America’s Hidden Trillion-Dollar Piggy Bank

America’s Hidden Trillion-Dollar Piggy Bank

Washington is inching toward ending the longest government shutdown in U.S. history. Headlines will soon move on, analysts will breathe a temporary sigh of relief, and markets will pretend this was just another episode of political theatre.

But underneath that theatre sits a set of structural realities you can’t unsee — a deteriorating labour market, an accelerating debt spiral, policymakers quietly studying how to reprice national gold reserves, and a small Central Asian state launching the world’s first fully gold-backed, state-issued stablecoin.

Together, they reveal a simple truth:

When the old monetary order strains, the search for anchors begins.

Let’s walk through the signs.

1. The shutdown is ending, but the labour data you can’t unsee is only beginning

With official government data frozen during the shutdown, investors have had to rely on private sources. And the latest Challenger, Gray & Christmas report landed like a brick.

- 153,074 announced job cuts in October

- A 183% surge month-on-month

- The worst October for layoffs since 2003

- 1.1 million job cuts announced year-to-date. This is the highest since 2009 (excluding COVID)

Source: Challenger

Two forces stand out:

1) Cost-cutting is back

Employers cited cost-cutting as the top reason for layoffs, responsible for:

- 50,437 job cuts (33% of October’s total)

After years of post-COVID labour hoarding: “don’t fire anyone, we won’t be able to hire them back”; CFOs have rediscovered spreadsheets.

2) AI is now officially on the layoff slips

Artificial intelligence was cited in:

- 31,039 job cuts (20% of October’s total)

- Nearly 50,000 AI-related layoffs year-to-date

Amazon alone has eliminated around 14,000 corporate roles as automation and restructuring accelerate.

This is the first real sign that AI is shifting from hype cycle to labour-displacing capital investment. This is something we’ve been expecting, but hadn’t yet seen at scale.

The twist?

We don’t fully know what’s happening in the broader labour market because the shutdown froze official data. When the government switches the lights back on, the picture may look very different from the soft-landing narrative investors still cling to.

2. Shutdown theatre vs a debt clock spinning out of control

Source: Peter G. Peterson Foundation

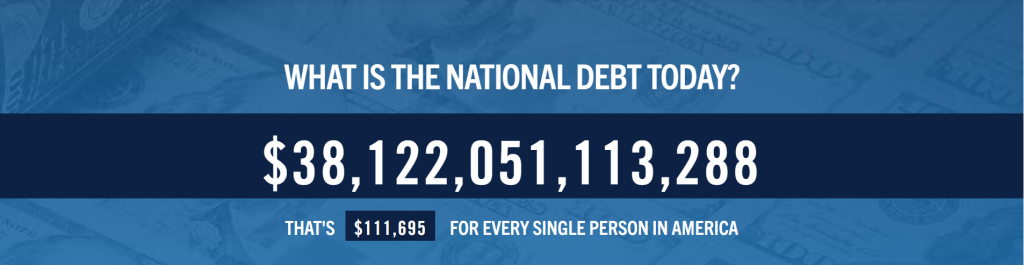

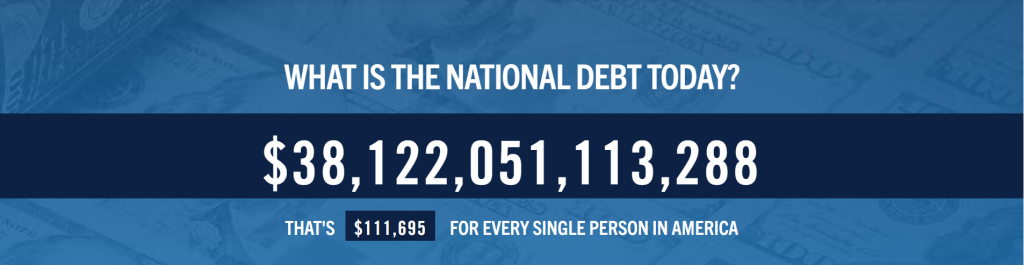

While Washington fights over weeks over extending spending, something far larger happened in the background:

U.S. national debt just crossed US$38 trillion and that’s only two months after crossing US$37 trillion!

The pace of debt accumulation has doubled compared with the long-term trend.

To put the scale in perspective, the U.S. has added roughly US$1 trillion in just 60 days, is running a US$1.8 trillion deficit in FY2025, and is projected to accumulate US$22.7 trillion in additional deficits over the next decade.

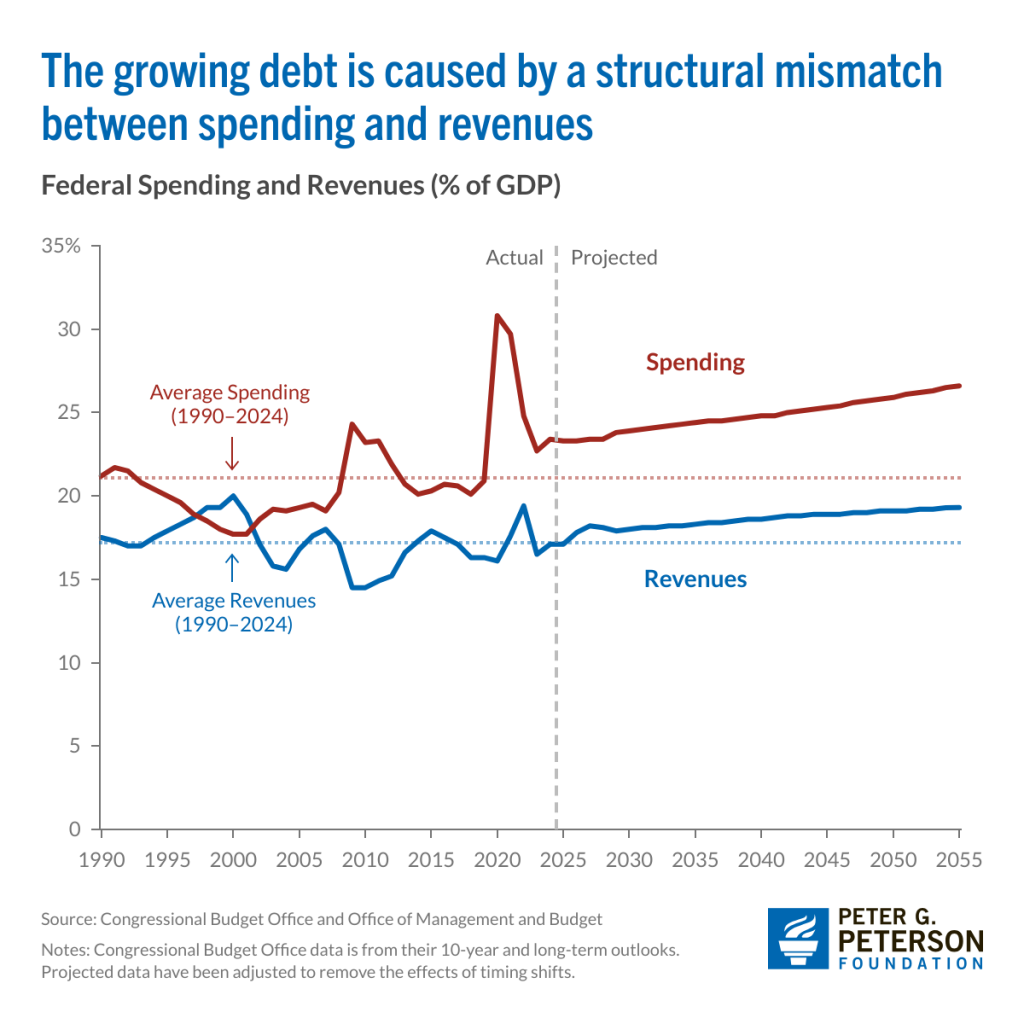

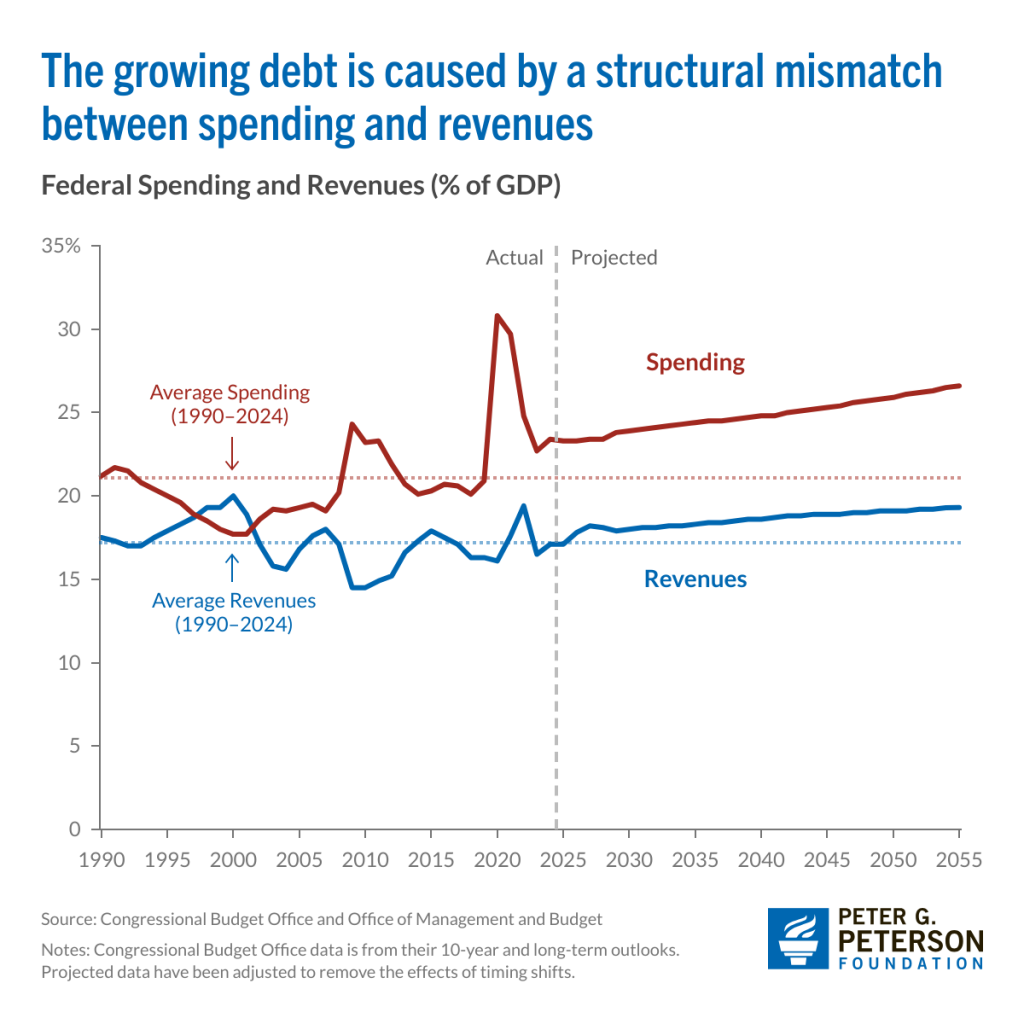

Interest expense is now the fastest-growing line item in the federal budget: the country spent US$4 trillion on interest over the past ten years and is on track to spend US$14 trillion in the decade ahead on top of that. With borrowing costs compounding at this pace, interest is increasingly crowding out public investment from infrastructure and education to research, defense planning, and even private-sector capital formation.

Source: Peter G. Peterson Foundation

Shutdowns, ironically, make it worse:

- 2013 shutdown → US$2B lost productivity

- 2018–19 shutdown → US$11B lost output, US$3B permanently lost

- 2025 shutdown → expected to shave US$7–14B off GDP

This isn’t fiscal discipline.

It’s fiscal erosion layered on top of political dysfunction.

All three major credit rating agencies have now lowered the U.S. below their top rating citing unsustainable fiscal trajectories and political gridlock.

This is the backdrop for what comes next.

3. The Fed’s hidden piggy bank: revaluing America’s gold

On August 1st, the Federal Reserve released a research note with a title that probably didn’t get enough attention:

“Official Reserve Revaluations: The International Experience.”

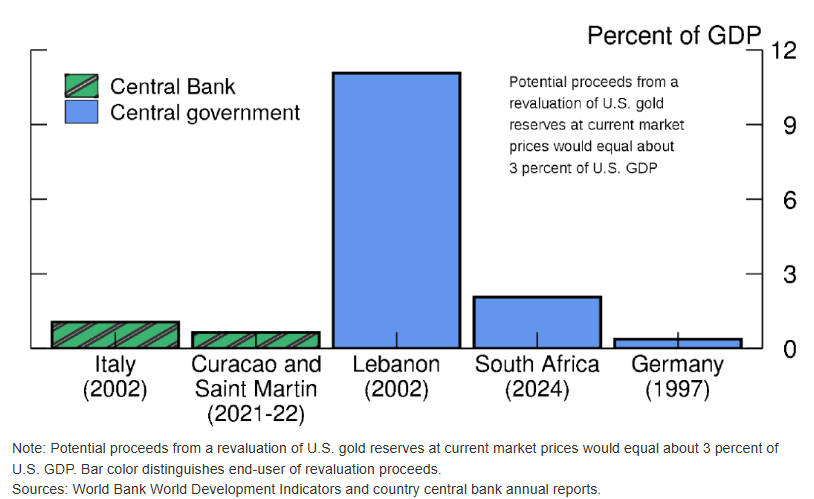

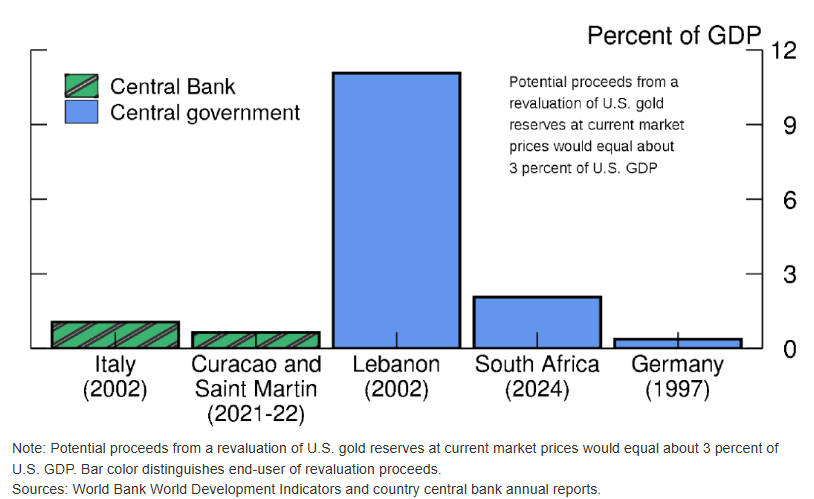

The note reviews how governments have used valuation gains on gold reserves to:

- plug fiscal gaps,

- recapitalize central banks,

- or create fiscal space without raising taxes or issuing new debt.

Countries cited:

Germany, Italy, Lebanon, Curaçao & Sint Maarten, and South Africa.

How much “extra money” countries got by revaluing their gold, and who got to use it.

Source: The Fed

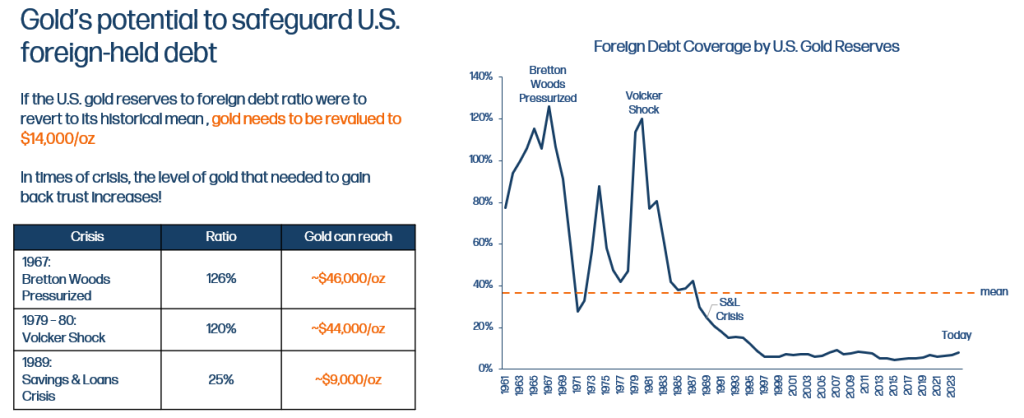

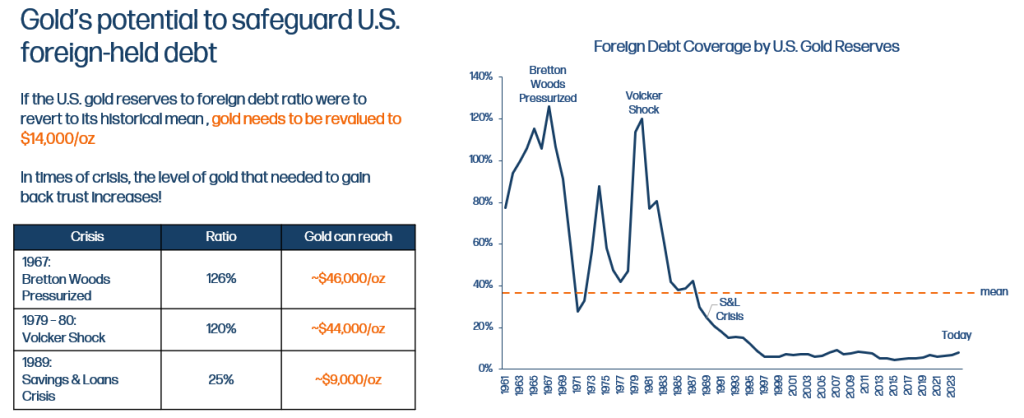

But the real implication is for the United States.

The U.S. Treasury still values its gold at US$42.22 per ounce. (Set in 1973.)

It officially holds:

261.5 million troy ounces of gold (or so they say).

Book value at US$42.22 → around US$11 billion.

Now compare that to today’s gold price:

Gold is hovering around US$4,200 per ounce.

At market value, the U.S. hoard is worth:

261.5m × 4,200 ≈ US$1.1 trillion

That’s almost 100× the book value.

In other words: the U.S. has a trillion-dollar hidden fiscal asset.

And the mechanism to tap it is shockingly simple.

Source: Heyokha Research

How a gold revaluation works

The Treasury already issues gold certificates to the Fed at the outdated US$42.22 price.

A revaluation would:

- Raise the official gold price

- Issue new gold certificates at the new valuation

- The Fed credits the Treasury’s account with the difference

- No gold is sold

- No debt ceiling is violated

- Hundreds of billions to over a trillion dollars appear

A pure accounting maneuver.

But not a free one

A move like this:

- is effectively stealth money printing

- could undermine confidence in the U.S. dollar

- may add another inflationary tailwind

- signals desperation in fiscal mechanics

Historically, gold revaluation only comes during:

- 1934: FDR uses it to fund the New Deal

- 1971–73: Nixon ends gold convertibility, triggering a de facto repricing

The fact that the Fed is studying this now, as debt hits US$38 trillion and interest costs spiral, speaks volumes.

When a system starts looking at its gold like a pawnshop looks at a wedding ring, something deeper is happening.

4. Meanwhile in Bishkek: Gold 2.0 goes on-chain

While the U.S. quietly examines gold revaluation as a balance-sheet tool, a small Central Asian nation is doing something far more explicit.

Meet USDKG -> Kyrgyzstan’s state-issued, gold-backed stablecoin.

USDKG went live on October 31, 2025, with its public listing following in early November. It’s designed to be simple in form but radical in implication: a digital token pegged 1:1 to the U.S. dollar, fully backed by physical gold, custodied and audited by the Kyrgyz Ministry of Finance, and recorded on transparent blockchain rails.

In other words: an old-world anchor meeting new-world plumbing.

Initial issuance: 50.1 million tokens

Initial gold reserve: roughly US$500 million, scaling toward US$2 billion

Kyrgyzstan is now the first country in the world to issue a state-backed stablecoin fully collateralized by gold.

Why they’re doing it

USDKG is meant to:

- modernize cross-border payments,

- attract capital seeking a hard-asset-backed digital alternative,

- hedge against dollar volatility,

- reduce dependence on U.S. banking rails,

- build economic sovereignty via blockchain.

For a region culturally anchored to gold, this offers a familiar foundation with modern infrastructure.

Risks

- credibility hinges on continuous audits,

- adoption must go beyond speculators,

- geopolitics may pressure its usage,

- liquidity must scale significantly.

But symbolically?

It’s a milestone.

In one part of the world, policymakers are quietly discussing revaluing gold to fill fiscal holes.

In another, a government is explicitly tokenizing gold to build a new monetary instrument.

5. The through-line: labour → debt → gold → digital gold

Put the pieces together:

- Labour market: layoffs are surging, AI is displacing jobs, cost-cutting is replacing labour hoarding.

- Debt: the U.S. is adding US$1 trillion around every 60 days, interest expense is exploding, and shutdowns only made it worse.

- Gold: the Fed is studying how to unlock US$1.1 trillion in unrealized gold gains via revaluation.

- Digital gold: Kyrgyzstan launches USDKG, the first state-backed gold-collateralized stablecoin.

These are not isolated events.

They’re signals of a monetary order under pressure and of societies reaching for anchors.

Corporates seek anchors in automation.

Governments seek anchors in asset revaluations.

Emerging markets seek anchors in tokenized gold.

For investors, the takeaway isn’t that the dollar collapses tomorrow or that gold-stablecoins replace SWIFT.

The message is subtler and more important:

In a regime where labour weakens, debt accelerates, and policymakers test non-traditional monetary levers, real assets and pricing power become the central pillars of portfolio resilience.

The shutdown may end.

The headlines will move on.

But the deeper story of a system inching toward a fiscal and monetary reset is just the beginning.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

Washington is inching toward ending the longest government shutdown in U.S. history. Headlines will soon move on, analysts will breathe a temporary sigh of relief, and markets will pretend this was just another episode of political theatre.

But underneath that theatre sits a set of structural realities you can’t unsee — a deteriorating labour market, an accelerating debt spiral, policymakers quietly studying how to reprice national gold reserves, and a small Central Asian state launching the world’s first fully gold-backed, state-issued stablecoin.

Together, they reveal a simple truth:

When the old monetary order strains, the search for anchors begins.

Let’s walk through the signs.

1. The shutdown is ending, but the labour data you can’t unsee is only beginning

With official government data frozen during the shutdown, investors have had to rely on private sources. And the latest Challenger, Gray & Christmas report landed like a brick.

- 153,074 announced job cuts in October

- A 183% surge month-on-month

- The worst October for layoffs since 2003

- 1.1 million job cuts announced year-to-date. This is the highest since 2009 (excluding COVID)

Source: Challenger

Two forces stand out:

1) Cost-cutting is back

Employers cited cost-cutting as the top reason for layoffs, responsible for:

- 50,437 job cuts (33% of October’s total)

After years of post-COVID labour hoarding: “don’t fire anyone, we won’t be able to hire them back”; CFOs have rediscovered spreadsheets.

2) AI is now officially on the layoff slips

Artificial intelligence was cited in:

- 31,039 job cuts (20% of October’s total)

- Nearly 50,000 AI-related layoffs year-to-date

Amazon alone has eliminated around 14,000 corporate roles as automation and restructuring accelerate.

This is the first real sign that AI is shifting from hype cycle to labour-displacing capital investment. This is something we’ve been expecting, but hadn’t yet seen at scale.

The twist?

We don’t fully know what’s happening in the broader labour market because the shutdown froze official data. When the government switches the lights back on, the picture may look very different from the soft-landing narrative investors still cling to.

2. Shutdown theatre vs a debt clock spinning out of control

Source: Peter G. Peterson Foundation

While Washington fights over weeks over extending spending, something far larger happened in the background:

U.S. national debt just crossed US$38 trillion and that’s only two months after crossing US$37 trillion!

The pace of debt accumulation has doubled compared with the long-term trend.

To put the scale in perspective, the U.S. has added roughly US$1 trillion in just 60 days, is running a US$1.8 trillion deficit in FY2025, and is projected to accumulate US$22.7 trillion in additional deficits over the next decade.

Interest expense is now the fastest-growing line item in the federal budget: the country spent US$4 trillion on interest over the past ten years and is on track to spend US$14 trillion in the decade ahead on top of that. With borrowing costs compounding at this pace, interest is increasingly crowding out public investment from infrastructure and education to research, defense planning, and even private-sector capital formation.

Source: Peter G. Peterson Foundation

Shutdowns, ironically, make it worse:

- 2013 shutdown → US$2B lost productivity

- 2018–19 shutdown → US$11B lost output, US$3B permanently lost

- 2025 shutdown → expected to shave US$7–14B off GDP

This isn’t fiscal discipline.

It’s fiscal erosion layered on top of political dysfunction.

All three major credit rating agencies have now lowered the U.S. below their top rating citing unsustainable fiscal trajectories and political gridlock.

This is the backdrop for what comes next.

3. The Fed’s hidden piggy bank: revaluing America’s gold

On August 1st, the Federal Reserve released a research note with a title that probably didn’t get enough attention:

“Official Reserve Revaluations: The International Experience.”

The note reviews how governments have used valuation gains on gold reserves to:

- plug fiscal gaps,

- recapitalize central banks,

- or create fiscal space without raising taxes or issuing new debt.

Countries cited:

Germany, Italy, Lebanon, Curaçao & Sint Maarten, and South Africa.

How much “extra money” countries got by revaluing their gold, and who got to use it.

Source: The Fed

But the real implication is for the United States.

The U.S. Treasury still values its gold at US$42.22 per ounce. (Set in 1973.)

It officially holds:

261.5 million troy ounces of gold (or so they say).

Book value at US$42.22 → around US$11 billion.

Now compare that to today’s gold price:

Gold is hovering around US$4,200 per ounce.

At market value, the U.S. hoard is worth:

261.5m × 4,200 ≈ US$1.1 trillion

That’s almost 100× the book value.

In other words: the U.S. has a trillion-dollar hidden fiscal asset.

And the mechanism to tap it is shockingly simple.

Source: Heyokha Research

How a gold revaluation works

The Treasury already issues gold certificates to the Fed at the outdated US$42.22 price.

A revaluation would:

- Raise the official gold price

- Issue new gold certificates at the new valuation

- The Fed credits the Treasury’s account with the difference

- No gold is sold

- No debt ceiling is violated

- Hundreds of billions to over a trillion dollars appear

A pure accounting maneuver.

But not a free one

A move like this:

- is effectively stealth money printing

- could undermine confidence in the U.S. dollar

- may add another inflationary tailwind

- signals desperation in fiscal mechanics

Historically, gold revaluation only comes during:

- 1934: FDR uses it to fund the New Deal

- 1971–73: Nixon ends gold convertibility, triggering a de facto repricing

The fact that the Fed is studying this now, as debt hits US$38 trillion and interest costs spiral, speaks volumes.

When a system starts looking at its gold like a pawnshop looks at a wedding ring, something deeper is happening.

4. Meanwhile in Bishkek: Gold 2.0 goes on-chain

While the U.S. quietly examines gold revaluation as a balance-sheet tool, a small Central Asian nation is doing something far more explicit.

Meet USDKG -> Kyrgyzstan’s state-issued, gold-backed stablecoin.

USDKG went live on October 31, 2025, with its public listing following in early November. It’s designed to be simple in form but radical in implication: a digital token pegged 1:1 to the U.S. dollar, fully backed by physical gold, custodied and audited by the Kyrgyz Ministry of Finance, and recorded on transparent blockchain rails.

In other words: an old-world anchor meeting new-world plumbing.

Initial issuance: 50.1 million tokens

Initial gold reserve: roughly US$500 million, scaling toward US$2 billion

Kyrgyzstan is now the first country in the world to issue a state-backed stablecoin fully collateralized by gold.

Why they’re doing it

USDKG is meant to:

- modernize cross-border payments,

- attract capital seeking a hard-asset-backed digital alternative,

- hedge against dollar volatility,

- reduce dependence on U.S. banking rails,

- build economic sovereignty via blockchain.

For a region culturally anchored to gold, this offers a familiar foundation with modern infrastructure.

Risks

- credibility hinges on continuous audits,

- adoption must go beyond speculators,

- geopolitics may pressure its usage,

- liquidity must scale significantly.

But symbolically?

It’s a milestone.

In one part of the world, policymakers are quietly discussing revaluing gold to fill fiscal holes.

In another, a government is explicitly tokenizing gold to build a new monetary instrument.

5. The through-line: labour → debt → gold → digital gold

Put the pieces together:

- Labour market: layoffs are surging, AI is displacing jobs, cost-cutting is replacing labour hoarding.

- Debt: the U.S. is adding US$1 trillion around every 60 days, interest expense is exploding, and shutdowns only made it worse.

- Gold: the Fed is studying how to unlock US$1.1 trillion in unrealized gold gains via revaluation.

- Digital gold: Kyrgyzstan launches USDKG, the first state-backed gold-collateralized stablecoin.

These are not isolated events.

They’re signals of a monetary order under pressure and of societies reaching for anchors.

Corporates seek anchors in automation.

Governments seek anchors in asset revaluations.

Emerging markets seek anchors in tokenized gold.

For investors, the takeaway isn’t that the dollar collapses tomorrow or that gold-stablecoins replace SWIFT.

The message is subtler and more important:

In a regime where labour weakens, debt accelerates, and policymakers test non-traditional monetary levers, real assets and pricing power become the central pillars of portfolio resilience.

The shutdown may end.

The headlines will move on.

But the deeper story of a system inching toward a fiscal and monetary reset is just the beginning.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share