We Are All Prospectors—Just Not with Pick-Axes

We Are All Prospectors—Just Not with Pick-Axes

Morning, Jakarta’s prospector

We are all a prospector, in one way or another

In the old days, prospectors panned rivers for gold; today, they ride motorbikes through Jakarta’s traffic, chasing fortunes of a different kind. From freelancers to sales reps, these urban adventurers trade pickaxes for smartphones, navigating the daily chaos with grit, caffeine, and a dream.

History is full of fortune chasers—rugged gold miners, daring merchants, and scrappy dreamers turning rags to riches. As Adam Smith famously noted, it’s not the butcher’s kindness that brings you meat, but his self-interest. The world runs on hustle, not handouts.

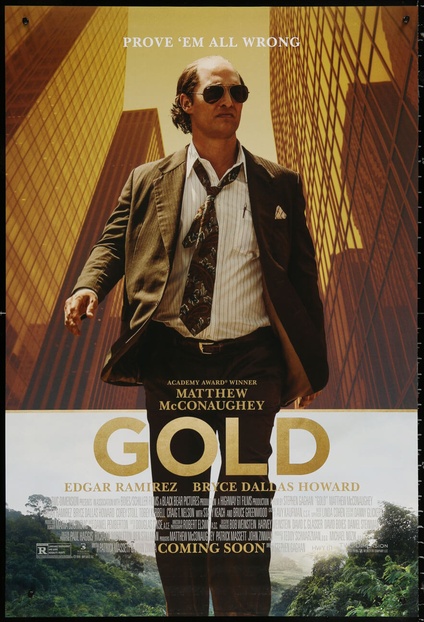

The thrill of prospectors brings back my memory about the movie “Gold”.

Gold (2016) is a gritty adventure-drama inspired by true events, starring Matthew McConaughey as Kenny Wells, a desperate prospector who teams up with a geologist to find gold deep in the jungles of Indonesia. Their discovery triggers a whirlwind of fame, fortune, and Wall Street frenzy—until things unravel in a web of greed, illusion, and betrayal. The film captures the highs and lows of chasing wealth, reminding us how thin the line is between striking it rich and losing everything.

The recent gold price action to all-time highs has given birth to new wave of gold prospectors. In Jakarta and reportedly many other cities in Asia, it is a common scene to see people lining up to buy gold bars. An asset class once considered for the elderly is now once again a hot trend.

We are all gold prospectors – Indonesians queued since dawn to buy gold at its peak early April

While recent gold price action has been exhilarating, it evokes mixed feelings for many. Some may fall back on the notion that whatever becomes “mainstream on Main Street” often signals a contrarian opportunity instead. But the lingering question remains: will this time be different?

Testing the waters

I had the privilege of speaking at a seminar for the Hungrystock community in Jakarta on May 1st, 2025.

The audience was filled with fundamental investing enthusiasts. Inspired by Warren Buffett, these individuals spend hours poring over research before making their stock purchases. They also have a fondness for buying stocks on a bargain — the kind that never flinches in the face of a bear market!

The topic of the seminar? Market and Macro Outlook. The room buzzed with curiosity, skepticism, and a shared hunger for what lies beneath the surface of this resource-rich nation, but one topic kept bouncing around the room as I made my way to the stage: “Is gold price going to get any higher?”.

Five minutes into a slide deck, I decided to test the room full of around 150 savvy retail investors with a quick show of hands survey:

“Who owns gold ?” About 8 people raised their hand (equal to 5% of the audience).

I suppose most of the married people forget what their wedding rings are made of.

“Who owns gold equities?” About four people raised their hand (equal to 2.6% of the audience).

This seems to indicate that gold, either in physical form or equities to be under owned to begin with. At least confined to that room.

Now this is where it gets interesting.

“Who thinks that the gold price is too high and will decline?” About 20 people raised their hand (equal to 13% of the audience).

“Who thinks that the gold price will continue to go up?” About roughly 70 people raised their hand (equivalent to 46% of the audience).

Apparently, most investors are missing the action in gold

The bottom line from this anecdotal exercise indicates that while most people are bullish on the gold price, it remains an under owned asset.

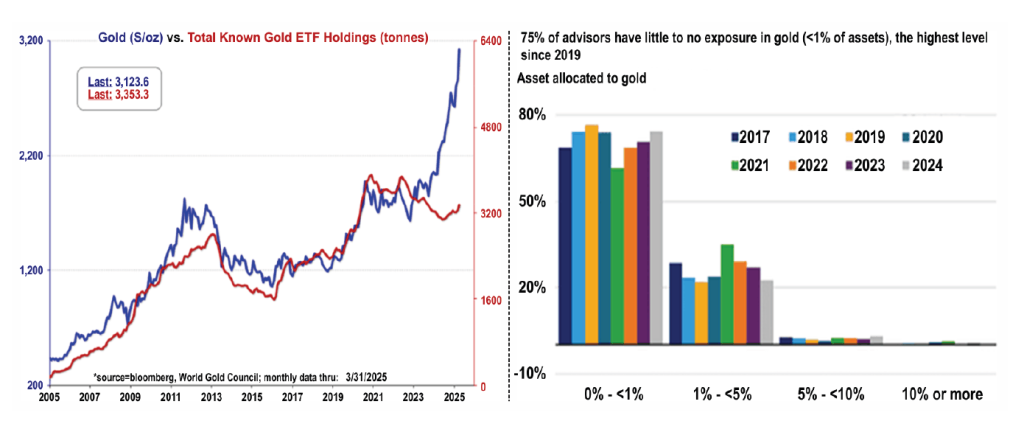

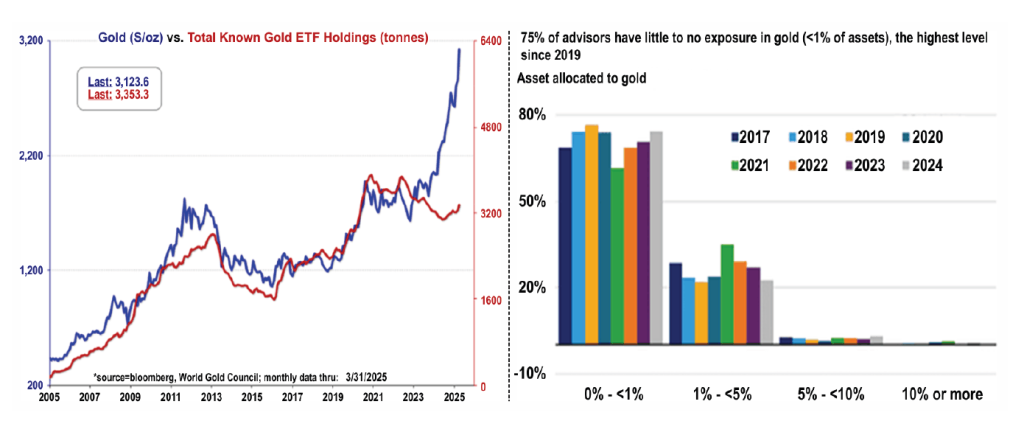

This issue is not just the retail investors. Sprott’s latest Q1-2025 commentary shows Western financial advisers sitting at their lowest gold allocation since 2019, while holdings in gold-backed ETFs remain almost 20 % below the 2020 peak.

Sources: Sprott

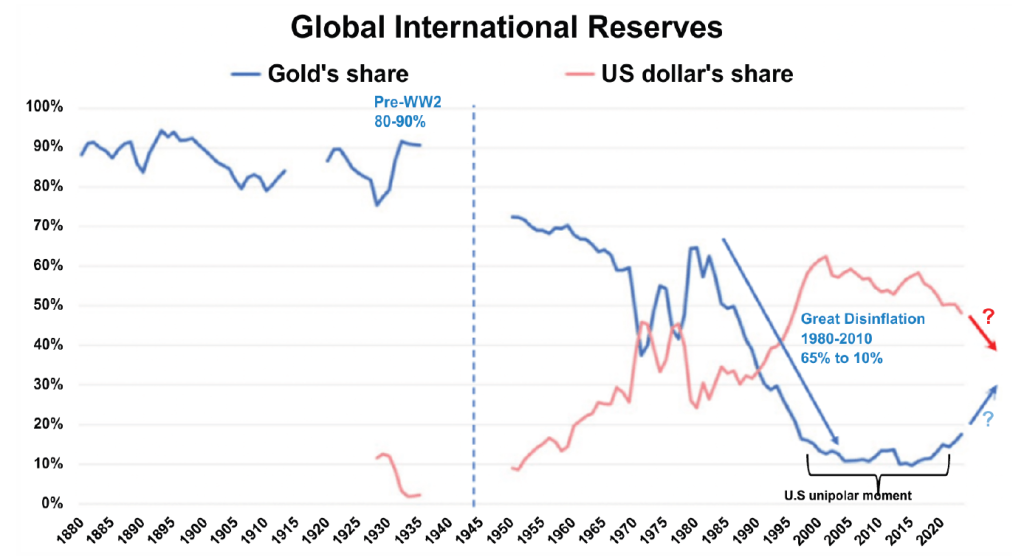

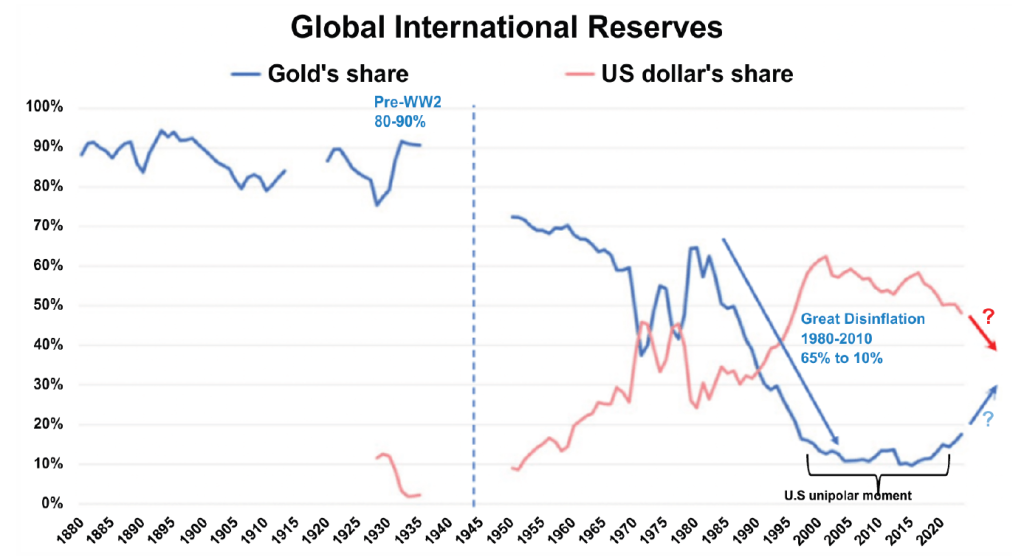

Central banks have not missed the game however and are the hoarding metal. Feast your eyes on the century-and-a-half roller-coaster below:

Exhibit A – “Gold’s Revenge Tour.” Gold’s share of global reserves (blue) dominated the pre-WWII era, went on a decades-long hiatus, and is now sneaking back on stage just as the dollar’s share (red) loses a few decibels.

And guess who’s buying backstage passes? Asian central banks specifically—they’ve been the biggest net buyers of bullion since the current dollar bull run kicked off in 2014.

Sources: Gainesville Coins, IMF

The Philosopher’s Nugget

Henry David Thoreau, famous American naturalist and philosopher, once said “There are a thousand hacking at the branches of evil to one who is striking at the root”. Investors, likewise, lunge at the branch called “price momentum” and ignore the root called “ownership base.” When ownership is thin, supply of new sellers is thinner still.

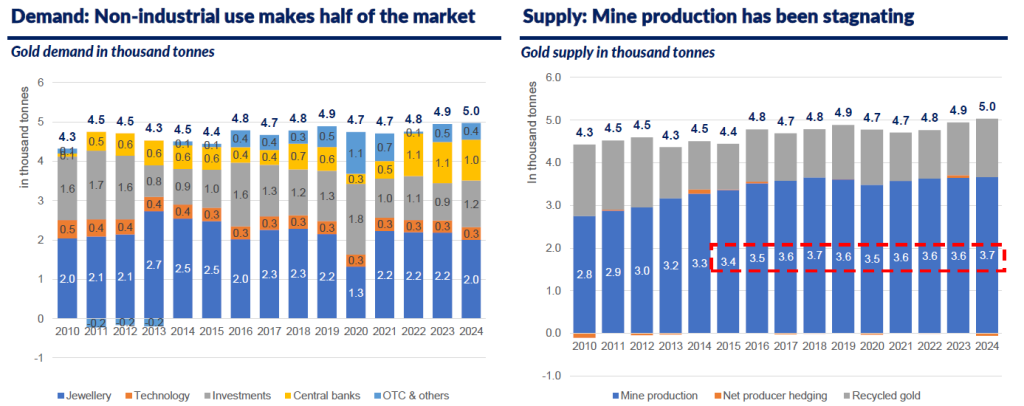

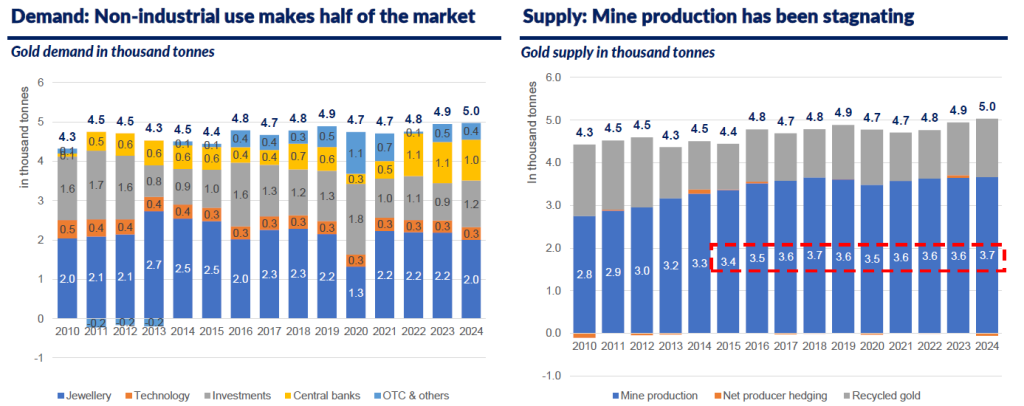

Over the last 10 years, freshly mined gold supply has been stagnating.

Source: World Gold Council

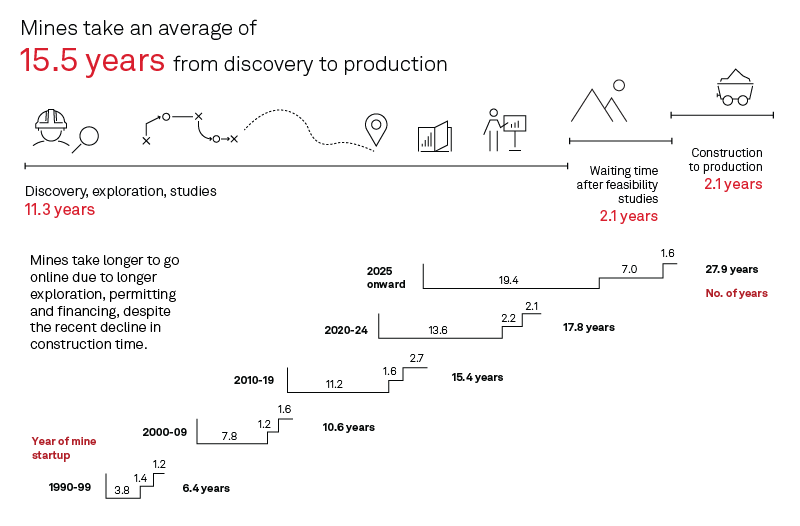

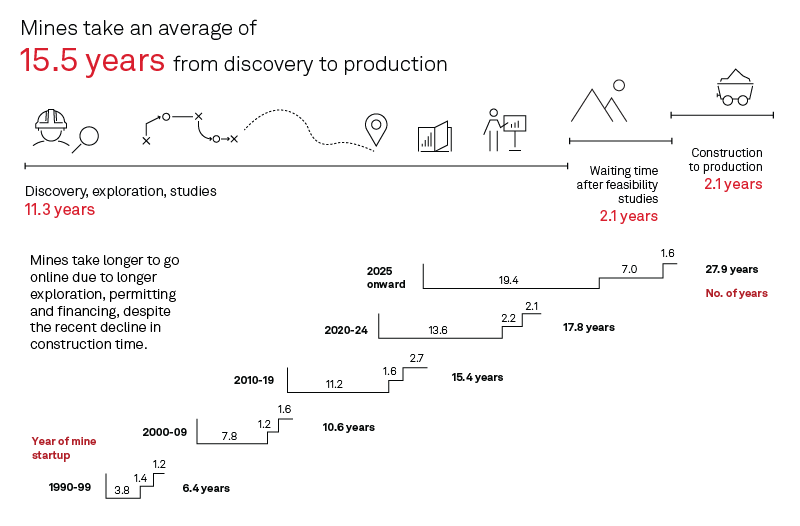

Global exploration budgets for new deposits actually fell 3 % last year—even with record gold prices—and it now takes an average of 15 years to shepherd a discovery from first soil sample to first pour.

Source: S&P Global

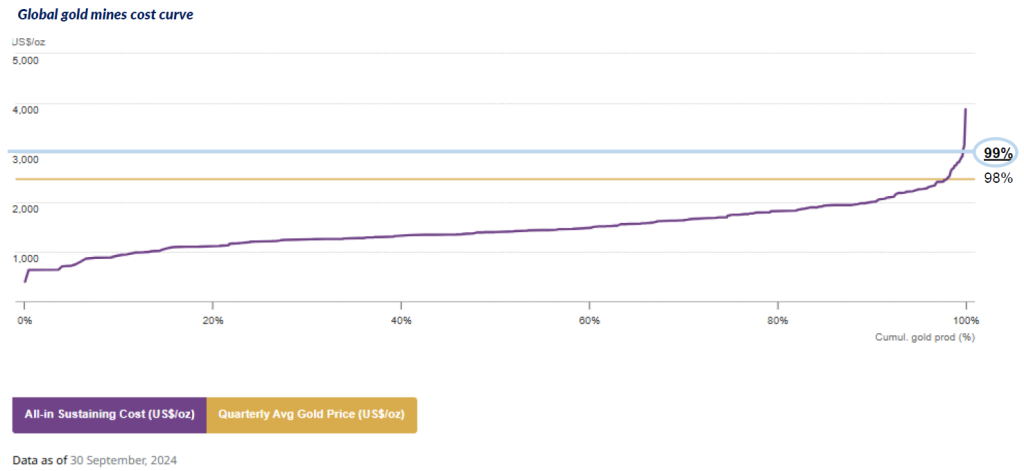

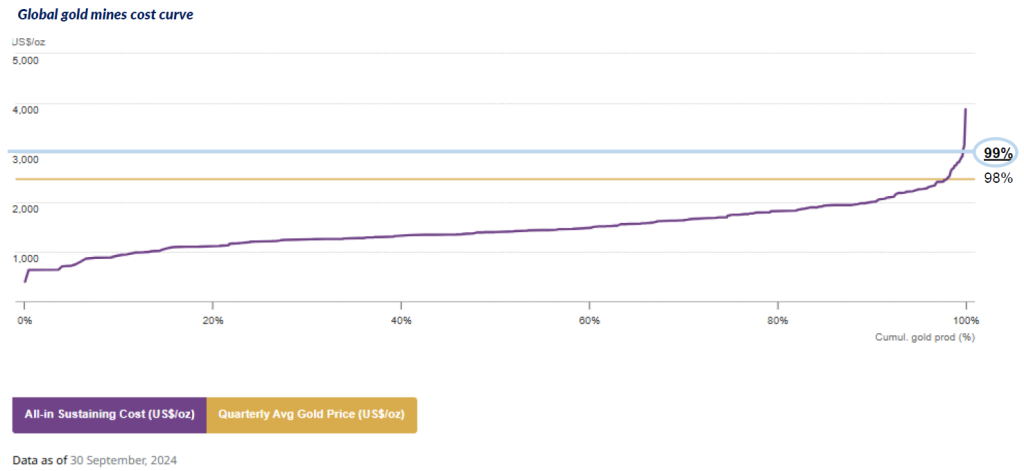

At the same time over 99 % of existing gold mines are profitable at today’s prices, with industry margins hovering near all-time highs.

Source: Metals Focus Gold Mine Cost Service

Top 10 things people ask Santa for: A time machine

After delivering the market and macro outlook presentation, I went down the stage and spoke with a few of the audience members. It seemed my impromptu survey left a mark on them as some lamented on not buying the bullion at US $1,000—or US $2,000 and wished they could go back in time to urge their past selves.

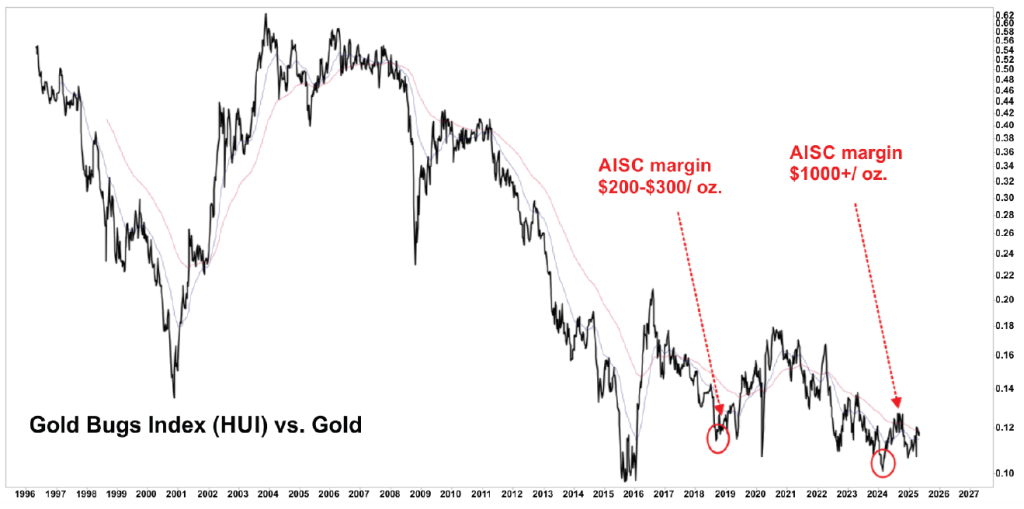

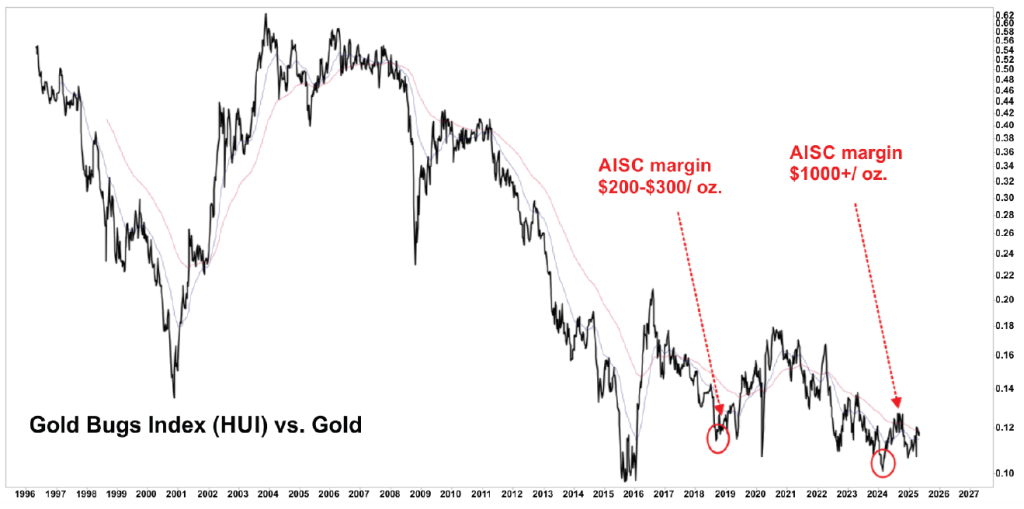

But here’s the thing – a time machine might not be needed after all – gold equities still trade at single-digit cash-flow multiples while bullion toys with record highs. As Sprott’s John Hathaway puts it, miners offer “significant torque (operational leverage) potential” versus the metal itself.

AISC margins are far higher than they were in 2018 making the HUI Index undervalued relative to gold price

Source: StockCharts

Parting Shot

As people started to file out of the hall, a gentleman approached me:

“Gold still feels risky. Don’t you think it’s overbought?” he paused then added, “But maybe the bigger risk is not owning any.”

That comment rings true now more than ever.

Fiat earned our trust once—backed by discipline, restraint, and real limits.

But over time, that trust has been stretched by endless debt and printing presses.

Gold, on the other hand, doesn’t ask for trust.

It doesn’t promise. It doesn’t default. It just is.

So maybe the real question isn’t whether gold is overbought—

but whether the paper we measure it in still deserves our trust.

Nicholas and Tara Mulia

Admin heyokha

Share

Morning, Jakarta’s prospector

We are all a prospector, in one way or another

In the old days, prospectors panned rivers for gold; today, they ride motorbikes through Jakarta’s traffic, chasing fortunes of a different kind. From freelancers to sales reps, these urban adventurers trade pickaxes for smartphones, navigating the daily chaos with grit, caffeine, and a dream.

History is full of fortune chasers—rugged gold miners, daring merchants, and scrappy dreamers turning rags to riches. As Adam Smith famously noted, it’s not the butcher’s kindness that brings you meat, but his self-interest. The world runs on hustle, not handouts.

The thrill of prospectors brings back my memory about the movie “Gold”.

Gold (2016) is a gritty adventure-drama inspired by true events, starring Matthew McConaughey as Kenny Wells, a desperate prospector who teams up with a geologist to find gold deep in the jungles of Indonesia. Their discovery triggers a whirlwind of fame, fortune, and Wall Street frenzy—until things unravel in a web of greed, illusion, and betrayal. The film captures the highs and lows of chasing wealth, reminding us how thin the line is between striking it rich and losing everything.

The recent gold price action to all-time highs has given birth to new wave of gold prospectors. In Jakarta and reportedly many other cities in Asia, it is a common scene to see people lining up to buy gold bars. An asset class once considered for the elderly is now once again a hot trend.

We are all gold prospectors – Indonesians queued since dawn to buy gold at its peak early April

While recent gold price action has been exhilarating, it evokes mixed feelings for many. Some may fall back on the notion that whatever becomes “mainstream on Main Street” often signals a contrarian opportunity instead. But the lingering question remains: will this time be different?

Testing the waters

I had the privilege of speaking at a seminar for the Hungrystock community in Jakarta on May 1st, 2025.

The audience was filled with fundamental investing enthusiasts. Inspired by Warren Buffett, these individuals spend hours poring over research before making their stock purchases. They also have a fondness for buying stocks on a bargain — the kind that never flinches in the face of a bear market!

The topic of the seminar? Market and Macro Outlook. The room buzzed with curiosity, skepticism, and a shared hunger for what lies beneath the surface of this resource-rich nation, but one topic kept bouncing around the room as I made my way to the stage: “Is gold price going to get any higher?”.

Five minutes into a slide deck, I decided to test the room full of around 150 savvy retail investors with a quick show of hands survey:

“Who owns gold ?” About 8 people raised their hand (equal to 5% of the audience).

I suppose most of the married people forget what their wedding rings are made of.

“Who owns gold equities?” About four people raised their hand (equal to 2.6% of the audience).

This seems to indicate that gold, either in physical form or equities to be under owned to begin with. At least confined to that room.

Now this is where it gets interesting.

“Who thinks that the gold price is too high and will decline?” About 20 people raised their hand (equal to 13% of the audience).

“Who thinks that the gold price will continue to go up?” About roughly 70 people raised their hand (equivalent to 46% of the audience).

Apparently, most investors are missing the action in gold

The bottom line from this anecdotal exercise indicates that while most people are bullish on the gold price, it remains an under owned asset.

This issue is not just the retail investors. Sprott’s latest Q1-2025 commentary shows Western financial advisers sitting at their lowest gold allocation since 2019, while holdings in gold-backed ETFs remain almost 20 % below the 2020 peak.

Sources: Sprott

Central banks have not missed the game however and are the hoarding metal. Feast your eyes on the century-and-a-half roller-coaster below:

Exhibit A – “Gold’s Revenge Tour.” Gold’s share of global reserves (blue) dominated the pre-WWII era, went on a decades-long hiatus, and is now sneaking back on stage just as the dollar’s share (red) loses a few decibels.

And guess who’s buying backstage passes? Asian central banks specifically—they’ve been the biggest net buyers of bullion since the current dollar bull run kicked off in 2014.

Sources: Gainesville Coins, IMF

The Philosopher’s Nugget

Henry David Thoreau, famous American naturalist and philosopher, once said “There are a thousand hacking at the branches of evil to one who is striking at the root”. Investors, likewise, lunge at the branch called “price momentum” and ignore the root called “ownership base.” When ownership is thin, supply of new sellers is thinner still.

Over the last 10 years, freshly mined gold supply has been stagnating.

Source: World Gold Council

Global exploration budgets for new deposits actually fell 3 % last year—even with record gold prices—and it now takes an average of 15 years to shepherd a discovery from first soil sample to first pour.

Source: S&P Global

At the same time over 99 % of existing gold mines are profitable at today’s prices, with industry margins hovering near all-time highs.

Source: Metals Focus Gold Mine Cost Service

Top 10 things people ask Santa for: A time machine

After delivering the market and macro outlook presentation, I went down the stage and spoke with a few of the audience members. It seemed my impromptu survey left a mark on them as some lamented on not buying the bullion at US $1,000—or US $2,000 and wished they could go back in time to urge their past selves.

But here’s the thing – a time machine might not be needed after all – gold equities still trade at single-digit cash-flow multiples while bullion toys with record highs. As Sprott’s John Hathaway puts it, miners offer “significant torque (operational leverage) potential” versus the metal itself.

AISC margins are far higher than they were in 2018 making the HUI Index undervalued relative to gold price

Source: StockCharts

Parting Shot

As people started to file out of the hall, a gentleman approached me:

“Gold still feels risky. Don’t you think it’s overbought?” he paused then added, “But maybe the bigger risk is not owning any.”

That comment rings true now more than ever.

Fiat earned our trust once—backed by discipline, restraint, and real limits.

But over time, that trust has been stretched by endless debt and printing presses.

Gold, on the other hand, doesn’t ask for trust.

It doesn’t promise. It doesn’t default. It just is.

So maybe the real question isn’t whether gold is overbought—

but whether the paper we measure it in still deserves our trust.

Nicholas and Tara Mulia

Admin heyokha

Share