The Transformation No One’s Watching: Reform Beneath the Algorithm

The Transformation No One’s Watching: Reform Beneath the Algorithm

I remember the moment vividly. I was sitting alone, eyes skimming across a late-night article when the words hit me: human intelligence may have peaked around 2012.

At first, I laughed—sharp, startled, almost too loud for the silence of the room. But it wasn’t joy that bubbled up. It was that peculiar kind of laughter we sometimes summon to soften the sting of something profoundly unsettling. Beneath the chuckle was a quiet ache, the kind of laugh you let out when the ship’s already halfway sunk and someone points out the hole – as if I had just stumbled upon an obituary for our collective potential.

Could it really be true that the year we collectively lost our minds to “Gangnam Style” marked the height of our cognitive brilliance?

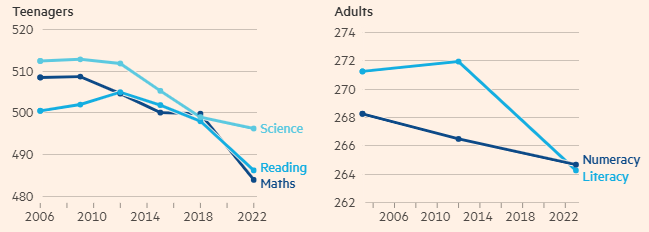

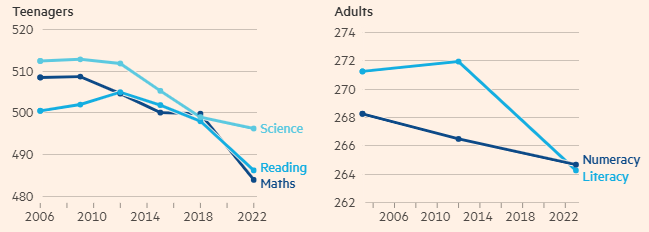

Yet as I sipped my tea, the absurdity faded into uneasy plausibility. According to the OECD’s PISA score, our global yardstick for reading, math, and science, we’ve been quietly declining ever since. Adults aren’t immune either; a third of Americans reportedly struggle with basic mathematical reasoning. No wonder family dinners can spiral from civil to chaotic faster than Twitter feuds—minus character limits, but with twice the drama.

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey

But hold your despair—I’m writing this precisely to preserve our collective IQ, a modest attempt at intellectual CPR in a sea of digital distraction.

Richard Thaler and Cass Sunstein’s groundbreaking book, Nudge, introduces choice architecture—the subtle art of shaping decisions without limiting freedom. Ironically, social-media giants have mastered the dark side of that idea, nudging us toward dopamine loops that short-circuit deeper thought.

Source: Chat GPT

Source: Chat GPT

Yet the same principle also guides policy on a far larger canvas. Sovereign wealth funds are countries’ macro-nudges: vast pools of capital intended to steer windfalls into long-term prosperity. Norway’s Government Pension Fund is the poster child — transparent, disciplined, quietly compounding for future generations. Malaysia’s 1MDB is the cautionary flip side, showing how quickly the architecture crumbles when sunlight and scrutiny vanish.

Which brings us to Indonesia’s bold move: Danantara. Conceived to overhaul a sprawl of 800 state-owned enterprises, Danantara aims to nudge them — with slimmer boards, clearer incentives, and outside capital — toward sharper efficiency and healthier profits.

Take Bank Mandiri (BMRI IJ), for instance. Following their March 2025 shareholder meeting, the board slimmed dramatically from ten commissioners down to six, cutting bureaucracy and refocusing on clear, market-oriented KPIs like total returns, regional benchmarking, and asset quality. If that isn’t stock market friendly governance – I don’t know what is.

Danantara plans to shrink about 800 SOEs into a more digestible 200, shifting public-service obligations directly to the government’s budget. Recently, it even sealed a solid $4 billion partnership with Qatar Investment Authority, a rather impressive thumbs-up from abroad.

Yet, Danantara isn’t without its skeptics—and perhaps rightly so. Governance is a challenge; juggling transparency, accountability, and efficiency across a vast portfolio isn’t exactly a walk in the park. Political influence remains a lurking threat, raising fears about meddling undermining the fund’s credibility. And let’s not forget the Herculean task of merging diverse corporate cultures and systems—a bit like blending oil, water, and a dash of chili sauce and hoping for gourmet cuisine.

Still, history offers comfort here. Barton Biggs, in his insightful book Wealth, War and Wisdom, reassures us that in the long run markets rewards patience, adaptability, and strategic prudence rather than reactionary panic. Danantara’s calculated, steady adjustments resonate deeply with this historical wisdom.

Back to the original point – what captures our online attention? Not the careful restructuring or billion-dollar partnerships, but isolated controversies or catchy headlines. Behavioral economics explains this perfectly: negativity bias and the availability heuristic lead us to equate visibility with importance. The architecture of our digital platforms nudges us toward reacting rather than reflecting.

Perhaps the renaissance we need isn’t limited to institutional reforms but extends to reclaiming our own attention and discernment. In an age of engineered distraction, the ultimate intelligence might just be knowing where to place our focus— recognizing the quieter, transformative work of initiatives like Danantara is precisely the kind of intellectual revival we need.

So next time I catch myself endlessly scrolling, half-liking forgettable posts and wondering why sock ads chase me after a single chat mention, I’ll remind myself to choose substance instead. A book that challenges my assumptions, a report that deepens understanding, or perhaps a thoughtful reflection on quieter transformations.

After all, true intelligence today isn’t just about what we know— it’s about deciding thoughtfully where to direct our attention. And perhaps, in doing so, we might start noticing transformative stories like Danantara that deserve far more than just a fleeting glance.

Wuddy Warsono, CFA and Tara Mulia

Admin heyokha

Share

I remember the moment vividly. I was sitting alone, eyes skimming across a late-night article when the words hit me: human intelligence may have peaked around 2012.

At first, I laughed—sharp, startled, almost too loud for the silence of the room. But it wasn’t joy that bubbled up. It was that peculiar kind of laughter we sometimes summon to soften the sting of something profoundly unsettling. Beneath the chuckle was a quiet ache, the kind of laugh you let out when the ship’s already halfway sunk and someone points out the hole – as if I had just stumbled upon an obituary for our collective potential.

Could it really be true that the year we collectively lost our minds to “Gangnam Style” marked the height of our cognitive brilliance?

Yet as I sipped my tea, the absurdity faded into uneasy plausibility. According to the OECD’s PISA score, our global yardstick for reading, math, and science, we’ve been quietly declining ever since. Adults aren’t immune either; a third of Americans reportedly struggle with basic mathematical reasoning. No wonder family dinners can spiral from civil to chaotic faster than Twitter feuds—minus character limits, but with twice the drama.

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey

But hold your despair—I’m writing this precisely to preserve our collective IQ, a modest attempt at intellectual CPR in a sea of digital distraction.

Richard Thaler and Cass Sunstein’s groundbreaking book, Nudge, introduces choice architecture—the subtle art of shaping decisions without limiting freedom. Ironically, social-media giants have mastered the dark side of that idea, nudging us toward dopamine loops that short-circuit deeper thought.

Source: Chat GPT

Source: Chat GPT

Yet the same principle also guides policy on a far larger canvas. Sovereign wealth funds are countries’ macro-nudges: vast pools of capital intended to steer windfalls into long-term prosperity. Norway’s Government Pension Fund is the poster child — transparent, disciplined, quietly compounding for future generations. Malaysia’s 1MDB is the cautionary flip side, showing how quickly the architecture crumbles when sunlight and scrutiny vanish.

Which brings us to Indonesia’s bold move: Danantara. Conceived to overhaul a sprawl of 800 state-owned enterprises, Danantara aims to nudge them — with slimmer boards, clearer incentives, and outside capital — toward sharper efficiency and healthier profits.

Take Bank Mandiri (BMRI IJ), for instance. Following their March 2025 shareholder meeting, the board slimmed dramatically from ten commissioners down to six, cutting bureaucracy and refocusing on clear, market-oriented KPIs like total returns, regional benchmarking, and asset quality. If that isn’t stock market friendly governance – I don’t know what is.

Danantara plans to shrink about 800 SOEs into a more digestible 200, shifting public-service obligations directly to the government’s budget. Recently, it even sealed a solid $4 billion partnership with Qatar Investment Authority, a rather impressive thumbs-up from abroad.

Yet, Danantara isn’t without its skeptics—and perhaps rightly so. Governance is a challenge; juggling transparency, accountability, and efficiency across a vast portfolio isn’t exactly a walk in the park. Political influence remains a lurking threat, raising fears about meddling undermining the fund’s credibility. And let’s not forget the Herculean task of merging diverse corporate cultures and systems—a bit like blending oil, water, and a dash of chili sauce and hoping for gourmet cuisine.

Still, history offers comfort here. Barton Biggs, in his insightful book Wealth, War and Wisdom, reassures us that in the long run markets rewards patience, adaptability, and strategic prudence rather than reactionary panic. Danantara’s calculated, steady adjustments resonate deeply with this historical wisdom.

Back to the original point – what captures our online attention? Not the careful restructuring or billion-dollar partnerships, but isolated controversies or catchy headlines. Behavioral economics explains this perfectly: negativity bias and the availability heuristic lead us to equate visibility with importance. The architecture of our digital platforms nudges us toward reacting rather than reflecting.

Perhaps the renaissance we need isn’t limited to institutional reforms but extends to reclaiming our own attention and discernment. In an age of engineered distraction, the ultimate intelligence might just be knowing where to place our focus— recognizing the quieter, transformative work of initiatives like Danantara is precisely the kind of intellectual revival we need.

So next time I catch myself endlessly scrolling, half-liking forgettable posts and wondering why sock ads chase me after a single chat mention, I’ll remind myself to choose substance instead. A book that challenges my assumptions, a report that deepens understanding, or perhaps a thoughtful reflection on quieter transformations.

After all, true intelligence today isn’t just about what we know— it’s about deciding thoughtfully where to direct our attention. And perhaps, in doing so, we might start noticing transformative stories like Danantara that deserve far more than just a fleeting glance.

Wuddy Warsono, CFA and Tara Mulia

Admin heyokha

Share