Stablecoins 101: Chips, Claw Machines, and the Subtle Rebuild of Money

Stablecoins 101: Chips, Claw Machines, and the Subtle Rebuild of Money

Picture this:

You’re at a noisy arcade like Timezone or Funworld in one of Jakarta’s malls lured by the flashing lights, blaring music, and a dose of nostalgia.

You swap a crisp Rp100,000 note for a plastic game card loaded with digital credits. (When I was younger, we used physical coin tokens and you had to wear pants with pockets deep enough to carry them)

Kid-friendly Vegas

You lose half in a rigged claw machine. A quarter to classic Tekken. And the rest for 7 minutes on a Dance Dance Revolution machine, feet flailing. You tap out, breathless, and redeem your hard-earned tickets — only to realize they get you exactly one pen that barely writes.

Did you just waste your money? Maybe.

But notice this: you trusted digital tokens over paper cash because inside the arcade, tokens are simpler, faster, and universally accepted.

Stablecoins are the arcade tokens of today’s global economy — but they don’t stay inside the arcade. They cross borders, never close, and quietly fix the pain points your bank still pretends are normal.

A Fix Hiding in Plain Sight

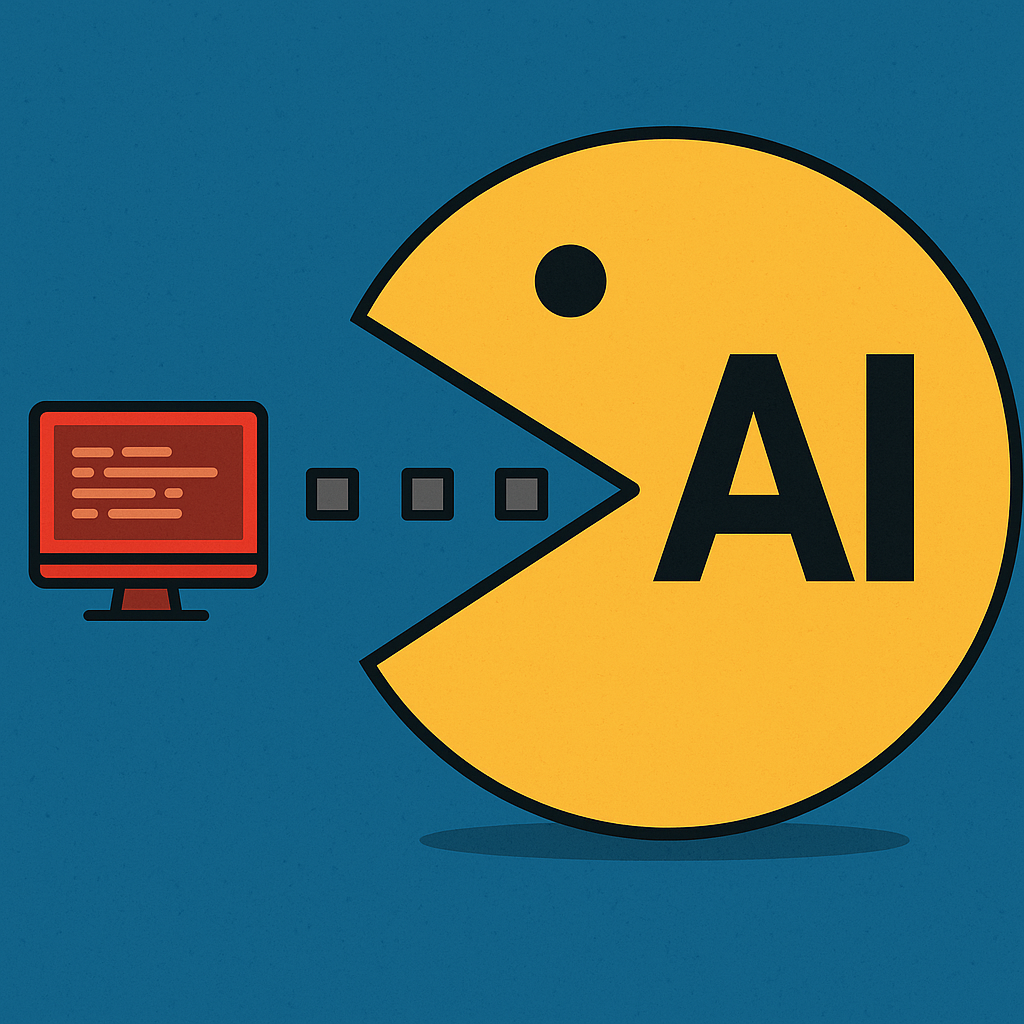

For all the hype around crypto moons and meme coins, stablecoins solve something far more boring — and therefore, more durable.

They answer a practical question:

How do you move dollars at internet speed, with blockchain-level transparency, and no wire fees or banker’s lunch break in the way?

They’re not here to replace money.

They’re here to upgrade money’s plumbing.

This Is Not a Revolution. It’s an Evolution.

If you look closer, stablecoins echo the big shifts we see playing out worldwide:

De-globalization? When trade routes get political and supply chains come home, people look for new rails to keep money moving, cheaply and discreetly.

De-dollarization? When countries fear dollar-based sanctions, stablecoins become a side door: a shadow dollar that’s programmable and borderless.

Decentralization? When trust in big intermediaries fades, people put faith in math. A blockchain ledger, open to all, beats a bank vault open 9–5.

Stablecoins quietly ride all three currents. They’re not protest coins or Ponzi bets. They’re pragmatic bridges from old pipes to new flows.

Why Use Them? Let’s Talk Chips

In Vegas, nobody slaps a hundred-dollar bill on the blackjack table. You use chips — faster, uniform, cashable anytime.

Heyokha Movie Favorites: “The Big Short” – specifically the scene with Selena Gomez explaining how CDOs work using the game of poker

Stablecoins? Same idea — except the casino is the global financial system.

Want to lend, borrow, or earn yield in crypto? You don’t wire money to some shady middleman. You park stablecoins on a blockchain app — better known as DeFi (short for Decentralized Finance). DeFi is just your local bank’s back office — minus the marble lobby and surly tellers.

Stablecoins make DeFi run smoothly:

- Programmable, so smart contracts do the paperwork.

- Redeemable, so trust is collateralised — real dollars and Treasuries sit behind them, verified by auditors.

- Global, so they ignore time zones and national borders.

Poker chips work because the casino cage redeems them at face value.

Stablecoins work because trustworthy issuers (like Circle’s USDC) guarantee that for every token minted, a real dollar or Treasury bill sits safely somewhere, verified by auditors.

Break that trust (hello, Terra Luna), and the market teaches a swift lesson.

Real World, Real Money

Here’s the kicker:

Tether, the biggest stablecoin, moves ~$100 billion daily, with ~90% of that volume living in emerging markets where people trust crypto dollars more than their own banks.

And this product? It’s now the backbone for tokenized Treasuries, DeFi lending, and cross-border paychecks — areas where “fast money” used to mean “expensive wires.”

Stablecoins rapidly becoming mainstream- in banking, groceries, and even in gaming!

When crypto kids sniff out an edge, that’s fun.

When Stripe, Visa, JPMorgan, and Citi sniff it too — you pay attention.

- Stripe scooped up Bridge for stablecoin rails and Privy for embedded wallets — so any dev can build instant crypto payments in five clicks.

- Visa & Mastercard pilot stablecoin settlement to cut costly FX loops.

- Big banks, once dismissive, now quietly sketch joint stablecoins to keep cross-border clients from drifting DeFi-ward.

It’s a game of keep-up. And the chips are stablecoins.

Old ETFs, New Tokens

Here’s your granddad’s way:

- Buy a Treasury ETF.

- Wait two days for settlement.

- Wait a month for yield.

The new way:

- Swap stablecoins for a tokenized Treasury.

- Yield streams daily.

- Cash out whenever, globally.

Franklin Templeton, the global investment firm? Doing it.

Stripe? Enabling it.

Next? Everyone who hates wire fees.

Final Thought: Chips at a Global Table

Odds you win that claw machine: 1 in 15.

Odds your bank wires your money on time: about the same on a public holiday.

Stablecoins skip both — they just work. They’re the chips on every table — Vegas or Jakarta — letting players bet, cash out, and stay liquid without asking permission.

Stablecoins won’t make you trust fiat again if you ever have doubts, but they might make you trust finance again.

No waiting room. No middleman. No banker asking what the funds are for.

Just verified, auditable, programmable value.

And maybe—just maybe—a new global monetary layer that’s not backed by belief in governments, but by math.

We don’t know if stablecoins will go to the moon, but they might build the bridge to the future.

Tara Mulia and Simon Chan

Admin heyokha

Share

Picture this:

You’re at a noisy arcade like Timezone or Funworld in one of Jakarta’s malls lured by the flashing lights, blaring music, and a dose of nostalgia.

You swap a crisp Rp100,000 note for a plastic game card loaded with digital credits. (When I was younger, we used physical coin tokens and you had to wear pants with pockets deep enough to carry them)

Kid-friendly Vegas

You lose half in a rigged claw machine. A quarter to classic Tekken. And the rest for 7 minutes on a Dance Dance Revolution machine, feet flailing. You tap out, breathless, and redeem your hard-earned tickets — only to realize they get you exactly one pen that barely writes.

Did you just waste your money? Maybe.

But notice this: you trusted digital tokens over paper cash because inside the arcade, tokens are simpler, faster, and universally accepted.

Stablecoins are the arcade tokens of today’s global economy — but they don’t stay inside the arcade. They cross borders, never close, and quietly fix the pain points your bank still pretends are normal.

A Fix Hiding in Plain Sight

For all the hype around crypto moons and meme coins, stablecoins solve something far more boring — and therefore, more durable.

They answer a practical question:

How do you move dollars at internet speed, with blockchain-level transparency, and no wire fees or banker’s lunch break in the way?

They’re not here to replace money.

They’re here to upgrade money’s plumbing.

This Is Not a Revolution. It’s an Evolution.

If you look closer, stablecoins echo the big shifts we see playing out worldwide:

De-globalization? When trade routes get political and supply chains come home, people look for new rails to keep money moving, cheaply and discreetly.

De-dollarization? When countries fear dollar-based sanctions, stablecoins become a side door: a shadow dollar that’s programmable and borderless.

Decentralization? When trust in big intermediaries fades, people put faith in math. A blockchain ledger, open to all, beats a bank vault open 9–5.

Stablecoins quietly ride all three currents. They’re not protest coins or Ponzi bets. They’re pragmatic bridges from old pipes to new flows.

Why Use Them? Let’s Talk Chips

In Vegas, nobody slaps a hundred-dollar bill on the blackjack table. You use chips — faster, uniform, cashable anytime.

Heyokha Movie Favorites: “The Big Short” – specifically the scene with Selena Gomez explaining how CDOs work using the game of poker

Stablecoins? Same idea — except the casino is the global financial system.

Want to lend, borrow, or earn yield in crypto? You don’t wire money to some shady middleman. You park stablecoins on a blockchain app — better known as DeFi (short for Decentralized Finance). DeFi is just your local bank’s back office — minus the marble lobby and surly tellers.

Stablecoins make DeFi run smoothly:

- Programmable, so smart contracts do the paperwork.

- Redeemable, so trust is collateralised — real dollars and Treasuries sit behind them, verified by auditors.

- Global, so they ignore time zones and national borders.

Poker chips work because the casino cage redeems them at face value.

Stablecoins work because trustworthy issuers (like Circle’s USDC) guarantee that for every token minted, a real dollar or Treasury bill sits safely somewhere, verified by auditors.

Break that trust (hello, Terra Luna), and the market teaches a swift lesson.

Real World, Real Money

Here’s the kicker:

Tether, the biggest stablecoin, moves ~$100 billion daily, with ~90% of that volume living in emerging markets where people trust crypto dollars more than their own banks.

And this product? It’s now the backbone for tokenized Treasuries, DeFi lending, and cross-border paychecks — areas where “fast money” used to mean “expensive wires.”

Stablecoins rapidly becoming mainstream- in banking, groceries, and even in gaming!

When crypto kids sniff out an edge, that’s fun.

When Stripe, Visa, JPMorgan, and Citi sniff it too — you pay attention.

- Stripe scooped up Bridge for stablecoin rails and Privy for embedded wallets — so any dev can build instant crypto payments in five clicks.

- Visa & Mastercard pilot stablecoin settlement to cut costly FX loops.

- Big banks, once dismissive, now quietly sketch joint stablecoins to keep cross-border clients from drifting DeFi-ward.

It’s a game of keep-up. And the chips are stablecoins.

Old ETFs, New Tokens

Here’s your granddad’s way:

- Buy a Treasury ETF.

- Wait two days for settlement.

- Wait a month for yield.

The new way:

- Swap stablecoins for a tokenized Treasury.

- Yield streams daily.

- Cash out whenever, globally.

Franklin Templeton, the global investment firm? Doing it.

Stripe? Enabling it.

Next? Everyone who hates wire fees.

Final Thought: Chips at a Global Table

Odds you win that claw machine: 1 in 15.

Odds your bank wires your money on time: about the same on a public holiday.

Stablecoins skip both — they just work. They’re the chips on every table — Vegas or Jakarta — letting players bet, cash out, and stay liquid without asking permission.

Stablecoins won’t make you trust fiat again if you ever have doubts, but they might make you trust finance again.

No waiting room. No middleman. No banker asking what the funds are for.

Just verified, auditable, programmable value.

And maybe—just maybe—a new global monetary layer that’s not backed by belief in governments, but by math.

We don’t know if stablecoins will go to the moon, but they might build the bridge to the future.

Tara Mulia and Simon Chan

Admin heyokha

Share