Gold out of Stock? But Still in Our Minds

Gold out of Stock? But Still in Our Minds

First it was Indonesia. Then Singapore. Now Japan.

Gold is disappearing from shelves across Asia — and not in a metaphysical, “store of value” kind of way. We mean literally. Sold out. Bars gone. Retailers suspending sales. ETFs trading at massive premiums. Even banks issuing crowd control notices for gold counters.

It feels less like a market trend, and more like a regional treasure hunt.

So what’s going on? And why does this moment feel both absurd and deeply logical?

Let’s dig in.

Japan Joins the Gold Shortage Club

Just this past week, Japan’s top gold retailer, Tanaka, paused sales of small bullion bars, citing overwhelming demand. Bars under 50 grams? Gone. Websites? Out of stock. Ginza? Lined up.

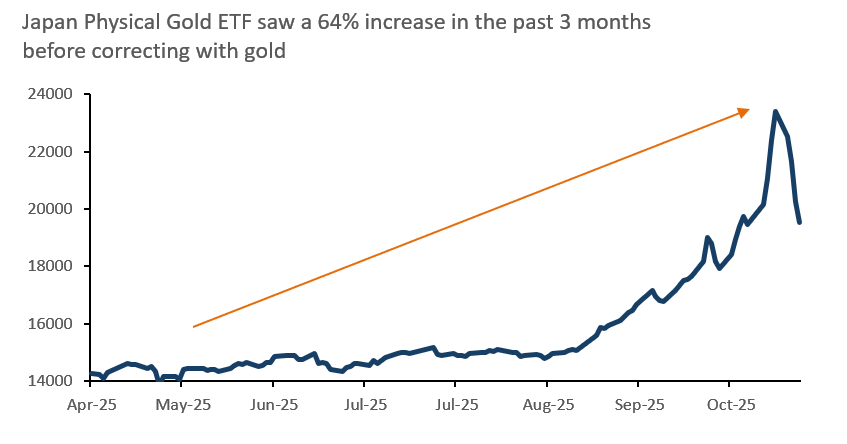

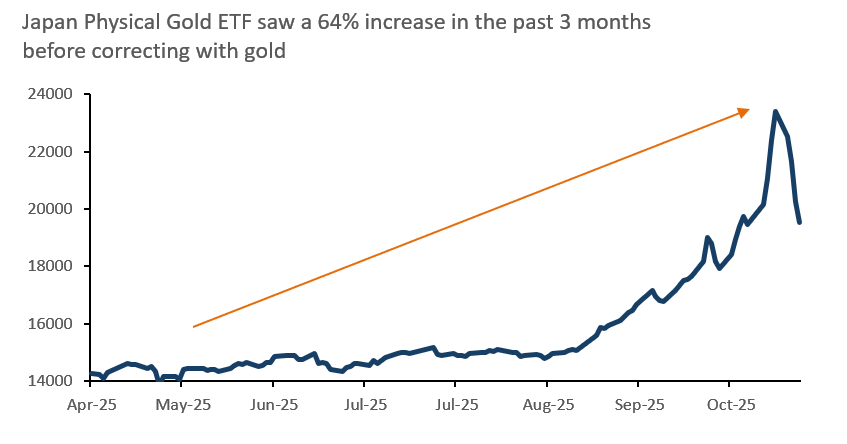

Meanwhile, the Japan Physical Gold ETF has been trading at a wild premium — as high as 16% above its net asset value. That’s the kind of divergence you don’t normally see unless there’s a serious supply-demand mismatch. Or in this case, when investors are literally willing to pay more for paper gold just to secure the option of turning it into physical.

Source: Bloomberg

Mitsubishi, the fund’s backer, is scrambling to source bullion both domestically and abroad, but can’t keep up. And it’s not just retail buying: the yen’s continued depreciation has made dollar-based gold look even more attractive for Japanese investors.

Gold Rush Déjà Vu – Indonesia Did It First?

Let the record show: Indonesia was early.

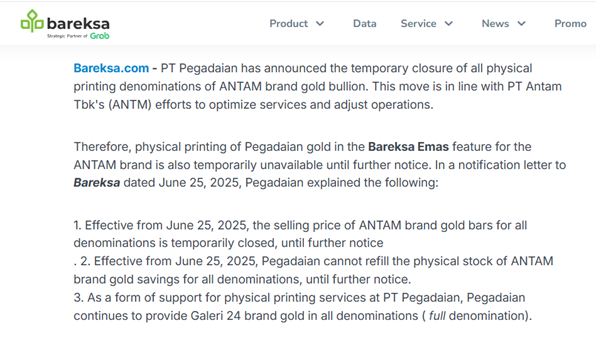

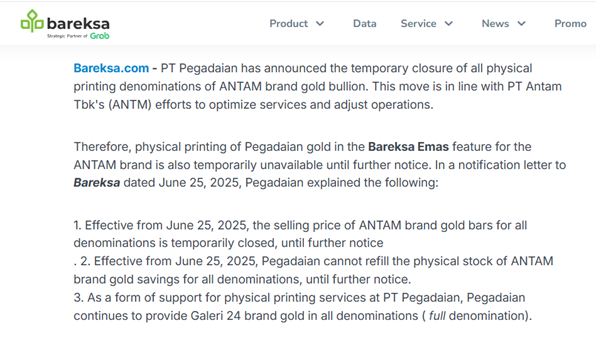

Back in June 2025, Pegadaian’s Galeri 24 (one of the biggest gold retailers in Indonesia) temporarily suspended all sales of ANTAM gold bars across all denominations. Supply constraints, operational issues, and unrelenting demand collided. And like in Japan, the smaller bars disappeared first.

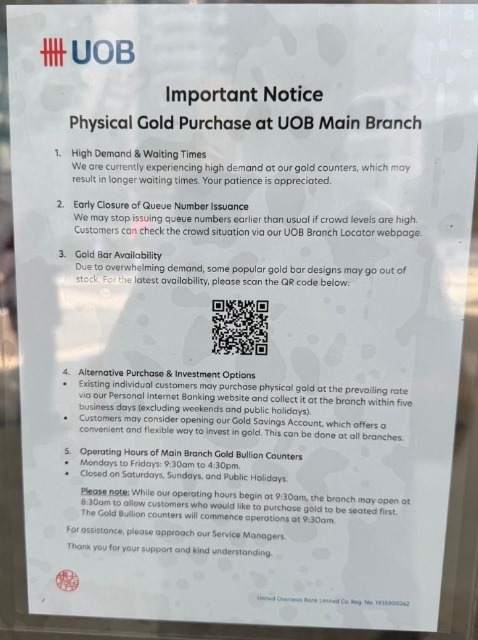

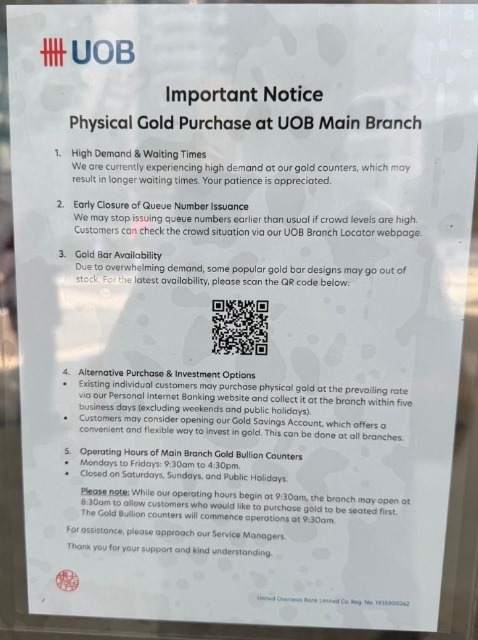

Notice of the temporary suspension in Bareksa (Indonesian financial marketplace) back in June alongside physical notice in one of UOB’s Singapore branch on the ground

Even UOB’s Singapore branch had to post notices about long queues, early closure of issuance numbers, and bar designs running out of stock. It was gold fever — with air conditioning.

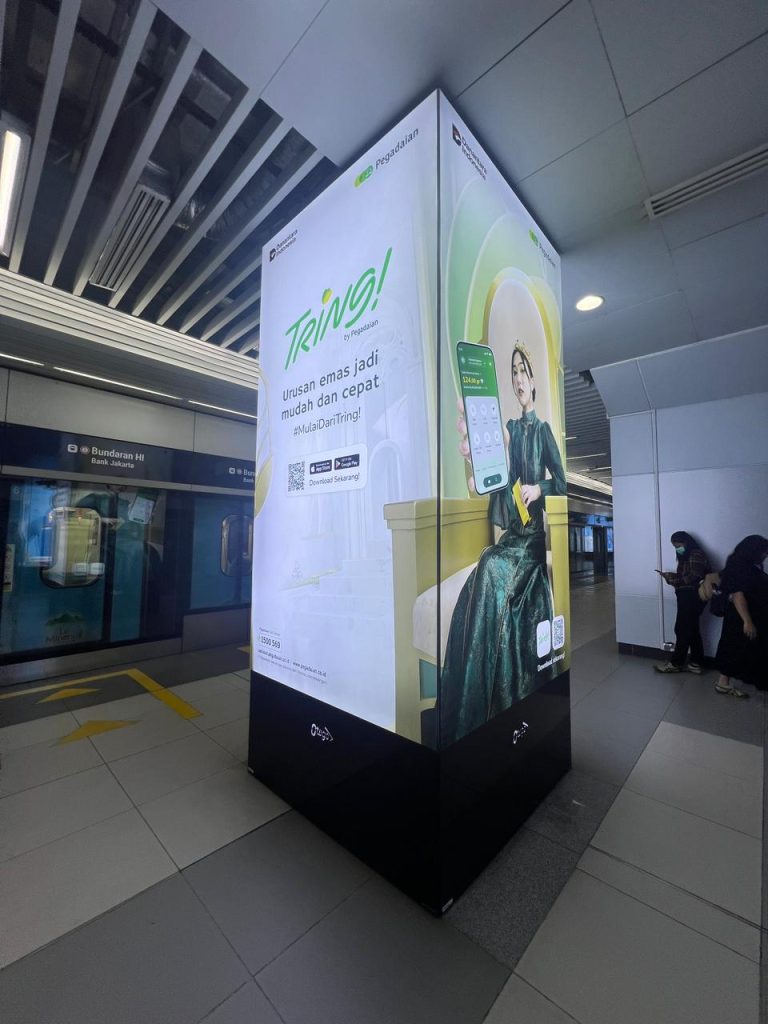

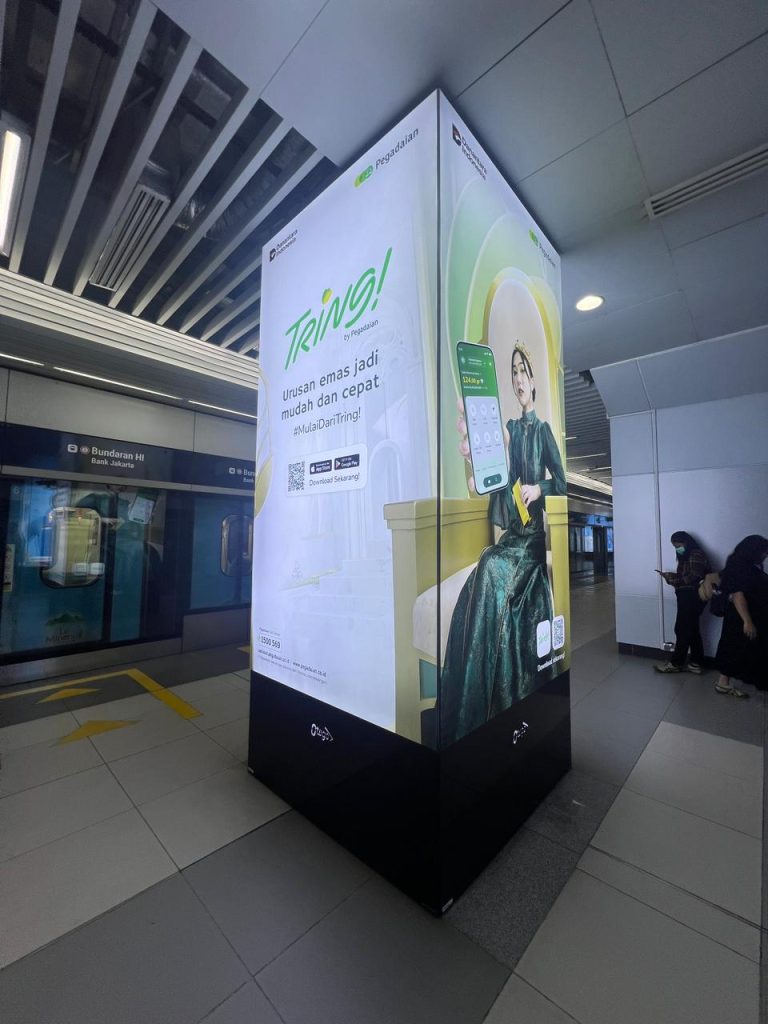

In Jakarta, gold is everywhere, even underground. This ad for Pegadaian’s Tring! app was spotted in the Bundaran HI MRT station, featuring a queen-like figure on a golden throne, smartphone in hand, and a bar of gold in the other.

Pegadaian’s newest digital gold app ads all over the Jakarta’s MRT busiest station

It’s an intriguing development this digitization of gold. In Indonesia, platforms like these are gamifying and simplifying gold investing. Want to buy 0.1 grams on your lunch break? There’s an app for that.

It’s part of a wider fintech movement that blends tradition with tech. Young Indonesians may never buy physical newspapers, but they’ll happily stack digital gold grams in an app, especially when headlines scream “stagflation” and “rate cuts delayed.”

And while Japan’s retail boom is currently showing in ETFs and queues at brick-and-mortar stores, we wouldn’t be surprised to see digital gold apps take off there too, especially as younger investors look for easier ways to escape yen depreciation.

If that doesn’t scream “gold is mainstream,” we don’t know what does.

Everyone Wants Real Assets Now

What we’re witnessing isn’t just a consumer fad. It’s the continuation of a deeper, structural trend we’ve written about in “The Return of Real Money”:

In an age of debt saturation, geopolitical shocks, and currency debasement, gold isn’t an asset. It’s insurance.

Unlike tech stocks or AI tokens, you can hold it. Store it. Gift it. Hide it in your grandma’s rice cooker if necessary. And perhaps most importantly, it doesn’t rely on someone else’s cash flow or promises.

As central banks (especially in the Global South) continue to accumulate gold, retail investors are following suit. The difference? Central banks hoard by the tonne. Retail investors hoard by the gram. But the psychology is the same.

What About the Correction?

Let’s address the elephant in the vault: gold recently tumbled nearly 6% in a single trading day after hitting record highs — the largest one‑day percentage drop in over a decade.

But rather than spooking the market, demand barely flinched. In fact, good luck getting your hands on physical gold right now. Even after the dip:

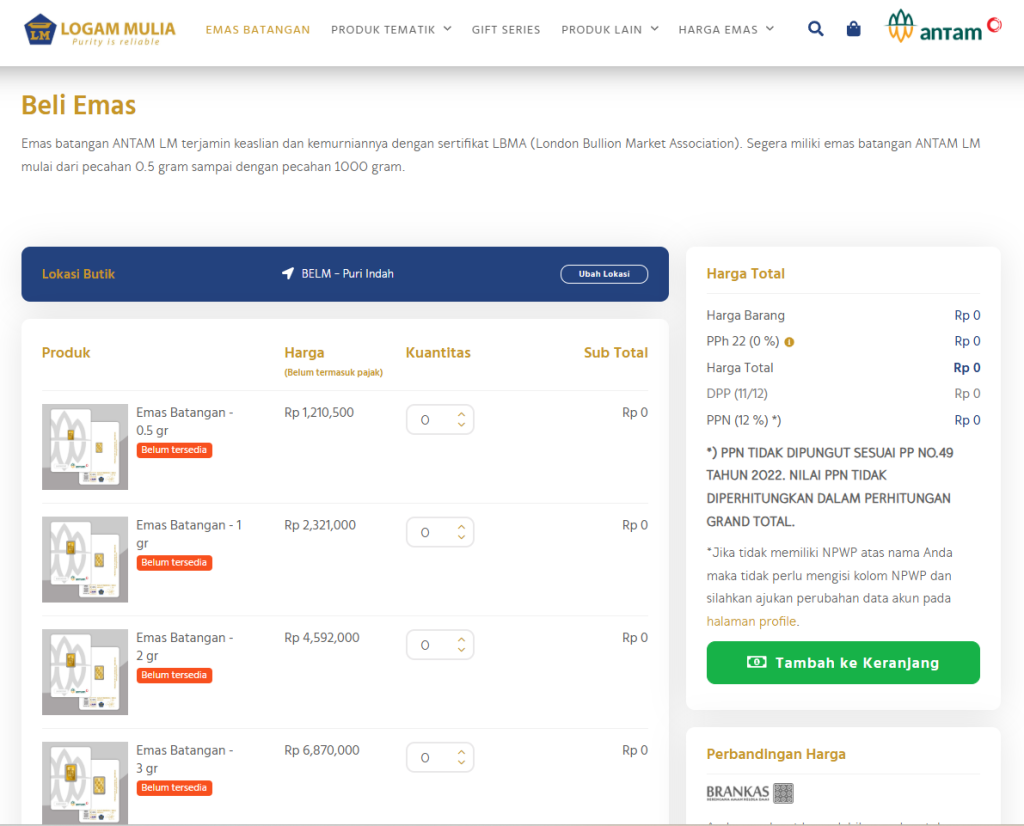

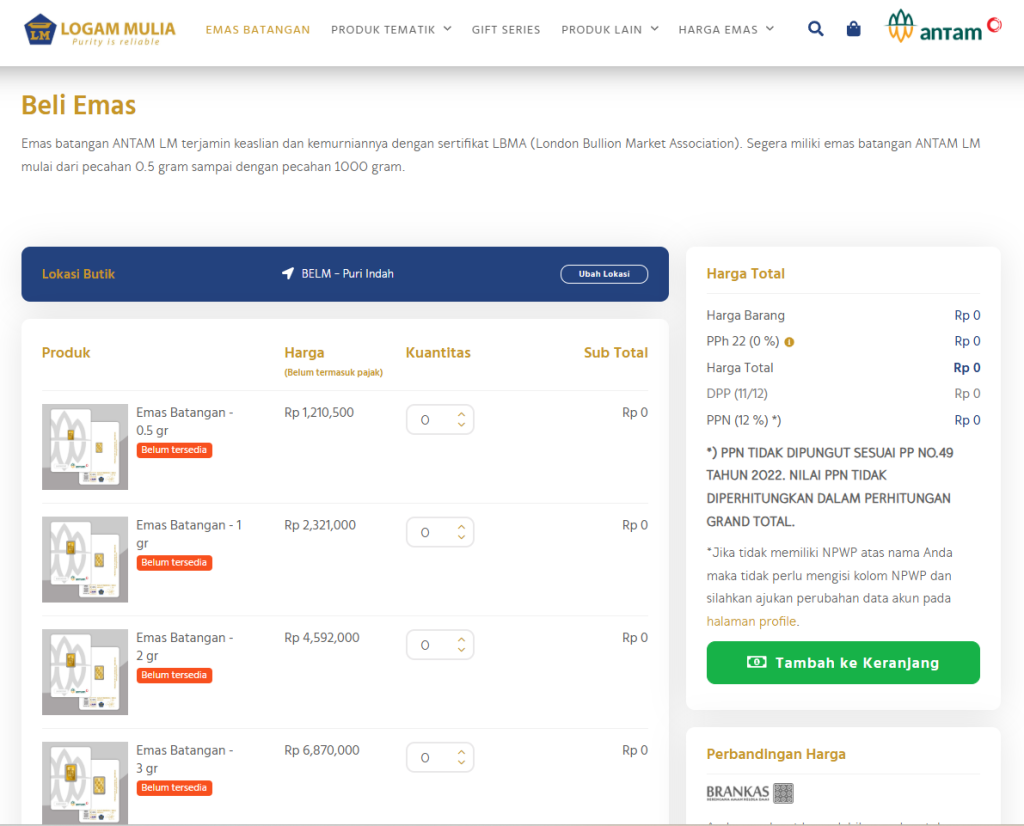

- On the official ANTAM website, gold remains sold out across all denominations.

Completely sold out online

- When one of our team members tried to call a secondary market dealer, the quote was an eye-watering Rp3,000,000/gram — nearly 30% above ANTAM’s own retail price and a premium of 37% above global gold spot price.

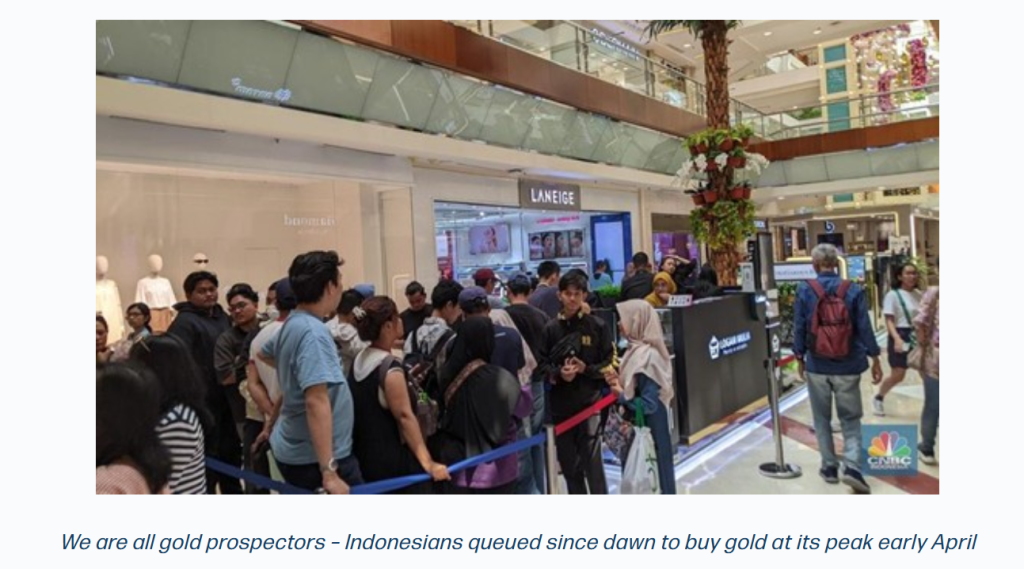

- This isn’t new. Back in May, during another gold frenzy, we published “We Are All Prospectors” and shared this photo of Indonesians lining up at dawn to buy gold in malls.

So yes, this correction might be technical — but structurally? The gold rush never really ended.

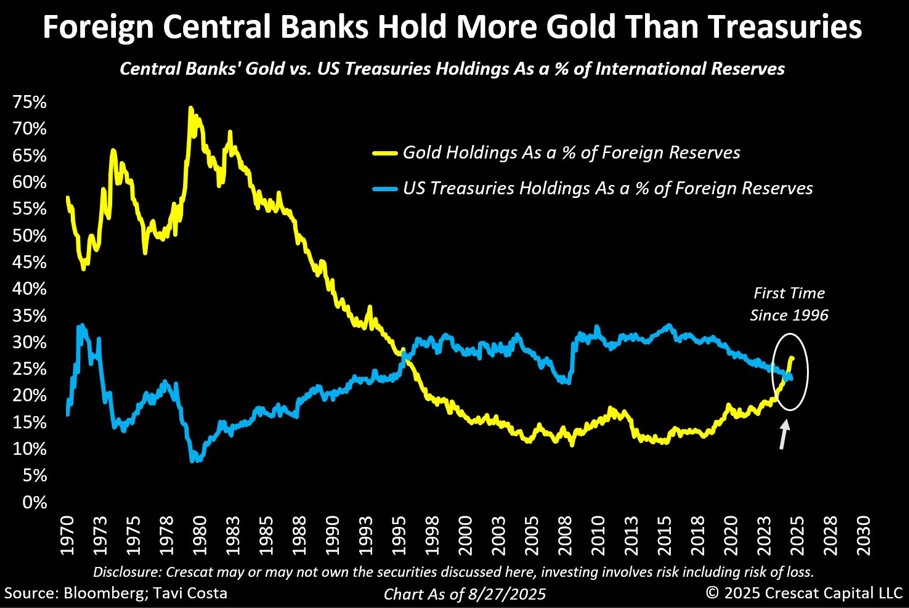

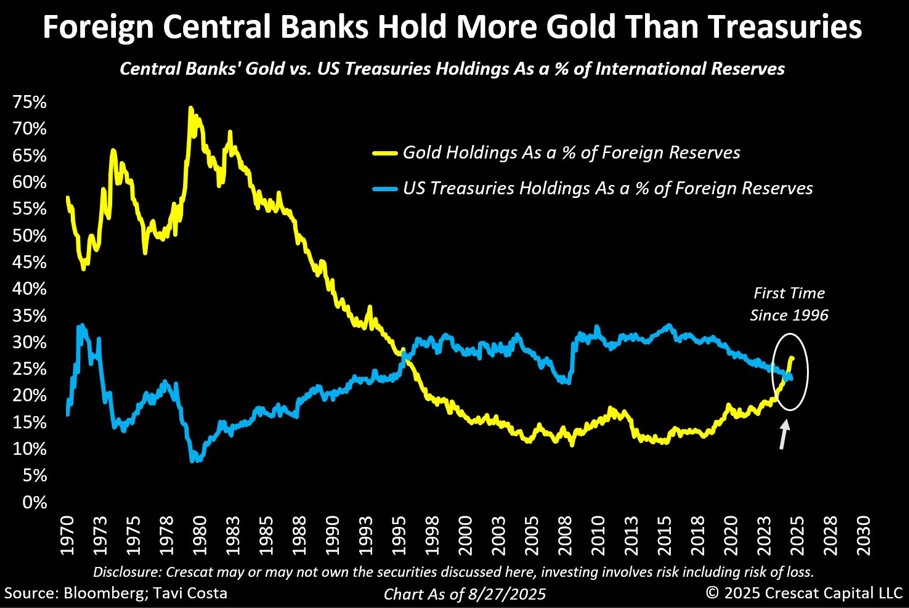

Just take a look at this chart:

For the first time since 1996, foreign central banks are holding more gold than US Treasuries as a percentage of their reserves. That’s not a fluke — it’s a statement.

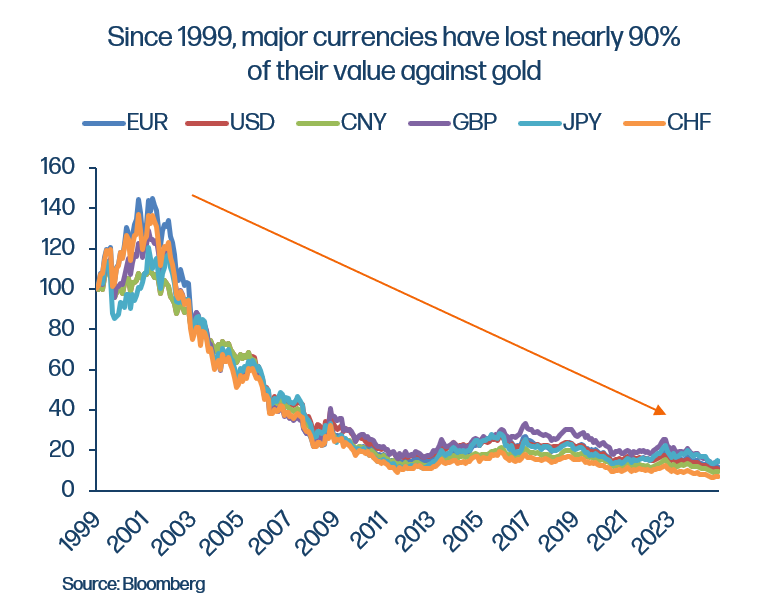

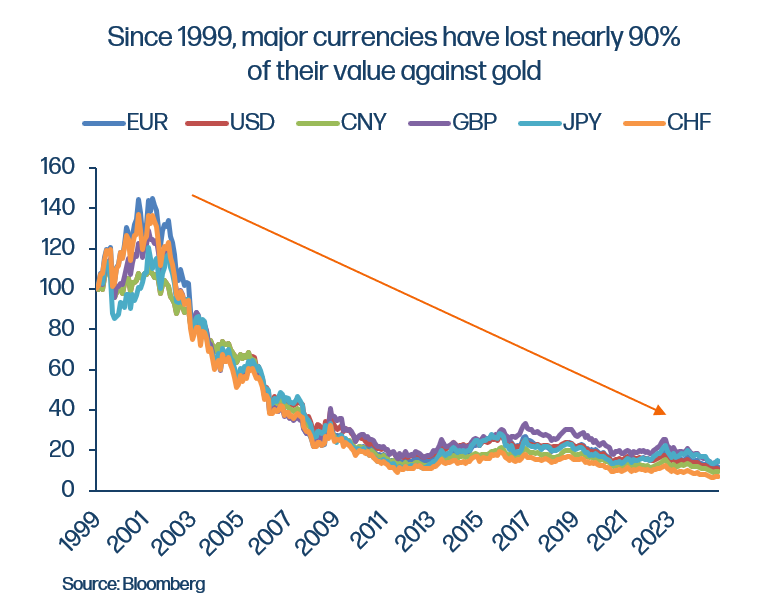

And if you’re wondering why, the chart below offers some answers:

Since 1999, major currencies have lost nearly 90% of their value against gold. And as history shows, no global reserve currency lasts forever.

Now, after all the retail queues, the stockouts, the ETF premiums, it might be tempting to think gold has become too obvious. That we’re at the top.

But here’s the contrarian reality:

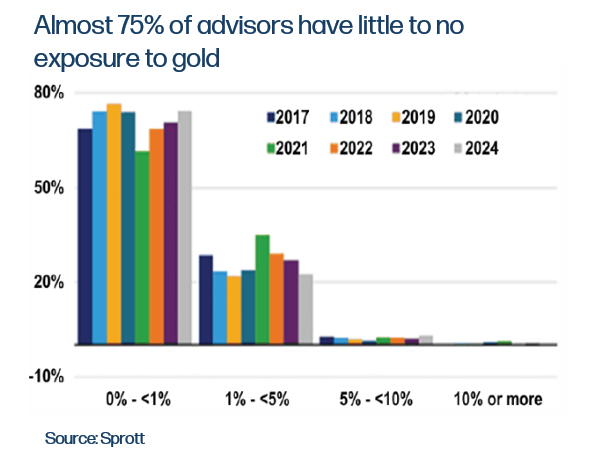

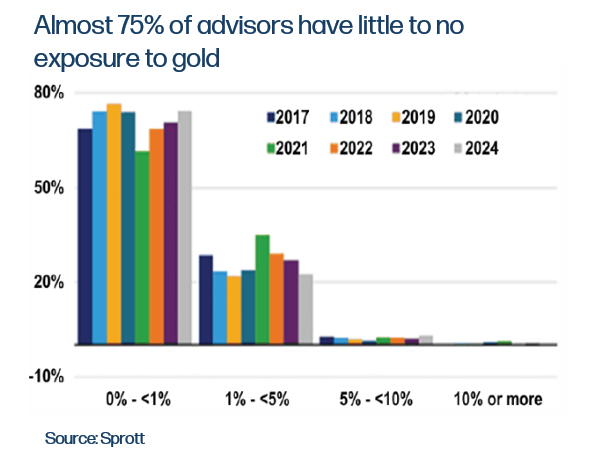

Almost 75% of financial advisors still allocate less than 1% to gold in client portfolios.

Let that sink in.

Even with central banks accumulating more gold than Treasuries for the first time since 1996… even with physical retail demand breaking supply chains… gold still remains a rounding error in most formal portfolios.

That’s underexposure.

Which raises the question: if this much buying is happening with barely any institutional participation, what happens if that starts to shift?

Final Thoughts: The Wisdom of Crowds in Gold

It’s easy to dismiss long queues and app downloads as retail noise. But as Barton Biggs observed in his book ‘Wealth, War & Wisdom’, markets are ultimately voting machines — messy, emotional, but often clairvoyant.

He wrote that the collective intuition of investors has an uncanny ability to sense regime shifts before the experts do. “We should be very respectful,” he warned, “of the collective wisdom of stock markets.”

We’d go one step further: Don’t underestimate the public.

When thousands of people from Tokyo to Jakarta line up, buy out inventory, or pay 30% premiums for a gram of gold, they may be voting with something deeper than just greed.

They might be sensing what the data now confirms: central banks shifting reserves, currencies debasing in plain sight, and trust migrating from promises to physicality

No, gold didn’t glitter slowly. But maybe it wasn’t supposed to.

Because when belief is this widespread, persistent, and still under-allocated — we may be watching the first inklings of a regime shift, not the last breath of a rally.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

First it was Indonesia. Then Singapore. Now Japan.

Gold is disappearing from shelves across Asia — and not in a metaphysical, “store of value” kind of way. We mean literally. Sold out. Bars gone. Retailers suspending sales. ETFs trading at massive premiums. Even banks issuing crowd control notices for gold counters.

It feels less like a market trend, and more like a regional treasure hunt.

So what’s going on? And why does this moment feel both absurd and deeply logical?

Let’s dig in.

Japan Joins the Gold Shortage Club

Just this past week, Japan’s top gold retailer, Tanaka, paused sales of small bullion bars, citing overwhelming demand. Bars under 50 grams? Gone. Websites? Out of stock. Ginza? Lined up.

Meanwhile, the Japan Physical Gold ETF has been trading at a wild premium — as high as 16% above its net asset value. That’s the kind of divergence you don’t normally see unless there’s a serious supply-demand mismatch. Or in this case, when investors are literally willing to pay more for paper gold just to secure the option of turning it into physical.

Source: Bloomberg

Mitsubishi, the fund’s backer, is scrambling to source bullion both domestically and abroad, but can’t keep up. And it’s not just retail buying: the yen’s continued depreciation has made dollar-based gold look even more attractive for Japanese investors.

Gold Rush Déjà Vu – Indonesia Did It First?

Let the record show: Indonesia was early.

Back in June 2025, Pegadaian’s Galeri 24 (one of the biggest gold retailers in Indonesia) temporarily suspended all sales of ANTAM gold bars across all denominations. Supply constraints, operational issues, and unrelenting demand collided. And like in Japan, the smaller bars disappeared first.

Notice of the temporary suspension in Bareksa (Indonesian financial marketplace) back in June alongside physical notice in one of UOB’s Singapore branch on the ground

Even UOB’s Singapore branch had to post notices about long queues, early closure of issuance numbers, and bar designs running out of stock. It was gold fever — with air conditioning.

In Jakarta, gold is everywhere, even underground. This ad for Pegadaian’s Tring! app was spotted in the Bundaran HI MRT station, featuring a queen-like figure on a golden throne, smartphone in hand, and a bar of gold in the other.

Pegadaian’s newest digital gold app ads all over the Jakarta’s MRT busiest station

It’s an intriguing development this digitization of gold. In Indonesia, platforms like these are gamifying and simplifying gold investing. Want to buy 0.1 grams on your lunch break? There’s an app for that.

It’s part of a wider fintech movement that blends tradition with tech. Young Indonesians may never buy physical newspapers, but they’ll happily stack digital gold grams in an app, especially when headlines scream “stagflation” and “rate cuts delayed.”

And while Japan’s retail boom is currently showing in ETFs and queues at brick-and-mortar stores, we wouldn’t be surprised to see digital gold apps take off there too, especially as younger investors look for easier ways to escape yen depreciation.

If that doesn’t scream “gold is mainstream,” we don’t know what does.

Everyone Wants Real Assets Now

What we’re witnessing isn’t just a consumer fad. It’s the continuation of a deeper, structural trend we’ve written about in “The Return of Real Money”:

In an age of debt saturation, geopolitical shocks, and currency debasement, gold isn’t an asset. It’s insurance.

Unlike tech stocks or AI tokens, you can hold it. Store it. Gift it. Hide it in your grandma’s rice cooker if necessary. And perhaps most importantly, it doesn’t rely on someone else’s cash flow or promises.

As central banks (especially in the Global South) continue to accumulate gold, retail investors are following suit. The difference? Central banks hoard by the tonne. Retail investors hoard by the gram. But the psychology is the same.

What About the Correction?

Let’s address the elephant in the vault: gold recently tumbled nearly 6% in a single trading day after hitting record highs — the largest one‑day percentage drop in over a decade.

But rather than spooking the market, demand barely flinched. In fact, good luck getting your hands on physical gold right now. Even after the dip:

- On the official ANTAM website, gold remains sold out across all denominations.

Completely sold out online

- When one of our team members tried to call a secondary market dealer, the quote was an eye-watering Rp3,000,000/gram — nearly 30% above ANTAM’s own retail price and a premium of 37% above global gold spot price.

- This isn’t new. Back in May, during another gold frenzy, we published “We Are All Prospectors” and shared this photo of Indonesians lining up at dawn to buy gold in malls.

So yes, this correction might be technical — but structurally? The gold rush never really ended.

Just take a look at this chart:

For the first time since 1996, foreign central banks are holding more gold than US Treasuries as a percentage of their reserves. That’s not a fluke — it’s a statement.

And if you’re wondering why, the chart below offers some answers:

Since 1999, major currencies have lost nearly 90% of their value against gold. And as history shows, no global reserve currency lasts forever.

Now, after all the retail queues, the stockouts, the ETF premiums, it might be tempting to think gold has become too obvious. That we’re at the top.

But here’s the contrarian reality:

Almost 75% of financial advisors still allocate less than 1% to gold in client portfolios.

Let that sink in.

Even with central banks accumulating more gold than Treasuries for the first time since 1996… even with physical retail demand breaking supply chains… gold still remains a rounding error in most formal portfolios.

That’s underexposure.

Which raises the question: if this much buying is happening with barely any institutional participation, what happens if that starts to shift?

Final Thoughts: The Wisdom of Crowds in Gold

It’s easy to dismiss long queues and app downloads as retail noise. But as Barton Biggs observed in his book ‘Wealth, War & Wisdom’, markets are ultimately voting machines — messy, emotional, but often clairvoyant.

He wrote that the collective intuition of investors has an uncanny ability to sense regime shifts before the experts do. “We should be very respectful,” he warned, “of the collective wisdom of stock markets.”

We’d go one step further: Don’t underestimate the public.

When thousands of people from Tokyo to Jakarta line up, buy out inventory, or pay 30% premiums for a gram of gold, they may be voting with something deeper than just greed.

They might be sensing what the data now confirms: central banks shifting reserves, currencies debasing in plain sight, and trust migrating from promises to physicality

No, gold didn’t glitter slowly. But maybe it wasn’t supposed to.

Because when belief is this widespread, persistent, and still under-allocated — we may be watching the first inklings of a regime shift, not the last breath of a rally.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share