesia in 2023, but its real breakout moment came in 2024 when it launched stores in Grand Indonesia, Kota Kasablanka, and Summarecon Mall. At key launches, queues reportedly lasted 2–3 hours, just to enter the store and secure a blind box collectible.

Social media exploded with unboxing videos, and resale values of some figurines hit 3x original price on local marketplaces.

Today, Pop Mart operates over 10 stores and pop-ups across Greater Jakarta and Surabaya, with more coming.

Chagee: When milk tea goes luxe

Chagee, a Chinese premium tea chain backed by Gen Z hype and minimalist aesthetics, launched in Indonesia in April 2025 at PIK Avenue. The opening weekend saw lines stretching up to three hours.

They now operate 5+ locations and are expanding aggressively — pairing high-end product quality with mall-center real estate.

3 hour long wait times during the grand opening of Chagee at Puri Indah Mall. Families were seen eager to take photos of the opening day goody bags and cups that looks very reminiscent of Dior’s luxury packaging – another tactic of selling “attainable luxury”

Chagee is less “hangout spot” and more “Apple Store for tea.” With drinks priced from IDR 40–50k, they hit the sweet spot between aspirational and affordable. Now present in 7+ major malls—including fX Sudirman, Puri Indah, MOI, Lotte Mall, and Epiwalk—the brand has entered with a bang.

Chagee created a whole campaign promoting another store opening in Gandaria City mall. Created hype by inviting prominent Kpop singer Chen le from NCT. Hundreds flocked to see him and Chagee is now associated with celebrity

Skintific: Skincare, Simplified

Skintific, the Chinese skincare brand with science-led formulas and minimalist branding, has quietly dominated Shopee’s skincare rankings, consistently appearing in the top 5 since early 2024. It has become the #1 retinol cream on the platform.

Their local growth strategy?

- Collaborations with Indonesian KOLs

- Smart TikTok-style reels

- Skin-analyzing vending machines in malls

They’ve opened 20+ offline counters in Watsons and Guardian stores this year, and have plans for dedicated brand stores in 2025.

According to Compas, a Business Intelligence research firm, Skintific has reigned as the #1 brand with the highest marketshare of 4.1% in skincare

Oh!Some & Miniso: Affordable Aesthetic

Miniso now has over 150 stores across Indonesia, but its newer rival Oh!Some is quickly catching up — reportedly opening 25 stores in the past 12 months, many of them in second-tier malls where Gen Z foot traffic thrives.

They’ve taken the Muji formula and added K-pop flash sales, Squid Game notebooks, and skincare fridges. It’s millennial minimalism meets Gen Z maximalism — and it’s working.

So What?

As investors, here’s what we’re watching:

- Can Japanese incumbents keep up, or will they lose premium market share?

- Are local dealerships and service networks ready to support the surge in Chinese brands?

- Could this be a blueprint for China’s playbook in other emerging markets?

Final Thought:

This isn’t just about one country’s brands gaining ground — it’s about a more competitive marketplace that’s forcing everyone to up their game.

For Indonesian consumers, it means more choice, better pricing, and products that fit how they actually live.

For local businesses, it’s a signal to double down on efficiency, strengthen supply chains, and build brand loyalty — because the competition is only getting sharper.

Luxury is no longer about badge status. It’s about smart pricing, high comfort, and a little TikTok clout.

And the brands — local or foreign — that read that brief well will be the ones in the fast lane.

Tara Mulia

Admin heyokha

Share