Not Just About Oil: Venezuela and the Currency of Power

Not Just About Oil: Venezuela and the Currency of Power

Something big happened. And no, we’re not talking about the dramatic military footage from Caracas. That was the trailer. The real story is about systems: who runs them, who controls access, and how trust in those systems is unraveling in real-time.

For decades, the petrodollar system anchored U.S. financial dominance. It was never about just oil, it was about trust. Trust that global trade would run through U.S. dollars. Trust that national borders would be respected. Trust that rule of law, not rule of force, governed the world’s financial plumbing.

That trust just took a direct hit.

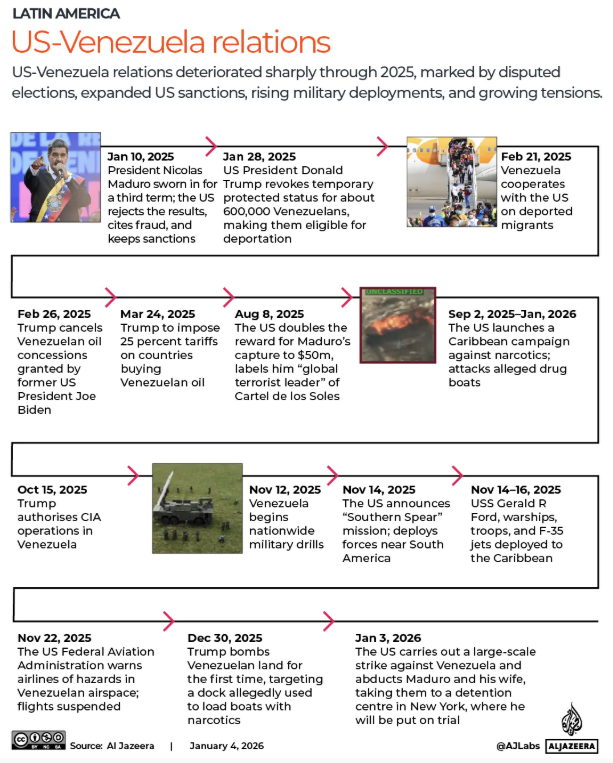

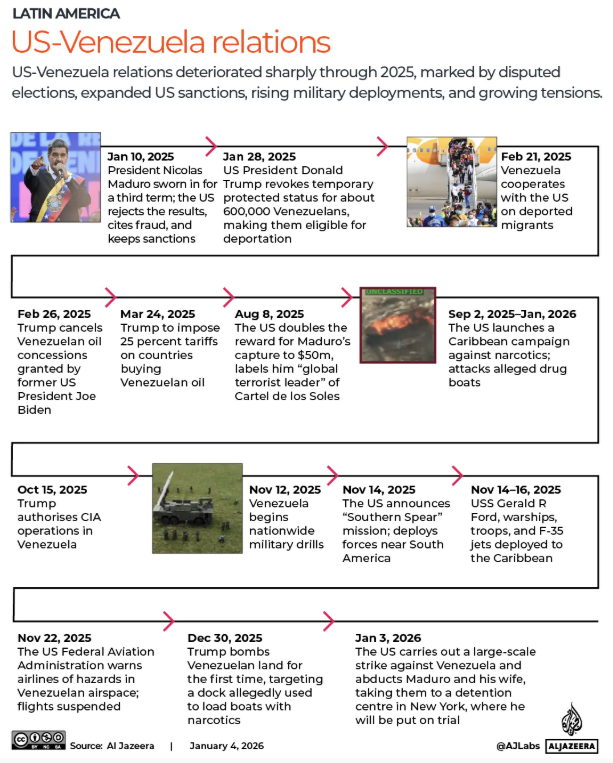

If you need a refresher of the events that transpired

Source: Al Jazeera

Venezuela Was Never About Venezuela

Let’s get one thing out of the way: Venezuela’s importance isn’t about what it produces now, it’s about what it could produce and who controls it.

Officially, Venezuela sits on the world’s largest proven oil reserves, an estimated 300 billion barrels. To put that in perspective, that is more than Saudi Arabia that holds an estimate of 267 billion barrels. Yet, the nation’s actual output has cratered:

- Peak (Early 2000s): ~3 million barrels per day (bpd).

- Today: Struggling to stay above 800,000–900,000 bpd.

Infrastructure is decaying. Expertise has fled. Most foreign players, save Chevron, were kicked out long ago. And yet, the U.S. is back.

Why?

Because even if Venezuela’s current output is minimal, it possesses the specific “heavy sour” crude needed by U.S. Gulf Coast refineries to optimize margins. However, the narrative that the U.S. can simply “turn on the taps” is a logistical fantasy.

The Dollar’s Soft Power Turns Hard

For years, the game plan was “isolation through paperwork.” Washington used sanctions to lock Venezuela out of Western banks and U.S. capital markets. It didn’t work.

Caracas simply built a “parallel plumbing” system to bypass the dollar. They rerouted trade through shadow fleets and leaned on Beijing for survival.

The China Play: Between 2007 and 2015, China funneled $60 billion into Venezuela. But Beijing isn’t a charity—they’ve spent the last decade quietly de-risking. By halting new loans and focusing on “extraction-for-repayment,” they have recouped roughly $50 billion, leaving a manageable $10–12 billion on the books.

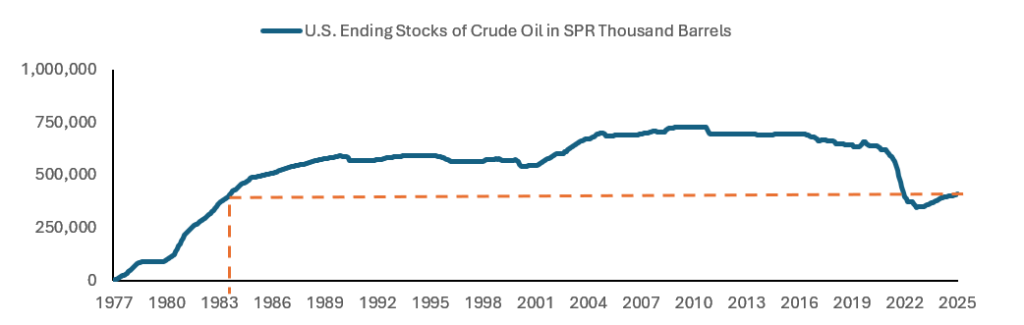

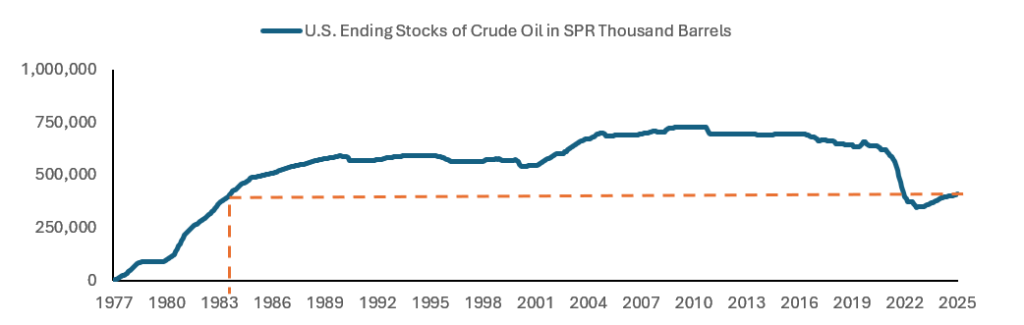

This operation was never about a “war for oil” in the traditional sense. While the U.S. Strategic Petroleum Reserve (SPR) is low (currently holding 413 million barrels, near 1980s benchmarks) the U.S. could be worried about a war higher than just oil.

U.S emergency stockpile is as low as it was in the 1980s. This gives the U.S. less flexibility in a crisis and weaker leverage against OPEC+ adversaries

Source: U.S. Energy Information Administration

This is a war for primacy. If a nation in the Western Hemisphere can successfully decouple from the dollar system using Chinese financial rails, the precedent is dangerous.

So, Washington pulled the emergency brake.

Maduro was taken. The military operation was swift and surgical, closer to a “decapitation strike” rather than a full invasion. But what followed wasn’t a puppet installation, but a bizarre cohabitation. With Delcy Rodríguez now sworn in as Acting President, the U.S. has proven it can remove a leader, but it hasn’t proven it can easily govern the aftermath.

Empire by Other Means

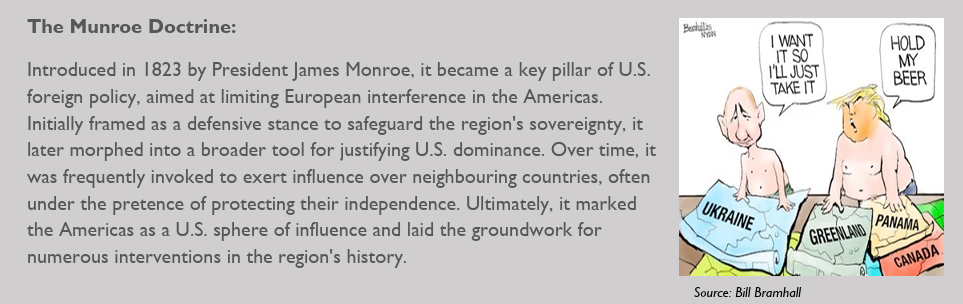

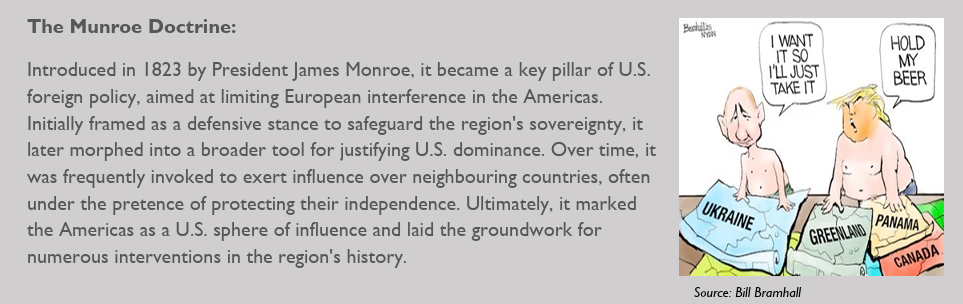

This is not a new doctrine—it’s the Monroe Doctrine, version 2.0.

We’ve talked about the Munroe Doctrine before in our Gold Report, here’s a sneak peak

But Venezuela is not a “banana republic” of the 1950s; it is a fragmented state with 20–30 million people and over 20 different armed groups controlling the interior.

And here’s the kicker: even if you stabilize the country, reactivating Venezuela’s oil machine will require more than $100 billion in capex and over a decade of patient rebuilding. That is a staggering sum for a nation that is effectively insolvent.

To put the scale of this challenge in perspective, consider the mountain of debt already on the books:

- Total External Debt: Estimated between $150–$170 billion.

- Economic Output: The International Monetary Fund (IMF) estimates Venezuela’s nominal GDP at about $82.8 billion for 2025.

- The Debt Trap: This implies a debt-to-GDP ratio of between 180%–200%.

In short: the cost to simply fix the oil fields is larger than the country’s entire annual economic output, and the debt they already owe is double that. This isn’t just a recovery project; it’s a multi-generational financial restructuring.

A Catalyst for Hard Assets

But what does all of this mean for investors?

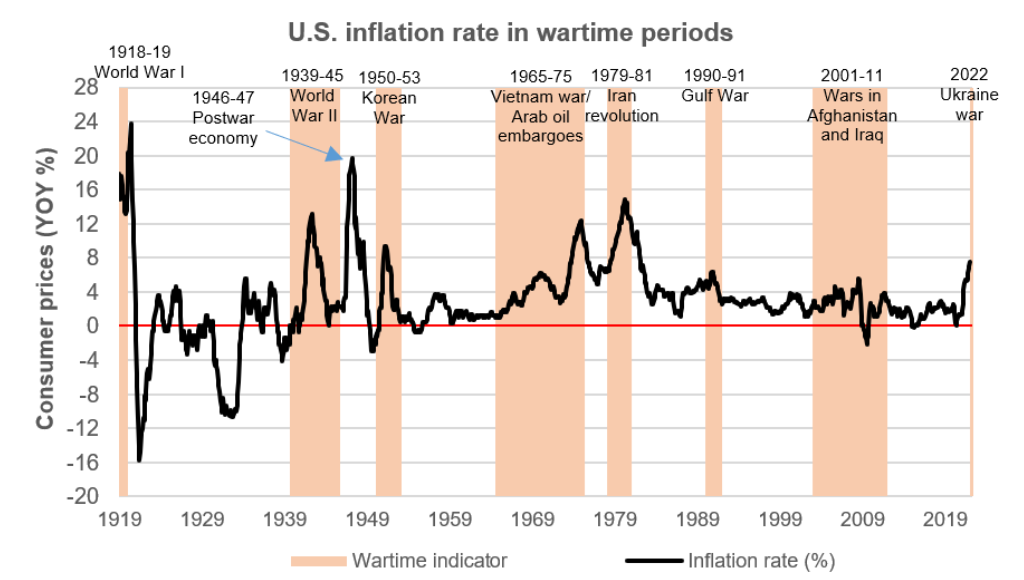

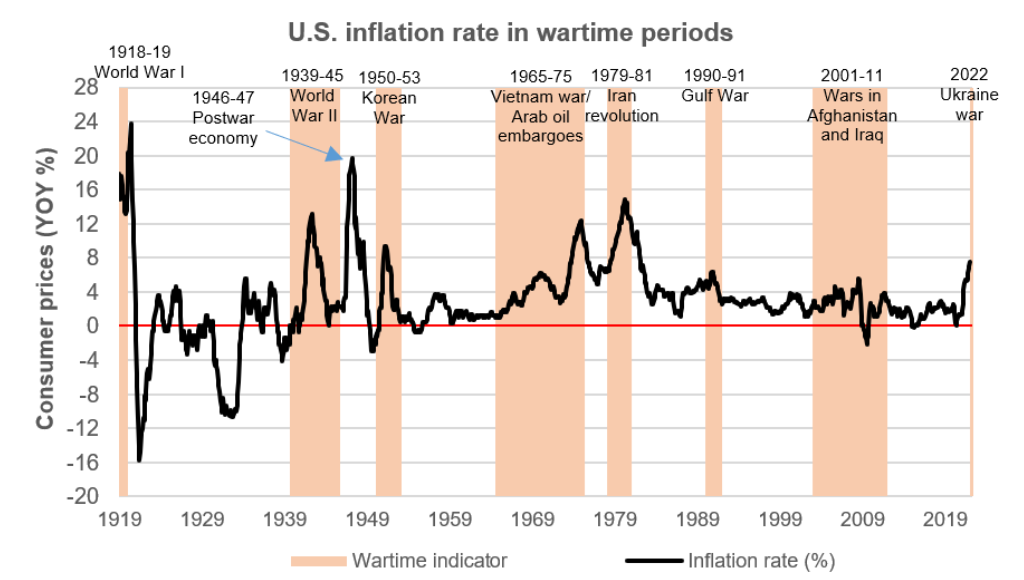

Wars are inflationary. Always have been. Resources are hoarded. Supply chains are weaponized. Deficits explode. And trust, especially trust in the currency used to finance these deteriorates.

War has always been inflationary

Source: RSM US

At Heyokha, we’ve been writing about this for years:

- In our Q2 2020 report History: A Better Guide than Good Intentions, we’ve argued that Modern Monetary Theory would eventually unleash inflation. With today’s ballooning war budgets and rising debt service, that forecast is aging well.”

- In “Gold: The Return of Real Money”, we mapped the declining credibility of fiat currencies and why gold is re-emerging as a store of trust in a fractured world.

- In “The Stablecoin that Bought a Central Bank’s Worth of Gold”, we showed how even crypto-native companies are seeking shelter in gold, echoing the behavior of central banks.

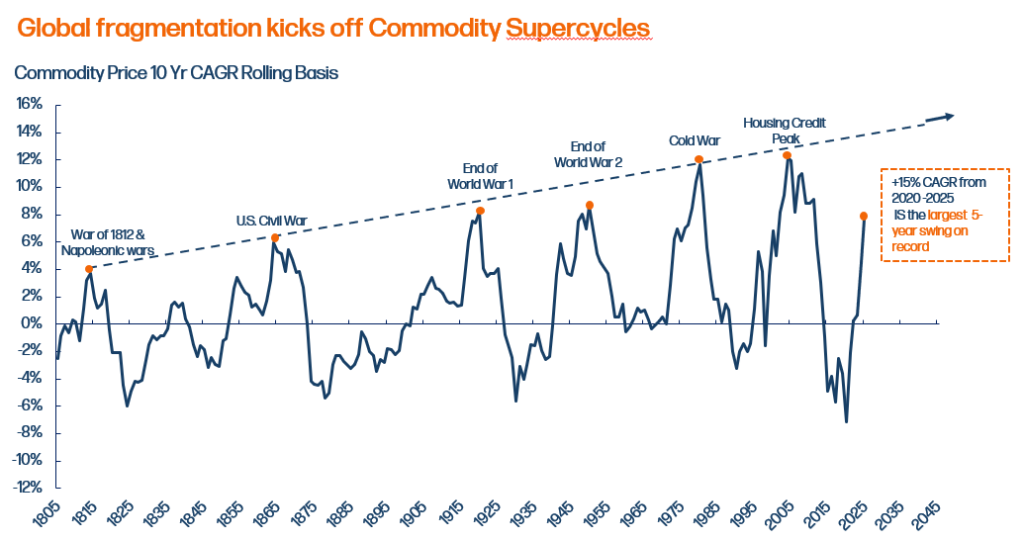

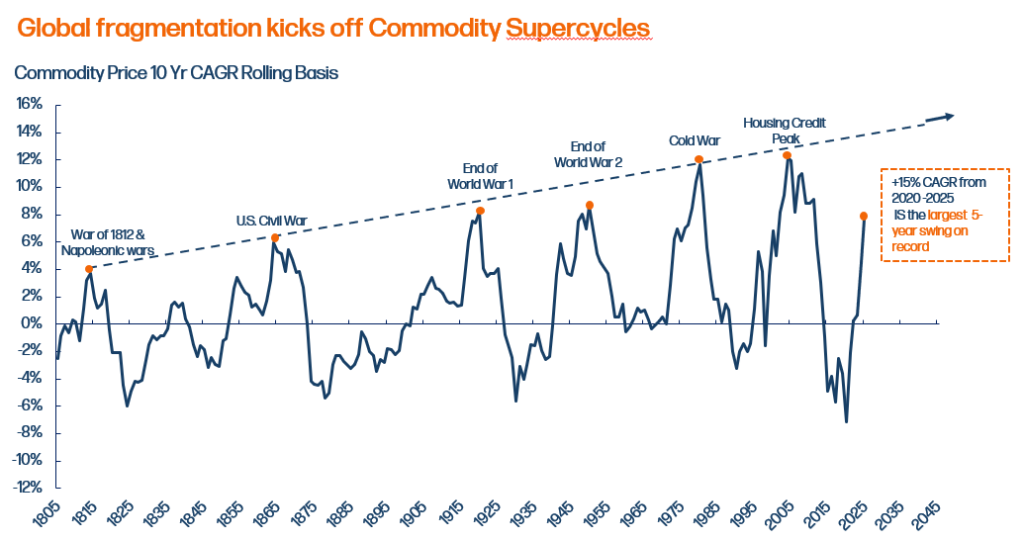

War also kicks off commodity prices to surge

Venezuela fits squarely into this narrative.

The show of force may have delivered a short-term win. But the long-term effect is clear: if you’re a resource-rich nation thinking of pricing oil or metals outside the dollar, this operation was a warning. The message? Don’t even try.

But the world is watching and taking notes. BRICS members are already settling trades in local currencies. China’s Cross-Border Interbank Payment System (CIPS) now links over 1,400 financial institutions across 109 countries. Gold purchases by central banks hit multi-decade highs last year.

In other words: trust is shifting.

Final Thoughts: A Wake-Up Call for the Financial System

The aircraft have left Caracas. Maduro is in New York facing trial. But the damage to the “rules-based order” is permanent.

This wasn’t just a regime change—it was a message to the rest of the world: U.S. access to resources comes first. Financial autonomy comes second.

That message will echo far beyond Latin America.

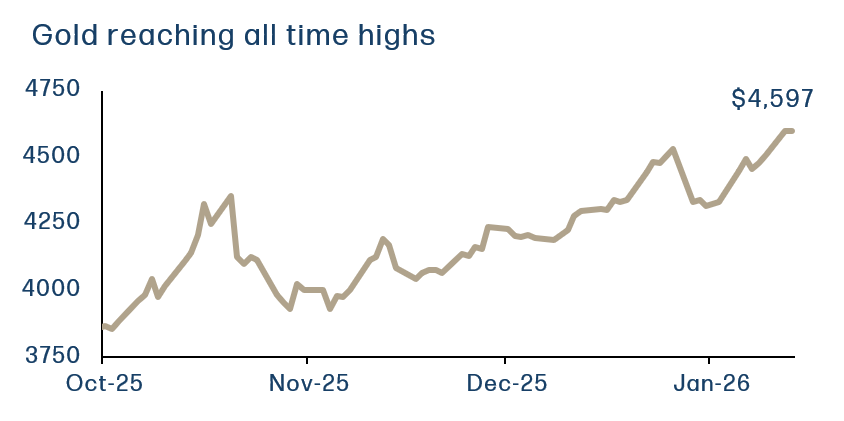

It will accelerate the move away from dollar-based systems. It will deepen skepticism of U.S. financial assets. And it will push more capital into real stores of value—like gold, silver, and the infrastructure tied to energy sovereignty.

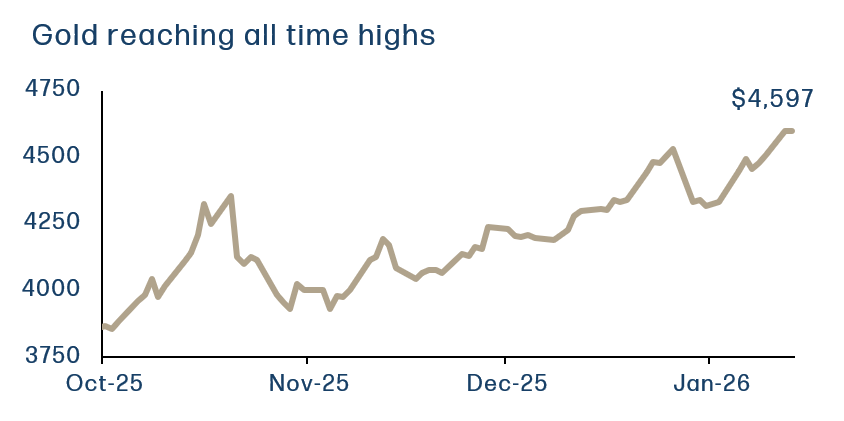

Up 73% since October 2025. How much higher can it go with increased political uncertainty?

At Heyokha, we see this moment not as an isolated geopolitical event, but as part of the broader endgame of the fiat era. When trust erodes, when power shifts, when the military becomes the backstop of monetary policy—it’s time to think hard about what you own.

Gold isn’t just a hedge anymore. It’s a protest vote. A way to opt out of systems that break their own rules. And the story of Venezuela might be the loudest signal yet.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

Something big happened. And no, we’re not talking about the dramatic military footage from Caracas. That was the trailer. The real story is about systems: who runs them, who controls access, and how trust in those systems is unraveling in real-time.

For decades, the petrodollar system anchored U.S. financial dominance. It was never about just oil, it was about trust. Trust that global trade would run through U.S. dollars. Trust that national borders would be respected. Trust that rule of law, not rule of force, governed the world’s financial plumbing.

That trust just took a direct hit.

If you need a refresher of the events that transpired

Source: Al Jazeera

Venezuela Was Never About Venezuela

Let’s get one thing out of the way: Venezuela’s importance isn’t about what it produces now, it’s about what it could produce and who controls it.

Officially, Venezuela sits on the world’s largest proven oil reserves, an estimated 300 billion barrels. To put that in perspective, that is more than Saudi Arabia that holds an estimate of 267 billion barrels. Yet, the nation’s actual output has cratered:

- Peak (Early 2000s): ~3 million barrels per day (bpd).

- Today: Struggling to stay above 800,000–900,000 bpd.

Infrastructure is decaying. Expertise has fled. Most foreign players, save Chevron, were kicked out long ago. And yet, the U.S. is back.

Why?

Because even if Venezuela’s current output is minimal, it possesses the specific “heavy sour” crude needed by U.S. Gulf Coast refineries to optimize margins. However, the narrative that the U.S. can simply “turn on the taps” is a logistical fantasy.

The Dollar’s Soft Power Turns Hard

For years, the game plan was “isolation through paperwork.” Washington used sanctions to lock Venezuela out of Western banks and U.S. capital markets. It didn’t work.

Caracas simply built a “parallel plumbing” system to bypass the dollar. They rerouted trade through shadow fleets and leaned on Beijing for survival.

The China Play: Between 2007 and 2015, China funneled $60 billion into Venezuela. But Beijing isn’t a charity—they’ve spent the last decade quietly de-risking. By halting new loans and focusing on “extraction-for-repayment,” they have recouped roughly $50 billion, leaving a manageable $10–12 billion on the books.

This operation was never about a “war for oil” in the traditional sense. While the U.S. Strategic Petroleum Reserve (SPR) is low (currently holding 413 million barrels, near 1980s benchmarks) the U.S. could be worried about a war higher than just oil.

U.S emergency stockpile is as low as it was in the 1980s. This gives the U.S. less flexibility in a crisis and weaker leverage against OPEC+ adversaries

Source: U.S. Energy Information Administration

This is a war for primacy. If a nation in the Western Hemisphere can successfully decouple from the dollar system using Chinese financial rails, the precedent is dangerous.

So, Washington pulled the emergency brake.

Maduro was taken. The military operation was swift and surgical, closer to a “decapitation strike” rather than a full invasion. But what followed wasn’t a puppet installation, but a bizarre cohabitation. With Delcy Rodríguez now sworn in as Acting President, the U.S. has proven it can remove a leader, but it hasn’t proven it can easily govern the aftermath.

Empire by Other Means

This is not a new doctrine—it’s the Monroe Doctrine, version 2.0.

We’ve talked about the Munroe Doctrine before in our Gold Report, here’s a sneak peak

But Venezuela is not a “banana republic” of the 1950s; it is a fragmented state with 20–30 million people and over 20 different armed groups controlling the interior.

And here’s the kicker: even if you stabilize the country, reactivating Venezuela’s oil machine will require more than $100 billion in capex and over a decade of patient rebuilding. That is a staggering sum for a nation that is effectively insolvent.

To put the scale of this challenge in perspective, consider the mountain of debt already on the books:

- Total External Debt: Estimated between $150–$170 billion.

- Economic Output: The International Monetary Fund (IMF) estimates Venezuela’s nominal GDP at about $82.8 billion for 2025.

- The Debt Trap: This implies a debt-to-GDP ratio of between 180%–200%.

In short: the cost to simply fix the oil fields is larger than the country’s entire annual economic output, and the debt they already owe is double that. This isn’t just a recovery project; it’s a multi-generational financial restructuring.

A Catalyst for Hard Assets

But what does all of this mean for investors?

Wars are inflationary. Always have been. Resources are hoarded. Supply chains are weaponized. Deficits explode. And trust, especially trust in the currency used to finance these deteriorates.

War has always been inflationary

Source: RSM US

At Heyokha, we’ve been writing about this for years:

- In our Q2 2020 report History: A Better Guide than Good Intentions, we’ve argued that Modern Monetary Theory would eventually unleash inflation. With today’s ballooning war budgets and rising debt service, that forecast is aging well.”

- In “Gold: The Return of Real Money”, we mapped the declining credibility of fiat currencies and why gold is re-emerging as a store of trust in a fractured world.

- In “The Stablecoin that Bought a Central Bank’s Worth of Gold”, we showed how even crypto-native companies are seeking shelter in gold, echoing the behavior of central banks.

War also kicks off commodity prices to surge

Venezuela fits squarely into this narrative.

The show of force may have delivered a short-term win. But the long-term effect is clear: if you’re a resource-rich nation thinking of pricing oil or metals outside the dollar, this operation was a warning. The message? Don’t even try.

But the world is watching and taking notes. BRICS members are already settling trades in local currencies. China’s Cross-Border Interbank Payment System (CIPS) now links over 1,400 financial institutions across 109 countries. Gold purchases by central banks hit multi-decade highs last year.

In other words: trust is shifting.

Final Thoughts: A Wake-Up Call for the Financial System

The aircraft have left Caracas. Maduro is in New York facing trial. But the damage to the “rules-based order” is permanent.

This wasn’t just a regime change—it was a message to the rest of the world: U.S. access to resources comes first. Financial autonomy comes second.

That message will echo far beyond Latin America.

It will accelerate the move away from dollar-based systems. It will deepen skepticism of U.S. financial assets. And it will push more capital into real stores of value—like gold, silver, and the infrastructure tied to energy sovereignty.

Up 73% since October 2025. How much higher can it go with increased political uncertainty?

At Heyokha, we see this moment not as an isolated geopolitical event, but as part of the broader endgame of the fiat era. When trust erodes, when power shifts, when the military becomes the backstop of monetary policy—it’s time to think hard about what you own.

Gold isn’t just a hedge anymore. It’s a protest vote. A way to opt out of systems that break their own rules. And the story of Venezuela might be the loudest signal yet.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share