The Circle of Financing: Is AI Becoming America’s Last Growth Narrative?

The Circle of Financing: Is AI Becoming America’s Last Growth Narrative?

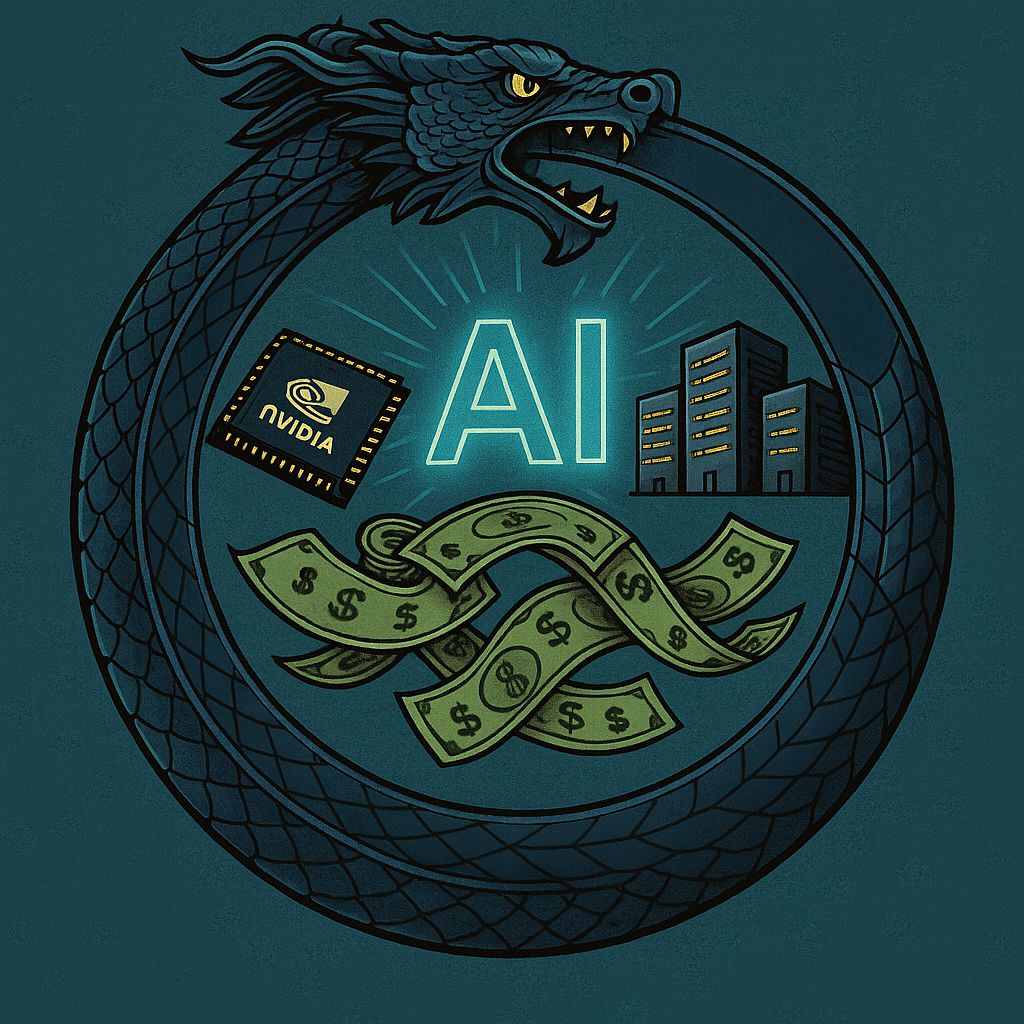

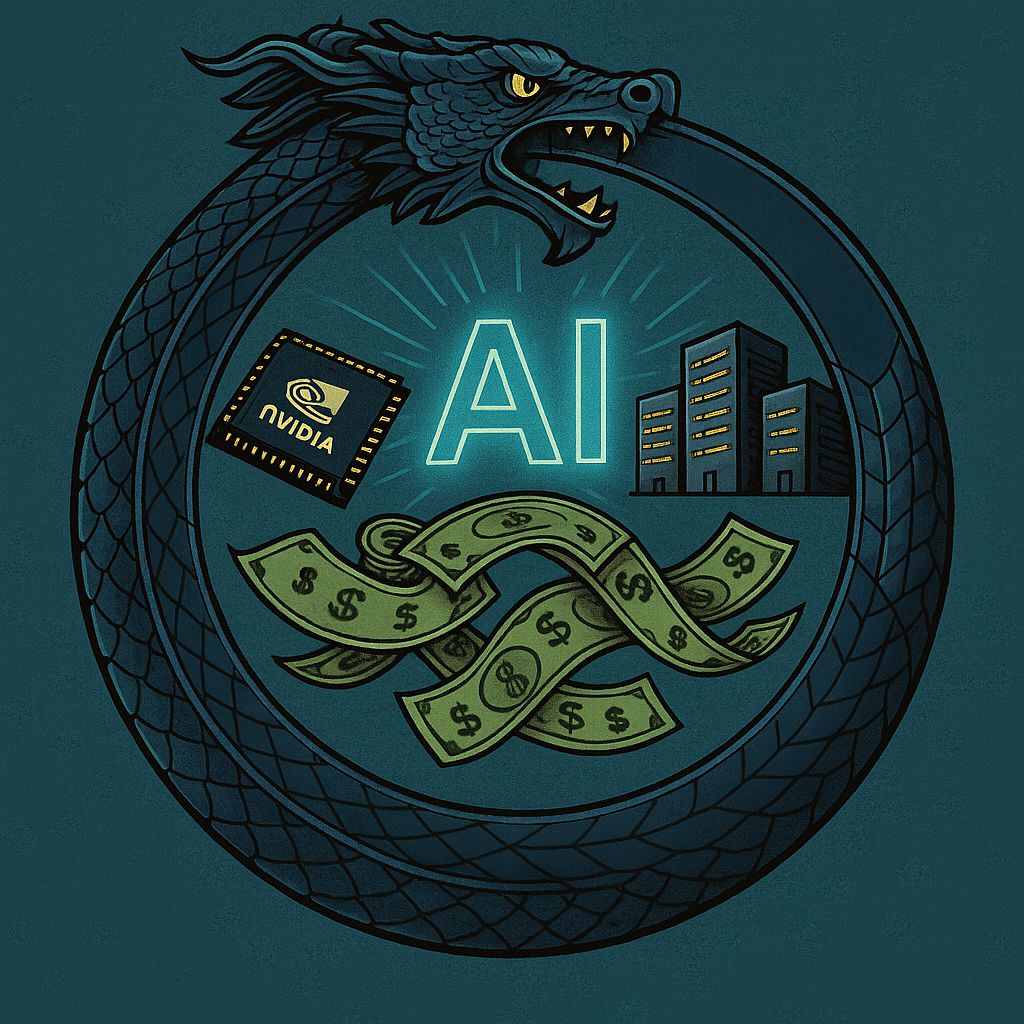

In Norse mythology, Jörmungandr, the World Serpen, is so vast that he encircles the Earth, biting his own tail. He is a living embodiment of the Ouroboros, an ancient symbol of infinite, self-reinforcing cycles.

Legend says that when Jörmungandr releases his tail, Ragnarök—the end of the world begins.

The Ouroboros has long stood for cosmic balance, but in markets, it often points to something more fragile: circular, self-fueling systems that can turn on themselves.

And that brings us to today’s AI boom which is an ecosystem that much like the Ouroboros, seems to be feeding on itself. Let’s hope it doesn’t let go.

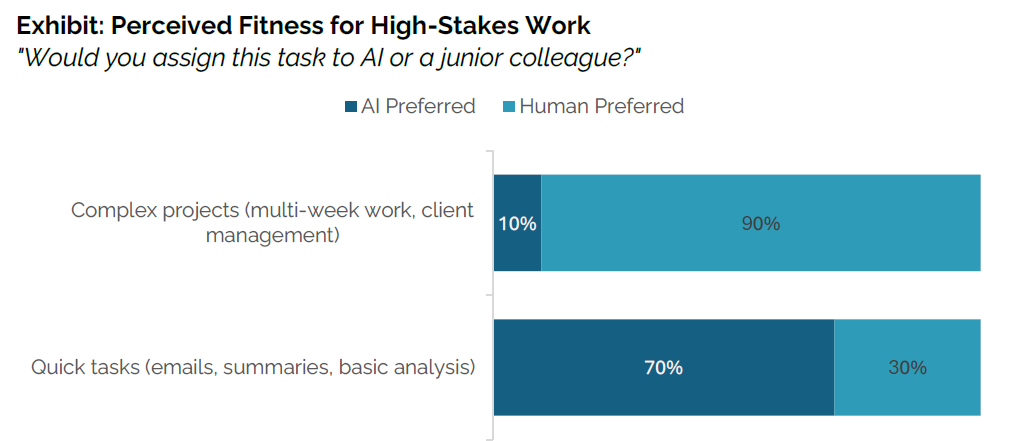

An illustration of Yggdrasil, the Norse World Tree that connects all realms, with Jörmungandr, the world serpent, encircling Midgard at its base.

Trillions In, Productivity TBD

2025 has been a great year to be bullish on AI. But is it getting too great?

Once again, a single theme did the heavy lifting for U.S. equities: artificial intelligence. AI-linked companies accounted for 80% of all U.S. stock market gains year-to-date. And it’s not just stocks. AI investment has driven an estimated 40% of U.S. GDP growth in 2025.

It sounds like a miracle.

But scratch beneath the surface and the picture gets… weird.

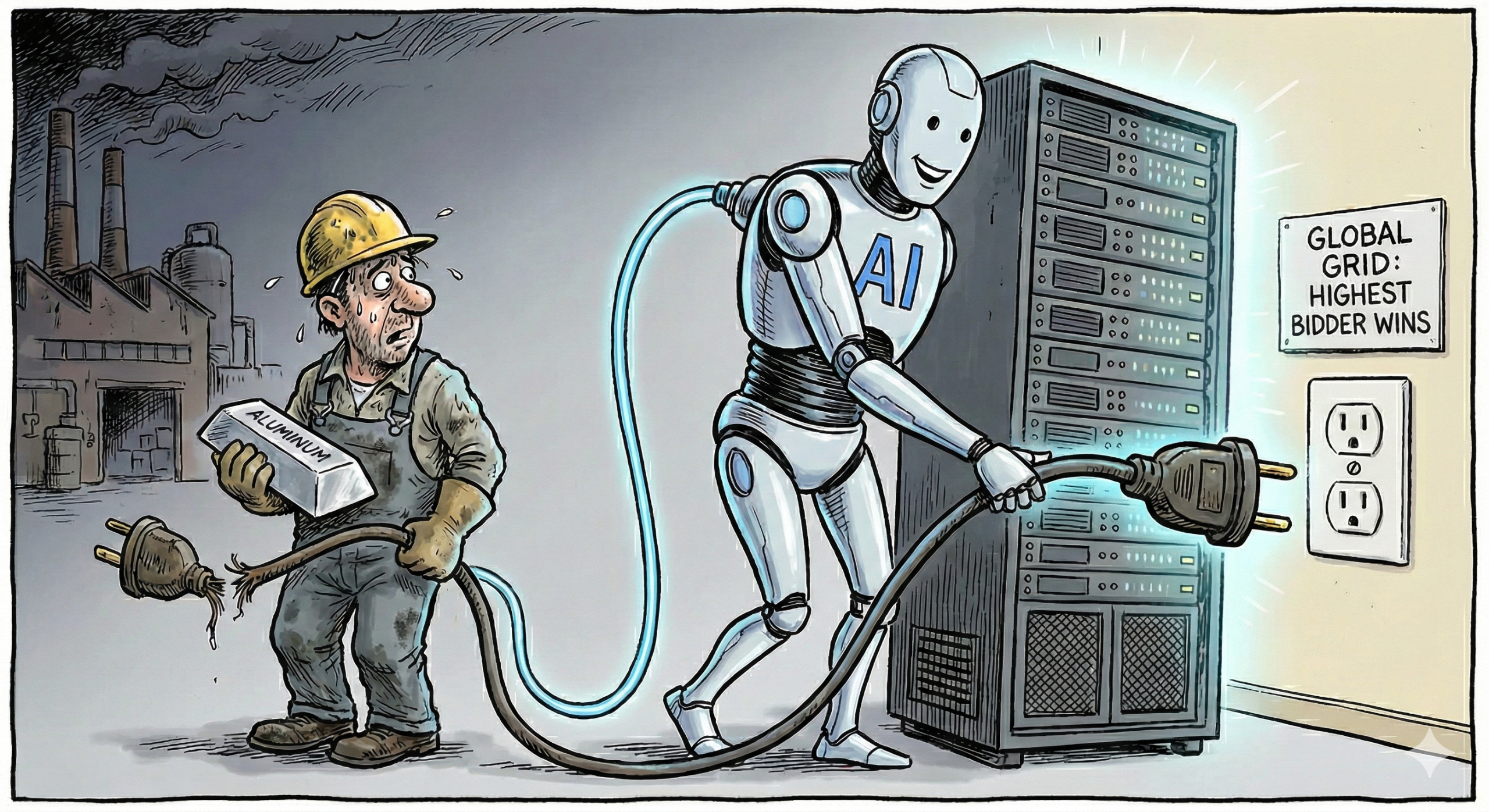

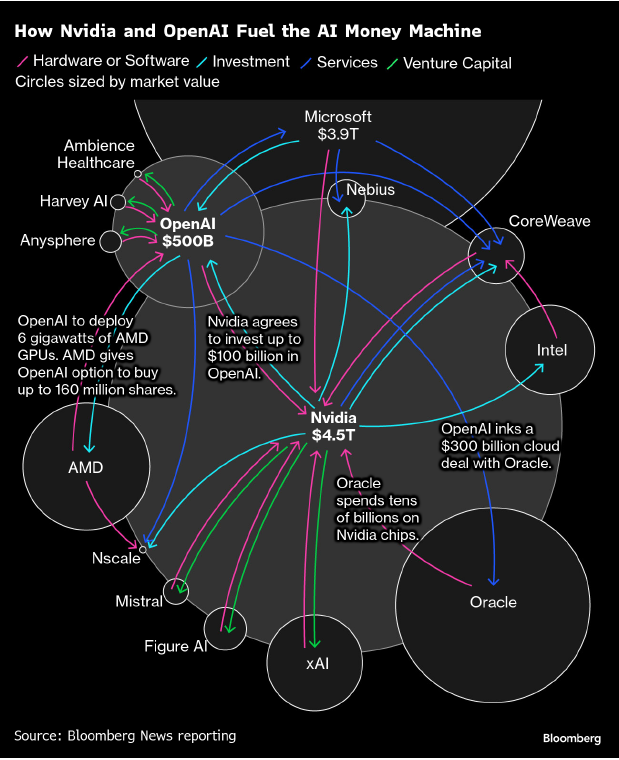

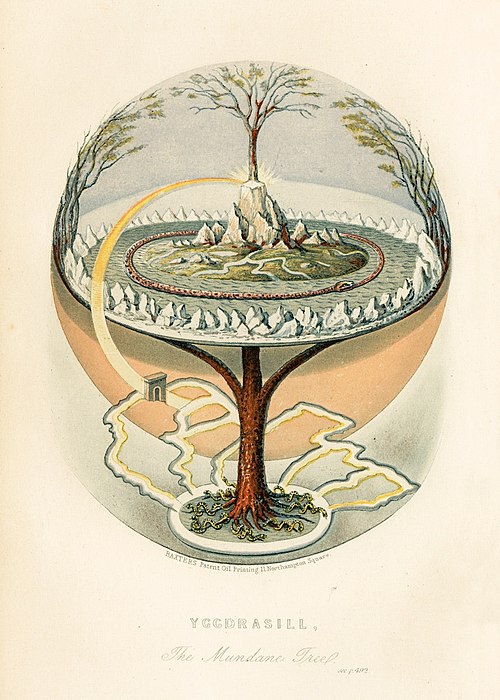

Everything looks to be one big giant interlocking circle

Source: Bloomberg

The rally isn’t broad-based. It’s the opposite. Outside of the Big AI names, the U.S. economy is showing cracks: a softening labor market, sluggish consumption, and record-high debt. In short, this isn’t a rising tide lifting all boats. It’s a hydrofoil dragging a bunch of broken paddleboards.

So what’s keeping it all aloft?

A lot of capital. And a lot of circularity.

Everyone Buys Everyone Else’s Chips

Let’s talk about the AI money machine. According to Bloomberg, here’s what the current capital flow looks like:

- Nvidia agrees to invest up to $100B in OpenAI

- OpenAI uses that money to buy Nvidia chips

- Oracle inks a $300B cloud deal with OpenAI

- Oracle spends billions on Nvidia chips

- CoreWeave gets Nvidia investment → sells compute to OpenAI → gives OpenAI equity

- xAI (Elon Musk) raises $20B to rent Nvidia chips

- OpenAI gets AMD chips → receives 10% equity stake in AMD via warrants

If that sounds a little too tidy, you’re not alone.

Veteran short seller Jim Chanos called it out bluntly: “If demand for compute is infinite, why do the sellers keep subsidizing the buyers?”

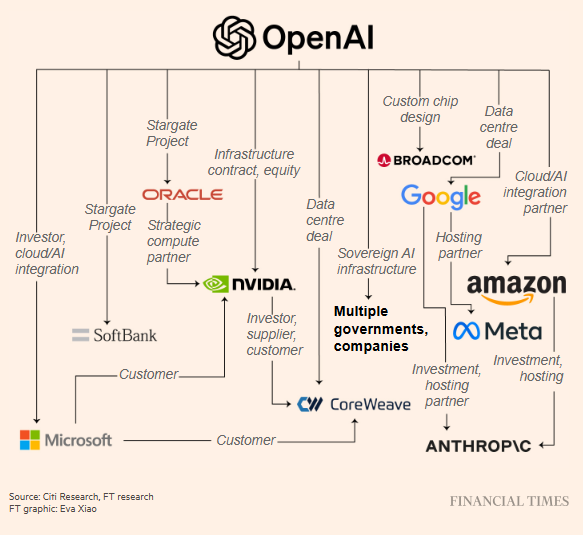

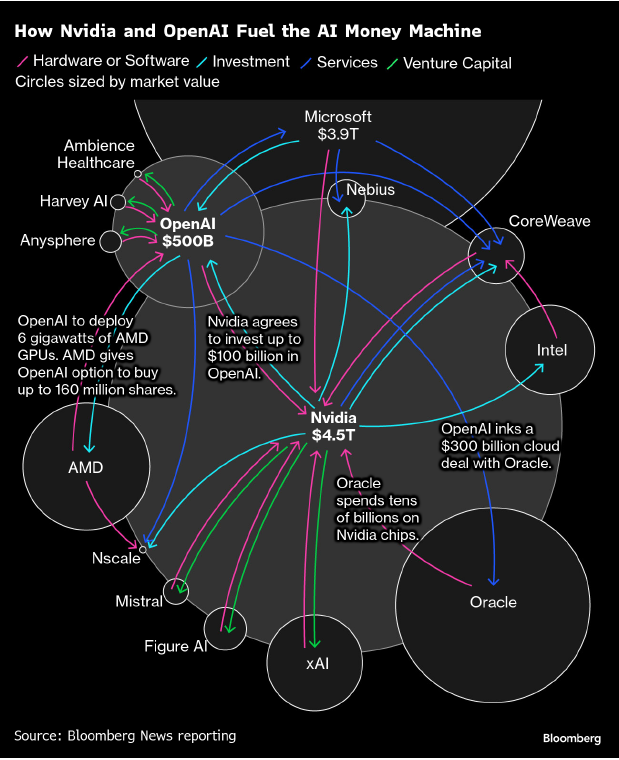

All major firms are tied to OpenAI one way or another

Source: Financial Times

What we’re witnessing is a $1 trillion capex circularity, where everyone is simultaneously the customer, supplier, and investor.

The Return of Vendor Financing (With Trillions Attached)

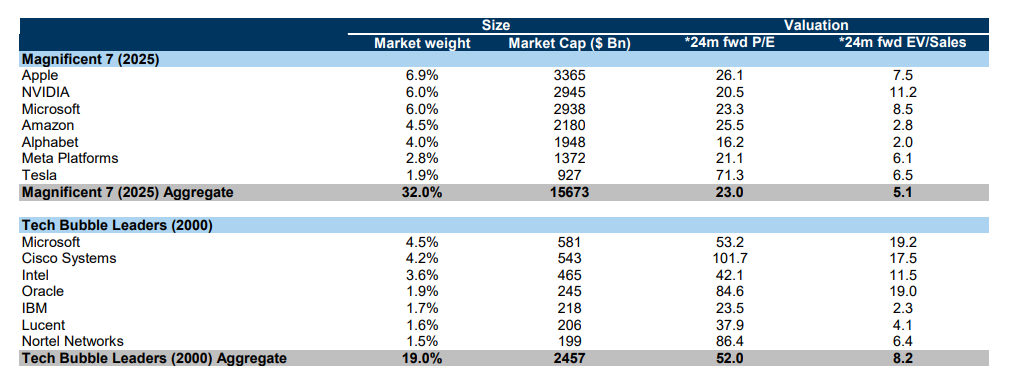

This circularity isn’t new. We saw something similar during the dot-com boom, when companies booked revenue by buying each other’s ads and services. Back then, it was banners and buzzwords. Now, it’s multi-billion-dollar chip orders and GPU rentals.

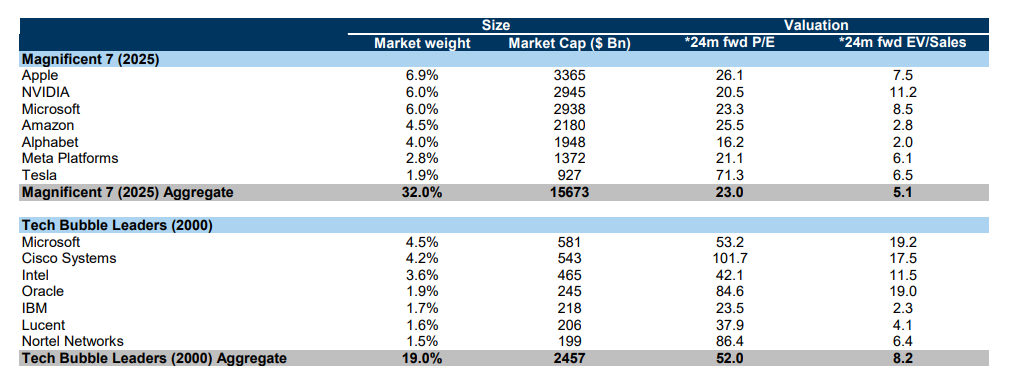

The Mag 7 vs Dot com Leaders – the stakes this time are dramatically higher.

Source: Goldman Sachs, March 2025

According to JPMorgan, over $1.2 trillion in investment-grade debt is now tied to companies linked to AI making it the largest segment in the high-grade bond market, surpassing even U.S. banks.

That figure has surged from just 11.5% of the market in 2020 to 14% today, encompassing 75 companies across tech, utilities, and capital goods, including Oracle, Apple, and even Duke Energy. Many of these firms are cash-rich, low-leverage, and considered high-quality issuers, which helps explain why their bonds trade tighter than the broader market.

But it also means one thing: AI is now a credit story.

Oracle’s recent $18 billion bond sale, the second-largest of the year, drew a staggering $88 billion in demand. Investors and underwriters are piling into the space, viewing AI data center expansion as the next secular credit theme. Even Bank of America says AI buildouts could meaningfully boost corporate debt issuance volumes.

And here’s the vendor-financing twist: much of this debt is being used to fund infrastructure that then services the same AI companies issuing the debt or receiving equity investments from those infrastructure providers.

The logic is tight. The flows are tighter.

But that also means risk is tightly concentrated. If AI fails to deliver, the unwind wouldn’t just hit equity. It could ripple through credit markets too.

JPMorgan notes that while fundamentals remain sound for now, the tight spread levels leave little margin for error. If companies use cash from bond proceeds for aggressive capex or acquisitions without generating returns before redemption, the risks compound.

It’s not fake. But it is increasingly leveraged belief.

Belief > Balance Sheets

So far, the justification for all this capex is that AI will supercharge productivity.

But here’s the catch: it hasn’t yet.

In our blog The AI Curveball, we warned that AI is front-loading costs, not savings. Power demand, chip inflation, cooling infrastructure — all up. But labor productivity? Still flat.

And now, there’s more data to back it up.

A recent MIT study of over 300 publicly disclosed AI initiatives found that 95% of enterprise GenAI pilots have failed to deliver any measurable financial return despite $30–40 billion invested into GenAI initiatives. While tools like ChatGPT and Copilot are widely adopted (with 40% of organizations reporting deployment), they’ve mostly enhanced individual productivity — not corporate P&Ls.

Enterprise-scale solutions? That’s where the failures stack up. Of those evaluated:

- Only 20% made it to pilot stage

- Only 5% reached full production

Why? It’s not the models, or the regulation, or even the infrastructure. It’s the lack of contextual learning and integration. Most AI systems don’t adapt, don’t retain feedback, and don’t align with actual business workflows.

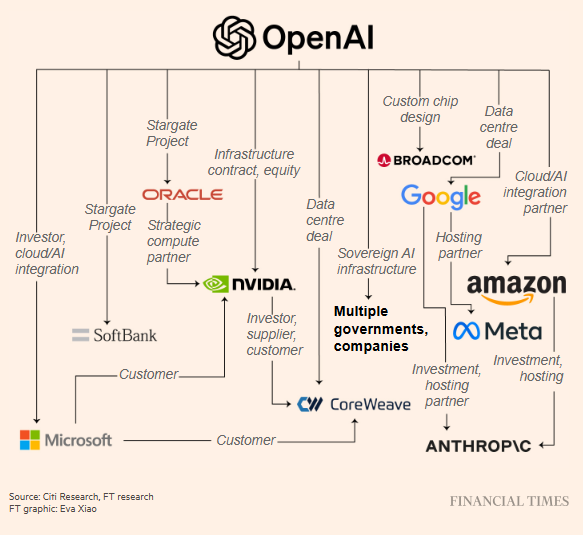

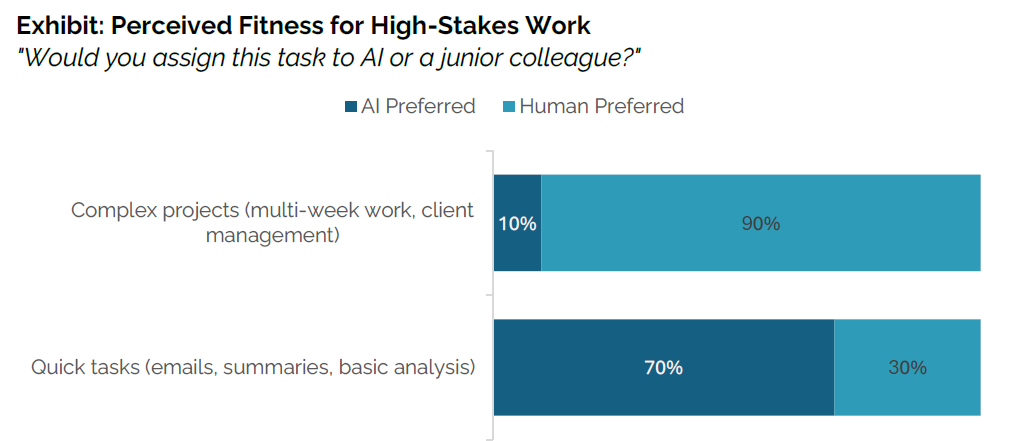

The more complex the task, the less willing people are going to use AI

Source: MIT

MIT calls it the GenAI Divide — a split between the 5% of companies extracting millions in value, and the 95% still stuck in pilot purgatory.

This is starting to feel less like a tech boom and more like a faith-based economy. The narrative has become:

Yes, debt is rising. Yes, consumption is fragile. But it’s okay, because AI will save us.

Let’s contrast this with another asset class we like: gold.

As we explored in The Price of Intelligence and The Return of Real Money, gold is also powered by belief — but it’s belief backed by restraint.

Gold supply is tight. Production growth is capped. Central banks continue to buy.

In short, it’s a real asset that doesn’t rely on everyone renting each other’s GPUs to keep the story going.

So What? A Market Built on Echoes

America has become one big bet on AI. And that bet is now funding:

- GDP growth

- Consumer wealth effects

- Investor inflows

- Even foreign demand for U.S. equities

But like any leverage cycle, it needs to work.

Because if AI doesn’t deliver the promised productivity gains soon, all those circular deals might look less like “strategic partnerships” and more like a trillion-dollar trust fall.

Final Thought: What Happens If Faith Gets Marked to Market?

We’re not anti-AI. But we are pro-questioning.

When a single theme drives 80% of the market and 40% of GDP, it becomes less a theme and more a theology. And theology, as investors know, doesn’t always translate into free cash flow.

So here’s the question: Is this still investing — or is it just narrative compounding?

If belief becomes the product, who’s left holding the faith?

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

In Norse mythology, Jörmungandr, the World Serpen, is so vast that he encircles the Earth, biting his own tail. He is a living embodiment of the Ouroboros, an ancient symbol of infinite, self-reinforcing cycles.

Legend says that when Jörmungandr releases his tail, Ragnarök—the end of the world begins.

The Ouroboros has long stood for cosmic balance, but in markets, it often points to something more fragile: circular, self-fueling systems that can turn on themselves.

And that brings us to today’s AI boom which is an ecosystem that much like the Ouroboros, seems to be feeding on itself. Let’s hope it doesn’t let go.

An illustration of Yggdrasil, the Norse World Tree that connects all realms, with Jörmungandr, the world serpent, encircling Midgard at its base.

Trillions In, Productivity TBD

2025 has been a great year to be bullish on AI. But is it getting too great?

Once again, a single theme did the heavy lifting for U.S. equities: artificial intelligence. AI-linked companies accounted for 80% of all U.S. stock market gains year-to-date. And it’s not just stocks. AI investment has driven an estimated 40% of U.S. GDP growth in 2025.

It sounds like a miracle.

But scratch beneath the surface and the picture gets… weird.

Everything looks to be one big giant interlocking circle

Source: Bloomberg

The rally isn’t broad-based. It’s the opposite. Outside of the Big AI names, the U.S. economy is showing cracks: a softening labor market, sluggish consumption, and record-high debt. In short, this isn’t a rising tide lifting all boats. It’s a hydrofoil dragging a bunch of broken paddleboards.

So what’s keeping it all aloft?

A lot of capital. And a lot of circularity.

Everyone Buys Everyone Else’s Chips

Let’s talk about the AI money machine. According to Bloomberg, here’s what the current capital flow looks like:

- Nvidia agrees to invest up to $100B in OpenAI

- OpenAI uses that money to buy Nvidia chips

- Oracle inks a $300B cloud deal with OpenAI

- Oracle spends billions on Nvidia chips

- CoreWeave gets Nvidia investment → sells compute to OpenAI → gives OpenAI equity

- xAI (Elon Musk) raises $20B to rent Nvidia chips

- OpenAI gets AMD chips → receives 10% equity stake in AMD via warrants

If that sounds a little too tidy, you’re not alone.

Veteran short seller Jim Chanos called it out bluntly: “If demand for compute is infinite, why do the sellers keep subsidizing the buyers?”

All major firms are tied to OpenAI one way or another

Source: Financial Times

What we’re witnessing is a $1 trillion capex circularity, where everyone is simultaneously the customer, supplier, and investor.

The Return of Vendor Financing (With Trillions Attached)

This circularity isn’t new. We saw something similar during the dot-com boom, when companies booked revenue by buying each other’s ads and services. Back then, it was banners and buzzwords. Now, it’s multi-billion-dollar chip orders and GPU rentals.

The Mag 7 vs Dot com Leaders – the stakes this time are dramatically higher.

Source: Goldman Sachs, March 2025

According to JPMorgan, over $1.2 trillion in investment-grade debt is now tied to companies linked to AI making it the largest segment in the high-grade bond market, surpassing even U.S. banks.

That figure has surged from just 11.5% of the market in 2020 to 14% today, encompassing 75 companies across tech, utilities, and capital goods, including Oracle, Apple, and even Duke Energy. Many of these firms are cash-rich, low-leverage, and considered high-quality issuers, which helps explain why their bonds trade tighter than the broader market.

But it also means one thing: AI is now a credit story.

Oracle’s recent $18 billion bond sale, the second-largest of the year, drew a staggering $88 billion in demand. Investors and underwriters are piling into the space, viewing AI data center expansion as the next secular credit theme. Even Bank of America says AI buildouts could meaningfully boost corporate debt issuance volumes.

And here’s the vendor-financing twist: much of this debt is being used to fund infrastructure that then services the same AI companies issuing the debt or receiving equity investments from those infrastructure providers.

The logic is tight. The flows are tighter.

But that also means risk is tightly concentrated. If AI fails to deliver, the unwind wouldn’t just hit equity. It could ripple through credit markets too.

JPMorgan notes that while fundamentals remain sound for now, the tight spread levels leave little margin for error. If companies use cash from bond proceeds for aggressive capex or acquisitions without generating returns before redemption, the risks compound.

It’s not fake. But it is increasingly leveraged belief.

Belief > Balance Sheets

So far, the justification for all this capex is that AI will supercharge productivity.

But here’s the catch: it hasn’t yet.

In our blog The AI Curveball, we warned that AI is front-loading costs, not savings. Power demand, chip inflation, cooling infrastructure — all up. But labor productivity? Still flat.

And now, there’s more data to back it up.

A recent MIT study of over 300 publicly disclosed AI initiatives found that 95% of enterprise GenAI pilots have failed to deliver any measurable financial return despite $30–40 billion invested into GenAI initiatives. While tools like ChatGPT and Copilot are widely adopted (with 40% of organizations reporting deployment), they’ve mostly enhanced individual productivity — not corporate P&Ls.

Enterprise-scale solutions? That’s where the failures stack up. Of those evaluated:

- Only 20% made it to pilot stage

- Only 5% reached full production

Why? It’s not the models, or the regulation, or even the infrastructure. It’s the lack of contextual learning and integration. Most AI systems don’t adapt, don’t retain feedback, and don’t align with actual business workflows.

The more complex the task, the less willing people are going to use AI

Source: MIT

MIT calls it the GenAI Divide — a split between the 5% of companies extracting millions in value, and the 95% still stuck in pilot purgatory.

This is starting to feel less like a tech boom and more like a faith-based economy. The narrative has become:

Yes, debt is rising. Yes, consumption is fragile. But it’s okay, because AI will save us.

Let’s contrast this with another asset class we like: gold.

As we explored in The Price of Intelligence and The Return of Real Money, gold is also powered by belief — but it’s belief backed by restraint.

Gold supply is tight. Production growth is capped. Central banks continue to buy.

In short, it’s a real asset that doesn’t rely on everyone renting each other’s GPUs to keep the story going.

So What? A Market Built on Echoes

America has become one big bet on AI. And that bet is now funding:

- GDP growth

- Consumer wealth effects

- Investor inflows

- Even foreign demand for U.S. equities

But like any leverage cycle, it needs to work.

Because if AI doesn’t deliver the promised productivity gains soon, all those circular deals might look less like “strategic partnerships” and more like a trillion-dollar trust fall.

Final Thought: What Happens If Faith Gets Marked to Market?

We’re not anti-AI. But we are pro-questioning.

When a single theme drives 80% of the market and 40% of GDP, it becomes less a theme and more a theology. And theology, as investors know, doesn’t always translate into free cash flow.

So here’s the question: Is this still investing — or is it just narrative compounding?

If belief becomes the product, who’s left holding the faith?

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share