The AI Curveball: Why It’s Fueling Inflation, Not Fighting It

The AI Curveball: Why It’s Fueling Inflation, Not Fighting It

AI is supposed to be deflationary, right?

It writes emails. It codes websites. It makes pictures of Elon Musk dressed like Napoleon. All with zero marginal cost.

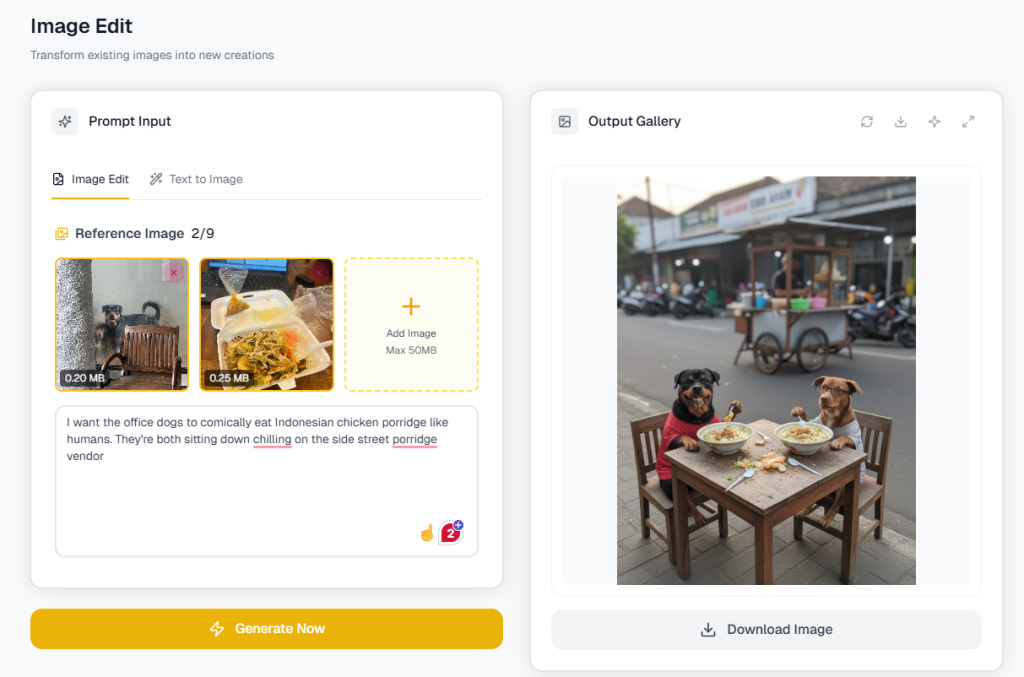

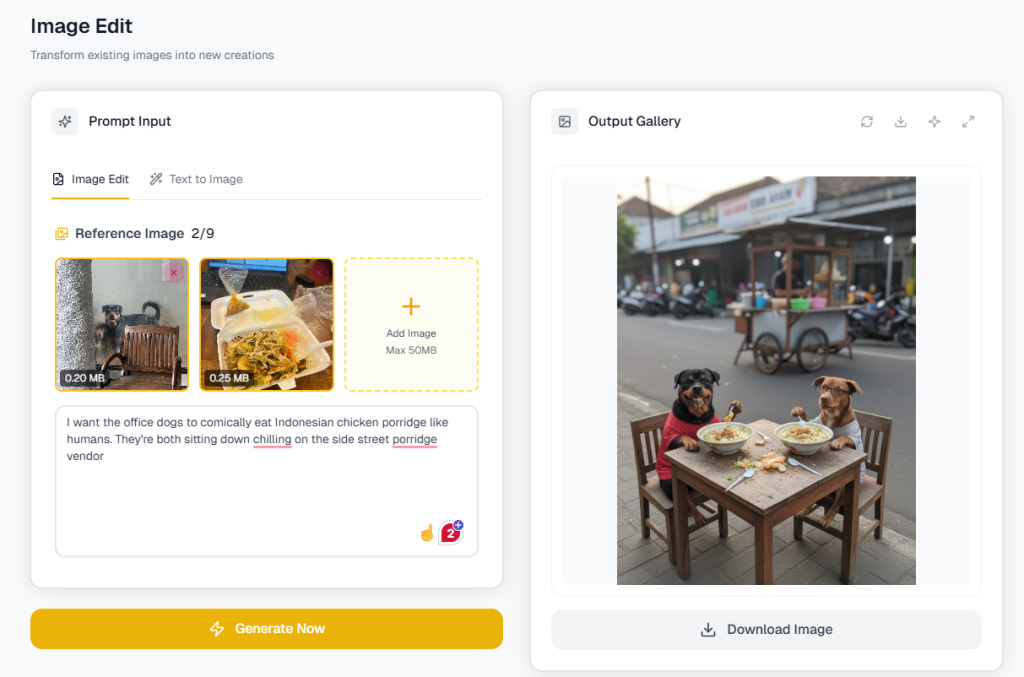

Here at Heyokha, we always love to experiment. Our current obsession right now is combining photos of our office dogs with the mundane with Google’s newest Nano Banana tool

And yet… Nvidia’s chips are backordered for months, power grids are groaning under GPU farms, and AI talent is demanding FAANG-level salaries just to show up on Zoom.

So what gives?

If AI is supposed to make everything cheaper, why does everything feel more expensive instead?

Meet the Productivity Paradox — AI Edition

We’ve been here before.

In the early days of the personal computer, productivity growth stalled. It wasn’t because the tech didn’t work, it was because it took years to reorganize businesses, retrain workers, and figure out what this “email” thing was actually for.

Now we’re watching the same movie — just with better graphics.

AI promises a world of abundance. But until we get there, we’re stuck in the messy, costly middle: a world where AI is generating capital expenditure, not cost savings.

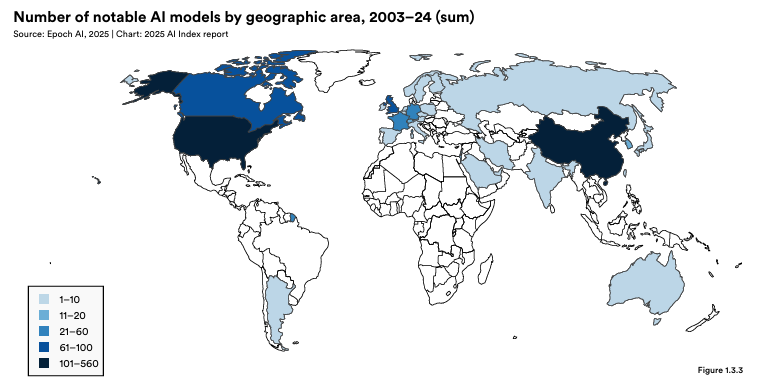

Source: Artificial Intelligence Index Report 2025

AI’s Inflationary Phase — The Unspoken Curve

Here’s the part most headlines miss:

The front-loaded costs of AI are enormous — and highly inflationary.

Let’s break it down:

- Talent scarcity: Top AI researchers are now more expensive than most C-suites.

- Compute demand: Data centers are hoarding GPUs like they’re gold bars.

- Energy prices: The AI boom is reviving power demand across grids — just ask Texas.

- Supply chains: The arms race for chips, memory, and servers is creating a new kind of bottleneck.

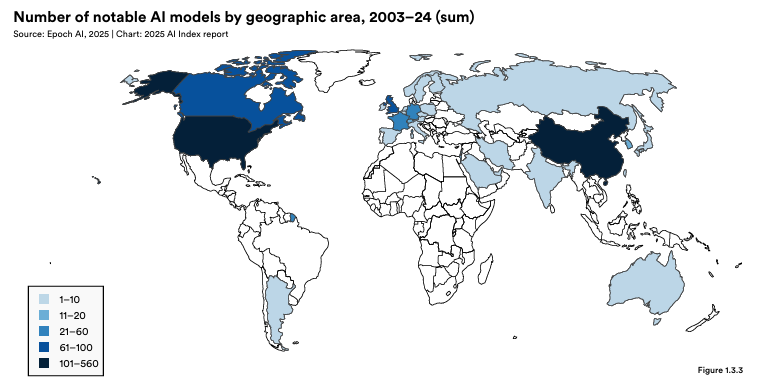

- Geopolitics: The U.S. is restricting chip exports. China is stockpiling semiconductors. Everyone is racing to build AI sovereignty.

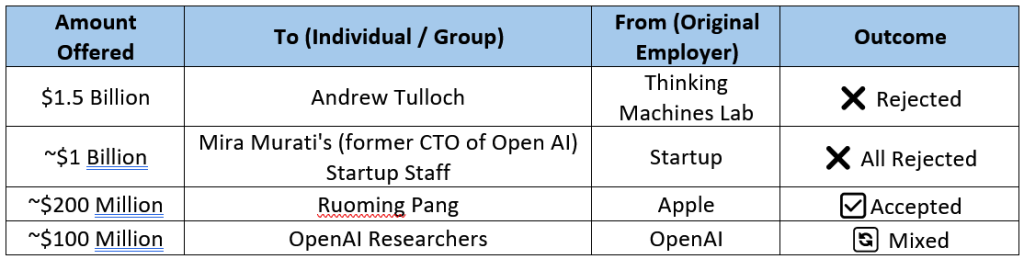

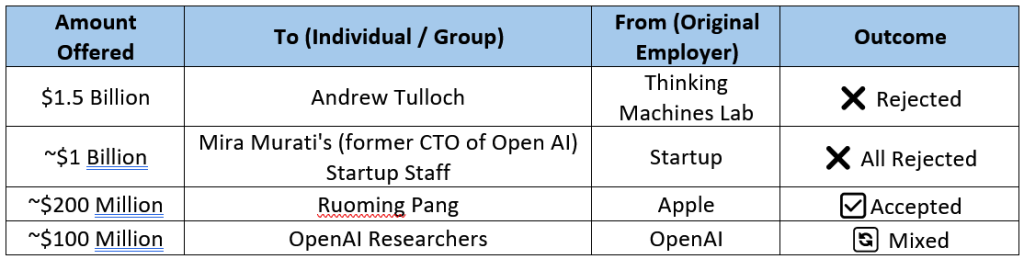

Drafting AI engineers like NBA players

Alleged major compensation packages reportedly offered by Meta to attract top AI talent from competitors

And on top of all that, governments are footing the bill, not just with vague promises, but with real budget lines, funds, and strategic infrastructure programs.

- In Europe, the InvestAI initiative (launched in early 2025) aims to mobilize €200 billion for AI investment, including a €20 billion fund toward AI gigafactories.

- In China, total AI investment is projected to reach US$98 billion in 2025, with the government expected to contribute US$56 billion of that.

- Alibaba itself is committing RMB 380B (~US$53B) over the next three years toward cloud and AI hardware infrastructure.

- Meanwhile, China set up a ¥60B (~US$8.2B) National AI Fund this year to fast‑track strategic infrastructure and emerging tech.

- Even state operators like China Unicom are scaling up: it’s increasing CAPEX for computing infrastructure by ~28% in 2025.

These are not marginal grants. These are infrastructure plays — compute, data centres, hardware — the heavy lifting behind the AI boom.

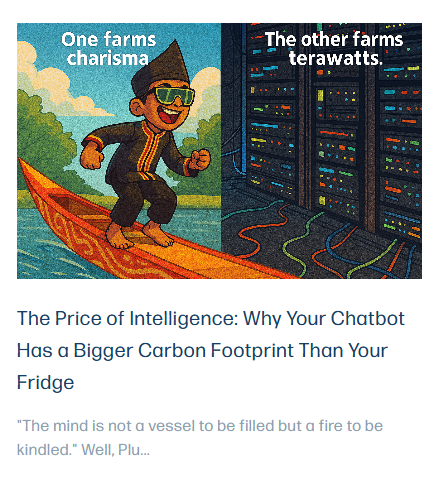

We wrote about this energy hunger in The Price of Intelligence — how your friendly chatbot has a bigger carbon footprint than your fridge. And that was before the AI race turned into a global compute arms race. Since then, demand for data center power, cooling infrastructure, and rare-earth-heavy hardware has only escalated.

Turns out, thinking really hard burns a lot more than midnight oil, it guzzles actual electricity.

Read and subscribe to receive our latest newsletters!

Free at the Margins, Expensive at the Core

Sure, ChatGPT might be free.

But building GPT? Not so much.

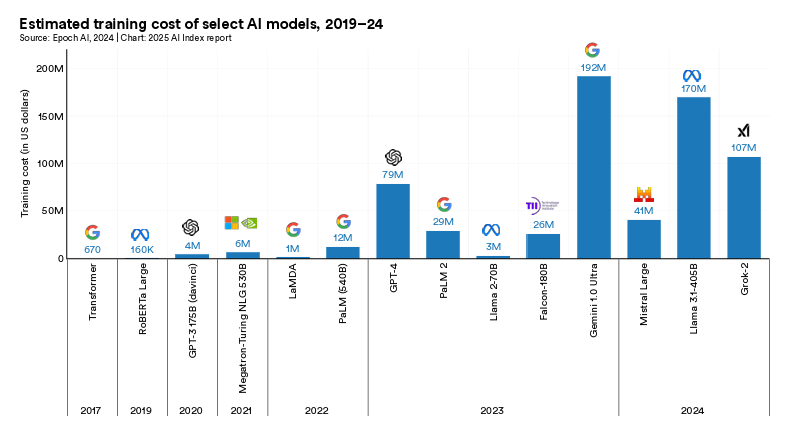

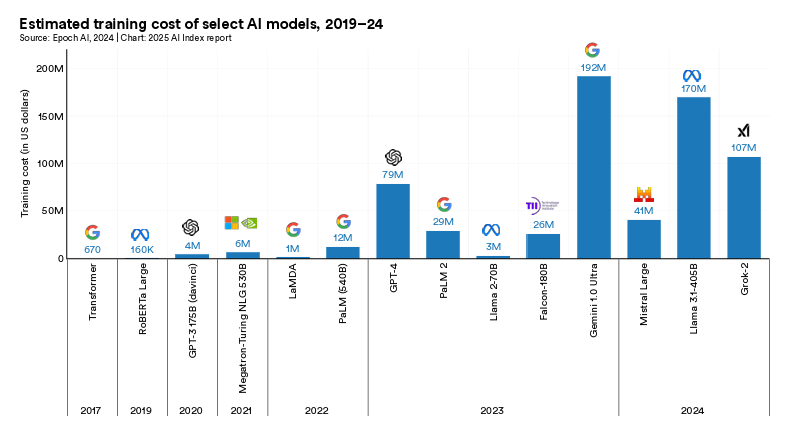

Estimates suggest that training a frontier model costs hundreds of millions of dollars — and that’s just the beginning. Once trained, you need:

- Power-hungry inference clusters

- Global latency optimization

- Cooling infrastructure

- Secure data hosting

- Legal compliance teams (unless your AI is into copyright theft)

It’s the classic tech bait-and-switch: free to use, terrifyingly expensive to build.

And this is exactly why AI is not yet deflationary. At least not in net terms. Right now, it’s a capex supercycle, and a brutally expensive one at that.

No matter the company or model, costs are in double to triple digits of millions and millions of dollars

Open Questions (Still Unanswered)

Like any structural shift, the final destination is unclear. The real question isn’t “is AI deflationary?” It’s when, and for whom.

A few questions we’re watching closely:

- When will productivity gains actually show up in the data?

- Will AI deepen inequality before it improves margins?

- Can companies pass through AI-related costs to customers — or will it compress margins first?

- Will geopolitics distort the rollout — favoring national champions over global efficiency?

These questions are not just academic. They impact where capital flows, how companies scale, and which business models survive the AI transition without bleeding out.

So What Does This Mean for Investors?

In the inflationary middle zone, AI doesn’t replace humans — it joins them on the payroll.

And that means:

- Margins get pressured, especially in industries where pricing power is weak.

- Input costs rise — energy, chips, infrastructure, talent.

- Investors misled by “AI will make everything cheaper” could end up paying more — and owning less.

But here’s the interesting part:

The companies that build, control, or monetize AI infrastructure. These would look like the chipmakers, hyperscalers, and strategic software platforms who are showing early signs of pricing power.

Nvidia isn’t selling GPUs. It’s auctioning pickaxes in a gold rush.

TSMC isn’t just printing wafers. It’s bottlenecking global ambition.

Microsoft isn’t just bundling Copilot, it’s rewriting enterprise workflow one token at a time.

Final Thought: Don’t Confuse “Tech” with “Deflation”

The 2010s trained us to believe that all tech was disinflationary. It made things faster, cheaper, and scalable.

But the 2020s tech stack is different.

It’s geopolitical. It’s energy-intensive. It’s capital-heavy. And..for now… it’s inflationary.

AI may eventually make the world cheaper. But building that world? That’s one expensive bet.

Tara Mulia

Admin heyokha

Share

AI is supposed to be deflationary, right?

It writes emails. It codes websites. It makes pictures of Elon Musk dressed like Napoleon. All with zero marginal cost.

Here at Heyokha, we always love to experiment. Our current obsession right now is combining photos of our office dogs with the mundane with Google’s newest Nano Banana tool

And yet… Nvidia’s chips are backordered for months, power grids are groaning under GPU farms, and AI talent is demanding FAANG-level salaries just to show up on Zoom.

So what gives?

If AI is supposed to make everything cheaper, why does everything feel more expensive instead?

Meet the Productivity Paradox — AI Edition

We’ve been here before.

In the early days of the personal computer, productivity growth stalled. It wasn’t because the tech didn’t work, it was because it took years to reorganize businesses, retrain workers, and figure out what this “email” thing was actually for.

Now we’re watching the same movie — just with better graphics.

AI promises a world of abundance. But until we get there, we’re stuck in the messy, costly middle: a world where AI is generating capital expenditure, not cost savings.

Source: Artificial Intelligence Index Report 2025

AI’s Inflationary Phase — The Unspoken Curve

Here’s the part most headlines miss:

The front-loaded costs of AI are enormous — and highly inflationary.

Let’s break it down:

- Talent scarcity: Top AI researchers are now more expensive than most C-suites.

- Compute demand: Data centers are hoarding GPUs like they’re gold bars.

- Energy prices: The AI boom is reviving power demand across grids — just ask Texas.

- Supply chains: The arms race for chips, memory, and servers is creating a new kind of bottleneck.

- Geopolitics: The U.S. is restricting chip exports. China is stockpiling semiconductors. Everyone is racing to build AI sovereignty.

Drafting AI engineers like NBA players

Alleged major compensation packages reportedly offered by Meta to attract top AI talent from competitors

And on top of all that, governments are footing the bill, not just with vague promises, but with real budget lines, funds, and strategic infrastructure programs.

- In Europe, the InvestAI initiative (launched in early 2025) aims to mobilize €200 billion for AI investment, including a €20 billion fund toward AI gigafactories.

- In China, total AI investment is projected to reach US$98 billion in 2025, with the government expected to contribute US$56 billion of that.

- Alibaba itself is committing RMB 380B (~US$53B) over the next three years toward cloud and AI hardware infrastructure.

- Meanwhile, China set up a ¥60B (~US$8.2B) National AI Fund this year to fast‑track strategic infrastructure and emerging tech.

- Even state operators like China Unicom are scaling up: it’s increasing CAPEX for computing infrastructure by ~28% in 2025.

These are not marginal grants. These are infrastructure plays — compute, data centres, hardware — the heavy lifting behind the AI boom.

We wrote about this energy hunger in The Price of Intelligence — how your friendly chatbot has a bigger carbon footprint than your fridge. And that was before the AI race turned into a global compute arms race. Since then, demand for data center power, cooling infrastructure, and rare-earth-heavy hardware has only escalated.

Turns out, thinking really hard burns a lot more than midnight oil, it guzzles actual electricity.

Read and subscribe to receive our latest newsletters!

Free at the Margins, Expensive at the Core

Sure, ChatGPT might be free.

But building GPT? Not so much.

Estimates suggest that training a frontier model costs hundreds of millions of dollars — and that’s just the beginning. Once trained, you need:

- Power-hungry inference clusters

- Global latency optimization

- Cooling infrastructure

- Secure data hosting

- Legal compliance teams (unless your AI is into copyright theft)

It’s the classic tech bait-and-switch: free to use, terrifyingly expensive to build.

And this is exactly why AI is not yet deflationary. At least not in net terms. Right now, it’s a capex supercycle, and a brutally expensive one at that.

No matter the company or model, costs are in double to triple digits of millions and millions of dollars

Open Questions (Still Unanswered)

Like any structural shift, the final destination is unclear. The real question isn’t “is AI deflationary?” It’s when, and for whom.

A few questions we’re watching closely:

- When will productivity gains actually show up in the data?

- Will AI deepen inequality before it improves margins?

- Can companies pass through AI-related costs to customers — or will it compress margins first?

- Will geopolitics distort the rollout — favoring national champions over global efficiency?

These questions are not just academic. They impact where capital flows, how companies scale, and which business models survive the AI transition without bleeding out.

So What Does This Mean for Investors?

In the inflationary middle zone, AI doesn’t replace humans — it joins them on the payroll.

And that means:

- Margins get pressured, especially in industries where pricing power is weak.

- Input costs rise — energy, chips, infrastructure, talent.

- Investors misled by “AI will make everything cheaper” could end up paying more — and owning less.

But here’s the interesting part:

The companies that build, control, or monetize AI infrastructure. These would look like the chipmakers, hyperscalers, and strategic software platforms who are showing early signs of pricing power.

Nvidia isn’t selling GPUs. It’s auctioning pickaxes in a gold rush.

TSMC isn’t just printing wafers. It’s bottlenecking global ambition.

Microsoft isn’t just bundling Copilot, it’s rewriting enterprise workflow one token at a time.

Final Thought: Don’t Confuse “Tech” with “Deflation”

The 2010s trained us to believe that all tech was disinflationary. It made things faster, cheaper, and scalable.

But the 2020s tech stack is different.

It’s geopolitical. It’s energy-intensive. It’s capital-heavy. And..for now… it’s inflationary.

AI may eventually make the world cheaper. But building that world? That’s one expensive bet.

Tara Mulia

Admin heyokha

Share