How Factfullness can help investors make better decisions

How Factfullness can help investors make better decisions

Most of us are surprisingly wrong about the world. We must have a correct world view in order to make a judgment about where the world is headed. Unfortunately, this is where most of us already go wrong.

We are wrong! This, we found out while reading the eye-opening book Factfullness, in which author Hans Rosling exposes that when we are asked simple questions about global trends e.g., “where does the majority of the world population live?”, we systematically get the answers wrong.

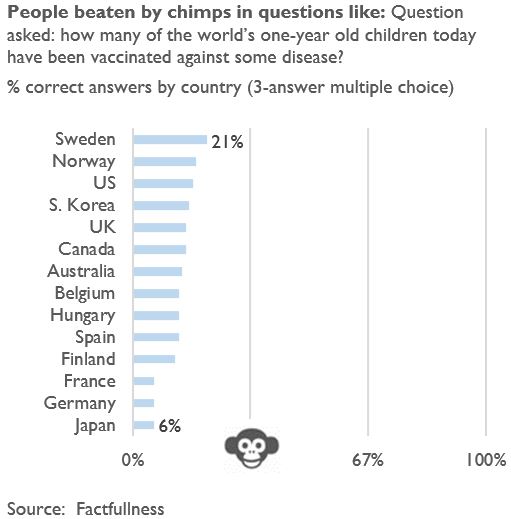

So wrong that chimps choosing answers at random would consistently outguess teachers, journalists, Nobel laureates, and investment bankers. In particular: 12 multiple-choice questions with three options were asked to around 12,000 people in 14 countries. The results? About 80% scored worse than chimps would have.

Only 10% scored better. Rosling writes that most people think they are getting it kind of right – until they get tested (click here to test yourself). However, the contrary is true. In respect of some matters, it even seems that the more educated you are, the more ignorant you are.

Why? Rosling points to 10 human instincts (like fear and generalisation) that impact our “information filter” and judgement to explain why we are so ignorant.

At the same time, the media is exacerbating matters by painting a distorted and dramatised picture as their coverage is dominated by the negative and the exceptional. As such, positive changes don’t find you. You need to find them (in statistics or by traveling, for example).

To see the world as it is, we need to refresh our knowledge more regularly and change our attitude.

Rosling closes his book with some suggestions to obtain a more fact-based world view which have much to do with our attitude:

1. be humble enough to recognise that (1) knowledge does not have an unlimited shelf-life and needs to be updated regularly, (2) our instincts impact our information filter and judgement, (3) we should be prepared to change our opinion, and

2. be curious enough to (1) be open to new information and actively seek it out, (2) embrace facts that do not fit our world view and (3) let our mistakes trigger curiosity instead of embarrassment.

In short, by being actively open-minded and committed to self-improvement, investors will have a more factual view of the world, which will help them make better decisions.

Admin heyokha

Share

Most of us are surprisingly wrong about the world. We must have a correct world view in order to make a judgment about where the world is headed. Unfortunately, this is where most of us already go wrong.

We are wrong! This, we found out while reading the eye-opening book Factfullness, in which author Hans Rosling exposes that when we are asked simple questions about global trends e.g., “where does the majority of the world population live?”, we systematically get the answers wrong.

So wrong that chimps choosing answers at random would consistently outguess teachers, journalists, Nobel laureates, and investment bankers. In particular: 12 multiple-choice questions with three options were asked to around 12,000 people in 14 countries. The results? About 80% scored worse than chimps would have.

Only 10% scored better. Rosling writes that most people think they are getting it kind of right – until they get tested (click here to test yourself). However, the contrary is true. In respect of some matters, it even seems that the more educated you are, the more ignorant you are.

Why? Rosling points to 10 human instincts (like fear and generalisation) that impact our “information filter” and judgement to explain why we are so ignorant.

At the same time, the media is exacerbating matters by painting a distorted and dramatised picture as their coverage is dominated by the negative and the exceptional. As such, positive changes don’t find you. You need to find them (in statistics or by traveling, for example).

To see the world as it is, we need to refresh our knowledge more regularly and change our attitude.

Rosling closes his book with some suggestions to obtain a more fact-based world view which have much to do with our attitude:

1. be humble enough to recognise that (1) knowledge does not have an unlimited shelf-life and needs to be updated regularly, (2) our instincts impact our information filter and judgement, (3) we should be prepared to change our opinion, and

2. be curious enough to (1) be open to new information and actively seek it out, (2) embrace facts that do not fit our world view and (3) let our mistakes trigger curiosity instead of embarrassment.

In short, by being actively open-minded and committed to self-improvement, investors will have a more factual view of the world, which will help them make better decisions.

Admin heyokha

Share