The Invisible Inflation We Live With

The Invisible Inflation We Live With

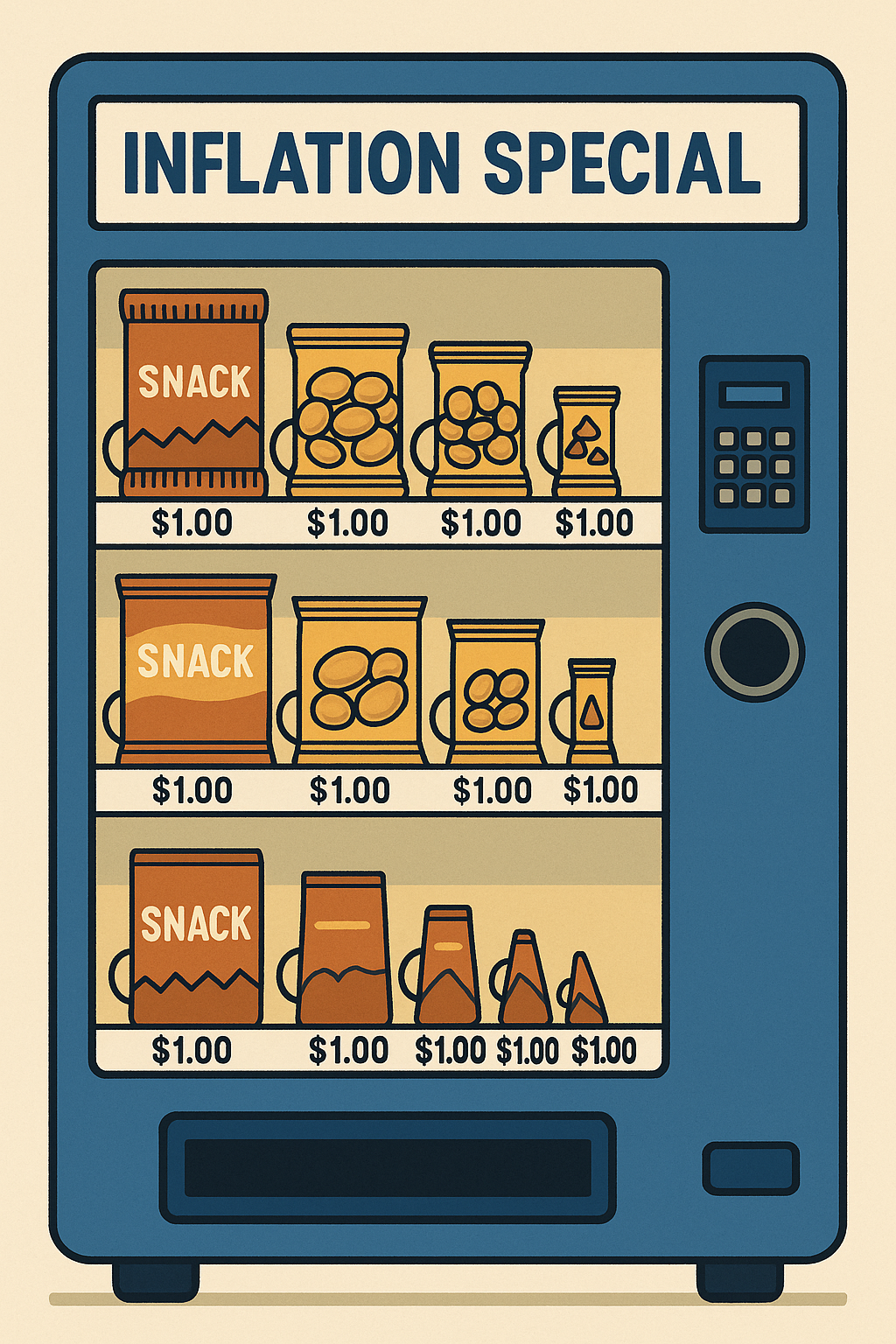

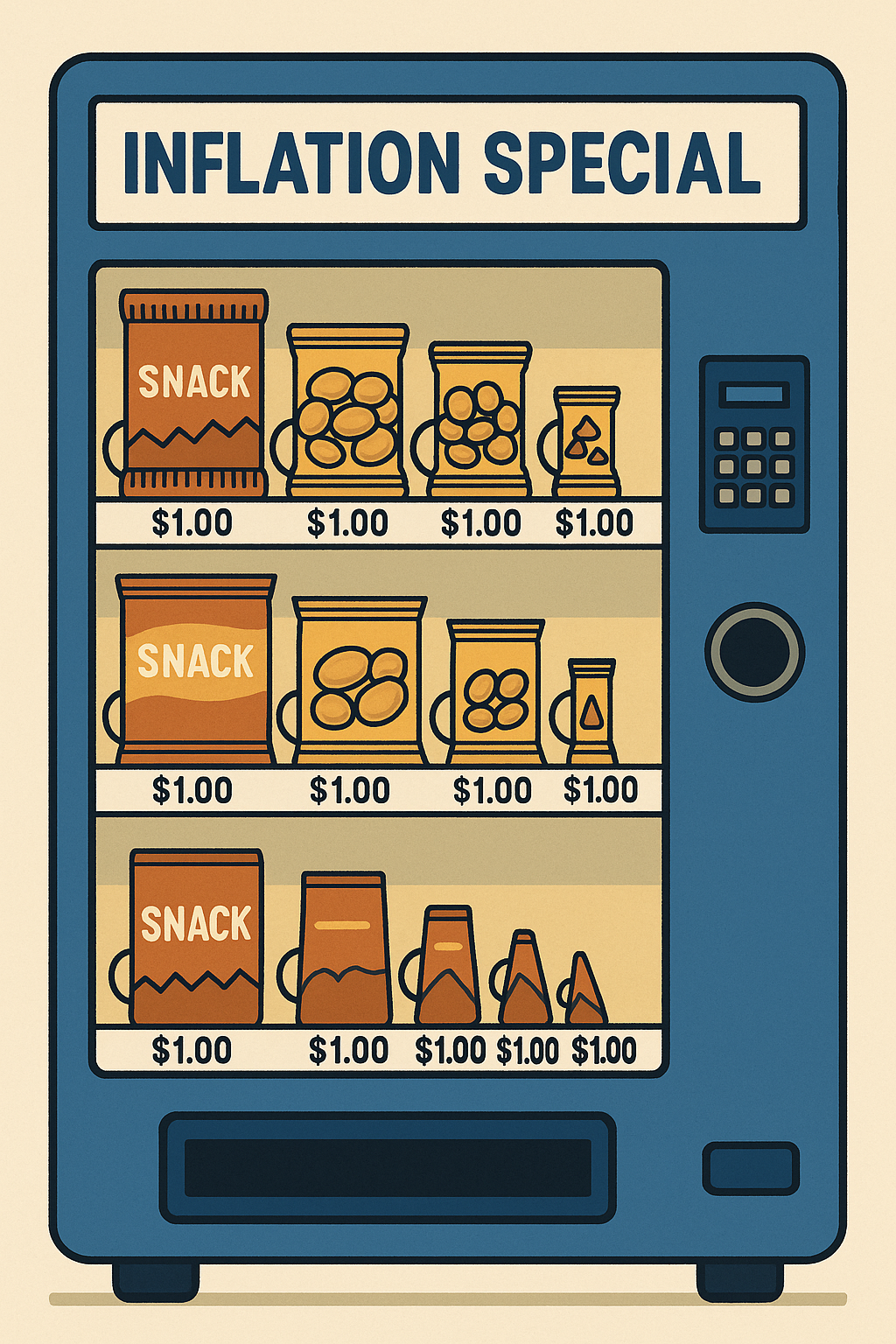

You might not see it on official spreadsheets. But if you’ve noticed your Cha Cha chocolate peanuts shrinking, or your hotel check-out times creeping earlier, you’ve already met inflation — not on a Bloomberg terminal, but in your daily life.

In Indonesia, Cha Cha chocolate-coated peanuts — once hefty enough to rival full-sized roasted peanuts — now barely tip the scale. Open the same pack, pay the same price, but feel just a bit… underwhelmed. It’s shrinkflation in its most digestible form. Brands keep the packaging and price, but quietly downsize the contents.

Travelers, too, are feeling the pinch. Globally, the standard hotel check-in time has hovered around 2–3 PM, with check-out at 12 PM. But lately, guests in Indonesia have begun noticing a subtle shift: check-ins pushed to 3 or even 4 PM, while check-outs pull back to 11 AM or earlier. A few hours may seem trivial, but over hundreds of thousands of stays, it’s a silent re-pricing of value — without changing the price tag.

In the age of sticky inflation, it’s no longer about rising prices alone. It’s about shrinking everything else — quantity, quality, and time — in ways so subtle they don’t get caught in CPI baskets. Welcome to the world of invisible inflation.

The Shrinking World of Everyday Things

Let’s start small. Or more precisely, smaller.

Take the once-humble Cha Cha chocolate peanut. For years, this was the Indonesian go-to snack: a crunchy peanut wrapped in a thick coat of chocolate. But as many Indonesians have noticed lately, the chocolate shell has been skimped. A recent purchase revealed shells so thin and a regular roasted peanut is bigger than the actual Cha Cha peanut inside.

Regular roasted peanuts are larger than Cha Cha peanuts now??

It’s not just taste that’s been sacrificed — it’s purchasing power. This isn’t just shrinkflation. It’s inflation disguised as business-as-usual.

This phenomenon stretches across borders. Remember when Toblerone famously increased the gaps between its chocolate triangles? It was the same idea: reduce the product, hold the price. The illusion remains, but the consumer value erodes. And it’s not just in snacks.

This caused an uproar back in 2016. By 2018, Mondelez, the parent company of the Swiss chocolate bar reverted to the original design although lighter at 200g

Another Indonesian snack favorite “Momogi” which has falled into downsizing to the size of a pinky

The Great Hotel Time Heist

Let’s talk time. If you’ve been traveling recently, you might have noticed the clock has become more expensive.

A decade ago, it was common for hotels to offer check-in at 1pm or 2pm, and checkout at noon. These days? Check-ins have quietly shifted to 3 or even 4pm, while checkouts are now often 10 or 11am.

We asked around a few of our friends who are avid travelers. Sure enough, the new normal is 15:00 check-in and 11:00 check-out. Sometimes worse. Your room rate didn’t go up? Great. But you’re getting 2–3 fewer hours of stay. That’s a 12% reduction in use, for the same price.

This kind of inflation doesn’t show up in official stats. After all, the room rate hasn’t changed. But the value has.

The CPI Mirage: Inflation We Feel but Can’t Measure

The Consumer Price Index (CPI) — the standard for measuring inflation — is built to track average price changes across a basket of goods and services. But it struggles with nuance. It’s slow to register qualitative erosion or quantity shrinkage. If your Cha Cha pack still costs Rp5,000, CPI sees it as unchanged — even if there are 15% fewer peanuts inside.

Globally, inflation feels like it has cooled. In the U.S., the most recent headline CPI reading for July 2025 came in at 3.2%, ticking up from 3.0% in June. Core inflation, which strips out food and energy, remained sticky at 4.0% — pointing to continued cost pressures in services like healthcare, insurance, and housing.

In Indonesia, Bank Indonesia (BI) made headlines by cutting its benchmark rate by 25bps to 5.00% on August 20, a move aimed at stimulating growth amid softer consumer spending. Inflation in Indonesia has cooled from last year’s highs, settling at 2.5% YoY in July, within BI’s target range. But even here, locals are noticing a cost squeeze — especially in daily essentials, dining out, and logistics.

It’s not just the price that’s changing. It’s the value proposition.

Value Erosion by a Thousand Cuts

This new era of inflation isn’t marked by price spikes alone — but by a death-by-a-thousand-cuts approach to value.

- Your cloud storage provider now charges more for less space.

- Airline economy tickets come with fewer perks (read: no baggage, no meals).

- Your favorite burger chain swaps beef for chicken, with the price untouched.

- Retail stores sneakily switch from glass bottles to thinner plastic, reducing durability while calling it “sustainability.”

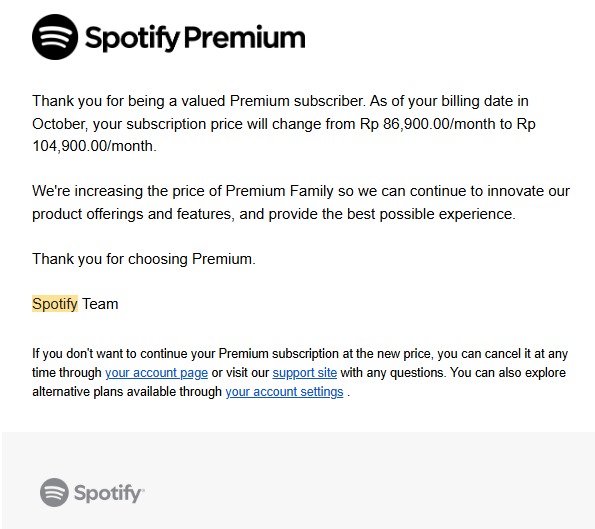

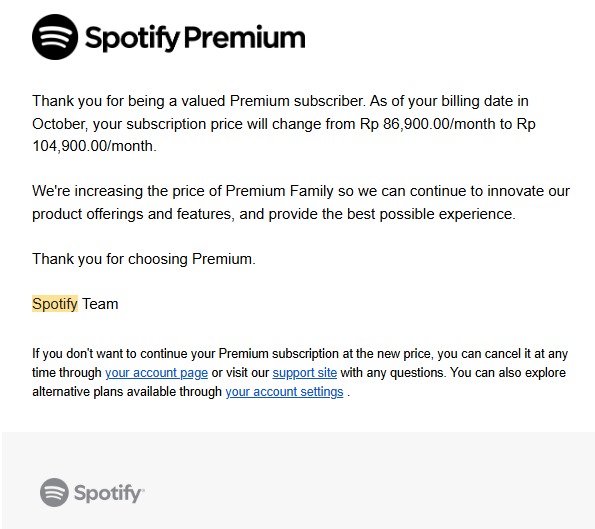

Even Spotify has just raised prices without allowing more flexibility on sharing accounts nor additional benefits

This is “stealth inflation.” It’s inflation that doesn’t look like inflation — until you realize you’re paying the same (or more) for less.

In behavioral economics, this taps into “money illusion”: the tendency to judge value by price tags, not by utility. If your chocolate bar looks the same on the outside, you may not notice what’s missing inside — until one day, it just feels… off.

This Isn’t a Blip — It’s a Regime Change

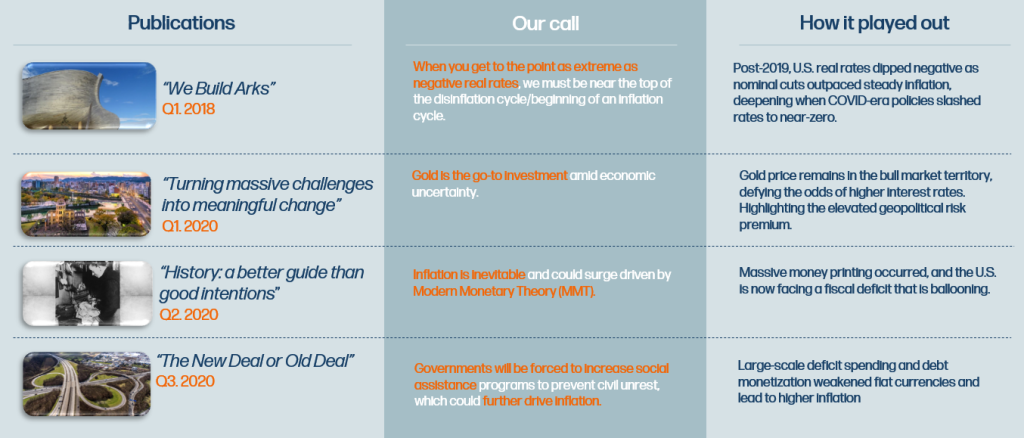

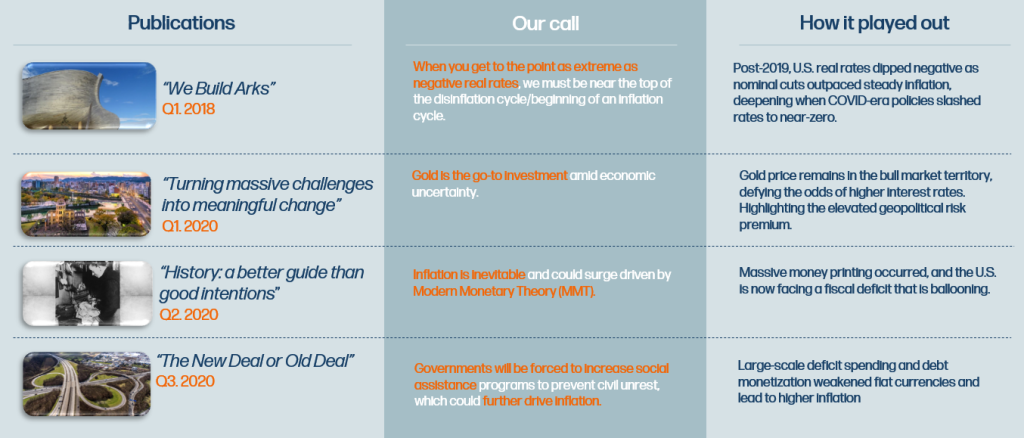

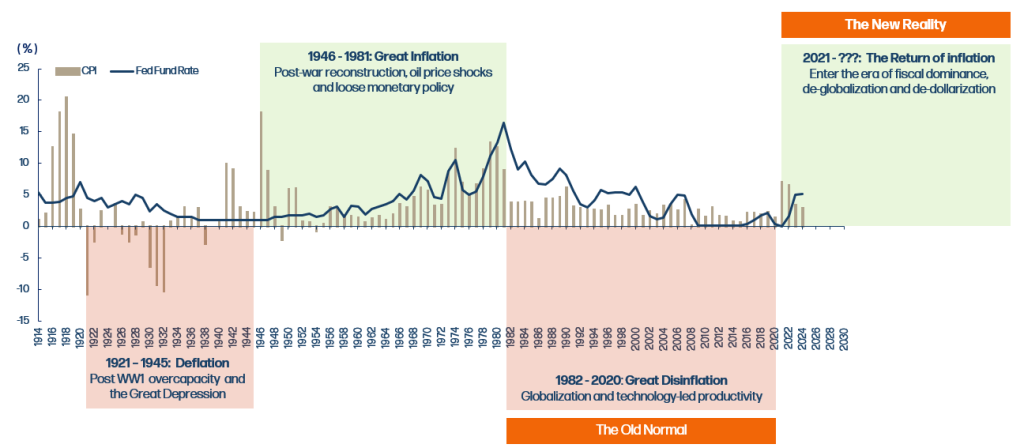

At Heyokha, we’ve argued since 2018 that inflation would not just return — it would change form.

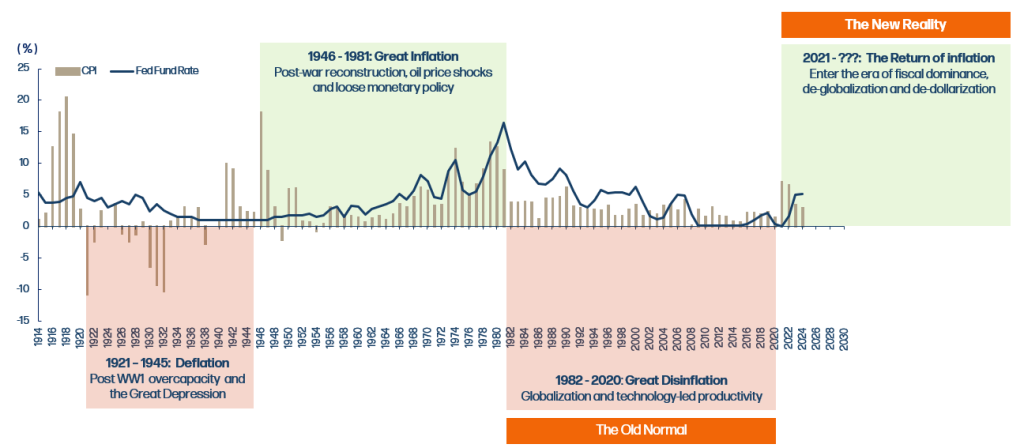

As early as Q1 2018, we warned that negative real rates signaled the end of the disinflation era. By 2020, we saw fiscal and monetary policy shifting in ways that echoed Modern Monetary Theory (MMT) — with governments pumping liquidity to solve structural shocks.

That conviction wasn’t based on guessing. It was driven by thesis.

Read our latest reports on our website under “Reports”!

Since then, the evidence has stacked up:

- Global debt levels hit record highs.

- Real wages in many countries failed to keep up with core services inflation.

- Commodity prices became more volatile due to geopolitical risks.

- Supply chains underwent de-globalization and regionalization, adding new frictions and costs.

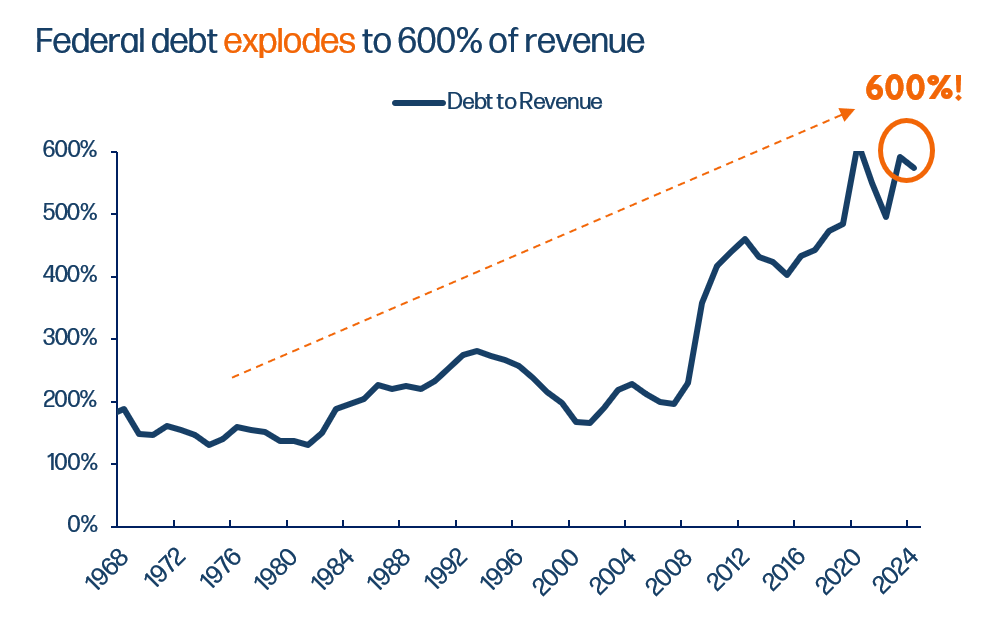

This isn’t just a blip — it’s a multi-decade regime. A return to fiscal dominance, where real yields stay compressed, and inflation becomes the tool to erode debt — silently.

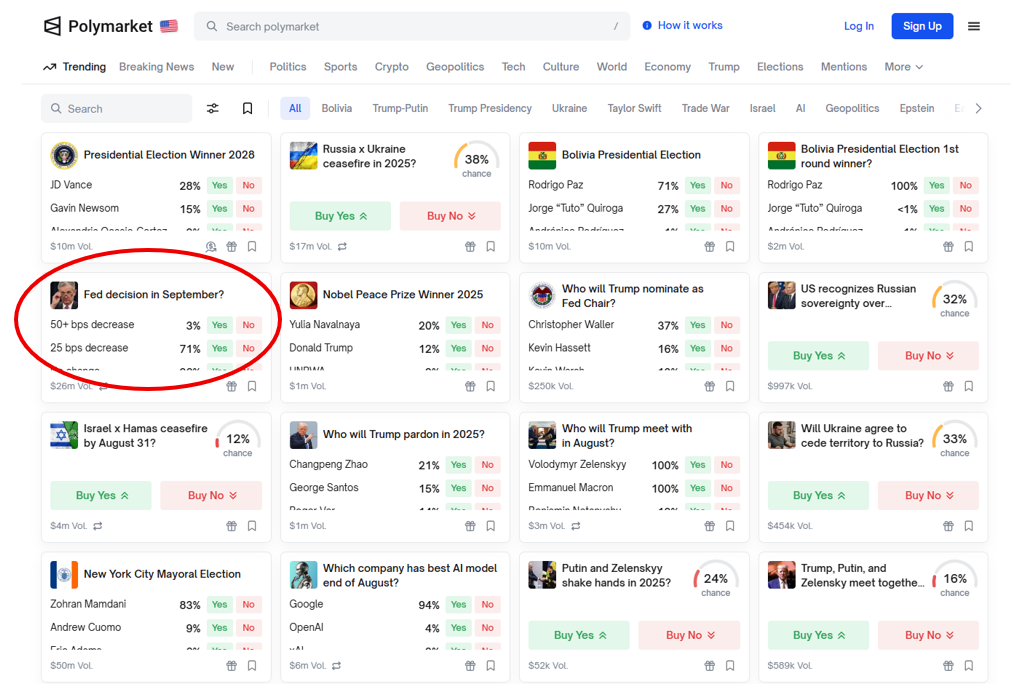

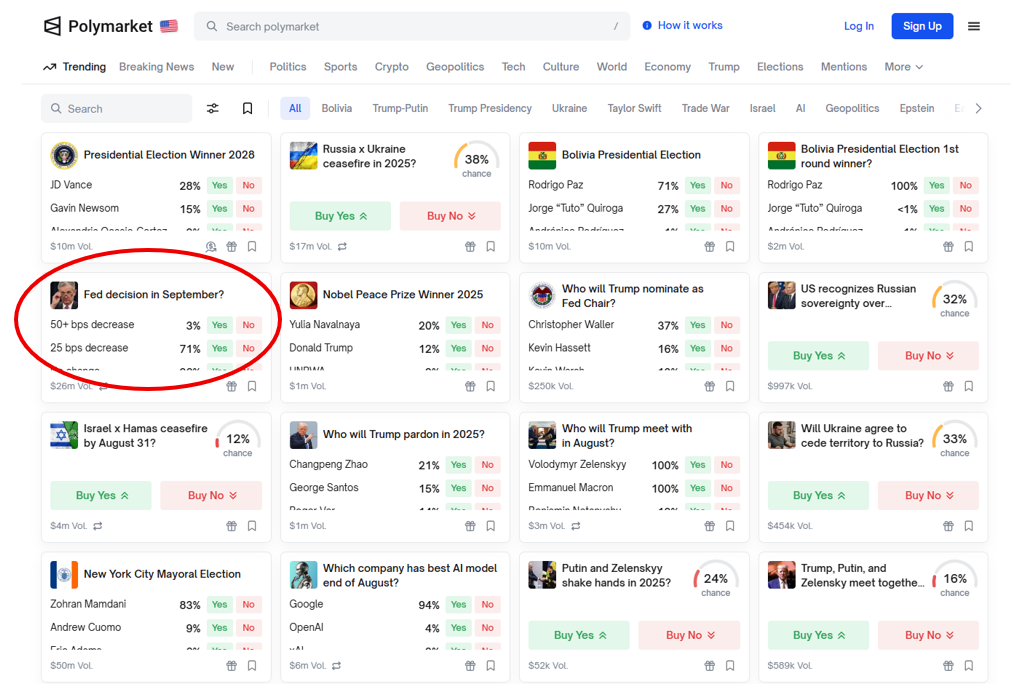

Polymarket is betting 71% chance of Powell cutting rates by 25 bps

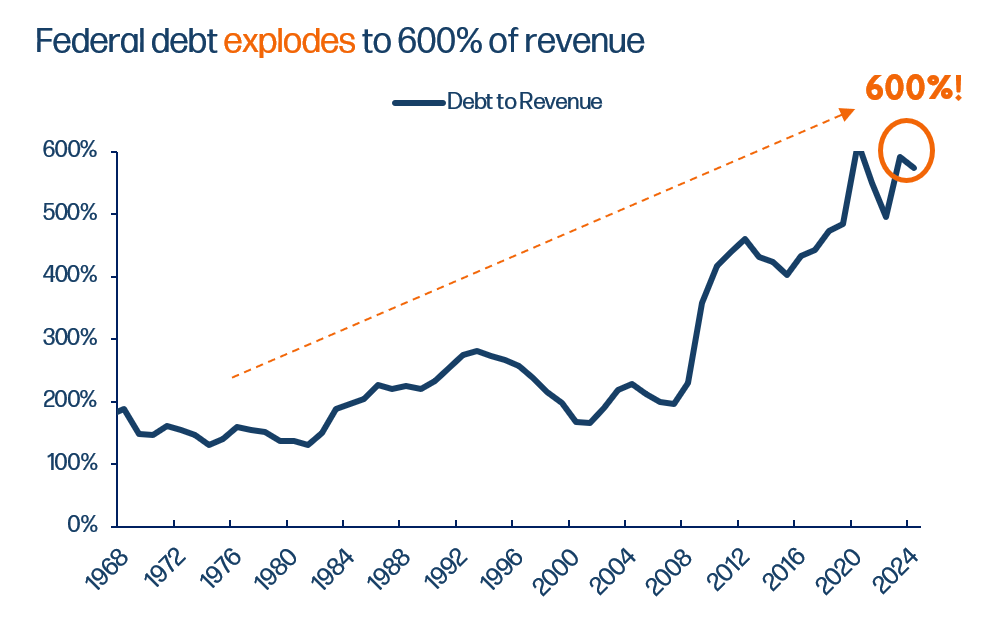

But with Federal debt exploding, can they really afford to cut that much?

A World of Permaflation?

Here’s the kicker: businesses have adapted.

Once a company gets away with shaving 10% off a chocolate bar without losing customers, it rarely brings it back. Instead, it redefines the new normal. The smaller pack, the tighter check-in window, the fewer amenities — they become permanent.

This is why we’re entering what we call the era of “permaflation”: persistent value erosion masked by stable prices. Inflation no longer announces itself with sirens. It knocks softly and rewrites the rules while you’re busy adjusting.

Inflation cycles also tend to be 10-40 years long, so we imagine this new reality of high inflation will be sticky for a long while

So What? What This Means for Investors

If the data doesn’t show the full picture, and central banks are playing catch-up, where does that leave us?

Waiting for CPI to confirm inflation pain is like waiting for a rear-view mirror to help you steer. Instead, we believe investors must adapt to forward-looking signals — those that measure not just price, but value resilience.

That means looking at:

- Hard assets: Gold, energy, and land — stores of value that resist debasement.

- Pricing power: Companies that can pass on costs without sacrificing demand.

- Commodities & food: Where inflation is real, sticky, and necessary.

At Heyokha, this is not new. We’ve always focused on structural shifts — not headlines. Our view remains that inflation is not an event — it’s a new operating system.

Final Thought: Not All Losses Are Loud

It’s tempting to wait for inflation to roar. But often, it whispers.

It trims a chocolate coating. It steals a few hours from your holiday. It skips features in your subscription. And unless you’re paying attention — it wins.

As investors, as consumers, and as citizens — we must read between the lines. The biggest risks aren’t always visible in bold font. Sometimes, they’re nestled between the chocolate and the peanut.

Tara Mulia

Admin heyokha

Share

You might not see it on official spreadsheets. But if you’ve noticed your Cha Cha chocolate peanuts shrinking, or your hotel check-out times creeping earlier, you’ve already met inflation — not on a Bloomberg terminal, but in your daily life.

In Indonesia, Cha Cha chocolate-coated peanuts — once hefty enough to rival full-sized roasted peanuts — now barely tip the scale. Open the same pack, pay the same price, but feel just a bit… underwhelmed. It’s shrinkflation in its most digestible form. Brands keep the packaging and price, but quietly downsize the contents.

Travelers, too, are feeling the pinch. Globally, the standard hotel check-in time has hovered around 2–3 PM, with check-out at 12 PM. But lately, guests in Indonesia have begun noticing a subtle shift: check-ins pushed to 3 or even 4 PM, while check-outs pull back to 11 AM or earlier. A few hours may seem trivial, but over hundreds of thousands of stays, it’s a silent re-pricing of value — without changing the price tag.

In the age of sticky inflation, it’s no longer about rising prices alone. It’s about shrinking everything else — quantity, quality, and time — in ways so subtle they don’t get caught in CPI baskets. Welcome to the world of invisible inflation.

The Shrinking World of Everyday Things

Let’s start small. Or more precisely, smaller.

Take the once-humble Cha Cha chocolate peanut. For years, this was the Indonesian go-to snack: a crunchy peanut wrapped in a thick coat of chocolate. But as many Indonesians have noticed lately, the chocolate shell has been skimped. A recent purchase revealed shells so thin and a regular roasted peanut is bigger than the actual Cha Cha peanut inside.

Regular roasted peanuts are larger than Cha Cha peanuts now??

It’s not just taste that’s been sacrificed — it’s purchasing power. This isn’t just shrinkflation. It’s inflation disguised as business-as-usual.

This phenomenon stretches across borders. Remember when Toblerone famously increased the gaps between its chocolate triangles? It was the same idea: reduce the product, hold the price. The illusion remains, but the consumer value erodes. And it’s not just in snacks.

This caused an uproar back in 2016. By 2018, Mondelez, the parent company of the Swiss chocolate bar reverted to the original design although lighter at 200g

Another Indonesian snack favorite “Momogi” which has falled into downsizing to the size of a pinky

The Great Hotel Time Heist

Let’s talk time. If you’ve been traveling recently, you might have noticed the clock has become more expensive.

A decade ago, it was common for hotels to offer check-in at 1pm or 2pm, and checkout at noon. These days? Check-ins have quietly shifted to 3 or even 4pm, while checkouts are now often 10 or 11am.

We asked around a few of our friends who are avid travelers. Sure enough, the new normal is 15:00 check-in and 11:00 check-out. Sometimes worse. Your room rate didn’t go up? Great. But you’re getting 2–3 fewer hours of stay. That’s a 12% reduction in use, for the same price.

This kind of inflation doesn’t show up in official stats. After all, the room rate hasn’t changed. But the value has.

The CPI Mirage: Inflation We Feel but Can’t Measure

The Consumer Price Index (CPI) — the standard for measuring inflation — is built to track average price changes across a basket of goods and services. But it struggles with nuance. It’s slow to register qualitative erosion or quantity shrinkage. If your Cha Cha pack still costs Rp5,000, CPI sees it as unchanged — even if there are 15% fewer peanuts inside.

Globally, inflation feels like it has cooled. In the U.S., the most recent headline CPI reading for July 2025 came in at 3.2%, ticking up from 3.0% in June. Core inflation, which strips out food and energy, remained sticky at 4.0% — pointing to continued cost pressures in services like healthcare, insurance, and housing.

In Indonesia, Bank Indonesia (BI) made headlines by cutting its benchmark rate by 25bps to 5.00% on August 20, a move aimed at stimulating growth amid softer consumer spending. Inflation in Indonesia has cooled from last year’s highs, settling at 2.5% YoY in July, within BI’s target range. But even here, locals are noticing a cost squeeze — especially in daily essentials, dining out, and logistics.

It’s not just the price that’s changing. It’s the value proposition.

Value Erosion by a Thousand Cuts

This new era of inflation isn’t marked by price spikes alone — but by a death-by-a-thousand-cuts approach to value.

- Your cloud storage provider now charges more for less space.

- Airline economy tickets come with fewer perks (read: no baggage, no meals).

- Your favorite burger chain swaps beef for chicken, with the price untouched.

- Retail stores sneakily switch from glass bottles to thinner plastic, reducing durability while calling it “sustainability.”

Even Spotify has just raised prices without allowing more flexibility on sharing accounts nor additional benefits

This is “stealth inflation.” It’s inflation that doesn’t look like inflation — until you realize you’re paying the same (or more) for less.

In behavioral economics, this taps into “money illusion”: the tendency to judge value by price tags, not by utility. If your chocolate bar looks the same on the outside, you may not notice what’s missing inside — until one day, it just feels… off.

This Isn’t a Blip — It’s a Regime Change

At Heyokha, we’ve argued since 2018 that inflation would not just return — it would change form.

As early as Q1 2018, we warned that negative real rates signaled the end of the disinflation era. By 2020, we saw fiscal and monetary policy shifting in ways that echoed Modern Monetary Theory (MMT) — with governments pumping liquidity to solve structural shocks.

That conviction wasn’t based on guessing. It was driven by thesis.

Read our latest reports on our website under “Reports”!

Since then, the evidence has stacked up:

- Global debt levels hit record highs.

- Real wages in many countries failed to keep up with core services inflation.

- Commodity prices became more volatile due to geopolitical risks.

- Supply chains underwent de-globalization and regionalization, adding new frictions and costs.

This isn’t just a blip — it’s a multi-decade regime. A return to fiscal dominance, where real yields stay compressed, and inflation becomes the tool to erode debt — silently.

Polymarket is betting 71% chance of Powell cutting rates by 25 bps

But with Federal debt exploding, can they really afford to cut that much?

A World of Permaflation?

Here’s the kicker: businesses have adapted.

Once a company gets away with shaving 10% off a chocolate bar without losing customers, it rarely brings it back. Instead, it redefines the new normal. The smaller pack, the tighter check-in window, the fewer amenities — they become permanent.

This is why we’re entering what we call the era of “permaflation”: persistent value erosion masked by stable prices. Inflation no longer announces itself with sirens. It knocks softly and rewrites the rules while you’re busy adjusting.

Inflation cycles also tend to be 10-40 years long, so we imagine this new reality of high inflation will be sticky for a long while

So What? What This Means for Investors

If the data doesn’t show the full picture, and central banks are playing catch-up, where does that leave us?

Waiting for CPI to confirm inflation pain is like waiting for a rear-view mirror to help you steer. Instead, we believe investors must adapt to forward-looking signals — those that measure not just price, but value resilience.

That means looking at:

- Hard assets: Gold, energy, and land — stores of value that resist debasement.

- Pricing power: Companies that can pass on costs without sacrificing demand.

- Commodities & food: Where inflation is real, sticky, and necessary.

At Heyokha, this is not new. We’ve always focused on structural shifts — not headlines. Our view remains that inflation is not an event — it’s a new operating system.

Final Thought: Not All Losses Are Loud

It’s tempting to wait for inflation to roar. But often, it whispers.

It trims a chocolate coating. It steals a few hours from your holiday. It skips features in your subscription. And unless you’re paying attention — it wins.

As investors, as consumers, and as citizens — we must read between the lines. The biggest risks aren’t always visible in bold font. Sometimes, they’re nestled between the chocolate and the peanut.

Tara Mulia

Admin heyokha

Share