From Buffet(t) to Bento Box: The Rise of Retail Avengers

From Buffet(t) to Bento Box: The Rise of Retail Avengers

Souvenirs, Snacks, and Shareholder Sovereignty

You’ve seen the footage.

Hundreds of Indonesian retail investors lining up since dawn. Not for a sneaker drop. Not for a Taylor Swift concert.

But for… Astra International’s Annual General Meeting (ASII IJ).

Yes. The AGM.

What’s the draw? The dividends? The management Q&A?

Not quite. We’re talking souvenirs.

Vouchers. Water bottles. And in recent years?

Digital blood pressure monitors. Xiaomi smartwatches. Bento boxes. And allegedly, headaches for the organizers—cue Bodrex, Indonesia’s beloved aspirin.

Tiktoks of attendees showing off their goody bags and proudly queuing

The scenes look like a scene from Comic-Con, not a corporate meeting. But perhaps that’s the point.

Sure, some come for the freebies. But many stick around for the long haul — not just for the snacks, but for the strategy.

And they’re not just showing up in Indonesia. They’re forming a quiet but powerful force globally.

Japan: Where AGMs Meet Gift Culture

Over in Japan, this retail investor culture has evolved into an art form.

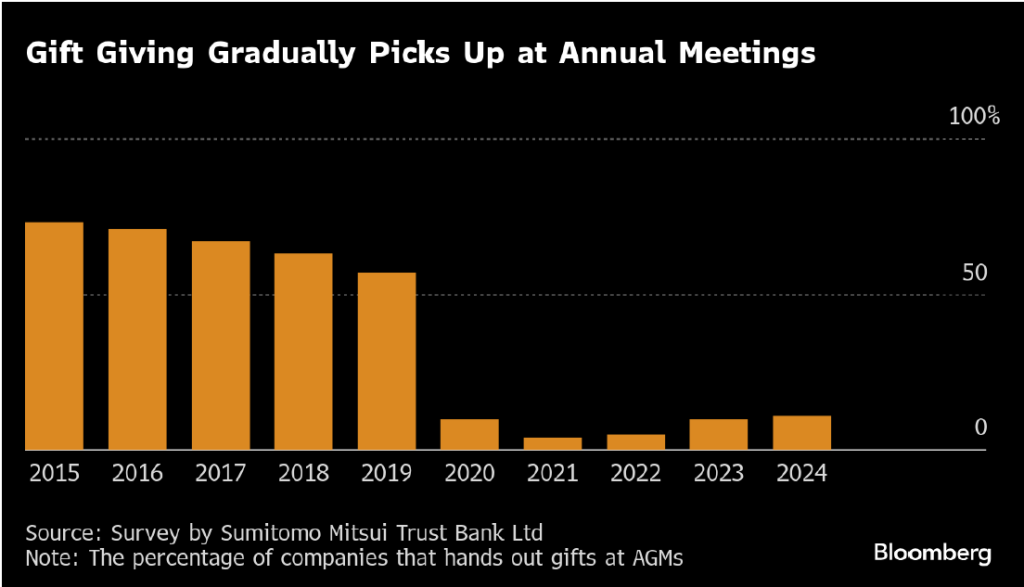

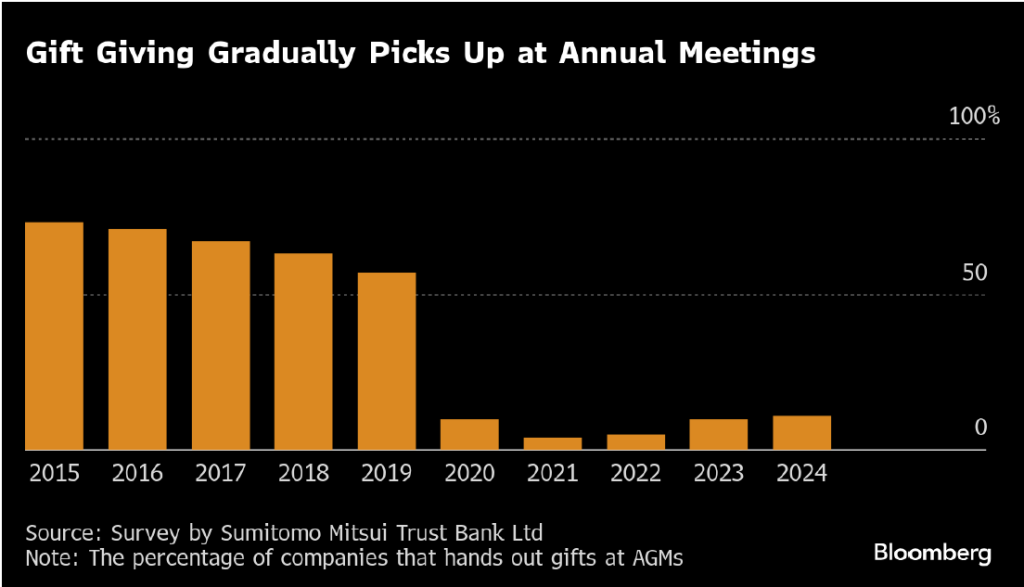

According to a Bloomberg report, more companies than ever are offering gifts at their annual meetings to attract what they call “fan shareholders.” From cash vouchers to collectible items, the movement is clear: companies are courting the crowd.

In 2024, 11% of Japanese firms offered AGM gifts, up from 4% in 2021.

More than 120 companies gave cash vouchers—5x more than in 2019.

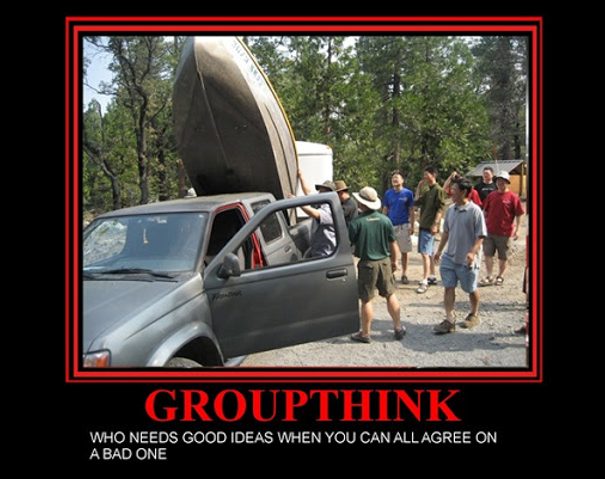

Why? Because retail investors vote.

And when activist investors start knocking, those loyal “fan” shareholders start looking a lot like defensive moats.

Source: Bloomberg

One Tokyo-based retail investor said it best:

“I get a HUB card for free drinks… I use it to treat my friends and kind of show off my shareholder status.”

It’s Buffett with a side of beer.

Why Retail Investors Sometimes Move First

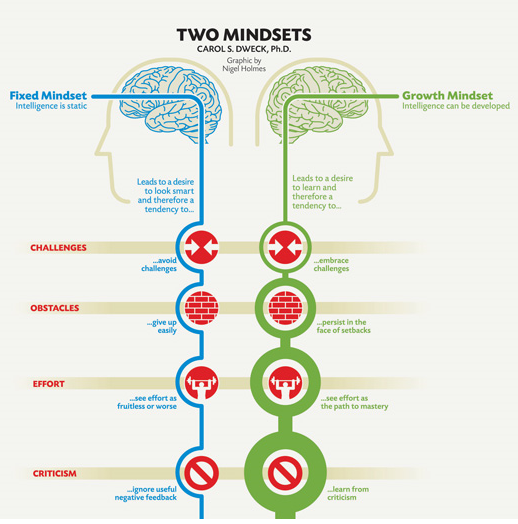

In capital markets, retail investors are often dismissed as emotional, erratic, and under-informed.

But here’s a crazy thought: maybe they just think differently.

Where institutions shuffle portfolios quarterly, retail investors show up with umbrellas and lunchboxes at 7AM.

Where the pros dig through terminal screens, the retail crowd is doing Peter Lynch-style scuttlebutt:

“I use this product.”

“I saw a line at their store.”

“My kid wants that toy.”

And sometimes? That works better.

Peter Lynch Knew Before It Was Cool

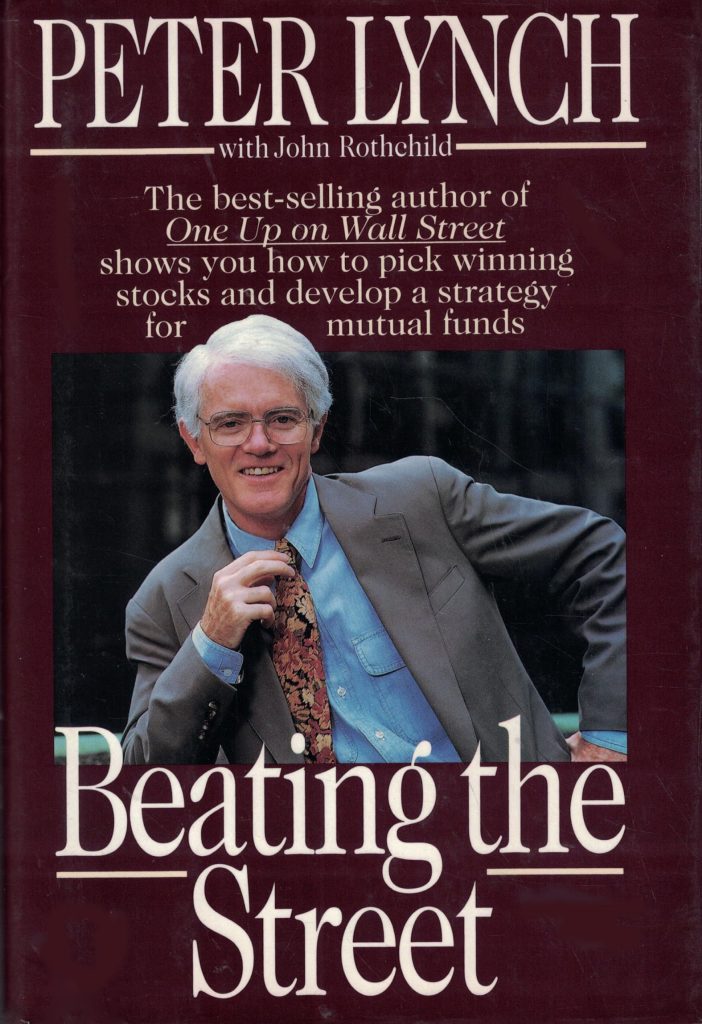

In Beating the Street, Lynch tells the story of 7th graders from St. Agnes School building a portfolio.

One of Heyokha’s favorite readings

Their secret? Vibes.

They picked stocks they knew: Nike, The Body Shop, Wal-Mart. They liked the products. They saw the lines.

Two years later?

The kids delivered a 70% return vs. the S&P’s 26%. They beat 99% of mutual funds.

The lesson? Retail doesn’t mean random.

It means they observe life and invest accordingly.

Retail: The Most Underappreciated “Whale” in the Market

Let’s look at the structural trends:

Technology has made investing frictionless.

The pandemic triggered millions of first-time investors.

Commission-free trading, fractional shares, TikTok explainers, and Whatsapp groups have turned curiosity into conviction.

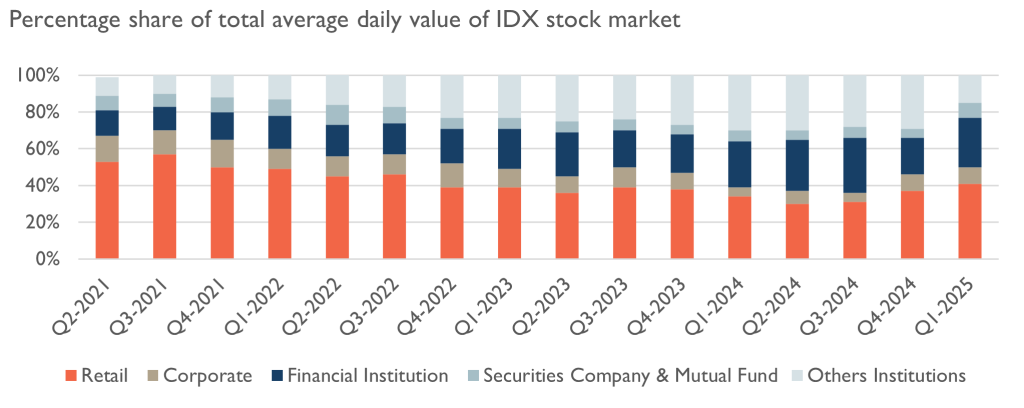

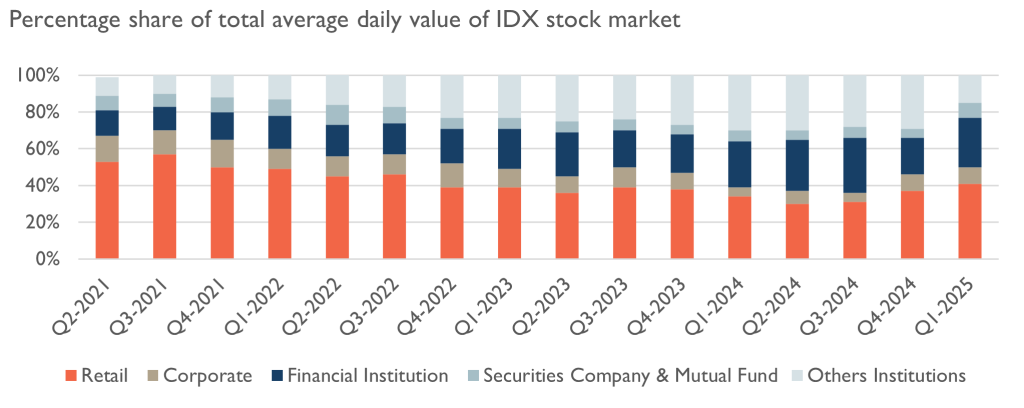

The numbers speak for themselves. Though it has not recovered from post pandemic levels nearing 60%, the latest number of 40% is still respectable!

Source: IDX

These retail investors:

- Sit through AGMs — some for the snacks, others for the substance (many for both)

- Vote with surprising consistency in favor of management.

- Stick around longer than most quant-driven funds.

Of course, retail investors aren’t a monolith. Some are day traders. Some are dividend die-hards. Some just want to flex their AGM goody bags. But that’s kind of the point — there’s no single archetype. Just millions of individual minds showing up with curiosity.

It’s the showing up that counts.

And it looks like they’re growing and actually sticking through.

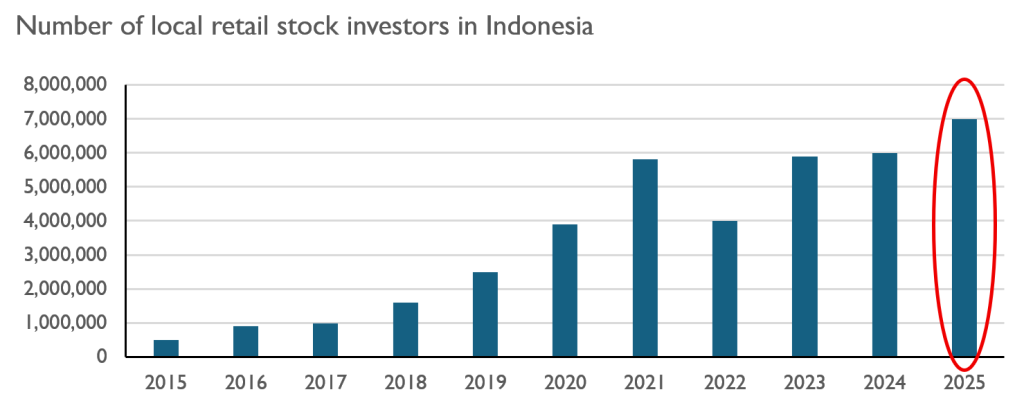

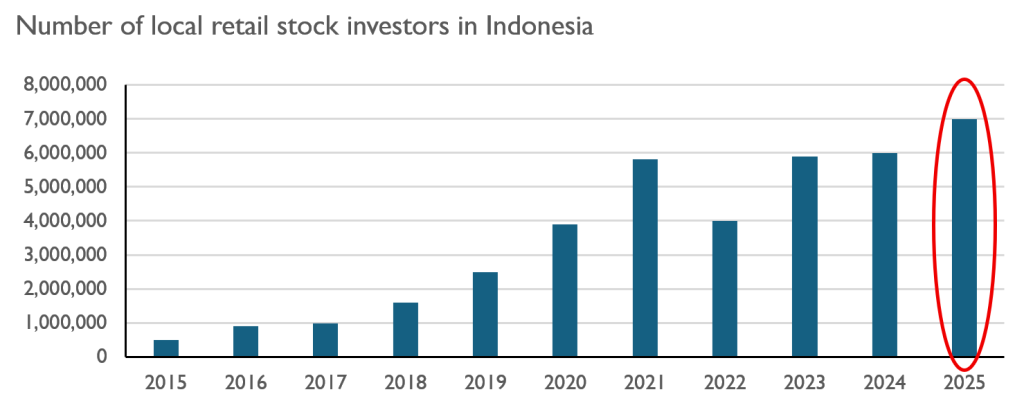

The Indonesian Retail Stock Investors Hit Record High of 7 million in 2025

Source: KSEI

The game isn’t: “How do we get rid of them?”

It’s: “How do we build with them?”

Final Thought: Maybe the Real Freebie… Is Loyalty

Sure, the bento box is cute.

But the real ROI might be in what it represents:

People showing up.

Voting.

Holding.

❤️ Caring.

It’s easy to call retail investors unsophisticated.

But maybe they’re just early to the stuff the pros haven’t priced in yet.

And if you’re worried about following the crowd?

Don’t be.

As long as you packed snacks and got there first.

Tara Mulia and Nicholas

Admin heyokha

Share

Souvenirs, Snacks, and Shareholder Sovereignty

You’ve seen the footage.

Hundreds of Indonesian retail investors lining up since dawn. Not for a sneaker drop. Not for a Taylor Swift concert.

But for… Astra International’s Annual General Meeting (ASII IJ).

Yes. The AGM.

What’s the draw? The dividends? The management Q&A?

Not quite. We’re talking souvenirs.

Vouchers. Water bottles. And in recent years?

Digital blood pressure monitors. Xiaomi smartwatches. Bento boxes. And allegedly, headaches for the organizers—cue Bodrex, Indonesia’s beloved aspirin.

Tiktoks of attendees showing off their goody bags and proudly queuing

The scenes look like a scene from Comic-Con, not a corporate meeting. But perhaps that’s the point.

Sure, some come for the freebies. But many stick around for the long haul — not just for the snacks, but for the strategy.

And they’re not just showing up in Indonesia. They’re forming a quiet but powerful force globally.

Japan: Where AGMs Meet Gift Culture

Over in Japan, this retail investor culture has evolved into an art form.

According to a Bloomberg report, more companies than ever are offering gifts at their annual meetings to attract what they call “fan shareholders.” From cash vouchers to collectible items, the movement is clear: companies are courting the crowd.

In 2024, 11% of Japanese firms offered AGM gifts, up from 4% in 2021.

More than 120 companies gave cash vouchers—5x more than in 2019.

Why? Because retail investors vote.

And when activist investors start knocking, those loyal “fan” shareholders start looking a lot like defensive moats.

Source: Bloomberg

One Tokyo-based retail investor said it best:

“I get a HUB card for free drinks… I use it to treat my friends and kind of show off my shareholder status.”

It’s Buffett with a side of beer.

Why Retail Investors Sometimes Move First

In capital markets, retail investors are often dismissed as emotional, erratic, and under-informed.

But here’s a crazy thought: maybe they just think differently.

Where institutions shuffle portfolios quarterly, retail investors show up with umbrellas and lunchboxes at 7AM.

Where the pros dig through terminal screens, the retail crowd is doing Peter Lynch-style scuttlebutt:

“I use this product.”

“I saw a line at their store.”

“My kid wants that toy.”

And sometimes? That works better.

Peter Lynch Knew Before It Was Cool

In Beating the Street, Lynch tells the story of 7th graders from St. Agnes School building a portfolio.

One of Heyokha’s favorite readings

Their secret? Vibes.

They picked stocks they knew: Nike, The Body Shop, Wal-Mart. They liked the products. They saw the lines.

Two years later?

The kids delivered a 70% return vs. the S&P’s 26%. They beat 99% of mutual funds.

The lesson? Retail doesn’t mean random.

It means they observe life and invest accordingly.

Retail: The Most Underappreciated “Whale” in the Market

Let’s look at the structural trends:

Technology has made investing frictionless.

The pandemic triggered millions of first-time investors.

Commission-free trading, fractional shares, TikTok explainers, and Whatsapp groups have turned curiosity into conviction.

The numbers speak for themselves. Though it has not recovered from post pandemic levels nearing 60%, the latest number of 40% is still respectable!

Source: IDX

These retail investors:

- Sit through AGMs — some for the snacks, others for the substance (many for both)

- Vote with surprising consistency in favor of management.

- Stick around longer than most quant-driven funds.

Of course, retail investors aren’t a monolith. Some are day traders. Some are dividend die-hards. Some just want to flex their AGM goody bags. But that’s kind of the point — there’s no single archetype. Just millions of individual minds showing up with curiosity.

It’s the showing up that counts.

And it looks like they’re growing and actually sticking through.

The Indonesian Retail Stock Investors Hit Record High of 7 million in 2025

Source: KSEI

The game isn’t: “How do we get rid of them?”

It’s: “How do we build with them?”

Final Thought: Maybe the Real Freebie… Is Loyalty

Sure, the bento box is cute.

But the real ROI might be in what it represents:

People showing up.

Voting.

Holding.

❤️ Caring.

It’s easy to call retail investors unsophisticated.

But maybe they’re just early to the stuff the pros haven’t priced in yet.

And if you’re worried about following the crowd?

Don’t be.

As long as you packed snacks and got there first.

Tara Mulia and Nicholas

Admin heyokha

Share