The perfect cocktail for commodities

The perfect cocktail for commodities

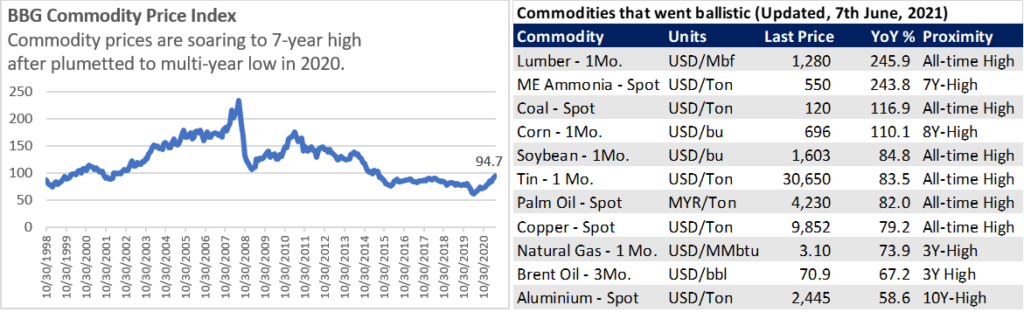

If we merely rely on periodicity measures, a commodity supercycle is supposed to happen only once in several decades. As the latest supercycle only ended about seven years ago in 2014, a new supercycle should not happen anytime soon.

However, dare we say that this time it’s different? The mix of worldwide synchronisation of government infrastructure spending as a response to COVID-19, a weak USD, underinvestment in the commodity sector, industry consolidation, and extreme weather could result in the perfect cocktail for the next commodity supercycle.

Both the swiftness and magnitude of the recent commodity rally is unprecedented. Within just a few months, the price levels of many commodities have risen to all-time-high and multi-year-high levels after suffered to a multi-year low plunge. This price movement occurred within two years.

In our previous blog, we already discussed the reasons behind the weak USD and inflation scares in the U.S that blame commodity as one of the scapegoats. Let us explore the other ingredients of the perfect cocktail:

Government spending synchronisation and green infrastructure construction across the world will translate into surging demand for base metals

In 2020, the COVID-19 pandemic has synchronised global government spending. According to Cassim et al. (2020), more than US$ 10 trillion, more than 11 per cent of global GDP, was spent last year to relieve the teetering global economy.

After the relief spending, the classic playbook of economic recovery would suggest increasing spending on infrastructure. This time around, we believe that the grand theme would be green and digital infrastructure as there have been escalating commitments by governments to battle climate change and to accelerate digitalisation during the pandemic.

Investors should note that these initiatives are metal-intensive.

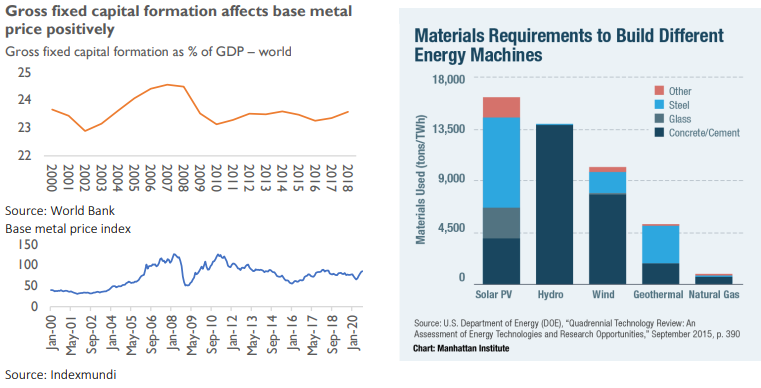

In our 3Q 2020 report, we discussed plans for large infrastructure spending (New-Deal-inspired policies) by governments to take on the “K-shaped” economic recovery. Historically, high infrastructure spending (measured by gross fixed capital formation) will translate into higher base metals prices as shown by the figures above.

In particular, we believe that base metals such as nickel and copper will benefit the most from digital and green infrastructure development because most of the upcoming projects will hover around electronics, electricity, and energy storage.

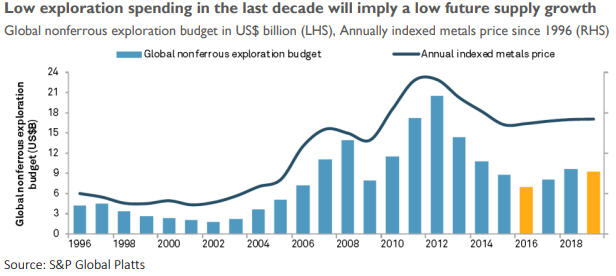

A decade of underinvestment in the mining industry could result in a potential supply crunch

The subdued commodity prices in the last decade reduced the appetite for investments in the mining and energy industries. Consequently, there will be a longer lead time from discoveries into production which would translate to lower replenishment of the depleting resources.

Furthermore, the rising ESG scrutiny in these sectors also makes it harder for the industry to obtain financing – which further decelerates the future supply growth.

This structural condition suggests that there would be insufficient supply to respond to the surging demand for mining and energy commodities. Such circumstance would drive prices up even further.

Oil great reset drives worldwide industry consolidation

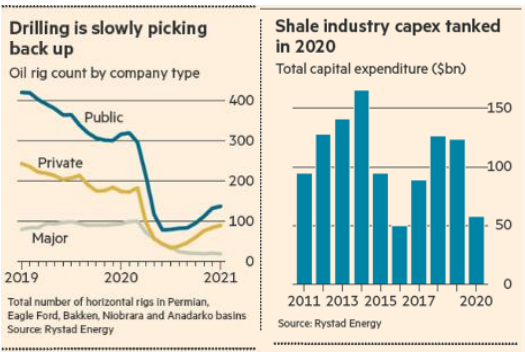

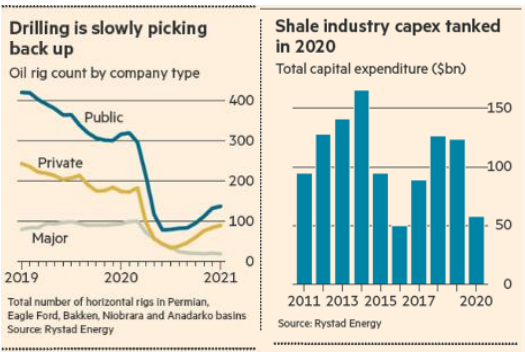

Many oil companies got burnt in 2020, especially shale oil producers, because of the historical plunge of oil price that was triggered by the sudden global lockdown. WTI oil price went negative for the first time in history. It forced them to cut production without any hesitation. It reversed the “growth at all cost” mindset to maximizing return on shareholders’ capital.

As oil prices plummeted to a historical negative level in 2020, the great reset of oil industry in 2020 has led to solid worldwide industry consolidation. Industry CAPEX tanked and production was cut significantly altogether. The consolidation enables tighter output control and leads to a more sustainable price increase.

As of February 28th, 2021, the OPEC is producing at 80% of 10Y-average production, 24.87 mn bpd, with a high compliance rate of 110% among OPEC10 members and showing reluctance to raise output amidst the recovering economy and travel ease. Until the recent OPEC meeting in June 2021, the solidarity among the cartel still persists.

Extreme weather conditions and supply chain disruption will also drive soft commodity price up

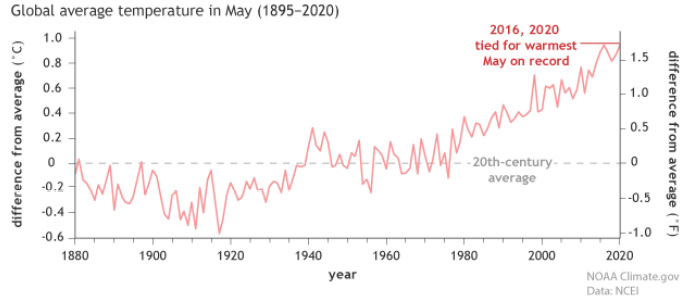

Despite the (pandemic) lockdown, the global average temperature is back to a record high in 2020. A study by Zhao et al. (2017) shows that for each degree Celsius increase in global temperature, yields of corn are expected to decrease by 7.4%, wheat by 6%, rice by 3.2%, and soybean by 3.2%.

The robustness of the recent agriculture rally is reflected in the soaring commodity price in the harvest season. Case in point: Indonesia’s corn price in East Java on farmer’s level has increased 42.8% from approximately IDR 3,500 (USD 0.246) at the beginning of the year to IDR 5,000 (USD 0.352) per kilogram in early May 2021, a harvest season for corn. This kind of event is truly rare.

Investors should be aware of weather conditions as it might further boost agricultural commodity prices if it turns to be unfavourable.

Disrupted supply chain is the cherry on top of the perfect cocktail

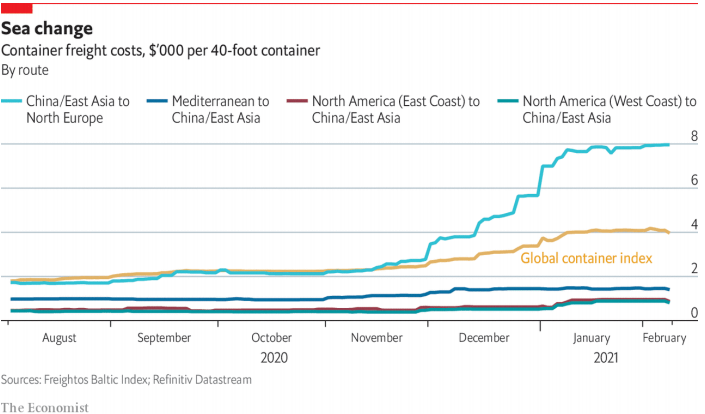

The uncertainty on travel restrictions has disrupted the global supply chain. To-the-moon freight costs in three months period between December 2020 to February 2021 perfectly reflect the severity of the disruption.

For instance, the cost of shipping a 40-foot container from Asia to Europe rose about 2.5 times from approximately USD 2,200 to over USD 7,900. From the global perspective, the Freightos Baltic Index, represent container-freight rates in 12 primary maritime lanes, has increased about 80 percent from USD 2,200 to USD 4,000 per container.

The uncertainty in the global supply chain has incentivised some producers to hoard feedstocks. Such behaviour is driven by their interest to secure their production continuity that is currently responding to the pent-up demand.

Furthermore, the disruption also meant a higher cost of production for everyone in the value chain. Consequently, every producer, including the commodity producer, is reluctant to sell cheap.

It is a cherry on top of the cocktail.

This perfect cocktail may either taste sweet or bitter

The pent-up demand from economic reopening and robust additional demand from the expansive economic policies will be responded unevenly from the supply side. Both demand and supply forces are driving prices up. As such, we are of the view that the stars are aligned to form a commodity supercycle.

Regardless of the commodity rally being a supercycle or transitory (might be one year, two years, five years- it’s too late to act by then), the cocktail will taste differently for everyone.

Commodity producing companies would certainly re-experience their glory days meanwhile companies who are unable to pass on their increasing production costs will see their profit margins fade. As the majority of costs rise, a period of sustained inflation would also become inevitable.

With rising inflation, a commodity supercycle, and the shift to value stocks becoming the investment backdrop for the upcoming years, could there be a certain region that benefits from all the forces?

Stay tuned to our next blog!

“The test of a first-rate intelligence is the ability to hold two opposite ideas in the mind at the same time, and still retain the ability to function”

-F. Scott Fitzgerald –

Reference:

Cassim, Z., Handjiski, B., Schubert, J., & Zouaoui, Y. (2020). The $10 trillion rescue: How governments can deliver impact. McKinsey & Company.

Chuang Zhao, et al. (2017). Temperature increase reduces global yields of major crops in four independent estimates. Proceedings of the National Academy of Sciences of the United States of America Vol. 114 no. 35, 9326-9331.

Admin heyokha

Share

If we merely rely on periodicity measures, a commodity supercycle is supposed to happen only once in several decades. As the latest supercycle only ended about seven years ago in 2014, a new supercycle should not happen anytime soon.

However, dare we say that this time it’s different? The mix of worldwide synchronisation of government infrastructure spending as a response to COVID-19, a weak USD, underinvestment in the commodity sector, industry consolidation, and extreme weather could result in the perfect cocktail for the next commodity supercycle.

Both the swiftness and magnitude of the recent commodity rally is unprecedented. Within just a few months, the price levels of many commodities have risen to all-time-high and multi-year-high levels after suffered to a multi-year low plunge. This price movement occurred within two years.

In our previous blog, we already discussed the reasons behind the weak USD and inflation scares in the U.S that blame commodity as one of the scapegoats. Let us explore the other ingredients of the perfect cocktail:

Government spending synchronisation and green infrastructure construction across the world will translate into surging demand for base metals

In 2020, the COVID-19 pandemic has synchronised global government spending. According to Cassim et al. (2020), more than US$ 10 trillion, more than 11 per cent of global GDP, was spent last year to relieve the teetering global economy.

After the relief spending, the classic playbook of economic recovery would suggest increasing spending on infrastructure. This time around, we believe that the grand theme would be green and digital infrastructure as there have been escalating commitments by governments to battle climate change and to accelerate digitalisation during the pandemic.

Investors should note that these initiatives are metal-intensive.

In our 3Q 2020 report, we discussed plans for large infrastructure spending (New-Deal-inspired policies) by governments to take on the “K-shaped” economic recovery. Historically, high infrastructure spending (measured by gross fixed capital formation) will translate into higher base metals prices as shown by the figures above.

In particular, we believe that base metals such as nickel and copper will benefit the most from digital and green infrastructure development because most of the upcoming projects will hover around electronics, electricity, and energy storage.

A decade of underinvestment in the mining industry could result in a potential supply crunch

The subdued commodity prices in the last decade reduced the appetite for investments in the mining and energy industries. Consequently, there will be a longer lead time from discoveries into production which would translate to lower replenishment of the depleting resources.

Furthermore, the rising ESG scrutiny in these sectors also makes it harder for the industry to obtain financing – which further decelerates the future supply growth.

This structural condition suggests that there would be insufficient supply to respond to the surging demand for mining and energy commodities. Such circumstance would drive prices up even further.

Oil great reset drives worldwide industry consolidation

Many oil companies got burnt in 2020, especially shale oil producers, because of the historical plunge of oil price that was triggered by the sudden global lockdown. WTI oil price went negative for the first time in history. It forced them to cut production without any hesitation. It reversed the “growth at all cost” mindset to maximizing return on shareholders’ capital.

As oil prices plummeted to a historical negative level in 2020, the great reset of oil industry in 2020 has led to solid worldwide industry consolidation. Industry CAPEX tanked and production was cut significantly altogether. The consolidation enables tighter output control and leads to a more sustainable price increase.

As of February 28th, 2021, the OPEC is producing at 80% of 10Y-average production, 24.87 mn bpd, with a high compliance rate of 110% among OPEC10 members and showing reluctance to raise output amidst the recovering economy and travel ease. Until the recent OPEC meeting in June 2021, the solidarity among the cartel still persists.

Extreme weather conditions and supply chain disruption will also drive soft commodity price up

Despite the (pandemic) lockdown, the global average temperature is back to a record high in 2020. A study by Zhao et al. (2017) shows that for each degree Celsius increase in global temperature, yields of corn are expected to decrease by 7.4%, wheat by 6%, rice by 3.2%, and soybean by 3.2%.

The robustness of the recent agriculture rally is reflected in the soaring commodity price in the harvest season. Case in point: Indonesia’s corn price in East Java on farmer’s level has increased 42.8% from approximately IDR 3,500 (USD 0.246) at the beginning of the year to IDR 5,000 (USD 0.352) per kilogram in early May 2021, a harvest season for corn. This kind of event is truly rare.

Investors should be aware of weather conditions as it might further boost agricultural commodity prices if it turns to be unfavourable.

Disrupted supply chain is the cherry on top of the perfect cocktail

The uncertainty on travel restrictions has disrupted the global supply chain. To-the-moon freight costs in three months period between December 2020 to February 2021 perfectly reflect the severity of the disruption.

For instance, the cost of shipping a 40-foot container from Asia to Europe rose about 2.5 times from approximately USD 2,200 to over USD 7,900. From the global perspective, the Freightos Baltic Index, represent container-freight rates in 12 primary maritime lanes, has increased about 80 percent from USD 2,200 to USD 4,000 per container.

The uncertainty in the global supply chain has incentivised some producers to hoard feedstocks. Such behaviour is driven by their interest to secure their production continuity that is currently responding to the pent-up demand.

Furthermore, the disruption also meant a higher cost of production for everyone in the value chain. Consequently, every producer, including the commodity producer, is reluctant to sell cheap.

It is a cherry on top of the cocktail.

This perfect cocktail may either taste sweet or bitter

The pent-up demand from economic reopening and robust additional demand from the expansive economic policies will be responded unevenly from the supply side. Both demand and supply forces are driving prices up. As such, we are of the view that the stars are aligned to form a commodity supercycle.

Regardless of the commodity rally being a supercycle or transitory (might be one year, two years, five years- it’s too late to act by then), the cocktail will taste differently for everyone.

Commodity producing companies would certainly re-experience their glory days meanwhile companies who are unable to pass on their increasing production costs will see their profit margins fade. As the majority of costs rise, a period of sustained inflation would also become inevitable.

With rising inflation, a commodity supercycle, and the shift to value stocks becoming the investment backdrop for the upcoming years, could there be a certain region that benefits from all the forces?

Stay tuned to our next blog!

“The test of a first-rate intelligence is the ability to hold two opposite ideas in the mind at the same time, and still retain the ability to function”

-F. Scott Fitzgerald –

Reference:

Cassim, Z., Handjiski, B., Schubert, J., & Zouaoui, Y. (2020). The $10 trillion rescue: How governments can deliver impact. McKinsey & Company.

Chuang Zhao, et al. (2017). Temperature increase reduces global yields of major crops in four independent estimates. Proceedings of the National Academy of Sciences of the United States of America Vol. 114 no. 35, 9326-9331.

Admin heyokha

Share