The Silver Reckoning

The Silver Reckoning

When the quiet metal stops whispering and starts shouting.

Just a few months ago, we wrote about silver’s long-overdue glow-up in “The Silver Awakening” blog. Back then, silver was still the underdog, the Luigi to gold’s Mario if you will, quietly building a case as both a monetary hedge and an industrial scarcity trade.

Now? It’s screaming. Loudly.

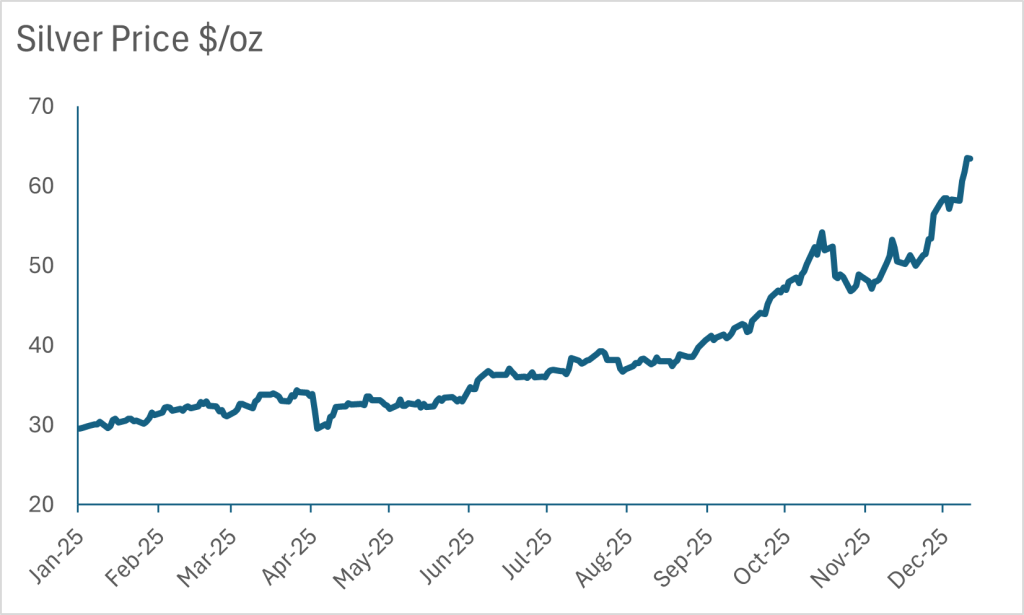

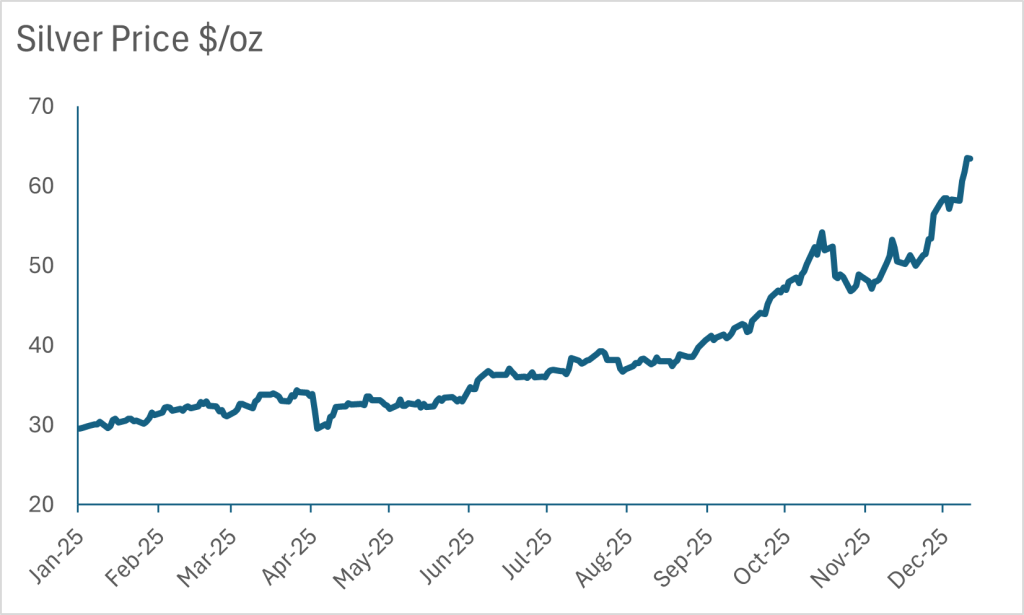

Silver has hit another all-time high, breaking past $60 an ounce for the first time. And while headlines focus on price, the real story lies beneath — in vaults running dry, critical minerals lists getting updated, and a market caught in its tightest squeeze in decades.

We’re not surprised. We warned this might happen.

YTD silver has gained 115%. Up and up!

Source: Bloomberg

When Inventory Vanishes, Prices Speak

It didn’t happen overnight. The signs were all there in early 2025: a structural supply deficit, overstretched mine production, and vaults across London and Shanghai thinning out like hairlines in a stress-filled market.

By March, silver flowed aggressively into COMEX, with inventories surpassing 420 million ounces. Meanwhile, London and Shanghai were bleeding metal. Traders were relocating inventory to the U.S. in anticipation of tariffs and Section 232 reviews.

Come summer, the real pain began. LBMA free-float inventories dropped to multi-year lows, hovering around 777 million ounces. Lease rates surged. Shanghai’s drawdowns intensified. And then in August, the U.S. officially added silver to its Critical Minerals List putting it in the same bucket as lithium and rare earths.

From there, the squeeze only accelerated.

By October, China exported over 21 million ounces of silver to London. This is an unusually large relief shipment that showed just how tight things had become. But it wasn’t enough. COMEX started sending silver back to London too, and borrowing costs in London spiked to record highs. At one point, banks were yelling over phones, refusing to quote lease prices.

Silver leasing rate remains elevated. This trend has been spiking up since the start of 2025.

Source: Bloomberg

India Pulls the Pin

And then came India.

As Diwali season approached, domestic demand exploded. For the first time in 27 years, the country’s largest precious metals refinery ran out of silver. Influencers fanned the fire with viral videos claiming the 100:1 gold-silver ratio made silver the trade of the year. The FOMO factor worked. Premiums in India shot past $5/oz.

Customers flocked to jewelry shops to buy silver in Mumbia

Source: Bloomberg

Banks like JPMorgan stopped delivering physical silver to Indian clients altogether. Vaults ran dry. At one point, multiple major ETF providers had to halt new subscriptions because they couldn’t source silver fast enough.

And this wasn’t just a demand shock. It was a geopolitical chess move, too.

Critical Minerals, Critical Pressure

Silver’s inclusion on the U.S. Critical Minerals List was a turning point. It reclassified the metal as essential infrastructure for energy, defense, and semiconductors, not just jewelry and coins.

This changed everything:

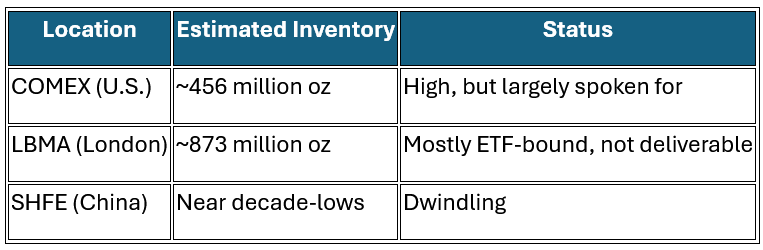

• Front-loading into U.S. vaults (COMEX hit ~456 million oz, triple historical norms)

• Concerns over tariffs or export controls

• Policy-fueled stockpiling in anticipation of Section 232 review outcomes

Effectively, the U.S. started hoarding. China started leaking. India started panicking. And London, the pricing hub, broke.

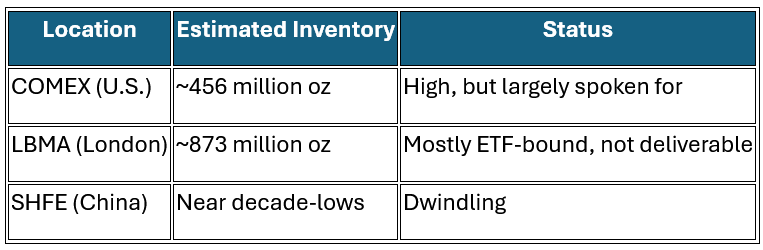

Let’s recap the December scoreboard:

Most London silver is “spoken for” by ETFs. In fact, 83% of LBMA silver was ETF-allocated as of end-September, meaning the actual available float was likely under 150 million ounces, which is barely enough to cover two days of London trading volume.

And let’s not forget: silver is in its fifth consecutive year of deficit. Global demand exceeded 1.14 billion ounces in 2025. Supply? Just 1.03 billion.

Even if you wanted more silver, it’s not easy to dig up. Production is stagnant. The top five producing nations control 62% of supply. Many of their flagship mines are nearing depletion.

Policy, Panic, and… Saudi Arabia?

Amid the chaos, Saudi Arabia quietly signaled a shift. As we noted in The Silver Awakening, the Saudi Central Bank opened positions in iShares Silver Trust and Global X Silver Miners ETF — its first-ever silver allocation.

It might look small on paper, but in geopolitics, signals matter more than size. A central bank that helped anchor the petrodollar is now experimenting with silver. It won’t be the last.

This fits the bigger pattern we’ve been tracking for years: real assets are in, fiat trust is out.

Silver: The Critical Commodity with Conviction

Silver has now been:

• Reclassified as a critical mineral in the U.S.

• Accumulated by central banks

• Strangled by ETF tightness

• Pulled in three directions by U.S., China, and India

• Embedded in everything from solar panels to semiconductors

• Used as a monetary hedge and an industrial necessity

No wonder it’s outperforming gold on momentum.

This isn’t just a catch-up trade. It’s a regime shift.

Final Thoughts: What’s the Real Price of Scarcity?

Silver is not merely the poor man’s gold anymore. It’s the broke system’s loudest whistleblower.

If gold reflects fear, silver reflects system strain. And right now, the system is groaning under the weight of physical shortages, policy bifurcation, and investor distrust.

We still believe silver is the most underappreciated character in this commodity cycle. It may not have gold’s headlines (yet). But when physical reality meets monetary erosion, silver doesn’t just wake up.

It explodes.

The rally isn’t the surprise. The surprise is that so few saw it coming….again.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

When the quiet metal stops whispering and starts shouting.

Just a few months ago, we wrote about silver’s long-overdue glow-up in “The Silver Awakening” blog. Back then, silver was still the underdog, the Luigi to gold’s Mario if you will, quietly building a case as both a monetary hedge and an industrial scarcity trade.

Now? It’s screaming. Loudly.

Silver has hit another all-time high, breaking past $60 an ounce for the first time. And while headlines focus on price, the real story lies beneath — in vaults running dry, critical minerals lists getting updated, and a market caught in its tightest squeeze in decades.

We’re not surprised. We warned this might happen.

YTD silver has gained 115%. Up and up!

Source: Bloomberg

When Inventory Vanishes, Prices Speak

It didn’t happen overnight. The signs were all there in early 2025: a structural supply deficit, overstretched mine production, and vaults across London and Shanghai thinning out like hairlines in a stress-filled market.

By March, silver flowed aggressively into COMEX, with inventories surpassing 420 million ounces. Meanwhile, London and Shanghai were bleeding metal. Traders were relocating inventory to the U.S. in anticipation of tariffs and Section 232 reviews.

Come summer, the real pain began. LBMA free-float inventories dropped to multi-year lows, hovering around 777 million ounces. Lease rates surged. Shanghai’s drawdowns intensified. And then in August, the U.S. officially added silver to its Critical Minerals List putting it in the same bucket as lithium and rare earths.

From there, the squeeze only accelerated.

By October, China exported over 21 million ounces of silver to London. This is an unusually large relief shipment that showed just how tight things had become. But it wasn’t enough. COMEX started sending silver back to London too, and borrowing costs in London spiked to record highs. At one point, banks were yelling over phones, refusing to quote lease prices.

Silver leasing rate remains elevated. This trend has been spiking up since the start of 2025.

Source: Bloomberg

India Pulls the Pin

And then came India.

As Diwali season approached, domestic demand exploded. For the first time in 27 years, the country’s largest precious metals refinery ran out of silver. Influencers fanned the fire with viral videos claiming the 100:1 gold-silver ratio made silver the trade of the year. The FOMO factor worked. Premiums in India shot past $5/oz.

Customers flocked to jewelry shops to buy silver in Mumbia

Source: Bloomberg

Banks like JPMorgan stopped delivering physical silver to Indian clients altogether. Vaults ran dry. At one point, multiple major ETF providers had to halt new subscriptions because they couldn’t source silver fast enough.

And this wasn’t just a demand shock. It was a geopolitical chess move, too.

Critical Minerals, Critical Pressure

Silver’s inclusion on the U.S. Critical Minerals List was a turning point. It reclassified the metal as essential infrastructure for energy, defense, and semiconductors, not just jewelry and coins.

This changed everything:

• Front-loading into U.S. vaults (COMEX hit ~456 million oz, triple historical norms)

• Concerns over tariffs or export controls

• Policy-fueled stockpiling in anticipation of Section 232 review outcomes

Effectively, the U.S. started hoarding. China started leaking. India started panicking. And London, the pricing hub, broke.

Let’s recap the December scoreboard:

Most London silver is “spoken for” by ETFs. In fact, 83% of LBMA silver was ETF-allocated as of end-September, meaning the actual available float was likely under 150 million ounces, which is barely enough to cover two days of London trading volume.

And let’s not forget: silver is in its fifth consecutive year of deficit. Global demand exceeded 1.14 billion ounces in 2025. Supply? Just 1.03 billion.

Even if you wanted more silver, it’s not easy to dig up. Production is stagnant. The top five producing nations control 62% of supply. Many of their flagship mines are nearing depletion.

Policy, Panic, and… Saudi Arabia?

Amid the chaos, Saudi Arabia quietly signaled a shift. As we noted in The Silver Awakening, the Saudi Central Bank opened positions in iShares Silver Trust and Global X Silver Miners ETF — its first-ever silver allocation.

It might look small on paper, but in geopolitics, signals matter more than size. A central bank that helped anchor the petrodollar is now experimenting with silver. It won’t be the last.

This fits the bigger pattern we’ve been tracking for years: real assets are in, fiat trust is out.

Silver: The Critical Commodity with Conviction

Silver has now been:

• Reclassified as a critical mineral in the U.S.

• Accumulated by central banks

• Strangled by ETF tightness

• Pulled in three directions by U.S., China, and India

• Embedded in everything from solar panels to semiconductors

• Used as a monetary hedge and an industrial necessity

No wonder it’s outperforming gold on momentum.

This isn’t just a catch-up trade. It’s a regime shift.

Final Thoughts: What’s the Real Price of Scarcity?

Silver is not merely the poor man’s gold anymore. It’s the broke system’s loudest whistleblower.

If gold reflects fear, silver reflects system strain. And right now, the system is groaning under the weight of physical shortages, policy bifurcation, and investor distrust.

We still believe silver is the most underappreciated character in this commodity cycle. It may not have gold’s headlines (yet). But when physical reality meets monetary erosion, silver doesn’t just wake up.

It explodes.

The rally isn’t the surprise. The surprise is that so few saw it coming….again.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share