One takeaway from the CIMB Indonesia Conference: An app alone is not a digital strategy

One takeaway from the CIMB Indonesia Conference: An app alone is not a digital strategy

Heyokha team recently attended the CIMB 11th Indonesia Conference. Admittedly, the venue of the event in Bali is a big pull factor, for obvious reasons. Yet, we also found out that despite Bali’s distractions, the fact that we were being away from hectic Hong Kong or Jakarta helped us to focus and think better. This enables deeper thinking (we discussed this topic in our Q12017 quarterly report).

One key takeaway from the conference, after series of meetings with corporates, is that we noticed how the incumbent businesses are trying hard to embark on – what they believe is a – digital business transformation (DBT). In general, we think the DBT has not been easy for the incumbents.

Before we discuss some examples from these meetings, we would like to point out that a recent McKinsey survey has both the good news and the bad news for the incumbents and their DBT journey.

Let’s start with the good news. Only 35% of companies’ revenues globally are digitised. This means incumbent companies across different industries still have time to act.

The bad news? While 90% of companies indicated that they are engaged in some form of digitalization, only 16% have responded with a bold strategy and at scale. The study also found out that incumbents often respond to disruption forces by engaging in “imitative innovation”.

Imitative innovation unlikely to solve problems in the best possible way Back to the takeaway from the conference, one common “imitative innovation” that we observe during the conference is that many incumbents talked about their apps as a way to embark on DBT.

One auto part company that is part of a big conglomerate is a case in point.

This spare part company tried to justify their app by stating that in some cases, their app will help those whose car battery goes flat in the parking space. Just go to their app, and a new battery will be sent your way.

While we appreciate the thought, we recognised two immediate challenges with this approach. Challenge number one is that to increase the innovator’s odds of success, the app should be able to connect the user’s problem with a company’s solution frequently enough to form a habit.

While flat car battery is annoying or even dangerous, depending on this flat battery situation means a contact with the app once every few years? We can’t even remember the last time we encountered a flat battery situation.

Challenge number two, when facing a dead car battery situation, a customer still has an option to just make a phone call to order a new battery. It appears that the app theoretically solves the problem, but the effort of installing the app while waiting alongside the road is less convenient than just making a simple phone call (to the same company!). More thought is definitely needed for an app to form a daily habit for car owners.

Also, interesting to notice that this auto part company, with their retail and “digital strategy”, opts to sell their merchandise at higher prices than in mom and pop stores. This is in contrary to Jeff Bezos’ disruption philosophy “your margin is my opportunity”.

Unfortunately, this spare part company is not unique in employing a half-baked app strategy. For example, a smartphone retailer/distributor was telling us that only 3-4% of the smartphones in Indonesia are purchased on-line, so according to them e-commerce is not really posing a threat. We think the opposite. Precisely because online smartphone only accounts for 3-4% market share in Indonesia (as opposed to China, about 56%), the incumbents need to be very prepared. There is a huge room for online start-ups to grab market share and they are trying very hard, 24/7 not 7-Eleven style.

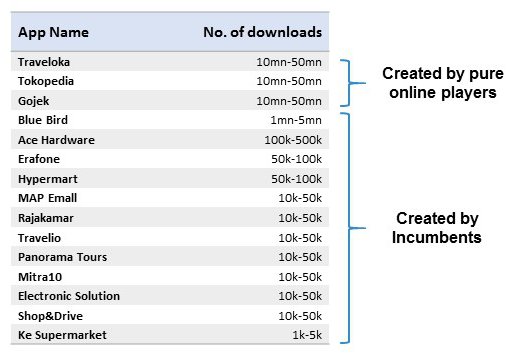

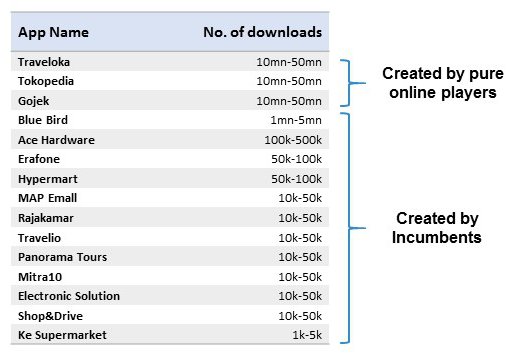

No. of app downloads in the Google Playstore.

Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.

Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.

Many incumbents in the disrupted industries such as retail, leisure, and transportation have launched their app as part of the DBT strategy but the number of downloads is minuscule in comparison to app download for pure Indonesian tech start-ups.

Among the names above, only leading taxi company Blue Bird who get more than 1mn download on their app. It is worth noting that despite this respectable achievement, Blue Bird still feels the need to form an alliance with Gojek.

A good DBT strategy requires a corresponding organisational, people, and business transformation. Having an app for the sake of having an app is not a sound DBT strategy, in our view. We will incorporate this factor – incumbents’ DBT strategy – in our long-term stock picking (short term strategy can differ as we may encounter massively oversold incumbent stocks in the market).

Cakrastudio

Share

Heyokha team recently attended the CIMB 11th Indonesia Conference. Admittedly, the venue of the event in Bali is a big pull factor, for obvious reasons. Yet, we also found out that despite Bali’s distractions, the fact that we were being away from hectic Hong Kong or Jakarta helped us to focus and think better. This enables deeper thinking (we discussed this topic in our Q12017 quarterly report).

One key takeaway from the conference, after series of meetings with corporates, is that we noticed how the incumbent businesses are trying hard to embark on – what they believe is a – digital business transformation (DBT). In general, we think the DBT has not been easy for the incumbents.

Before we discuss some examples from these meetings, we would like to point out that a recent McKinsey survey has both the good news and the bad news for the incumbents and their DBT journey.

Let’s start with the good news. Only 35% of companies’ revenues globally are digitised. This means incumbent companies across different industries still have time to act.

The bad news? While 90% of companies indicated that they are engaged in some form of digitalization, only 16% have responded with a bold strategy and at scale. The study also found out that incumbents often respond to disruption forces by engaging in “imitative innovation”.

Imitative innovation unlikely to solve problems in the best possible way Back to the takeaway from the conference, one common “imitative innovation” that we observe during the conference is that many incumbents talked about their apps as a way to embark on DBT.

One auto part company that is part of a big conglomerate is a case in point.

This spare part company tried to justify their app by stating that in some cases, their app will help those whose car battery goes flat in the parking space. Just go to their app, and a new battery will be sent your way.

While we appreciate the thought, we recognised two immediate challenges with this approach. Challenge number one is that to increase the innovator’s odds of success, the app should be able to connect the user’s problem with a company’s solution frequently enough to form a habit.

While flat car battery is annoying or even dangerous, depending on this flat battery situation means a contact with the app once every few years? We can’t even remember the last time we encountered a flat battery situation.

Challenge number two, when facing a dead car battery situation, a customer still has an option to just make a phone call to order a new battery. It appears that the app theoretically solves the problem, but the effort of installing the app while waiting alongside the road is less convenient than just making a simple phone call (to the same company!). More thought is definitely needed for an app to form a daily habit for car owners.

Also, interesting to notice that this auto part company, with their retail and “digital strategy”, opts to sell their merchandise at higher prices than in mom and pop stores. This is in contrary to Jeff Bezos’ disruption philosophy “your margin is my opportunity”.

Unfortunately, this spare part company is not unique in employing a half-baked app strategy. For example, a smartphone retailer/distributor was telling us that only 3-4% of the smartphones in Indonesia are purchased on-line, so according to them e-commerce is not really posing a threat. We think the opposite. Precisely because online smartphone only accounts for 3-4% market share in Indonesia (as opposed to China, about 56%), the incumbents need to be very prepared. There is a huge room for online start-ups to grab market share and they are trying very hard, 24/7 not 7-Eleven style.

No. of app downloads in the Google Playstore.

Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.

Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.

Many incumbents in the disrupted industries such as retail, leisure, and transportation have launched their app as part of the DBT strategy but the number of downloads is minuscule in comparison to app download for pure Indonesian tech start-ups.

Among the names above, only leading taxi company Blue Bird who get more than 1mn download on their app. It is worth noting that despite this respectable achievement, Blue Bird still feels the need to form an alliance with Gojek.

A good DBT strategy requires a corresponding organisational, people, and business transformation. Having an app for the sake of having an app is not a sound DBT strategy, in our view. We will incorporate this factor – incumbents’ DBT strategy – in our long-term stock picking (short term strategy can differ as we may encounter massively oversold incumbent stocks in the market).

Cakrastudio

Share