The AI Arms Race: The Battle for the Chokepoint

The AI Arms Race: The Battle for the Chokepoint

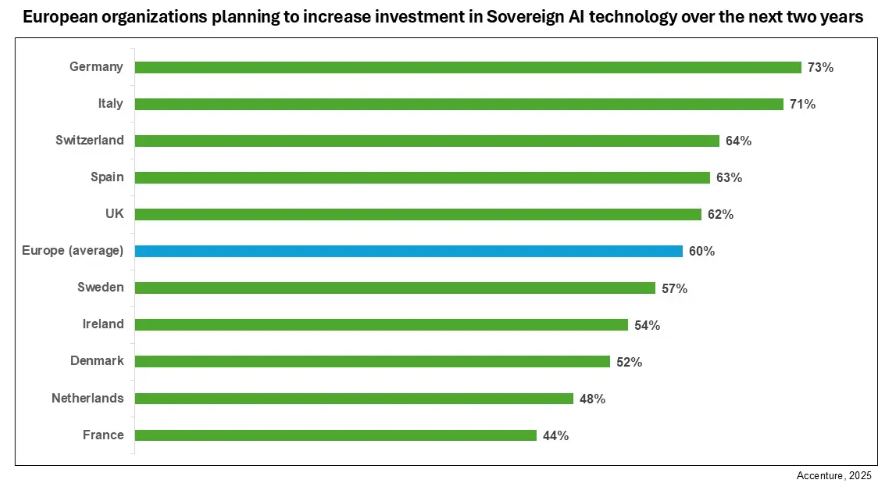

We are currently witnessing the largest capital expenditure in the history of technology. Hundreds of billions flowing into a machine designed to create infinite digital abundance. It looks like a paradox: Why fight a resource-heavy war over a technology that promises infinite digital abundance?

The answer lies in a lesson history has taught us repeatedly: Abundance does not mean equity. The neighbors fighting over the orange tree aren’t fighting for the fruit; they’re fighting to decide who owns the fence around the orchard.

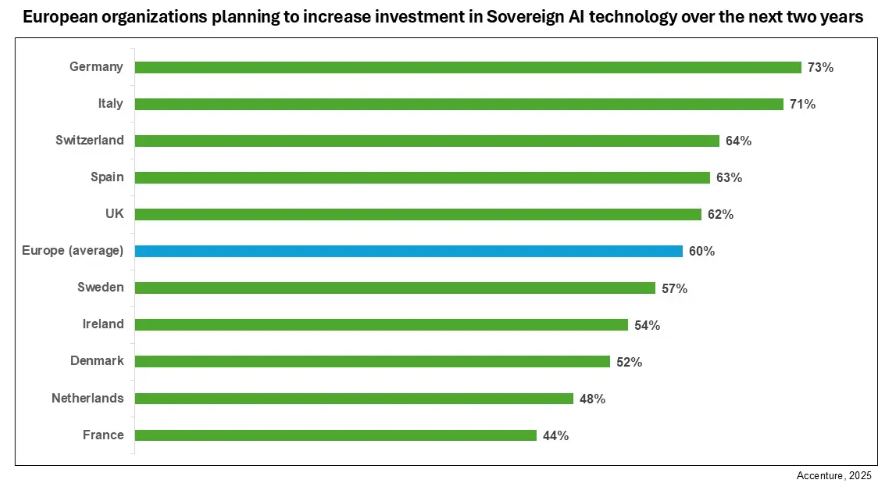

Source: Accenture

The Logic of Control

The reason nations are hoarding chips and energy isn’t because they don’t believe in the abundance AI will bring. It’s because they don’t trust how it will be distributed.

History is littered with technologies that created massive surplus value, only to have that value concentrated in the hands of whoever owned the pipes.

- The Printing Press made information cheap; publishing houses became gatekeepers.

- Railroads made transportation cheap; railroad barons became oligarchs.

- The Internet made distribution free; platform monopolies became trillion-dollar rentiers.

The lesson is clear: New technologies don’t make old power structures obsolete. They get captured by them.

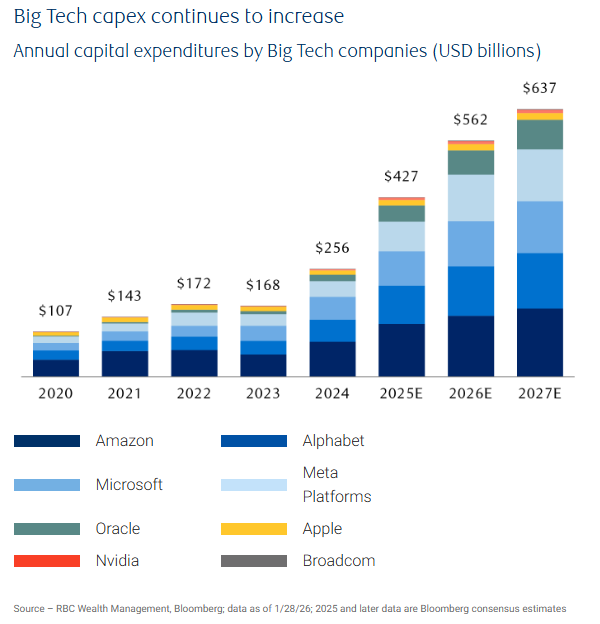

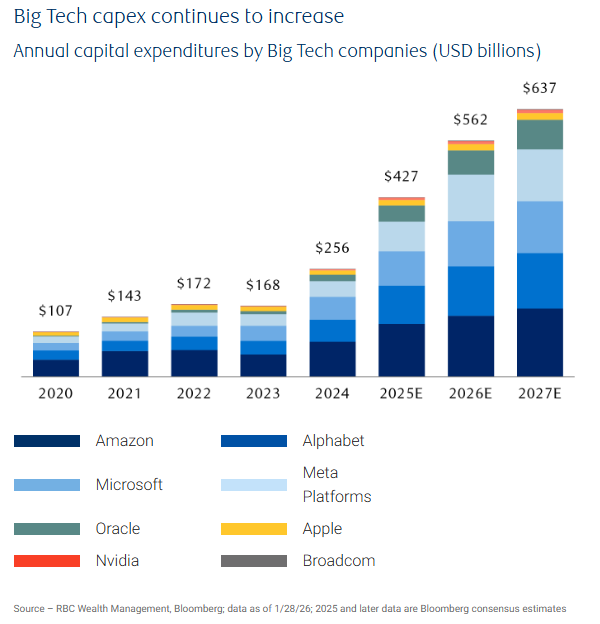

The question isn’t whether AI will make intelligence cheap. It is whether that cheap intelligence will be a public utility or a rentier’s monopoly. Right now, tech giants have been spending $427 billion on infrastructure in 2025 alone, and nations and corporations are betting trillions on it as well. They are securing their position not for a world of scarcity, but for a world where controlling the infrastructure of abundance is the new form of power.

For perspective, $427 billion is the size close to Norway’s entire GDP

Source: RBC Wealth Management

The Current Battlefield: Strategic Stockpiles

This shift has created a “Wartime Economy” for physical assets where nations have stopped viewing compute as a commercial service and started viewing it as a strategic reserve.

If you look at the global map, the chess pieces are moving to secure the two things AI consumes. Energy acts as the calories, and Rare Earths serve as the vitamins. The diplomatic maneuvering behind these acquisitions is geopolitical calculus rather than casual cooperation.

Read more on our Think Pieces and Reports page

- Three Mile Island: When AI Resurrects the Dead

In September 2024, Microsoft struck a deal that crystallizes just how desperate the energy situation has become: a 20-year power purchase agreement to restart Three Mile Island—yes, that Three Mile Island, site of America’s most notorious nuclear accident in 1979.

The reactor being restarted (renamed “Crane Clean Energy Center”) wasn’t part of the 1979 meltdown, but it had been shut down in 2019 for economic reasons. Now, with AI driving unprecedented electricity demand, what was economically unviable five years ago has become strategic necessity.

Here’s where government got involved: Pennsylvania Governor Josh Shapiro personally pushed for the project to be fast-tracked through PJM Interconnection’s grid approval process. Normally, power projects languish in PJM’s queue for years. Crane was the largest project ever expedited by PJM, cutting the timeline from an expected 2028 restart to 2027.

Then in 2025, the Trump administration’s Energy Department announced a $1 billion federal loan to support the restart. This is explicit government backing to resurrect a dormant nuclear plant exclusively to power Microsoft’s AI data centers.

This isn’t economic development. This is the government treating AI infrastructure like wartime production, fast-tracking approvals and deploying federal capital to ensure the power doesn’t run out. When you’re restarting nuclear reactors mothballed for safety concerns, you’re not optimizing—you’re scrambling.

- Greenland: The Fight for Vitamins

Greenland represents the other half of the equation. As we analyzed in “The Grandmaster’s Gambit,” the island is a fortress of strategic necessity because of its critical minerals.

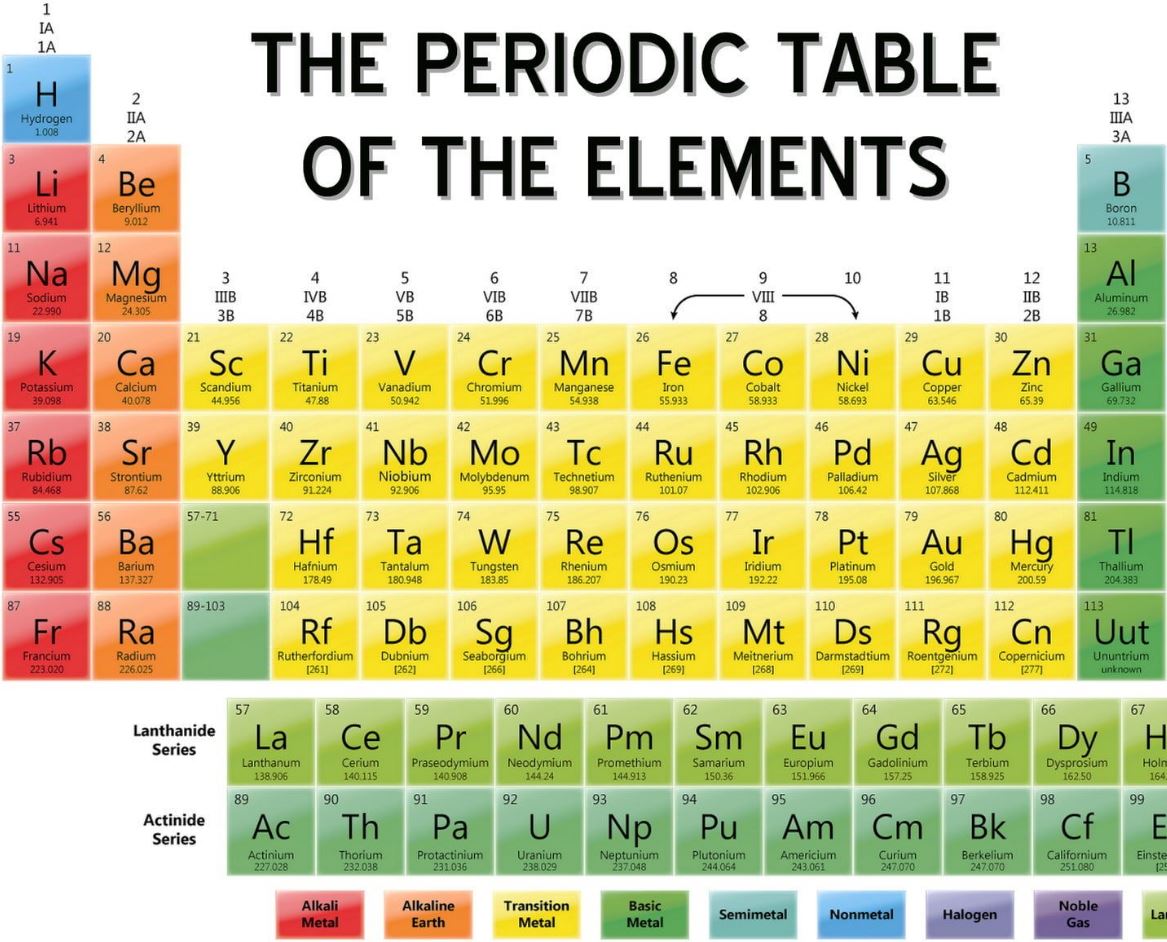

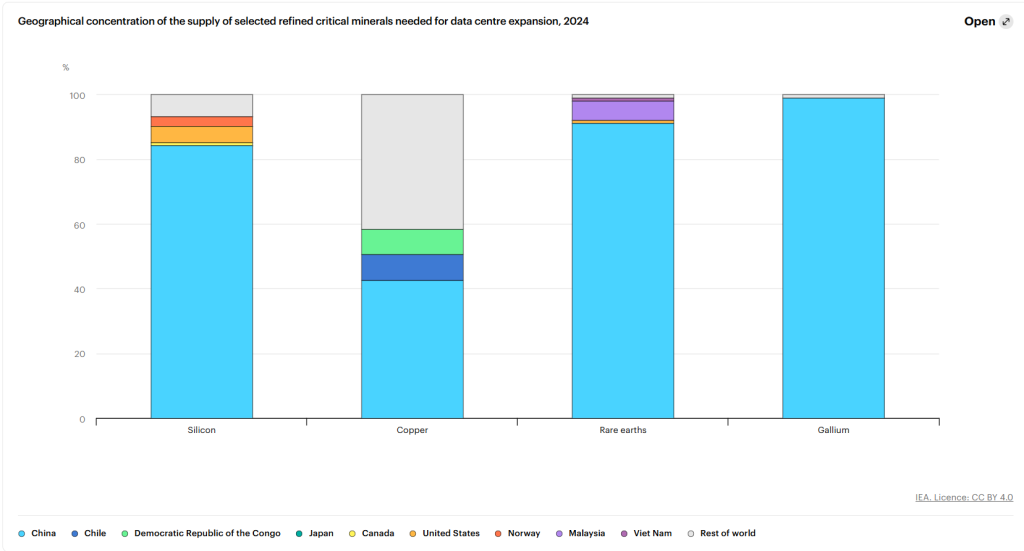

AI data centers require advanced cooling systems and high-performance magnets, which rely on rare earth elements like neodymium and dysprosium. China currently dominates roughly 90% of the processing for these minerals and 94% of rare earth magnet manufacturing. This leverage is a structural vulnerability that Western policymakers are desperate to close.

If China cuts off rare earth exports tomorrow (as they did during the 2010 rare earth crisis with Japan), Western AI infrastructure stops scaling. Not gradually. Immediately.

To counter this, the Trump administration announced Project Vault, a $12 billion strategic minerals stockpile designed to fortify supply chains. The goal is to treat Greenland and similar upstream sources as insurance against geopolitical supply disruptions. A supply chain that does not control its rare earth inputs cannot guarantee uninterrupted AI manufacturing.

- Pax Silica: The Allied Supply Bloc

Beyond unilateral stockpiling, we are seeing the formation of a “NATO for Supply Chains.”

In late 2025, the U.S. and allied nations convened the Pax Silica Initiative. This coalition includes Japan, South Korea, the Netherlands, and the UK. Their goal is to build a resilient global silicon supply chain that spans from upstream minerals to data centers.

This initiative is explicitly positioned to protect against coercive dependencies—to ensure China can’t use rare earth leverage the way Russia used gas pipelines. It creates a collective stockpile and innovation infrastructure regime constrained by allied trust networks rather than free market arms races.

But there’s a vulnerability: the “America First” imperative. What happens when U.S. priorities clash with Japanese or Korean interests? Can partners be assured their access won’t be cut off when Washington changes course? This is the tension nobody wants to discuss publicly, but it’s the fault line that could fracture the coalition.

Some diplomacy had to be involved but can partners be assured the “America First” agenda imperative won’t overshadow efforts?

Source: U.S. Department of State

China Isn’t Sitting Idle

While the West scrambles to diversify supply chains, China is doubling down on its advantages.

- Export Controls as Strategic Leverage

China has moved beyond simple export policy tweaks to use export controls as a tool of industrial diplomacy:

- April 2025: China placed seven medium and heavy rare earth elements including samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium under an export-control licensing regime. This requires government permits for exports and gives Beijing bureaucratic discretion over flows.

- October 9, 2025: Beijing announced a much broader set of export controls covering additional rare earths, associated technologies, and related materials, including five more medium/heavy rare earths (erbium, europium, holmium, thulium, and ytterbium) and even materials/tech that have downstream industrial applications.

- November 7, 2025: China paused implementation of many provisions of the October export-control package through Nov 10, 2026 under an agreement with the United States, effectively creating a temporary suspension, not a full rollback. The underlying licensing requirements and levers of control remain in place, and China continues to control the vast majority of processed rare earth exports.

What this means:

Rather than an outright ban, China now works with a licensing and procedural regime that gives it a scalable strategic lever. Even during the “pause,” China retains control over rare earth export licenses and can tighten or relax terms as geopolitical conditions evolve.

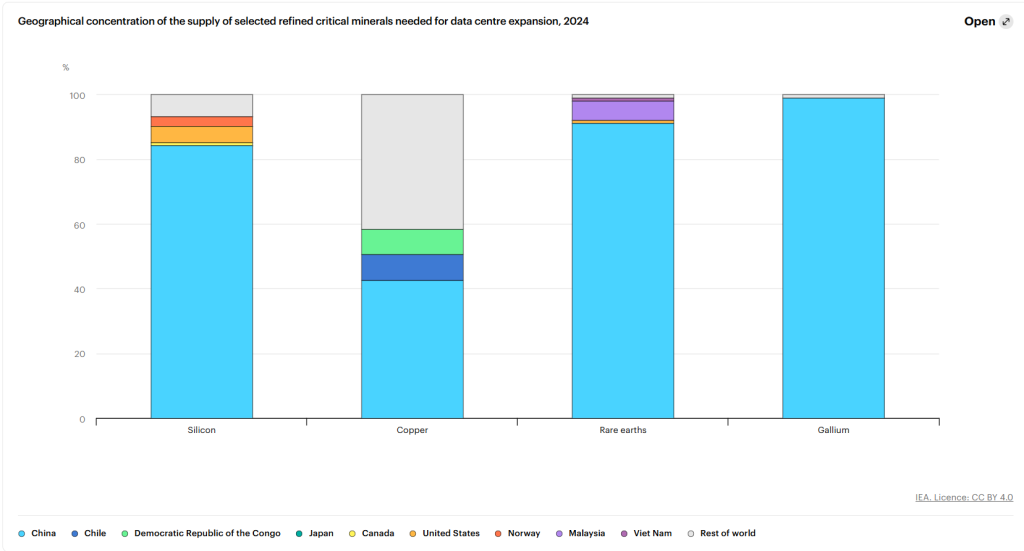

Source: IEA

- Supply Chain Leverage and Global Flows

China’s dominance in rare earths remains remarkable:

- China accounts for over 90% of processed rare earth supply globally, a concentration that gives Beijing outsized influence over global magnet, EV, and high-tech supply chains — even if controls are not always actively tightened.

- Western governments and firms remain acutely aware of this leverage: critics warn China could return to more aggressive export behavior once temporary suspensions lapse.

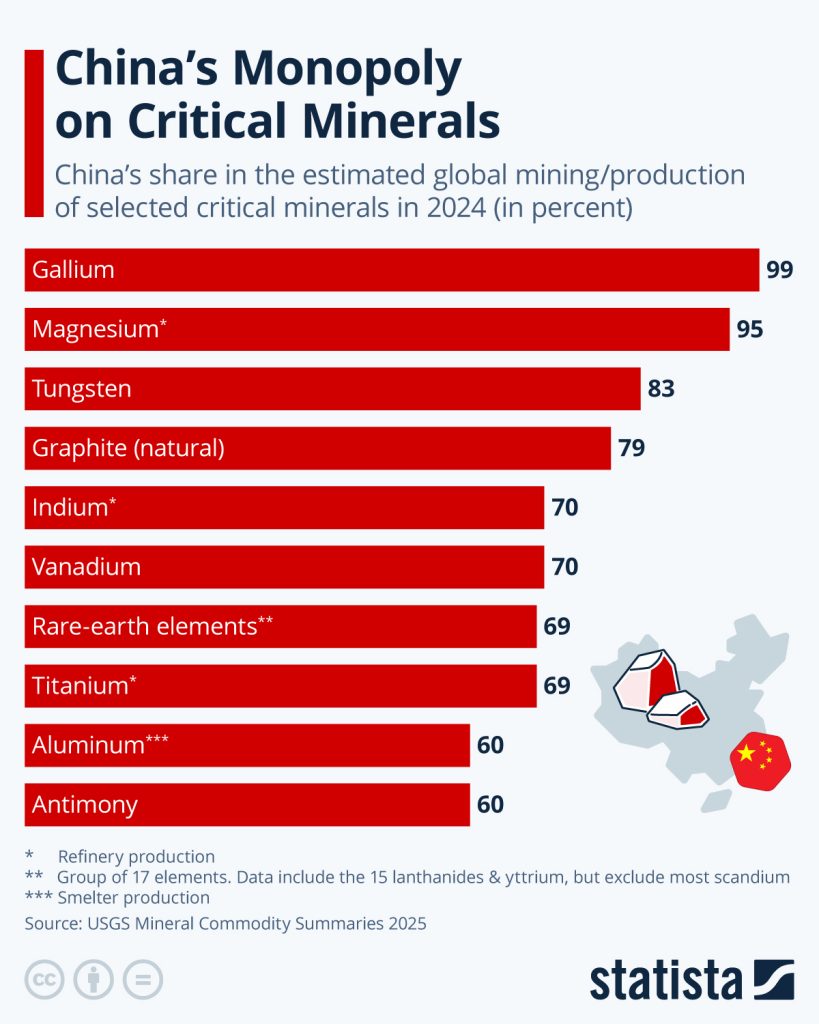

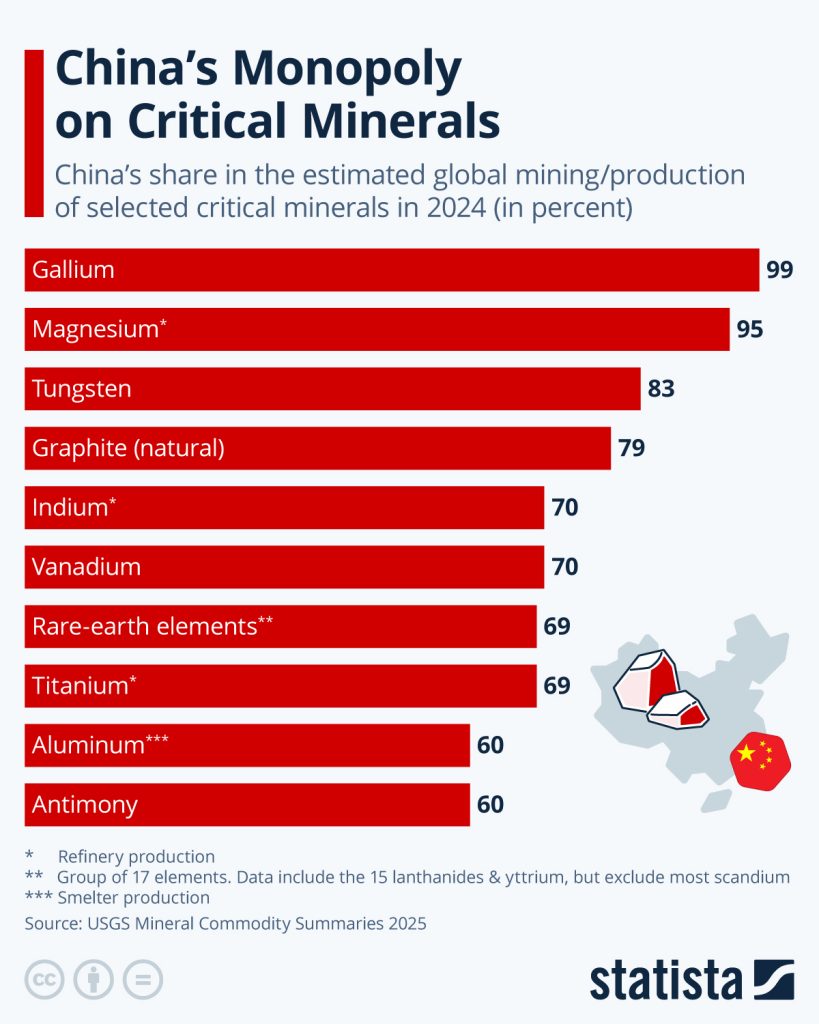

Source: Statista

- Domestic Stockpiling + Recycling as Resource Security

While precise numeric targets like “75% of global battery materials recycled by 2030” are difficult to verify in authoritative public policy documents, the direction of travel is clear: China is scaling recycling into a strategic extension of its critical minerals dominance.

- China is rapidly expanding its battery recycling industry, with forecasts showing strong growth through 2030 and expectations that it will remain the global leader in recycling market share.

- Installed recycling capacity was already in the multiple-million-tonnes per year range by 2024, positioning China as the world’s hub for end-of-life battery processing.

- Chinese firms and state-linked enterprises are building global recycling footprints, partnering internationally on recycling centers and after-sales recovery networks.

- Most importantly, Beijing has begun formalizing this into national industrial architecture: the China Resources Recycling Group Co., Ltd. (CRRG) was established in 2024 as a central, state-backed recycling platform spanning batteries, metals, and e-waste.

A state-owned recycling champion is a tell: China isn’t treating recycling as ESG. It’s treating it as resource security. If Beijing can control not just mining and refining, but also the “second mine” of end-of-life recovery, it can keep domestic industry fed while retaining long-term leverage over global supply chains.

The Real Bet

The question isn’t whether AI creates abundance. It’s who controls access once abundance arrives.

And they’re probably right.

You can have the smartest AI in the world. But if you don’t have the kilowatts to run it, the chips to scale it, the rare earths to cool it, or the legal sovereignty to control it, you’re a client state.

They’re not fighting over intelligence. They’re fighting over who gets to set the terms once intelligence is abundant.

And when intelligence is abundant, infrastructure is and will be the bottleneck.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

We are currently witnessing the largest capital expenditure in the history of technology. Hundreds of billions flowing into a machine designed to create infinite digital abundance. It looks like a paradox: Why fight a resource-heavy war over a technology that promises infinite digital abundance?

The answer lies in a lesson history has taught us repeatedly: Abundance does not mean equity. The neighbors fighting over the orange tree aren’t fighting for the fruit; they’re fighting to decide who owns the fence around the orchard.

Source: Accenture

The Logic of Control

The reason nations are hoarding chips and energy isn’t because they don’t believe in the abundance AI will bring. It’s because they don’t trust how it will be distributed.

History is littered with technologies that created massive surplus value, only to have that value concentrated in the hands of whoever owned the pipes.

- The Printing Press made information cheap; publishing houses became gatekeepers.

- Railroads made transportation cheap; railroad barons became oligarchs.

- The Internet made distribution free; platform monopolies became trillion-dollar rentiers.

The lesson is clear: New technologies don’t make old power structures obsolete. They get captured by them.

The question isn’t whether AI will make intelligence cheap. It is whether that cheap intelligence will be a public utility or a rentier’s monopoly. Right now, tech giants have been spending $427 billion on infrastructure in 2025 alone, and nations and corporations are betting trillions on it as well. They are securing their position not for a world of scarcity, but for a world where controlling the infrastructure of abundance is the new form of power.

For perspective, $427 billion is the size close to Norway’s entire GDP

Source: RBC Wealth Management

The Current Battlefield: Strategic Stockpiles

This shift has created a “Wartime Economy” for physical assets where nations have stopped viewing compute as a commercial service and started viewing it as a strategic reserve.

If you look at the global map, the chess pieces are moving to secure the two things AI consumes. Energy acts as the calories, and Rare Earths serve as the vitamins. The diplomatic maneuvering behind these acquisitions is geopolitical calculus rather than casual cooperation.

Read more on our Think Pieces and Reports page

- Three Mile Island: When AI Resurrects the Dead

In September 2024, Microsoft struck a deal that crystallizes just how desperate the energy situation has become: a 20-year power purchase agreement to restart Three Mile Island—yes, that Three Mile Island, site of America’s most notorious nuclear accident in 1979.

The reactor being restarted (renamed “Crane Clean Energy Center”) wasn’t part of the 1979 meltdown, but it had been shut down in 2019 for economic reasons. Now, with AI driving unprecedented electricity demand, what was economically unviable five years ago has become strategic necessity.

Here’s where government got involved: Pennsylvania Governor Josh Shapiro personally pushed for the project to be fast-tracked through PJM Interconnection’s grid approval process. Normally, power projects languish in PJM’s queue for years. Crane was the largest project ever expedited by PJM, cutting the timeline from an expected 2028 restart to 2027.

Then in 2025, the Trump administration’s Energy Department announced a $1 billion federal loan to support the restart. This is explicit government backing to resurrect a dormant nuclear plant exclusively to power Microsoft’s AI data centers.

This isn’t economic development. This is the government treating AI infrastructure like wartime production, fast-tracking approvals and deploying federal capital to ensure the power doesn’t run out. When you’re restarting nuclear reactors mothballed for safety concerns, you’re not optimizing—you’re scrambling.

- Greenland: The Fight for Vitamins

Greenland represents the other half of the equation. As we analyzed in “The Grandmaster’s Gambit,” the island is a fortress of strategic necessity because of its critical minerals.

AI data centers require advanced cooling systems and high-performance magnets, which rely on rare earth elements like neodymium and dysprosium. China currently dominates roughly 90% of the processing for these minerals and 94% of rare earth magnet manufacturing. This leverage is a structural vulnerability that Western policymakers are desperate to close.

If China cuts off rare earth exports tomorrow (as they did during the 2010 rare earth crisis with Japan), Western AI infrastructure stops scaling. Not gradually. Immediately.

To counter this, the Trump administration announced Project Vault, a $12 billion strategic minerals stockpile designed to fortify supply chains. The goal is to treat Greenland and similar upstream sources as insurance against geopolitical supply disruptions. A supply chain that does not control its rare earth inputs cannot guarantee uninterrupted AI manufacturing.

- Pax Silica: The Allied Supply Bloc

Beyond unilateral stockpiling, we are seeing the formation of a “NATO for Supply Chains.”

In late 2025, the U.S. and allied nations convened the Pax Silica Initiative. This coalition includes Japan, South Korea, the Netherlands, and the UK. Their goal is to build a resilient global silicon supply chain that spans from upstream minerals to data centers.

This initiative is explicitly positioned to protect against coercive dependencies—to ensure China can’t use rare earth leverage the way Russia used gas pipelines. It creates a collective stockpile and innovation infrastructure regime constrained by allied trust networks rather than free market arms races.

But there’s a vulnerability: the “America First” imperative. What happens when U.S. priorities clash with Japanese or Korean interests? Can partners be assured their access won’t be cut off when Washington changes course? This is the tension nobody wants to discuss publicly, but it’s the fault line that could fracture the coalition.

Some diplomacy had to be involved but can partners be assured the “America First” agenda imperative won’t overshadow efforts?

Source: U.S. Department of State

China Isn’t Sitting Idle

While the West scrambles to diversify supply chains, China is doubling down on its advantages.

- Export Controls as Strategic Leverage

China has moved beyond simple export policy tweaks to use export controls as a tool of industrial diplomacy:

- April 2025: China placed seven medium and heavy rare earth elements including samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium under an export-control licensing regime. This requires government permits for exports and gives Beijing bureaucratic discretion over flows.

- October 9, 2025: Beijing announced a much broader set of export controls covering additional rare earths, associated technologies, and related materials, including five more medium/heavy rare earths (erbium, europium, holmium, thulium, and ytterbium) and even materials/tech that have downstream industrial applications.

- November 7, 2025: China paused implementation of many provisions of the October export-control package through Nov 10, 2026 under an agreement with the United States, effectively creating a temporary suspension, not a full rollback. The underlying licensing requirements and levers of control remain in place, and China continues to control the vast majority of processed rare earth exports.

What this means:

Rather than an outright ban, China now works with a licensing and procedural regime that gives it a scalable strategic lever. Even during the “pause,” China retains control over rare earth export licenses and can tighten or relax terms as geopolitical conditions evolve.

Source: IEA

- Supply Chain Leverage and Global Flows

China’s dominance in rare earths remains remarkable:

- China accounts for over 90% of processed rare earth supply globally, a concentration that gives Beijing outsized influence over global magnet, EV, and high-tech supply chains — even if controls are not always actively tightened.

- Western governments and firms remain acutely aware of this leverage: critics warn China could return to more aggressive export behavior once temporary suspensions lapse.

Source: Statista

- Domestic Stockpiling + Recycling as Resource Security

While precise numeric targets like “75% of global battery materials recycled by 2030” are difficult to verify in authoritative public policy documents, the direction of travel is clear: China is scaling recycling into a strategic extension of its critical minerals dominance.

- China is rapidly expanding its battery recycling industry, with forecasts showing strong growth through 2030 and expectations that it will remain the global leader in recycling market share.

- Installed recycling capacity was already in the multiple-million-tonnes per year range by 2024, positioning China as the world’s hub for end-of-life battery processing.

- Chinese firms and state-linked enterprises are building global recycling footprints, partnering internationally on recycling centers and after-sales recovery networks.

- Most importantly, Beijing has begun formalizing this into national industrial architecture: the China Resources Recycling Group Co., Ltd. (CRRG) was established in 2024 as a central, state-backed recycling platform spanning batteries, metals, and e-waste.

A state-owned recycling champion is a tell: China isn’t treating recycling as ESG. It’s treating it as resource security. If Beijing can control not just mining and refining, but also the “second mine” of end-of-life recovery, it can keep domestic industry fed while retaining long-term leverage over global supply chains.

The Real Bet

The question isn’t whether AI creates abundance. It’s who controls access once abundance arrives.

And they’re probably right.

You can have the smartest AI in the world. But if you don’t have the kilowatts to run it, the chips to scale it, the rare earths to cool it, or the legal sovereignty to control it, you’re a client state.

They’re not fighting over intelligence. They’re fighting over who gets to set the terms once intelligence is abundant.

And when intelligence is abundant, infrastructure is and will be the bottleneck.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share