The crypto market’s latest rally isn’t just about Bitcoin and Ethereum making new highs (again). This time, the spotlight belongs to something… boring. Not in the sense of ‘uninteresting’, but in the sense of ‘infrastructure-grade’. And in crypto, boring might just be the new brilliant.

We’ve written about this before in our blog Stablecoins 101: Chips, Claw Machines, and the Subtle Rebuild of Money, where we compared stablecoins to arcade tokens — fast, functional, and trusted inside high-stakes arenas.

But now, with the passing of the GENIUS Act in the U.S., stablecoins are leveling up from arcade chips to financial infrastructure.

What Are Stablecoins (Again)?

Stablecoins are the crypto world’s answer to volatility. Unlike Bitcoin or Ethereum, they’re designed to be boring: 1 coin = 1 dollar, always.

They combine the flexibility of blockchain with the stability of fiat. You get the speed and programmability of crypto without worrying that your “money” might drop 10% overnight because someone tweeted something.

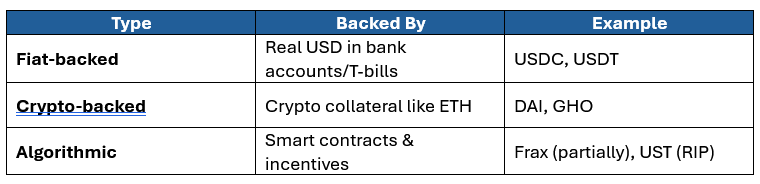

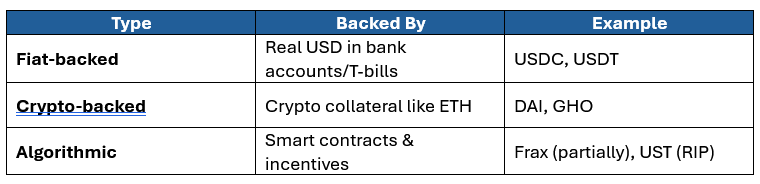

The 3 Flavors of Stability

Fiat-backed: You send $1, you get 1 token. The issuer holds your $1 in cash or Treasuries. When you redeem, the token gets burned. Think vending machine: 1 coin in, 1 snack out.

Crypto-backed: You lock $150 in ETH to mint $100 in stablecoins. Overcollateralization protects against volatility. If ETH crashes too far, your collateral gets liquidated.

Algorithmic: No real backing. Stability via code and incentives. Worked until it didn’t (hi, UST). Most of these now come with a side of trauma.

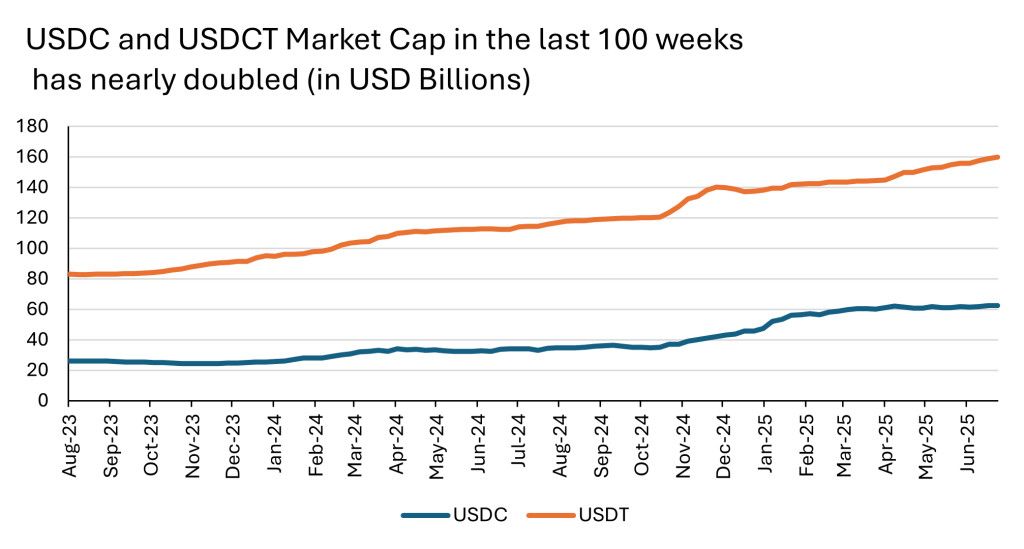

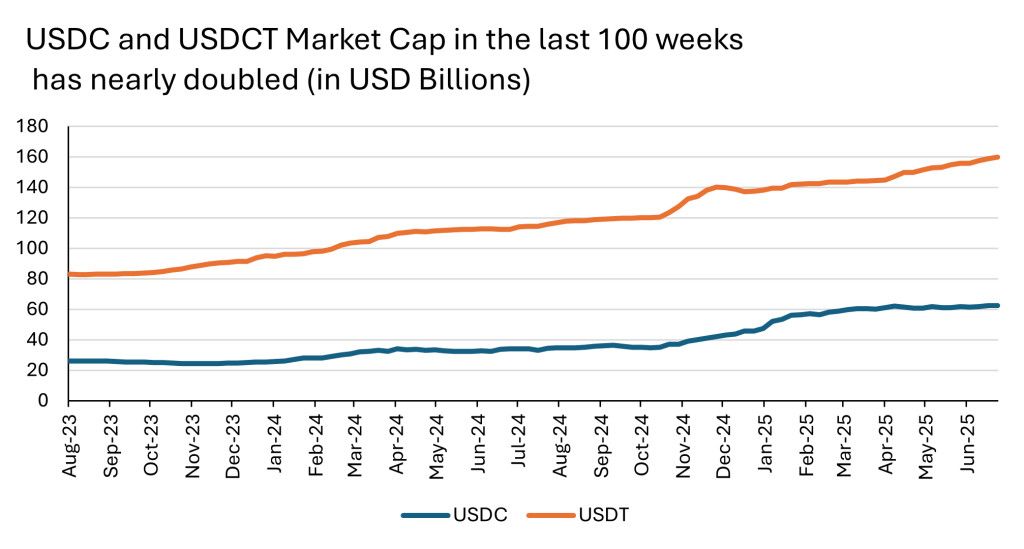

Source: Bloomberg

USDC (Circle)’s market cap nears $63 billion USD which is bigger than Ford Motors ($45 billion USD)

USDT (Tether)’s market cap nears $160 billion USD which is worth more than Wall Street giant Morgan Stanley founded in 1935 ($146 billion USD)

Why Use Them?

- Transfer money globally in seconds

- Avoid volatility when trading crypto

- Escape inflation in fragile economies

- Use DeFi without touching a bank

- Get paid in dollars, anywhere, anytime

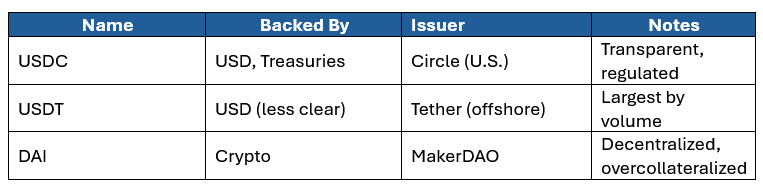

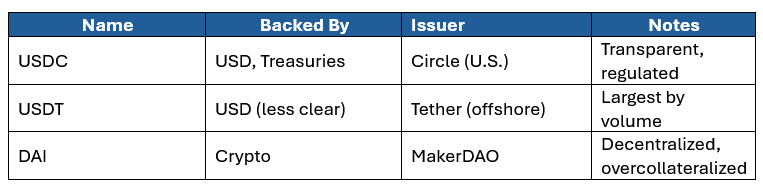

Popular Players

So, What Changed? Enter: The GENIUS Act

In July 2025, the U.S. passed the GENIUS Act: Guiding and Establishing National Innovation for U.S. Stablecoins. Finally, a clear federal law for payment stablecoins.

Key Changes:

- Only licensed entities (banks, OCC-chartered nonbanks) can issue stablecoins

- Must be 100% backed by USD or short-term Treasuries

- Must offer monthly audits, segregated reserves, AML/KYC compliance

- No interest allowed on stablecoin holdings

- Consumer protection rules + priority claims if issuer goes bust

Effectively: stablecoins are now legal, safe, and boringly bank-grade.

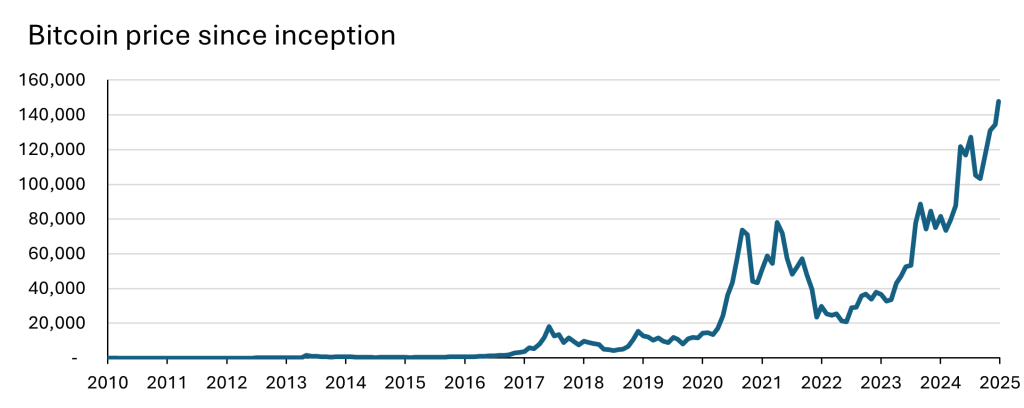

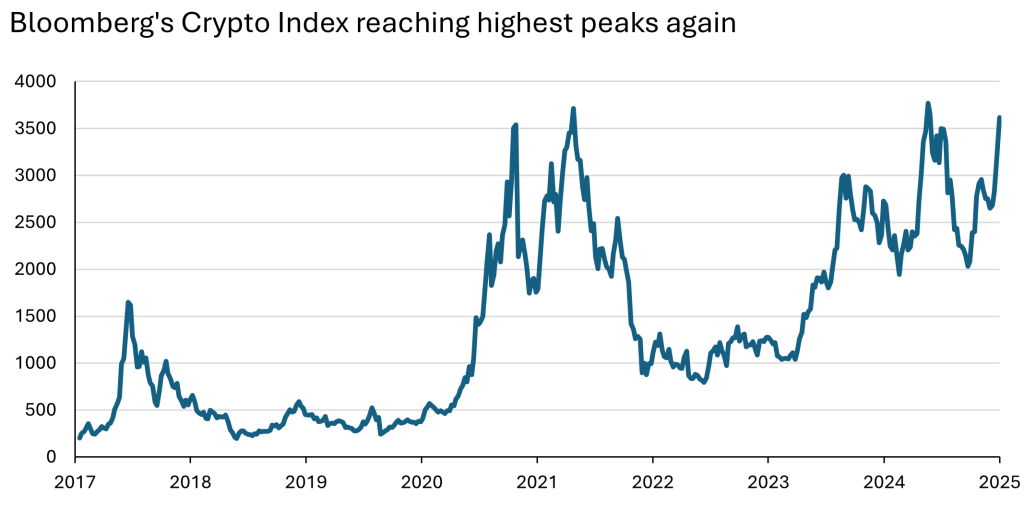

The Rally Heard Round the Blockchain

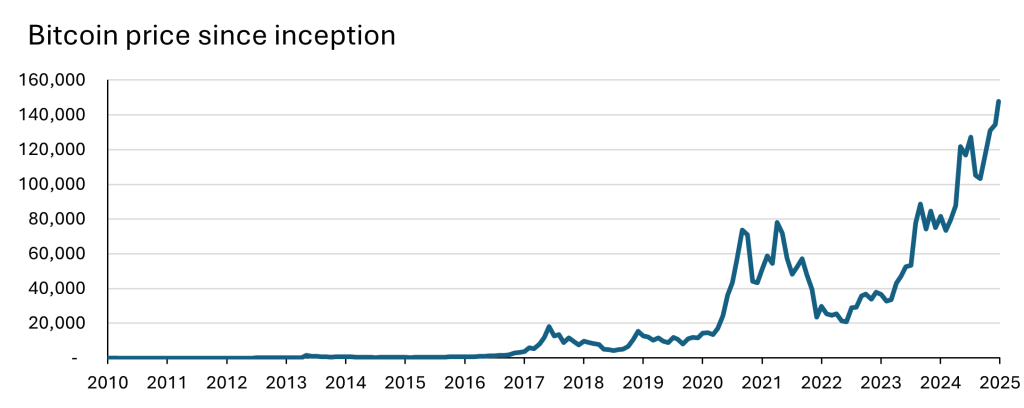

Source: Bloomberg

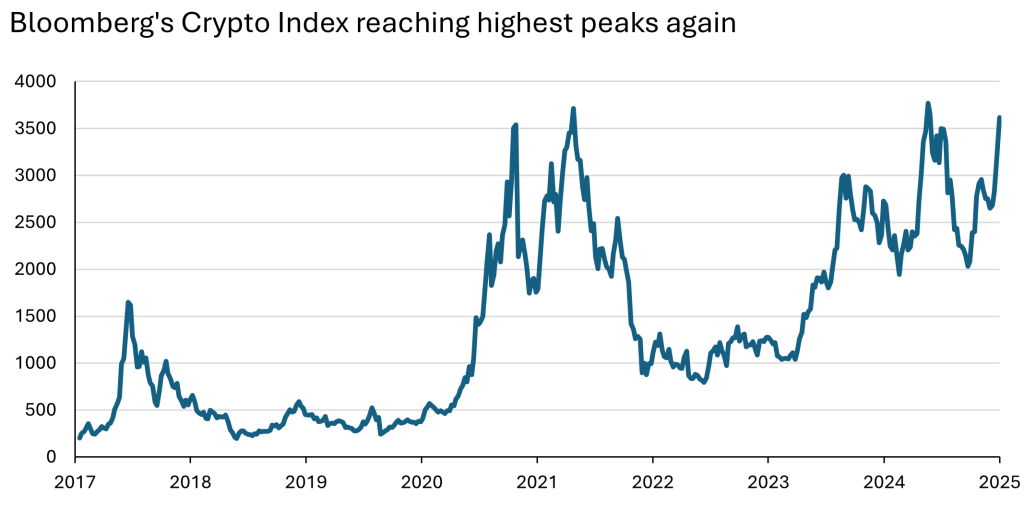

Source: Bloomberg Galaxy Crypto Index, which is designed to measure the performance of the largest cryptocurrencies traded in USD

Since the GENIUS Act passed:

- Global crypto market cap surpassed $4 trillion, marking one of the biggest surges of the year.

- Ethereum (ETH) rallied to a 2025 high of $3,795, fueled in part by the GENIUS Act’s prohibition on yield-bearing stablecoins — which, according to Deutsche Bank, has driven more capital toward ETH-based DeFi for yield opportunities.

- Altcoins like SOL, LINK, and XRP posted double-digit gains, with Solana reaching its highest since February.

- Circle and Coinbase stocks rose, while BitMine, Bit Digital, and other ETH-holding firms surged between 2.3% and 8%.

- The BlackRock Bitcoin ETF (IBIT) rose over 10%, while the Ethereum ETF soared more than 36% in July.

- Dynamix Corporation (DYNX) skyrocketed 26.2% after announcing a merger with Ether Reserve to create “The Ether Machine.”

With regulatory clarity now in place, institutional investors seem to be re-entering the chat — this time with bigger wallets.

Hot Take: Regulation isn’t the kryptonite — it’s the rocket fuel. With the U.S. lending legal cover, capital is flooding in. Four trillion reasons and counting.

Impact? Bullish for Both Crypto & Treasuries

Stablecoins are now required to hold billions in cash or T-bills. That means massive new demand for U.S. debt. Every $1 of stablecoin issued means $1 parked in U.S. Treasuries.

Circle, for instance, will likely grow their reserves into the hundreds of billions. More issuers will emerge. The U.S. gets cheap financing. Crypto gets regulatory clarity.

Everyone wins (except unregulated offshore tokens).

Winners & Losers

Winners:

- Circle (USDC): Already compliant, positioned to scale

- U.S. Treasury: Billions in new T-bill demand

- Banks & Fintechs: Legal path to issue their own stablecoins

- Consumers: Safer digital dollars with redemption rights

- DeFi: Clearer rails for payment and lending infrastructure

Losers:

- Tether (USDT): Offshore, less transparent, facing delisting

- Algorithmic Coins: Not legally usable for U.S. payments

- DeFi Maximalists: More regulation, less decentralization

- Non-compliant Exchanges: Will need to delist or adapt

Why It Matters Globally

In emerging markets, stablecoins are already used more than local banks. They’re trusted, 24/7, borderless. With legal clarity now in the U.S., these tools can go mainstream without fear of a Terra-style rug pull.

This isn’t just a crypto win. It’s a blueprint for programmable dollars, with auditable reserves, and global accessibility.

Final Thought: The Dollar’s New Skin

The GENIUS Act doesn’t reinvent money. It reissues it — wrapped in code, guarded by law, and designed for the internet.

We used to say stablecoins were arcade tokens.

Now they’re starting to look more like digital Treasuries.

The chips are real. The stakes are global. And the table just got a lot bigger.

Tara Mulia

Admin heyokha

Share

The crypto market’s latest rally isn’t just about Bitcoin and Ethereum making new highs (again). This time, the spotlight belongs to something… boring. Not in the sense of ‘uninteresting’, but in the sense of ‘infrastructure-grade’. And in crypto, boring might just be the new brilliant.

We’ve written about this before in our blog Stablecoins 101: Chips, Claw Machines, and the Subtle Rebuild of Money, where we compared stablecoins to arcade tokens — fast, functional, and trusted inside high-stakes arenas.

But now, with the passing of the GENIUS Act in the U.S., stablecoins are leveling up from arcade chips to financial infrastructure.

What Are Stablecoins (Again)?

Stablecoins are the crypto world’s answer to volatility. Unlike Bitcoin or Ethereum, they’re designed to be boring: 1 coin = 1 dollar, always.

They combine the flexibility of blockchain with the stability of fiat. You get the speed and programmability of crypto without worrying that your “money” might drop 10% overnight because someone tweeted something.

The 3 Flavors of Stability

Fiat-backed: You send $1, you get 1 token. The issuer holds your $1 in cash or Treasuries. When you redeem, the token gets burned. Think vending machine: 1 coin in, 1 snack out.

Crypto-backed: You lock $150 in ETH to mint $100 in stablecoins. Overcollateralization protects against volatility. If ETH crashes too far, your collateral gets liquidated.

Algorithmic: No real backing. Stability via code and incentives. Worked until it didn’t (hi, UST). Most of these now come with a side of trauma.

Source: Bloomberg

USDC (Circle)’s market cap nears $63 billion USD which is bigger than Ford Motors ($45 billion USD)

USDT (Tether)’s market cap nears $160 billion USD which is worth more than Wall Street giant Morgan Stanley founded in 1935 ($146 billion USD)

Why Use Them?

- Transfer money globally in seconds

- Avoid volatility when trading crypto

- Escape inflation in fragile economies

- Use DeFi without touching a bank

- Get paid in dollars, anywhere, anytime

Popular Players

So, What Changed? Enter: The GENIUS Act

In July 2025, the U.S. passed the GENIUS Act: Guiding and Establishing National Innovation for U.S. Stablecoins. Finally, a clear federal law for payment stablecoins.

Key Changes:

- Only licensed entities (banks, OCC-chartered nonbanks) can issue stablecoins

- Must be 100% backed by USD or short-term Treasuries

- Must offer monthly audits, segregated reserves, AML/KYC compliance

- No interest allowed on stablecoin holdings

- Consumer protection rules + priority claims if issuer goes bust

Effectively: stablecoins are now legal, safe, and boringly bank-grade.

The Rally Heard Round the Blockchain

Source: Bloomberg

Source: Bloomberg Galaxy Crypto Index, which is designed to measure the performance of the largest cryptocurrencies traded in USD

Since the GENIUS Act passed:

- Global crypto market cap surpassed $4 trillion, marking one of the biggest surges of the year.

- Ethereum (ETH) rallied to a 2025 high of $3,795, fueled in part by the GENIUS Act’s prohibition on yield-bearing stablecoins — which, according to Deutsche Bank, has driven more capital toward ETH-based DeFi for yield opportunities.

- Altcoins like SOL, LINK, and XRP posted double-digit gains, with Solana reaching its highest since February.

- Circle and Coinbase stocks rose, while BitMine, Bit Digital, and other ETH-holding firms surged between 2.3% and 8%.

- The BlackRock Bitcoin ETF (IBIT) rose over 10%, while the Ethereum ETF soared more than 36% in July.

- Dynamix Corporation (DYNX) skyrocketed 26.2% after announcing a merger with Ether Reserve to create “The Ether Machine.”

With regulatory clarity now in place, institutional investors seem to be re-entering the chat — this time with bigger wallets.

Hot Take: Regulation isn’t the kryptonite — it’s the rocket fuel. With the U.S. lending legal cover, capital is flooding in. Four trillion reasons and counting.

Impact? Bullish for Both Crypto & Treasuries

Stablecoins are now required to hold billions in cash or T-bills. That means massive new demand for U.S. debt. Every $1 of stablecoin issued means $1 parked in U.S. Treasuries.

Circle, for instance, will likely grow their reserves into the hundreds of billions. More issuers will emerge. The U.S. gets cheap financing. Crypto gets regulatory clarity.

Everyone wins (except unregulated offshore tokens).

Winners & Losers

Winners:

- Circle (USDC): Already compliant, positioned to scale

- U.S. Treasury: Billions in new T-bill demand

- Banks & Fintechs: Legal path to issue their own stablecoins

- Consumers: Safer digital dollars with redemption rights

- DeFi: Clearer rails for payment and lending infrastructure

Losers:

- Tether (USDT): Offshore, less transparent, facing delisting

- Algorithmic Coins: Not legally usable for U.S. payments

- DeFi Maximalists: More regulation, less decentralization

- Non-compliant Exchanges: Will need to delist or adapt

Why It Matters Globally

In emerging markets, stablecoins are already used more than local banks. They’re trusted, 24/7, borderless. With legal clarity now in the U.S., these tools can go mainstream without fear of a Terra-style rug pull.

This isn’t just a crypto win. It’s a blueprint for programmable dollars, with auditable reserves, and global accessibility.

Final Thought: The Dollar’s New Skin

The GENIUS Act doesn’t reinvent money. It reissues it — wrapped in code, guarded by law, and designed for the internet.

We used to say stablecoins were arcade tokens.

Now they’re starting to look more like digital Treasuries.

The chips are real. The stakes are global. And the table just got a lot bigger.

Tara Mulia

Admin heyokha

Share