It used to be so simple.

Asia made it. The West bought it. Everyone was happy.

China kept margins slim, logistics humming, and Walmart aisles overflowing with low-cost goods. Southeast Asia played the cost-arbitrage understudy. Japan and Korea brought the tech. And in the background, central banks celebrated low inflation like it was their doing.

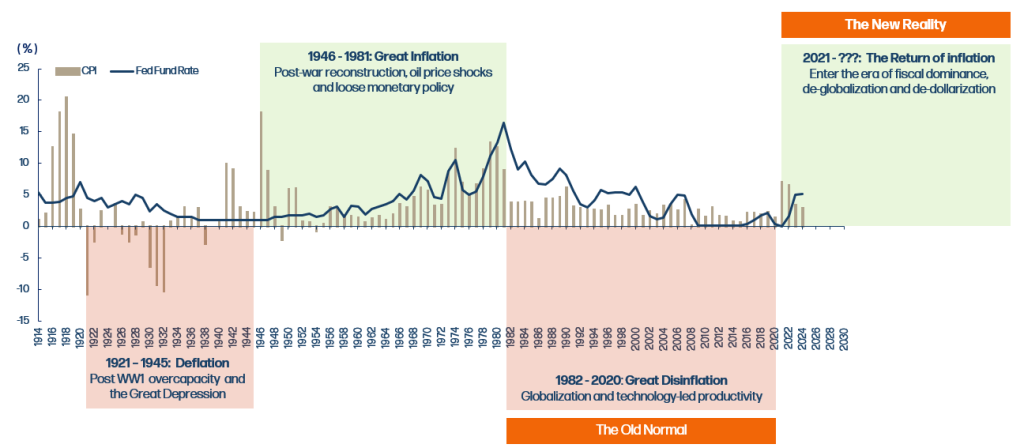

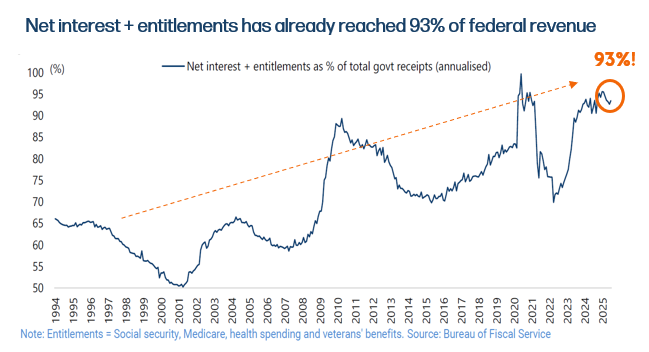

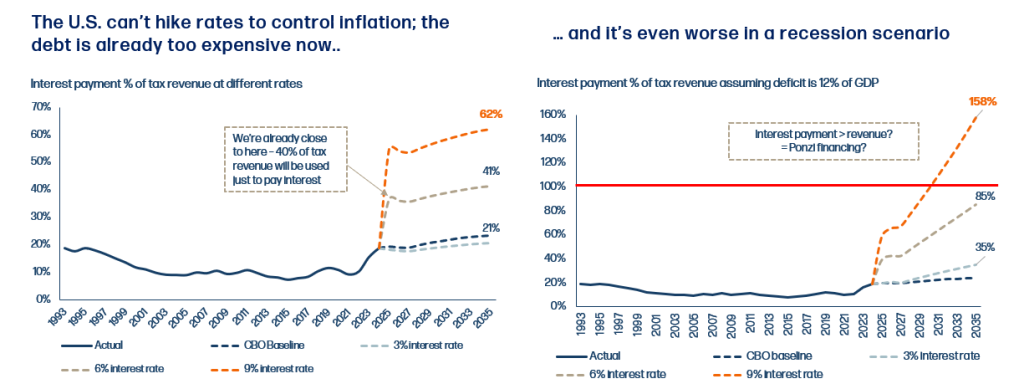

But that script is changing. Fast.

Exiting a Deflationary Asia, Entering a Price-Setter Asia

Today, the story is more complex. China is no longer the margin martyr it once was. Wages have risen. Demographics have shifted. And with rising geopolitical tensions, the world’s biggest exporter is turning inward.

Rather than a race to the bottom, China is climbing the value chain focusing on electric vehicles, AI, semiconductors, and green tech.

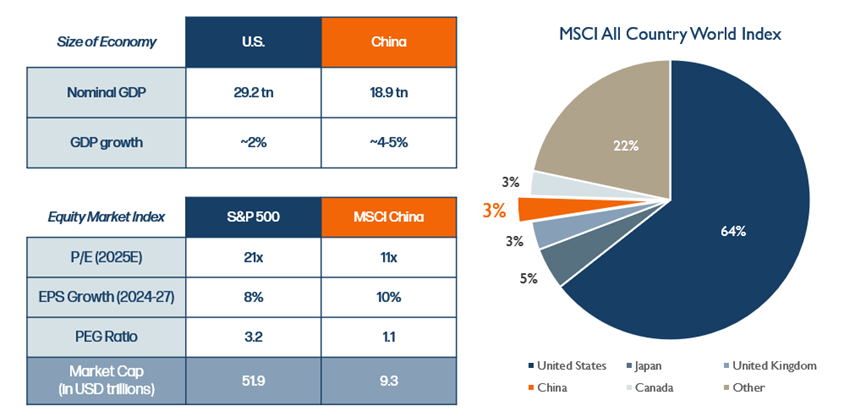

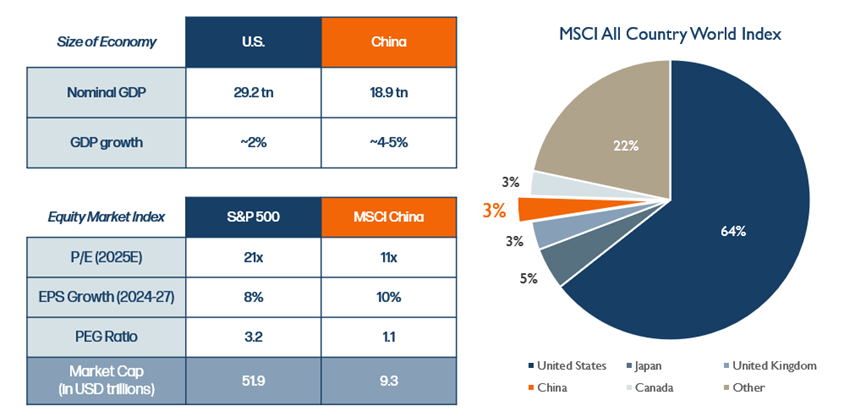

China has twice the growth of the U.S. and yet only represent a meager 3% of MSCI World Index

As Beijing becomes more selective in what it exports and prioritizes domestic strategic sectors, the deflationary spillovers the world once enjoyed are starting to fade.

Emerging Asia is stepping up to absorb parts of the global manufacturing shift. Factory investments are rising in Vietnam, Indonesia, and India. But don’t expect the same playbook.

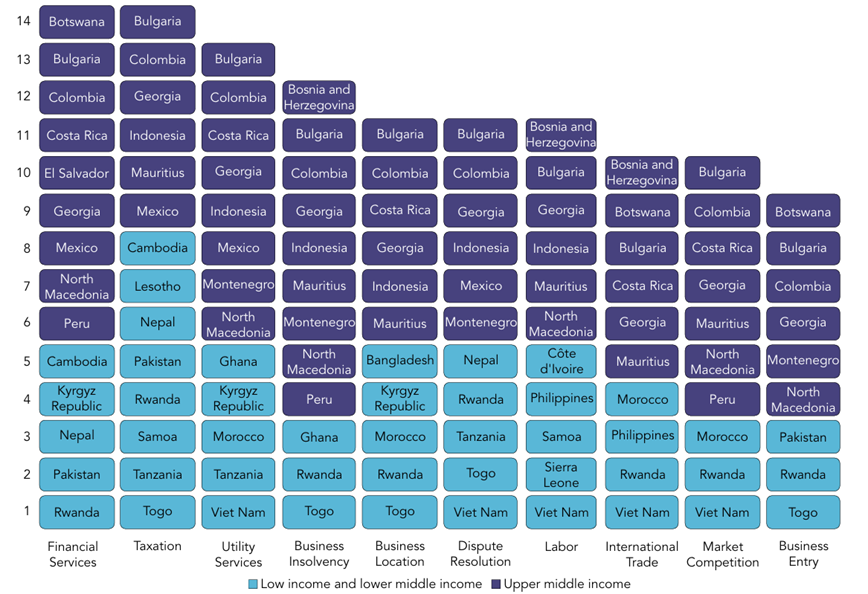

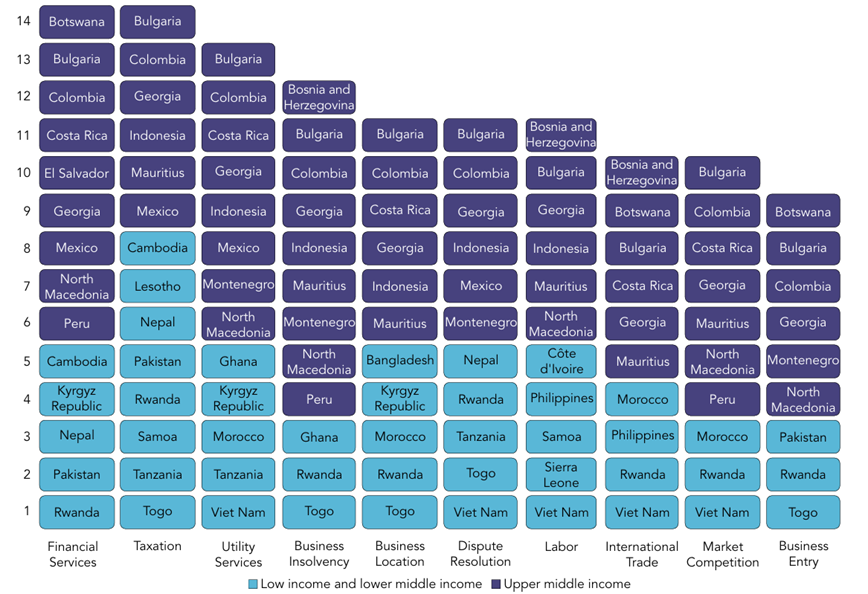

These countries are no longer just chasing cost advantage. They’re developing better infrastructure, reforming regulatory frameworks, and improving market readiness. According to the World Bank’s B-READY 2024 index, several low- and middle-income Asian economies now score in the top performance bands in key business metrics like taxation, market competition, and trade facilitation.

Emerging Asia Is Not Just Cheaper—It’s Getting Smarter

Note: Columns represent the 12 key topics that B-Ready evaluates and Y-axis represents the performance bands (quintiles) across each topic with Rank 1 = Top Performance and Rank 14= Bottom Performance

The sample comprises 50 economies. The income classification data are as of June 2024 to ensure alignment with the latest data collection period.

Source: World Bank Group, B-READY 2024

That said, costs are rising too. Labor markets are tightening. Energy and logistics infrastructure are in flux. And unlike the China of the early 2000s, these countries face a world less committed to frictionless globalization. The result? Higher costs, more regional variation, and increased pricing pressure throughout the supply chain.

Indonesia’s Quiet Pricing Evolution

At our home turf, we’re seeing early signs of a structural pivot. Indonesia’s inflation isn’t just about cost pressures. It’s about a changing economic foundation.

A young, increasingly urbanized population is fueling domestic demand. And through its ambitious industrial downstreaming policy, particularly in nickel and battery materials, the country is shifting from an exporter of raw commodities to a value-added processor.

According to recent research, Indonesia now accounts for over 60% of global nickel production, up from 30% a decade ago.

This shift gives select firms the leverage to shape global prices, especially where strategic resources are concerned. Think of it as the OPEC moment, but for battery metals.

Asia’s Ecosystem Advantage: Scarcity Meets Stickiness

If scarcity grants the power to raise prices, ecosystems create the conditions to make it stick.

Asia’s tech and consumer giants are not just selling products — they’re engineering platforms, communities, and behavioral defaults.

In China, WeChat and Alipay pioneered the superapp model, integrating messaging, payments, shopping, and services into one seamless experience. They’re not just apps; they’re operating systems for daily life.

Southeast Asia followed with Grab and Gojek, evolving from ride-hailing platforms into fintech, delivery, and logistics hubs. They don’t just deliver food or rides; they deliver habits. The more you use them, the harder it is to leave. Add loyalty points, embedded wallets, and gamified experiences, and you’ve got not just a user base, but a captive audience.

Shopee applies the same logic in e-commerce. The better they target you, the more you buy. The more you buy, the more they know. Over time, this creates not just pricing power, but behavioral momentum.

What’s unique about Asia is that much of this growth is happening in mobile-first environments. In places like Indonesia, the Philippines, and Vietnam, users leapfrog traditional infrastructure and go straight to digital. That means companies can shape habits before they’re fully formed.

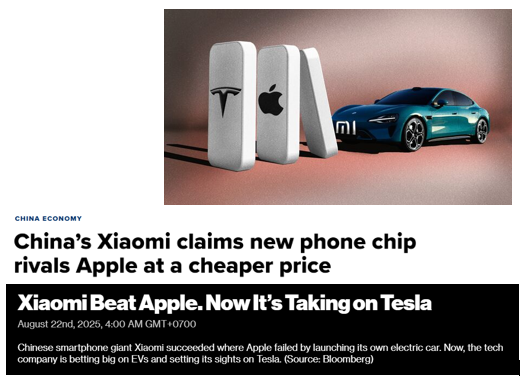

Meanwhile, China isn’t just building superapps. It’s building global champions. Xiaomi and BYD now compete across smartphones, EVs, and smart home devices. It’s not mission creep — it’s ecosystem control. These firms integrate hardware, software, and supply chains, locking in users and cost advantages alike.

And investors are starting to notice.

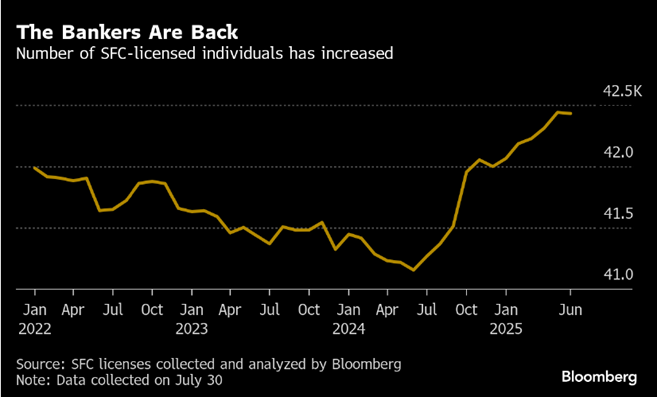

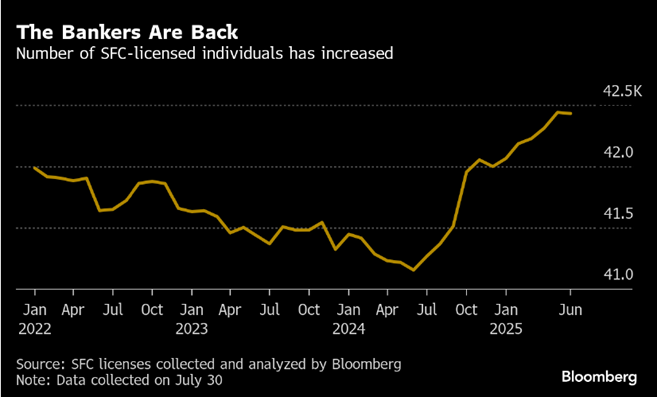

In H1 2025, Hong Kong IPOs surged nearly 8x to $17 billion, led by Chinese consumer and tech firms like CATL, Mixue, and Xiaomi. This isn’t just liquidity hunting — it’s global signaling. These are companies with pricing power at home, now going global with capital to back it.

Renewed surge of interest in investment banking in Hong Kong

It’s no coincidence that capital markets are rewarding ecosystem builders. They don’t just have users. They have pricing leverage.

From Cost Center to Price-Maker

The takeaway?

Asia is no longer just a passive cog in the global supply machine. In multiple ways through industrial strategy, ecosystem-building, demographic shifts, and resource control, it is becoming an active shaper of global pricing dynamics.

Investors who still think of the region as just the “cheap factory floor” may be missing the plot. Asia’s strategic pivot toward value-added manufacturing, digital ecosystems, domestic demand, and pricing resilience is changing how prices get set, and who gets to set them.

For years, the West asked: “What happens if China stops exporting deflation?”

Now we’re beginning to see the answer take shape.

And it’s setting a very different price.

Tara Mulia

Admin heyokha

Share

It used to be so simple.

Asia made it. The West bought it. Everyone was happy.

China kept margins slim, logistics humming, and Walmart aisles overflowing with low-cost goods. Southeast Asia played the cost-arbitrage understudy. Japan and Korea brought the tech. And in the background, central banks celebrated low inflation like it was their doing.

But that script is changing. Fast.

Exiting a Deflationary Asia, Entering a Price-Setter Asia

Today, the story is more complex. China is no longer the margin martyr it once was. Wages have risen. Demographics have shifted. And with rising geopolitical tensions, the world’s biggest exporter is turning inward.

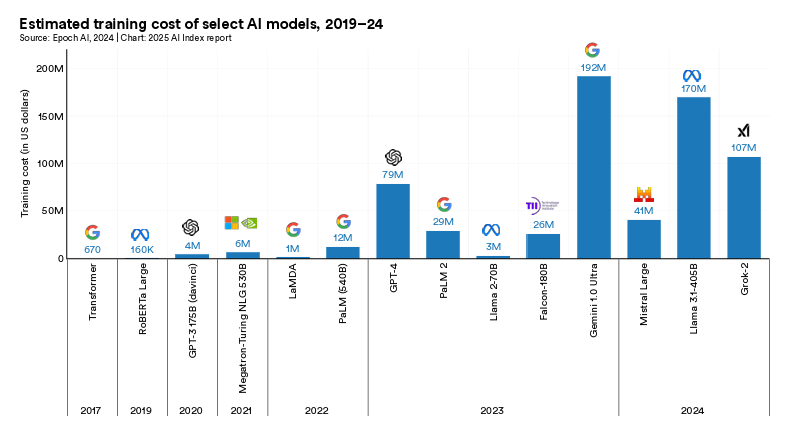

Rather than a race to the bottom, China is climbing the value chain focusing on electric vehicles, AI, semiconductors, and green tech.

China has twice the growth of the U.S. and yet only represent a meager 3% of MSCI World Index

As Beijing becomes more selective in what it exports and prioritizes domestic strategic sectors, the deflationary spillovers the world once enjoyed are starting to fade.

Emerging Asia is stepping up to absorb parts of the global manufacturing shift. Factory investments are rising in Vietnam, Indonesia, and India. But don’t expect the same playbook.

These countries are no longer just chasing cost advantage. They’re developing better infrastructure, reforming regulatory frameworks, and improving market readiness. According to the World Bank’s B-READY 2024 index, several low- and middle-income Asian economies now score in the top performance bands in key business metrics like taxation, market competition, and trade facilitation.

Emerging Asia Is Not Just Cheaper—It’s Getting Smarter

Note: Columns represent the 12 key topics that B-Ready evaluates and Y-axis represents the performance bands (quintiles) across each topic with Rank 1 = Top Performance and Rank 14= Bottom Performance

The sample comprises 50 economies. The income classification data are as of June 2024 to ensure alignment with the latest data collection period.

Source: World Bank Group, B-READY 2024

That said, costs are rising too. Labor markets are tightening. Energy and logistics infrastructure are in flux. And unlike the China of the early 2000s, these countries face a world less committed to frictionless globalization. The result? Higher costs, more regional variation, and increased pricing pressure throughout the supply chain.

Indonesia’s Quiet Pricing Evolution

At our home turf, we’re seeing early signs of a structural pivot. Indonesia’s inflation isn’t just about cost pressures. It’s about a changing economic foundation.

A young, increasingly urbanized population is fueling domestic demand. And through its ambitious industrial downstreaming policy, particularly in nickel and battery materials, the country is shifting from an exporter of raw commodities to a value-added processor.

According to recent research, Indonesia now accounts for over 60% of global nickel production, up from 30% a decade ago.

This shift gives select firms the leverage to shape global prices, especially where strategic resources are concerned. Think of it as the OPEC moment, but for battery metals.

Asia’s Ecosystem Advantage: Scarcity Meets Stickiness

If scarcity grants the power to raise prices, ecosystems create the conditions to make it stick.

Asia’s tech and consumer giants are not just selling products — they’re engineering platforms, communities, and behavioral defaults.

In China, WeChat and Alipay pioneered the superapp model, integrating messaging, payments, shopping, and services into one seamless experience. They’re not just apps; they’re operating systems for daily life.

Southeast Asia followed with Grab and Gojek, evolving from ride-hailing platforms into fintech, delivery, and logistics hubs. They don’t just deliver food or rides; they deliver habits. The more you use them, the harder it is to leave. Add loyalty points, embedded wallets, and gamified experiences, and you’ve got not just a user base, but a captive audience.

Shopee applies the same logic in e-commerce. The better they target you, the more you buy. The more you buy, the more they know. Over time, this creates not just pricing power, but behavioral momentum.

What’s unique about Asia is that much of this growth is happening in mobile-first environments. In places like Indonesia, the Philippines, and Vietnam, users leapfrog traditional infrastructure and go straight to digital. That means companies can shape habits before they’re fully formed.

Meanwhile, China isn’t just building superapps. It’s building global champions. Xiaomi and BYD now compete across smartphones, EVs, and smart home devices. It’s not mission creep — it’s ecosystem control. These firms integrate hardware, software, and supply chains, locking in users and cost advantages alike.

And investors are starting to notice.

In H1 2025, Hong Kong IPOs surged nearly 8x to $17 billion, led by Chinese consumer and tech firms like CATL, Mixue, and Xiaomi. This isn’t just liquidity hunting — it’s global signaling. These are companies with pricing power at home, now going global with capital to back it.

Renewed surge of interest in investment banking in Hong Kong

It’s no coincidence that capital markets are rewarding ecosystem builders. They don’t just have users. They have pricing leverage.

From Cost Center to Price-Maker

The takeaway?

Asia is no longer just a passive cog in the global supply machine. In multiple ways through industrial strategy, ecosystem-building, demographic shifts, and resource control, it is becoming an active shaper of global pricing dynamics.

Investors who still think of the region as just the “cheap factory floor” may be missing the plot. Asia’s strategic pivot toward value-added manufacturing, digital ecosystems, domestic demand, and pricing resilience is changing how prices get set, and who gets to set them.

For years, the West asked: “What happens if China stops exporting deflation?”

Now we’re beginning to see the answer take shape.

And it’s setting a very different price.

Tara Mulia

Admin heyokha

Share