The Silver Awakening: What Gold’s Quieter Sibling is Telling Us

The Silver Awakening: What Gold’s Quieter Sibling is Telling Us

The Silver Awakening

The quiet metal that might just outshine gold

For centuries, silver has been gold’s quieter sibling — less glamorous, less hoarded, and often left out of the spotlight. But sometimes, little brothers grow up. And if recent market signals are any clue, silver might be entering its glow-up era.

We’re not talking about speculative hype. We’re talking about a confluence of technical breakouts, fundamental tailwinds, and structural regime shifts — all pointing to one underpriced conclusion: Silver is waking up.

And it might not go back to sleep anytime soon.

Gold has fans. Silver has torque.

It’s no secret that investors have been piling into gold. It’s become a familiar safe-haven story: fiscal dominance, geopolitical risk, and an increasingly unstable USD have made the yellow metal a preferred portfolio hedge. Gold even hit a new all-time high of $3,578 just this week!

Silver is exposed to the same macro risks as gold whether that be fiscal erosion, currency distrust, inflation, but with less acknowledgment and far less institutional love. It’s the vulnerability we ignore. Until we can’t.

If recent trends are anything to go by, we may be seeing the early signs of silver following gold’s monetary comeback.

- According to its Q2 2025 13F filing, the Saudi Central Bank opened new positions in iShares Silver Trust (SLV) and Global X Silver Miners ETF (SIL).

- While small (1.25% and 0.4% of their U.S. portfolio, respectively), this marks the first-ever silver allocation from a central bank whose gold repatriation has accelerated since 2022.

- Meanwhile, Russia’s Ministry of Finance announced it would allocate $520 million through 2027 to precious metals — including silver.

Think about that for a second.

If central banks — traditionally allergic to silver — are beginning to experiment with it again, perhaps the market is underestimating the next leg of the monetary metals story.

A Metal Out of Time: Supply Can’t Keep Up with the Silver Rush

The market often treats silver as a humble sidekick to gold — the Robin to its Batman, the Luigi to its Mario, the… you get it. But while gold basks in the limelight of central bank vaults and global headlines, silver has been quietly building a case as the most underappreciated protagonist in the precious metals saga. In a crisis, sidekicks often can save the day.

Let’s start with the basics: Silver supply is structurally broken.

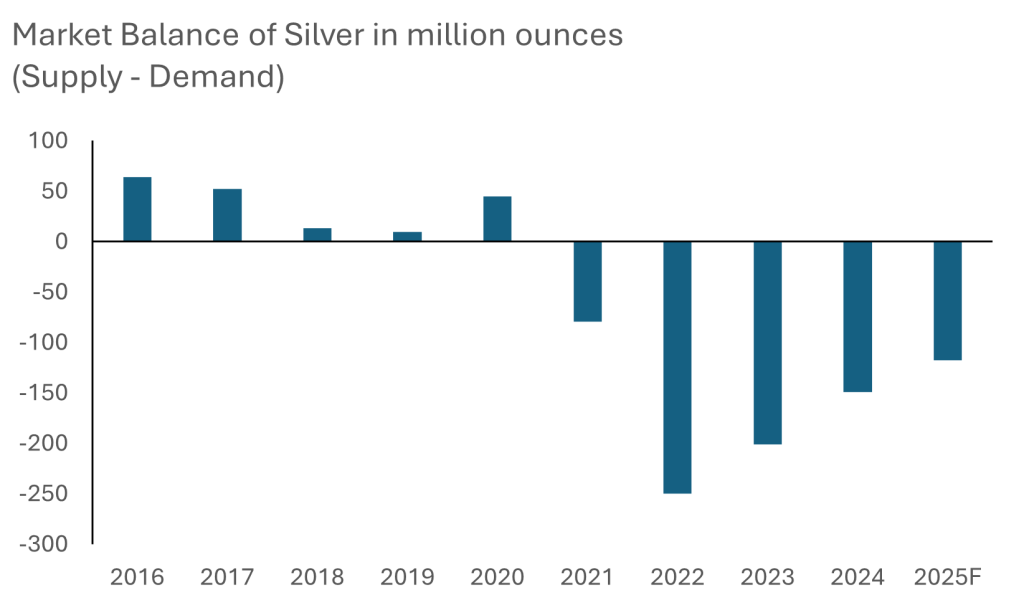

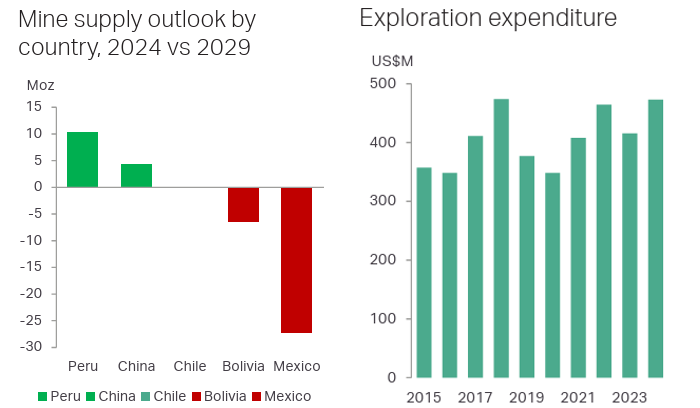

According to Metals Focus, mine production peaked in 2016 and has flatlined since. Meanwhile, demand has been ramping up across industrial, investment, and even monetary fronts — leading to five consecutive years of deficits, as the Silver Institute tracks. In 2025 alone, the silver market is expected to see another deficit of 117.6 million ounces, continuing a now-familiar shortfall pattern.

Source: The Silver Institute

There is more demand than supply is able to keep up with for 5 years now

To put that into perspective, 2025’s expected demand is 1,148.3 million ounces, while total supply clocks in at just 1,030.6 million ounces. That’s not a gap — that’s a canyon. And it’s one we’ve been dancing around for most of the past decade.

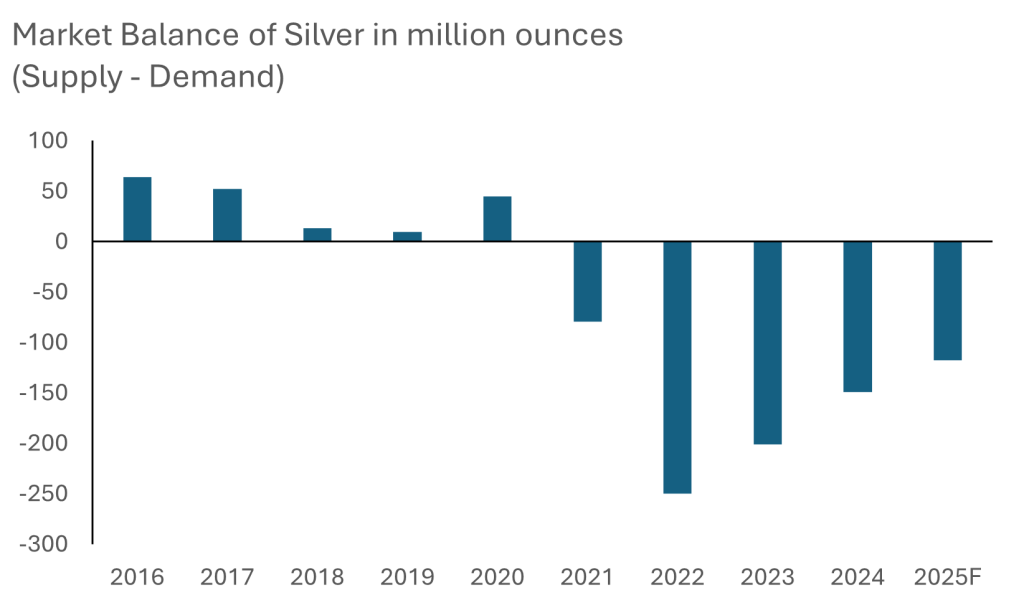

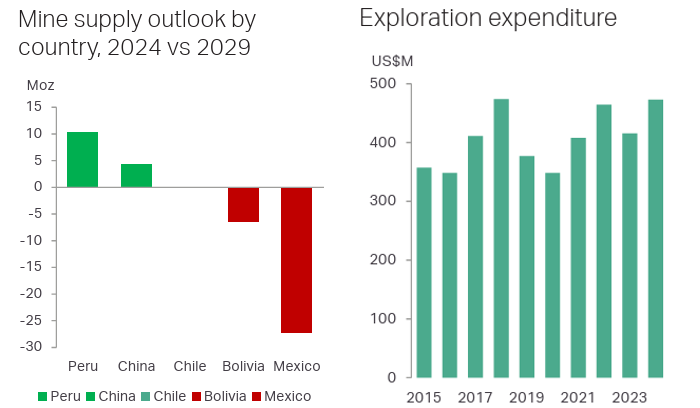

Adding salt to the shortage wound: silver production is not only stagnant, but concentrated and vulnerable. Just five countries — Mexico, Peru, China, Chile, and Bolivia — are responsible for 62% of global mine supply. And guess what? Production from these top five is expected to fall by 19 million ounces by 2029, led by a 13% drop in Mexico alone, as key mines like San Julián, Fresnillo, and La Encantada approach closure due to reserve depletion.

In other words, the supply picture is looking more like an aging rock band on its farewell tour — tired, stretched, and nowhere near replacing its biggest hits.

Source: Metals Focus

Mine supply outlook is looking bleak and exploration expenditure remains stagnant

Meanwhile, demand is living its best life.

On the industrial side, solar photovoltaic demand has grown from 5.6% of total demand in 2015 to 17% in 2024, with projections that 332 million ounces of silver will be needed annually by 2050 just to support new solar buildouts. And remember, that’s just one sliver (pun intended) of silver’s industrial use cases.

On the investment side, silver is no longer just the speculative playground of Reddit-fueled squeezes. According to the Silver Institute, silver-backed exchange-traded products (ETPs) attracted 95 million ounces in net inflows in the first half of 2025 alone, already surpassing the total for all of 2024. Holdings now sit at 1.13 billion ounces, nearing their pandemic-era highs.

Institutional futures traders are piling in too — net long positions on CME silver futures are up 163% YTD, reaching their highest levels since the first half of 2021.

But perhaps the biggest “hello, something’s changed” moment is in the gold-to-silver ratio.

After peaking above 100 earlier this year — meaning one ounce of gold bought you more than 100 ounces of silver — the ratio has compressed into the 80s–90s range. The 10-year average is around 81. Historically, this ratio tends to overshoot before silver plays catch-up — and when it does, it doesn’t just keep pace; it flies. In previous cycles, silver rallies have been twice as large as gold’s.

In 2025, gold is already up around 38%.

If silver’s rally is only just beginning — well, you can do the math.

And yet… most portfolios still treat silver as an afterthought.

In an environment where everyone’s chasing the AI trade, this sets up a perfect contrarian setup — because silver is fundamentally leveraged gold. When gold rises 10%, silver has historically moved 20–30%. If gold is fear, silver is panic.

And panic, dear reader, can be a great trade.

In the shadows of empires

There’s a philosophical angle here, too.

Throughout history, silver has played the role of monetary glue in collapsing empires and uncertain regimes. In ancient China, it was the foundation of dynastic trade. In the Americas, silver funded colonization. And in 19th century Asia, the Mexican silver dollar became the region’s de facto currency — circulating freely across Indonesia, the Philippines, and China.

Why? Because silver isn’t just valuable — it’s usable. Divisible. Ubiquitous. It’s the money of the people, not just the money of kings.

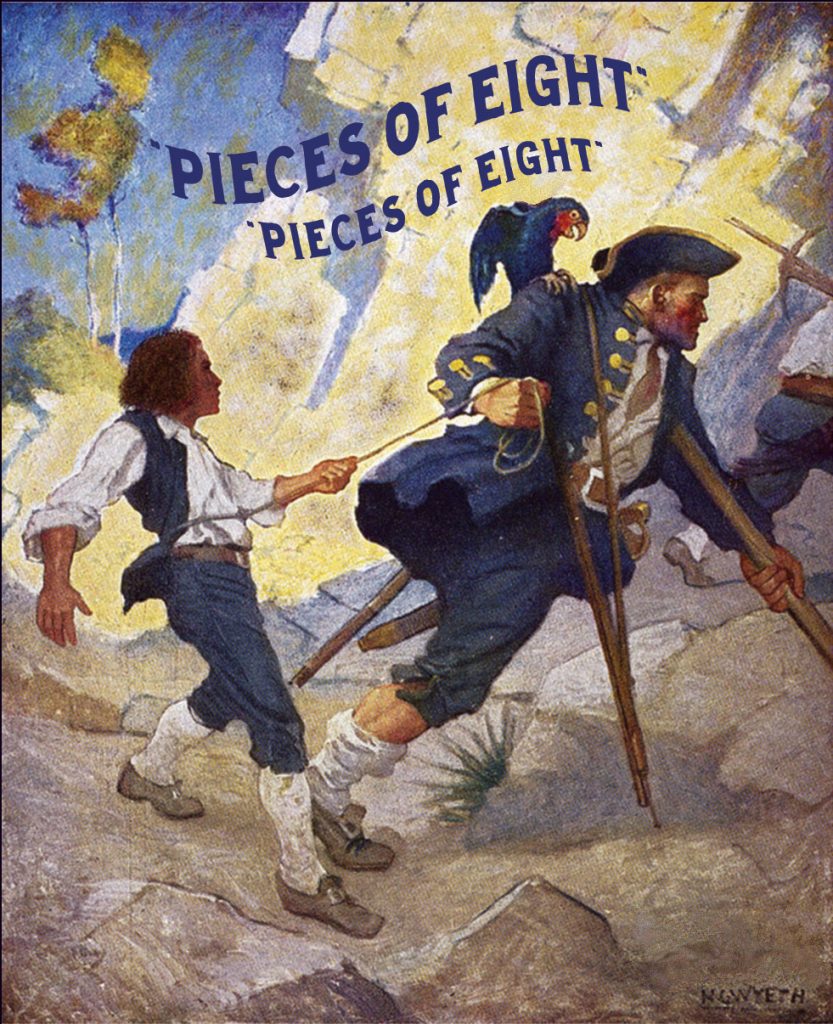

“Pieces of Eight, Pieces of Eight!” squaked by Long John Silver’s parrot, Captain Flint in the beloved novel ‘Treasure Island’ refers to the Spanish silver dollar!

The silver coin was the actual form of currency during the Spanish Empire and worth eight reales (former unit of currency in Spain). It can notably be cut into eight smaller pieces or “bits to to make smaller change

And in a world where monetary trust is fraying — where sanctions freeze reserves, fiat erodes in silence, and crypto volatility terrifies grandmothers — silver might offer a familiar fallback. A metallic middle ground between central bank distrust and digital confusion.

Silver’s story, in many ways, is about resilience. It doesn’t chase headlines. It doesn’t get invited to Davos. But when trust breaks down, silver shows up.

So what? Why Silver? Why, Now?

At Heyokha, we’ve written extensively about the end of disinflation, the rise of gold, and the need for real assets in a world of monetary erosion. But silver’s time may have come — not instead of gold, but alongside it.

In our view, silver fits squarely into the de-dollarization and deglobalization thesis — a hard asset in an increasingly soft world. It’s small enough to move fast, but big enough to matter.

We live in an era of geopolitical currency distrust, capital flow bifurcation, and monetary weaponization.

- The U.S. is running a fiscal deficit close to 6.5% of GDP.

- The dollar’s role as neutral reserve is eroding — slowly, but clearly.

- Nations like Saudi Arabia are pivoting to hard assets for strategic security.

If gold is the anchor, silver is the accelerant.

Final thought: The Underdog Metal

Silver is rarely the first to run. But when it does, it sprints.

Right now, gold has the narrative — but silver may have the upside.

In a world seeking store-of-value assets beyond central bank reach and dollar dominance, silver’s next chapter could be much louder than its last.

Most investors are still watching gold. But in our view, the real sleeper trade for the next inflation cycle may not just be gold.

It might just be the gray metal that still has some shine.

Maybe we need a staircase for silver too

Tara Mulia

Admin heyokha

Share

The Silver Awakening

The quiet metal that might just outshine gold

For centuries, silver has been gold’s quieter sibling — less glamorous, less hoarded, and often left out of the spotlight. But sometimes, little brothers grow up. And if recent market signals are any clue, silver might be entering its glow-up era.

We’re not talking about speculative hype. We’re talking about a confluence of technical breakouts, fundamental tailwinds, and structural regime shifts — all pointing to one underpriced conclusion: Silver is waking up.

And it might not go back to sleep anytime soon.

Gold has fans. Silver has torque.

It’s no secret that investors have been piling into gold. It’s become a familiar safe-haven story: fiscal dominance, geopolitical risk, and an increasingly unstable USD have made the yellow metal a preferred portfolio hedge. Gold even hit a new all-time high of $3,578 just this week!

Silver is exposed to the same macro risks as gold whether that be fiscal erosion, currency distrust, inflation, but with less acknowledgment and far less institutional love. It’s the vulnerability we ignore. Until we can’t.

If recent trends are anything to go by, we may be seeing the early signs of silver following gold’s monetary comeback.

- According to its Q2 2025 13F filing, the Saudi Central Bank opened new positions in iShares Silver Trust (SLV) and Global X Silver Miners ETF (SIL).

- While small (1.25% and 0.4% of their U.S. portfolio, respectively), this marks the first-ever silver allocation from a central bank whose gold repatriation has accelerated since 2022.

- Meanwhile, Russia’s Ministry of Finance announced it would allocate $520 million through 2027 to precious metals — including silver.

Think about that for a second.

If central banks — traditionally allergic to silver — are beginning to experiment with it again, perhaps the market is underestimating the next leg of the monetary metals story.

A Metal Out of Time: Supply Can’t Keep Up with the Silver Rush

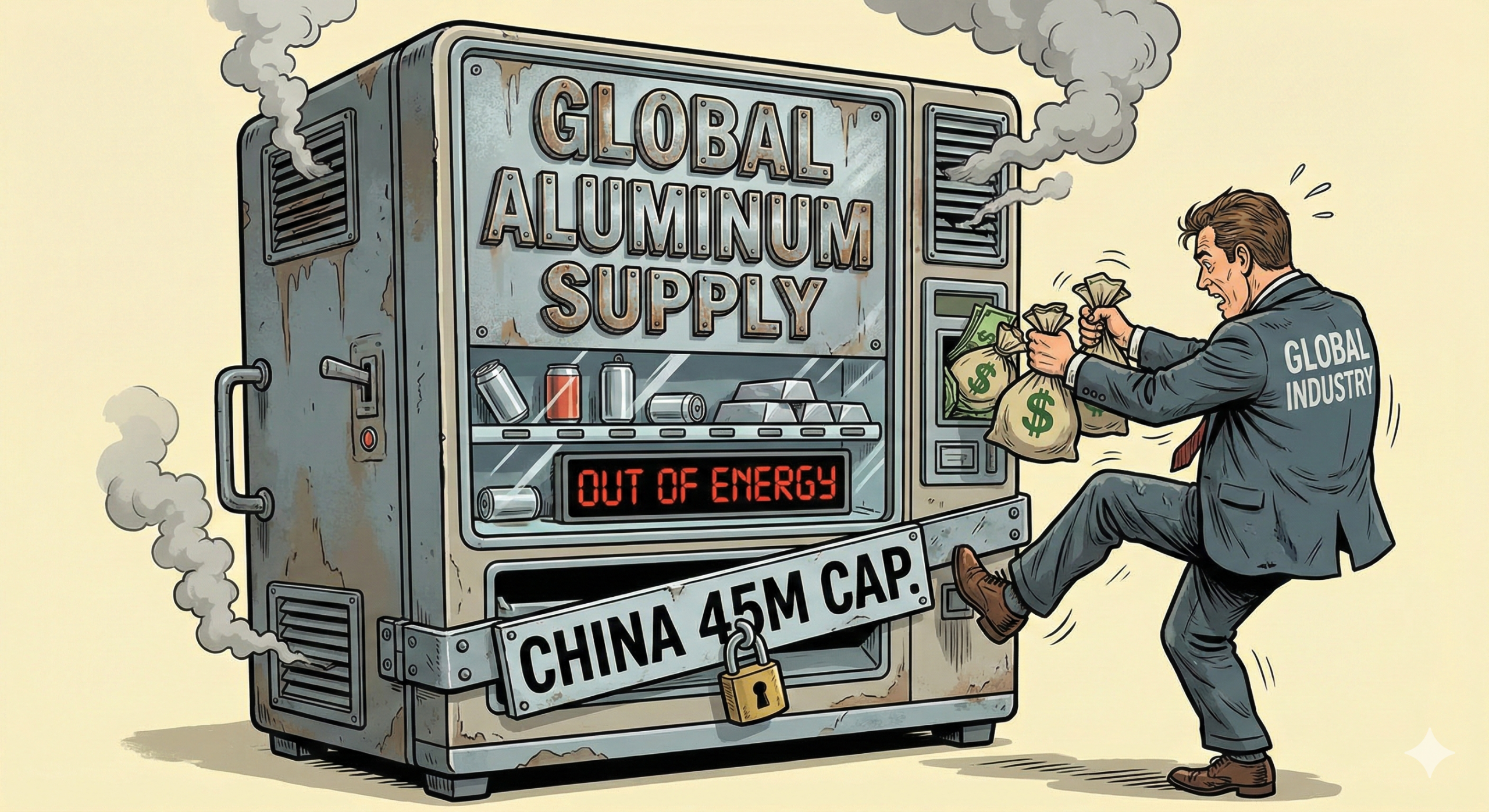

The market often treats silver as a humble sidekick to gold — the Robin to its Batman, the Luigi to its Mario, the… you get it. But while gold basks in the limelight of central bank vaults and global headlines, silver has been quietly building a case as the most underappreciated protagonist in the precious metals saga. In a crisis, sidekicks often can save the day.

Let’s start with the basics: Silver supply is structurally broken.

According to Metals Focus, mine production peaked in 2016 and has flatlined since. Meanwhile, demand has been ramping up across industrial, investment, and even monetary fronts — leading to five consecutive years of deficits, as the Silver Institute tracks. In 2025 alone, the silver market is expected to see another deficit of 117.6 million ounces, continuing a now-familiar shortfall pattern.

Source: The Silver Institute

There is more demand than supply is able to keep up with for 5 years now

To put that into perspective, 2025’s expected demand is 1,148.3 million ounces, while total supply clocks in at just 1,030.6 million ounces. That’s not a gap — that’s a canyon. And it’s one we’ve been dancing around for most of the past decade.

Adding salt to the shortage wound: silver production is not only stagnant, but concentrated and vulnerable. Just five countries — Mexico, Peru, China, Chile, and Bolivia — are responsible for 62% of global mine supply. And guess what? Production from these top five is expected to fall by 19 million ounces by 2029, led by a 13% drop in Mexico alone, as key mines like San Julián, Fresnillo, and La Encantada approach closure due to reserve depletion.

In other words, the supply picture is looking more like an aging rock band on its farewell tour — tired, stretched, and nowhere near replacing its biggest hits.

Source: Metals Focus

Mine supply outlook is looking bleak and exploration expenditure remains stagnant

Meanwhile, demand is living its best life.

On the industrial side, solar photovoltaic demand has grown from 5.6% of total demand in 2015 to 17% in 2024, with projections that 332 million ounces of silver will be needed annually by 2050 just to support new solar buildouts. And remember, that’s just one sliver (pun intended) of silver’s industrial use cases.

On the investment side, silver is no longer just the speculative playground of Reddit-fueled squeezes. According to the Silver Institute, silver-backed exchange-traded products (ETPs) attracted 95 million ounces in net inflows in the first half of 2025 alone, already surpassing the total for all of 2024. Holdings now sit at 1.13 billion ounces, nearing their pandemic-era highs.

Institutional futures traders are piling in too — net long positions on CME silver futures are up 163% YTD, reaching their highest levels since the first half of 2021.

But perhaps the biggest “hello, something’s changed” moment is in the gold-to-silver ratio.

After peaking above 100 earlier this year — meaning one ounce of gold bought you more than 100 ounces of silver — the ratio has compressed into the 80s–90s range. The 10-year average is around 81. Historically, this ratio tends to overshoot before silver plays catch-up — and when it does, it doesn’t just keep pace; it flies. In previous cycles, silver rallies have been twice as large as gold’s.

In 2025, gold is already up around 38%.

If silver’s rally is only just beginning — well, you can do the math.

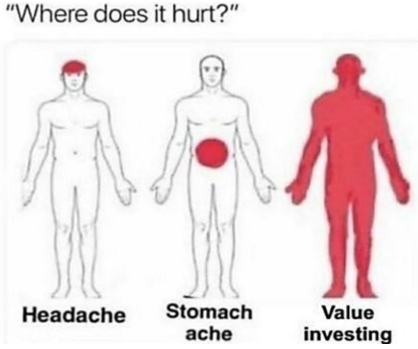

And yet… most portfolios still treat silver as an afterthought.

In an environment where everyone’s chasing the AI trade, this sets up a perfect contrarian setup — because silver is fundamentally leveraged gold. When gold rises 10%, silver has historically moved 20–30%. If gold is fear, silver is panic.

And panic, dear reader, can be a great trade.

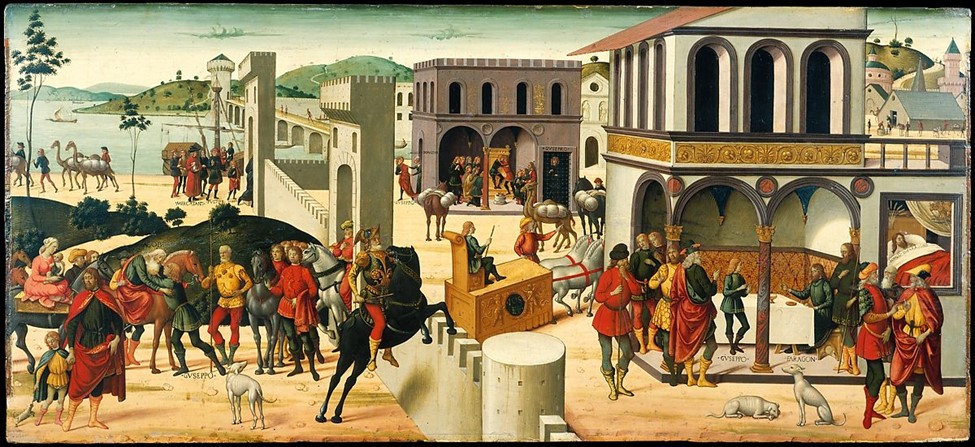

In the shadows of empires

There’s a philosophical angle here, too.

Throughout history, silver has played the role of monetary glue in collapsing empires and uncertain regimes. In ancient China, it was the foundation of dynastic trade. In the Americas, silver funded colonization. And in 19th century Asia, the Mexican silver dollar became the region’s de facto currency — circulating freely across Indonesia, the Philippines, and China.

Why? Because silver isn’t just valuable — it’s usable. Divisible. Ubiquitous. It’s the money of the people, not just the money of kings.

“Pieces of Eight, Pieces of Eight!” squaked by Long John Silver’s parrot, Captain Flint in the beloved novel ‘Treasure Island’ refers to the Spanish silver dollar!

The silver coin was the actual form of currency during the Spanish Empire and worth eight reales (former unit of currency in Spain). It can notably be cut into eight smaller pieces or “bits to to make smaller change

And in a world where monetary trust is fraying — where sanctions freeze reserves, fiat erodes in silence, and crypto volatility terrifies grandmothers — silver might offer a familiar fallback. A metallic middle ground between central bank distrust and digital confusion.

Silver’s story, in many ways, is about resilience. It doesn’t chase headlines. It doesn’t get invited to Davos. But when trust breaks down, silver shows up.

So what? Why Silver? Why, Now?

At Heyokha, we’ve written extensively about the end of disinflation, the rise of gold, and the need for real assets in a world of monetary erosion. But silver’s time may have come — not instead of gold, but alongside it.

In our view, silver fits squarely into the de-dollarization and deglobalization thesis — a hard asset in an increasingly soft world. It’s small enough to move fast, but big enough to matter.

We live in an era of geopolitical currency distrust, capital flow bifurcation, and monetary weaponization.

- The U.S. is running a fiscal deficit close to 6.5% of GDP.

- The dollar’s role as neutral reserve is eroding — slowly, but clearly.

- Nations like Saudi Arabia are pivoting to hard assets for strategic security.

If gold is the anchor, silver is the accelerant.

Final thought: The Underdog Metal

Silver is rarely the first to run. But when it does, it sprints.

Right now, gold has the narrative — but silver may have the upside.

In a world seeking store-of-value assets beyond central bank reach and dollar dominance, silver’s next chapter could be much louder than its last.

Most investors are still watching gold. But in our view, the real sleeper trade for the next inflation cycle may not just be gold.

It might just be the gray metal that still has some shine.

Maybe we need a staircase for silver too

Tara Mulia

Admin heyokha

Share