The Grandmaster’s Gambit: Greenland, the “Board of Peace,” and the New American Empire

The Grandmaster’s Gambit: Greenland, the “Board of Peace,” and the New American Empire

The Opening: A Musical Flop and a Geopolitical Stage

In 1986, ABBA’s Benny Andersson and Björn Ulvaeus teamed up to write Chess, a musical about the Cold War where the board served as a metaphor for superpower rivalry. Despite the catchy score, the production was a flop. It struggled to balance human drama with the cold machinery of global politics.

Caught the Broadway production in December. Full house. It seems American audiences can feel the geopolitical temperature rising. Suddenly, this musical feels less like history and more like a preview

Fast forward to 2026, and we are watching a new production on the global stage that is anything but a song and dance. President Trump has officially signed the charter for the “Board of Peace” at Davos. While it was initially pitched as a mechanism for Gaza’s reconstruction, the charter signed this January reveals a much broader mandate: to “promote stability” and resolve international conflicts.

While the name sounds diplomatic, the mechanics are novel. Permanent membership on the board reportedly requires a $1 billion contribution, and the charter grants “Chairman Trump” sweeping authority, including veto power over resolutions. It is a bold attempt to create a “nimble” alternative to the United Nations. However, in a game of chess, you need players willing to sit at the table. While over 20 nations like Saudi Arabia, Turkey, and Indonesia have signed on, heavyweights like France and Germany have declined, citing concerns over undermining the UN. Right now, much of the world is busy building their own boards.

The Thesis: The Empire Strikes Back

It is easy to dismiss Trump’s headlines: buying Greenland, slapping 25% tariffs on neighbors, proposing grand peace boards: as eccentric noise. But what if they aren’t random at all?

At Heyokha, we see these moves as a coherent strategy to build a resource-based American empire in a de-globalizing world. Trump isn’t just making deals; he is attempting to lock down the hard assets: land, energy, and minerals: required to survive the end of the “just-in-time” global order.

Remember this post that the White House did last year?

Why Greenland Was the Opening Move

In 2019, the world laughed when Trump suggested the U.S. buy Greenland. But as Trump wrote in The Art of the Deal, “Location is everything.”

Maybe we should brush up and read the “Art of the Deal”. Cover image is from our blog – “Art of the Deal” Tops Amazon as Tariffs Stirs Comedy and Chaos

Even though the Greenland talks have now subsided into a formal framework for cooperation, the underlying intent of the original ‘buy’ offer to secure resources remain.

Greenland isn’t just ice; it is a fortress of strategic necessity:

- Critical Minerals: The island holds massive reserves of rare earth minerals (estimated at 1.5 million metric tons, with some deposits reaching 28 million metric tons). These are the vitamins of modern defense and technology, and China currently dominates roughly 90% of global processing.

- Arctic Shipping Lanes: As sea ice declines, the Northern Sea Route offers up to 40% savings in time and cost for shipping between Asia and Europe. Controlling this “Polar Silk Road” is a generational prize.

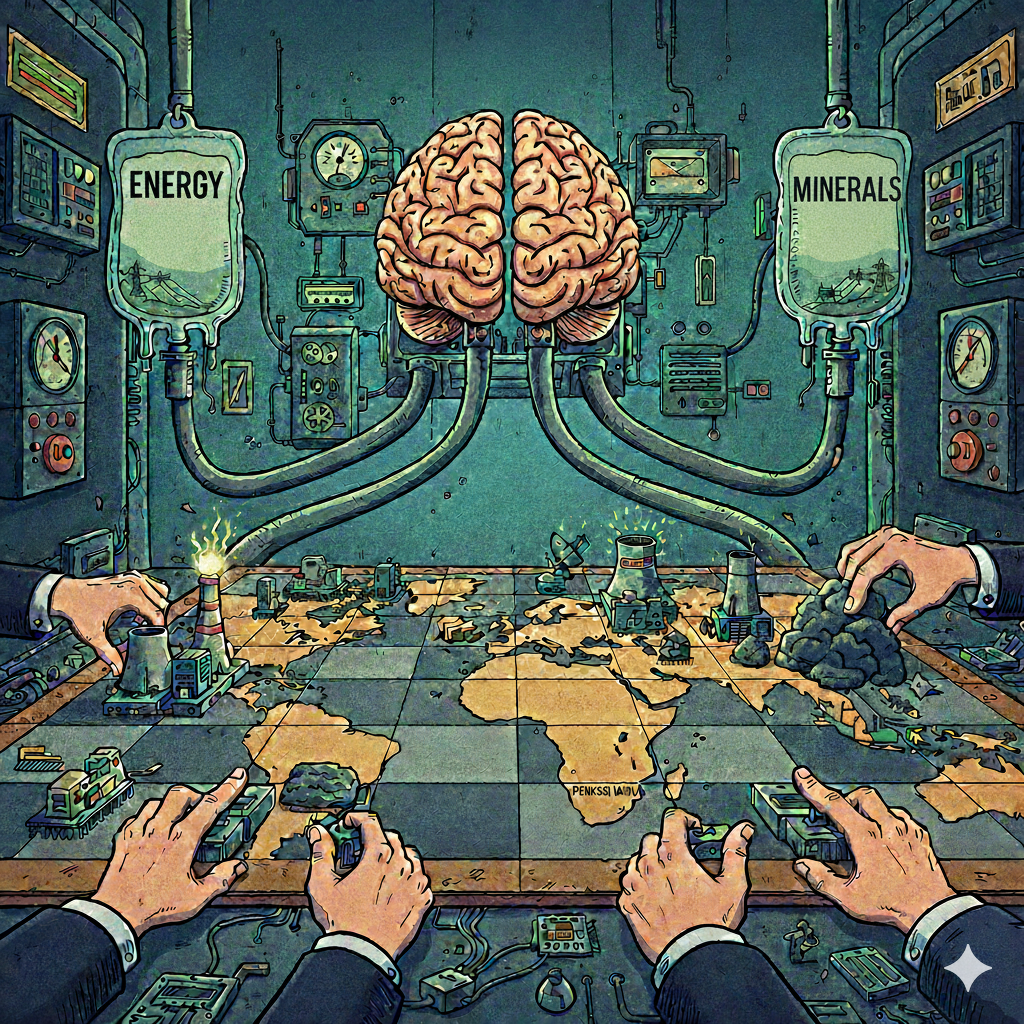

- The AI Power Race: As we explored in our AI Curveball blog, the bottleneck for AI is no longer just code; it is energy and cooling. Greenland’s massive hydro potential and Arctic climate make it a “sovereign heat sink” for the data centers of the future.

This isn’t real estate speculation; it is Monroe Doctrine 2.0. It is a move to secure the Western Hemisphere’s physical supply chain. As we noted in The Price of Sovereignty, in 2026, safety isn’t measured just in missiles, but in who owns the warehouses of food, fuel, and the resources needed to win the AI race.

The “Board of Peace” vs. The Board of Reality

Trump’s “Board of Peace” pitch fits this empire-building mold: a transactional attempt to manage global stability from a position of top-down strength. But the board has changed since 1945.

We aren’t in a unipolar world anymore. As highlighted in our report on De-dollarization, nations like the BRICS bloc are actively building parallel financial rails to bypass the dollar. They’ve seen the U.S. weaponize the dollar against Russia, and they are opting out of the game entirely. You can set up a “Board of Peace,” but it’s hard to play when half the grandmasters are leaving the tournament to start their own league.

The Bill for the Empire

This brings us to the most uncomfortable truth. Empires are expensive.

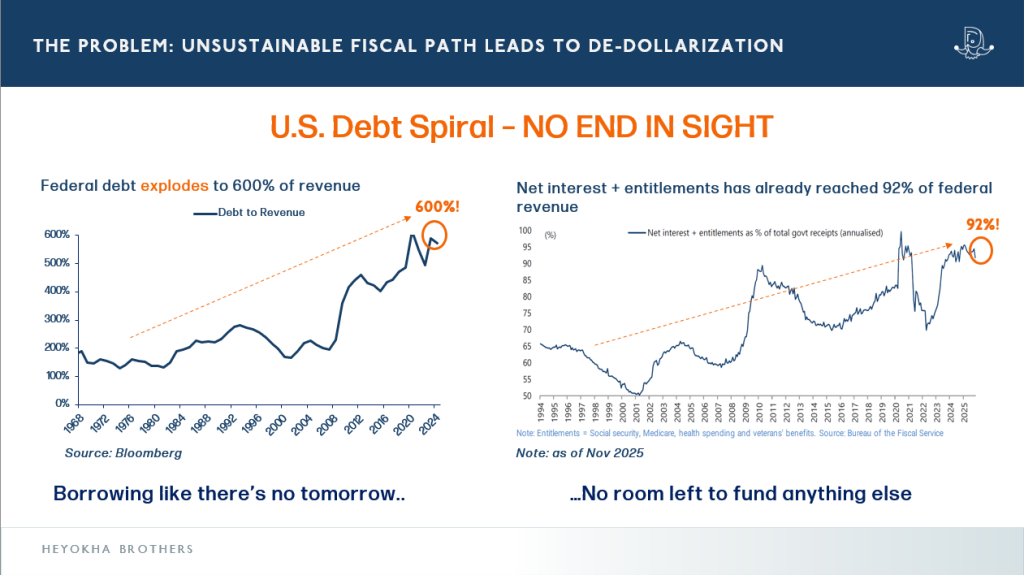

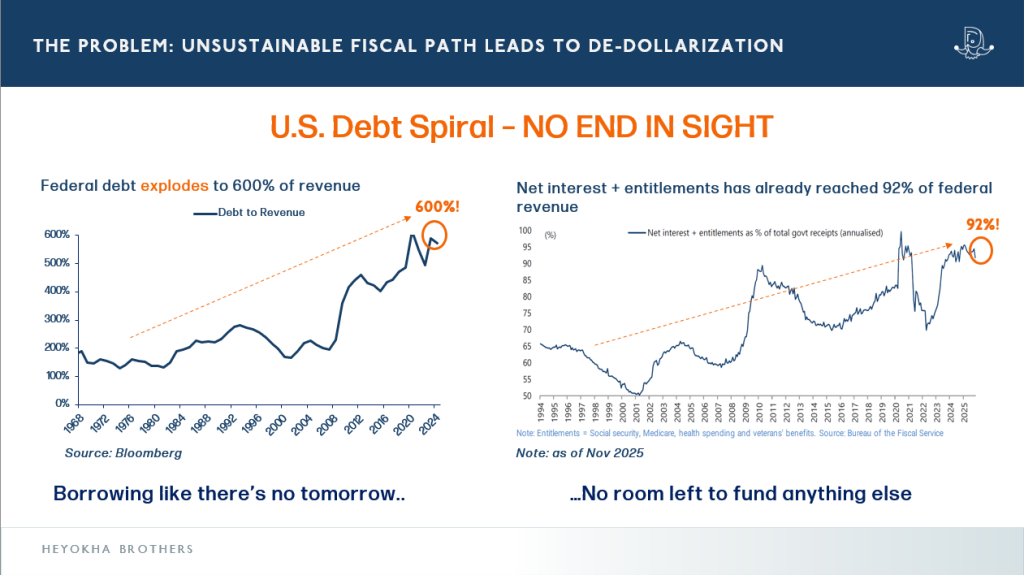

While the strategy to secure hard assets like Greenland makes geopolitical sense, the balance sheet tells a different story. In FY 2025, the U.S. federal government spent $970 billion on net interest alone. This exceeded national defense spending ($917 billion). When you combine interest payments with mandatory entitlements (Social Security and Medicare), these costs are essentially consuming the vast majority of federal revenue, around 92%.

How is this sustainable?

Think about that. Nearly every dollar the government collects is swallowed up just to service past debt and keep the lights on for mandatory programs. That leaves almost nothing for defense, infrastructure, or buying massive islands. The U.S. is effectively trying to finance a 19th-century style expansion with a balance sheet that looks like a distressed tech startup.

The Investor Takeaway

We have been writing about this shift for years: from our Gold: The Return of Real Money report predicting the flight to hard assets, to our analysis of the debt spiral from the report. The “Trump Trade” isn’t just about lower taxes; it’s about a turbulent transition from a paper-based global order to one backed by hard resources.

When a superpower tries to reassert control while drowning in debt, the currency is usually the casualty. That is why central banks are hoarding gold at record rates. They know the cost of maintaining this empire is likely to be paid in inflation.

The End Game

As the U.S. races to lock down Arctic shipping lanes and mineral deposits, the picture is becoming clear. Trump may be playing a winning hand on the geopolitical chessboard, but the financial clock is ticking louder than anyone admits.

The real question isn’t whether America is building a new empire: it’s whether the American people realize they are financing one they can no longer afford.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

The Opening: A Musical Flop and a Geopolitical Stage

In 1986, ABBA’s Benny Andersson and Björn Ulvaeus teamed up to write Chess, a musical about the Cold War where the board served as a metaphor for superpower rivalry. Despite the catchy score, the production was a flop. It struggled to balance human drama with the cold machinery of global politics.

Caught the Broadway production in December. Full house. It seems American audiences can feel the geopolitical temperature rising. Suddenly, this musical feels less like history and more like a preview

Fast forward to 2026, and we are watching a new production on the global stage that is anything but a song and dance. President Trump has officially signed the charter for the “Board of Peace” at Davos. While it was initially pitched as a mechanism for Gaza’s reconstruction, the charter signed this January reveals a much broader mandate: to “promote stability” and resolve international conflicts.

While the name sounds diplomatic, the mechanics are novel. Permanent membership on the board reportedly requires a $1 billion contribution, and the charter grants “Chairman Trump” sweeping authority, including veto power over resolutions. It is a bold attempt to create a “nimble” alternative to the United Nations. However, in a game of chess, you need players willing to sit at the table. While over 20 nations like Saudi Arabia, Turkey, and Indonesia have signed on, heavyweights like France and Germany have declined, citing concerns over undermining the UN. Right now, much of the world is busy building their own boards.

The Thesis: The Empire Strikes Back

It is easy to dismiss Trump’s headlines: buying Greenland, slapping 25% tariffs on neighbors, proposing grand peace boards: as eccentric noise. But what if they aren’t random at all?

At Heyokha, we see these moves as a coherent strategy to build a resource-based American empire in a de-globalizing world. Trump isn’t just making deals; he is attempting to lock down the hard assets: land, energy, and minerals: required to survive the end of the “just-in-time” global order.

Remember this post that the White House did last year?

Why Greenland Was the Opening Move

In 2019, the world laughed when Trump suggested the U.S. buy Greenland. But as Trump wrote in The Art of the Deal, “Location is everything.”

Maybe we should brush up and read the “Art of the Deal”. Cover image is from our blog – “Art of the Deal” Tops Amazon as Tariffs Stirs Comedy and Chaos

Even though the Greenland talks have now subsided into a formal framework for cooperation, the underlying intent of the original ‘buy’ offer to secure resources remain.

Greenland isn’t just ice; it is a fortress of strategic necessity:

- Critical Minerals: The island holds massive reserves of rare earth minerals (estimated at 1.5 million metric tons, with some deposits reaching 28 million metric tons). These are the vitamins of modern defense and technology, and China currently dominates roughly 90% of global processing.

- Arctic Shipping Lanes: As sea ice declines, the Northern Sea Route offers up to 40% savings in time and cost for shipping between Asia and Europe. Controlling this “Polar Silk Road” is a generational prize.

- The AI Power Race: As we explored in our AI Curveball blog, the bottleneck for AI is no longer just code; it is energy and cooling. Greenland’s massive hydro potential and Arctic climate make it a “sovereign heat sink” for the data centers of the future.

This isn’t real estate speculation; it is Monroe Doctrine 2.0. It is a move to secure the Western Hemisphere’s physical supply chain. As we noted in The Price of Sovereignty, in 2026, safety isn’t measured just in missiles, but in who owns the warehouses of food, fuel, and the resources needed to win the AI race.

The “Board of Peace” vs. The Board of Reality

Trump’s “Board of Peace” pitch fits this empire-building mold: a transactional attempt to manage global stability from a position of top-down strength. But the board has changed since 1945.

We aren’t in a unipolar world anymore. As highlighted in our report on De-dollarization, nations like the BRICS bloc are actively building parallel financial rails to bypass the dollar. They’ve seen the U.S. weaponize the dollar against Russia, and they are opting out of the game entirely. You can set up a “Board of Peace,” but it’s hard to play when half the grandmasters are leaving the tournament to start their own league.

The Bill for the Empire

This brings us to the most uncomfortable truth. Empires are expensive.

While the strategy to secure hard assets like Greenland makes geopolitical sense, the balance sheet tells a different story. In FY 2025, the U.S. federal government spent $970 billion on net interest alone. This exceeded national defense spending ($917 billion). When you combine interest payments with mandatory entitlements (Social Security and Medicare), these costs are essentially consuming the vast majority of federal revenue, around 92%.

How is this sustainable?

Think about that. Nearly every dollar the government collects is swallowed up just to service past debt and keep the lights on for mandatory programs. That leaves almost nothing for defense, infrastructure, or buying massive islands. The U.S. is effectively trying to finance a 19th-century style expansion with a balance sheet that looks like a distressed tech startup.

The Investor Takeaway

We have been writing about this shift for years: from our Gold: The Return of Real Money report predicting the flight to hard assets, to our analysis of the debt spiral from the report. The “Trump Trade” isn’t just about lower taxes; it’s about a turbulent transition from a paper-based global order to one backed by hard resources.

When a superpower tries to reassert control while drowning in debt, the currency is usually the casualty. That is why central banks are hoarding gold at record rates. They know the cost of maintaining this empire is likely to be paid in inflation.

The End Game

As the U.S. races to lock down Arctic shipping lanes and mineral deposits, the picture is becoming clear. Trump may be playing a winning hand on the geopolitical chessboard, but the financial clock is ticking louder than anyone admits.

The real question isn’t whether America is building a new empire: it’s whether the American people realize they are financing one they can no longer afford.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share