The early miles were filled with the sound of tires crunching on gravel and the chatter of fellow cyclists, all sharing the same ambitious goal. The terrain quickly becomes demanding, with steep climbs and sharp descents testing your legs and bike handling skills. The landscape stretches endlessly before you, offering breathtaking views of rolling hills, vast prairies, and the occasional wild animal companion.

As the miles accumulate, fatigue sets in. The sun beats down mercilessly, and the wind, sometimes a gentle nudge, other times a relentless force, adds to the challenge.

The loneliness of the open road is both daunting and liberating, giving you space to reflect on why you chose this challenge. The scenery, ever-changing yet consistently harsh, becomes a silent companion in your journey.

This is a common experience that extreme cyclists are all too familiar with.

In a world captivated by the grandeur of the Olympics and the Tour de France, it’s easy to overlook the extraordinary feats of endurance and resilience happening right in our backyard. Enter John Boemihardjo, an Indonesian cyclist whose journey embodies the indomitable human spirit. His story isn’t just a testament to perseverance; it’s a powerful parallel to the world of investments, where grit and strategy are key.

Then vs Now: John’s amazing health transformation

Initially weighing 103 kg, John dropped 28kg since starting to cycle

John’s journey into cycling began in 2013, under circumstances that would have deterred many. Diagnosed with a herniated disk and weighing 103 kg, he was advised by his chiropractor to take up cycling. What began as a health recommendation quickly morphed into a life-altering passion. John shed 28 kg, competed in his first race, and discovered a new zest for life. He has been unstoppable ever since.

With countless races under his belt, John’s recent feat in the East Java Journey this past March, an ultra-cycling event covering 1,500 km with a staggering 16,000 meters of elevation with a time limit of 156 hours stands out. He accomplished the course in just 101 hours, encompassing 4 full days and he shows no signs of stopping anytime soon.

East Java Journey, one of the hardest races John has ever done

The route spans across 4 cities of Surabaya, Madiun, Blitar, and Banyuwangi covering a total of 1500 km

Picture 1 (left): John with the backdrop of Mount Semeru

Picture 2 (right): full map course of the East Java Journey 1500

The Unbound Gravel race in America, one of the toughest gravel cycling events tested John. For context, it has a 43% DNF (Did Not Finish) rate given how difficult it is and John faced the challenge not once, but twice in 2021 and 2022!

Facing dehydration, mud, and the grueling task of hauling his bike through sludge, John’s relentless spirit shone through all 200 miles (320 km). He finished his 2022 race in just 13 hours and 34 minutes. Fast mortals typically finish in 12-16 hours and the majority nearly 20 hours long. On top of beating his previous year’s record of 16 hours and 13 minutes, he finished before sundown receiving the “Race the Sun” award. Talk about incredible growth!

Snapshots from the Unbound Gravel race in Kansas, United States

Bikers haul through the 200 mile route facing inclement weather, gravel, and dirt roads that can become mud roads

Image credits: Unbound Gravel website and Life Time

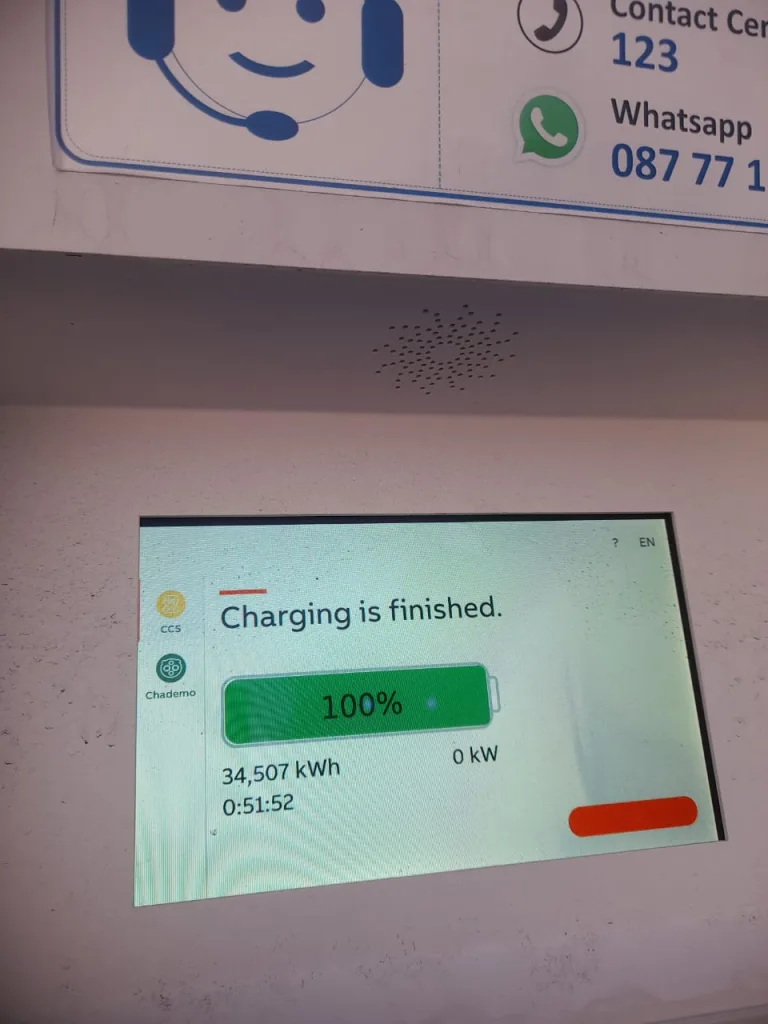

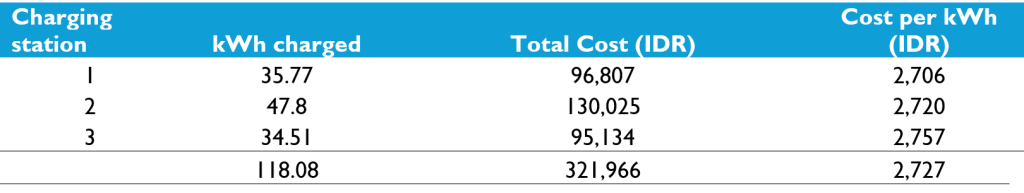

As of last week – John has also completed the Bentang Java race which encompasses the whole of Java island. This race is a more challenging route that is entirely self-navigated and unsupported, meaning no help or assistance from third parties including friends, relatives, family, acquaintances or even the local residents in any form. Cyclists have to rely on themselves and bring their own necessities including clothes, spare equipment, water, food, and medicine from the start of the race or purchase along the day.

John finished in just 4 days 12 hours 16 minutes, placing 5th! His journey for this recent race is one for the books. Facing stomach pains mid-way that led to a fever, John had to make the tough decision to take longer rest times to keep going. On top of that, he also had instances where he got lost due to surprising dead-ends and lack of road infrastructure. “At one point, there was no road or another instance where there was one but it was totally covered in banana trees!”, John recounted. Despite not surpassing his target of less than 4 days, John was all smiles by the end citing his spirit to keep pushing and the valuable lesson to have a plan B and C if plan A doesn’t work out.

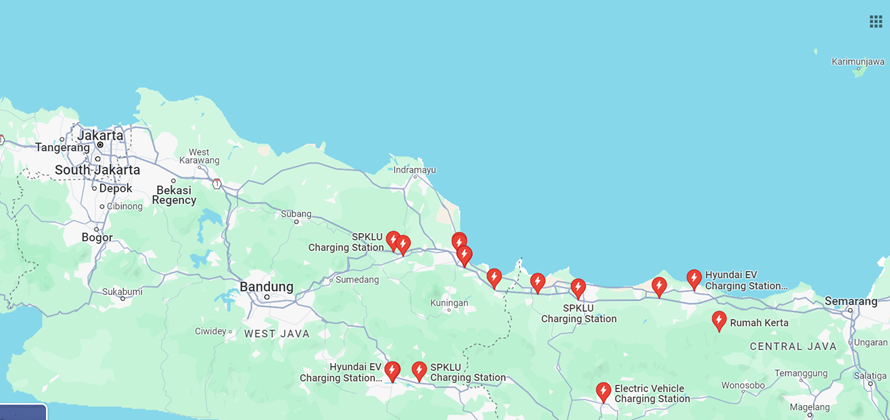

Bentang Java, an unsupported and unguided tour across Java

Participants depart from the westernmost province of Banten all the way east ending at Banyuwangi

John finishing 5th place wearing his custom jersey with our Heyokha logo!

When asked about his most challenging moments, John’s response was telling. “The body wants to stop, but the mind wants to keep going,” he said. This battle between mind and body is not just a cycling challenge—it’s a metaphor for the investment world. In the face of market volatility or business setbacks, the ability to push forward and keep a long-term perspective is crucial.

John’s cycling adventures offer profound lessons for investments and business. The negative split strategy in cycling—pacing oneself in the first half and accelerating in the second—mirrors the patience needed in investing. It’s about staying calm during market lows and seizing opportunities during the highs.

His adaptability in the Unbound Gravel races and Bentang Java, switching between offensive and defensive tactics, echoes the dynamic decision-making required in investment management. Knowing when to take risks and when to hold back is a skill that translates directly from the track to the boardroom.

All smiles galore at the finish line

John and fellow cyclist Edo Bawono finishing Unbound Gravel 2022 beating the sunrise under 14 hours

John’s mantra, “Buang pikiran menyerah, dan biasakan finish what you have started”, which translates to “Discard thoughts of giving up and always finish what you start”, encapsulates a mindset that resonates deeply with us. The patience, persistence, and pain resistance that make John a phenomenal cyclist are the same traits that define successful investors. Challenges are inevitable, but a resilient spirit makes all the difference. At Heyokha Brothers, we embody this spirit—constantly challenging conventional thinking and adapting to change to provide unparalleled investment perspectives and solutions.

In our fast-paced digital age, it’s easy to become overly focused on outcomes, overlooking the intrinsic beauty of the process. John Boemihardjo’s journey offers a refreshing counterbalance—a return to real experiences and the great outdoors, which aligns closely with Heyokha’s investment philosophy. We’re committed to harmonizing the digital and physical realms, fostering a sense of togetherness through shared experiences. Whether it’s a local cycling club or a family hike, these activities bring people together, much like a well-played game of Monopoly—minus the inevitable family feud over who gets to be the banker.

John’s mantra isn’t just a slogan; it’s a way of life that resonates with us. His journey embodies the resilience of the human spirit—the ability to persevere, adapt, and thrive amidst challenges. This resilience is crucial not only in sports or investments but in all aspects of life. Investing without a sense of adventure is like cycling without a bike: you’re not going far! So, when you find yourself lost in the digital abyss, remember that there’s a whole world out there waiting to be explored. The best investments are often those that bring you back to what truly matters—living, laughing, and loving the journey.

Tara Mulia and Chloe Yu

Admin heyokha

Share

The early miles were filled with the sound of tires crunching on gravel and the chatter of fellow cyclists, all sharing the same ambitious goal. The terrain quickly becomes demanding, with steep climbs and sharp descents testing your legs and bike handling skills. The landscape stretches endlessly before you, offering breathtaking views of rolling hills, vast prairies, and the occasional wild animal companion.

As the miles accumulate, fatigue sets in. The sun beats down mercilessly, and the wind, sometimes a gentle nudge, other times a relentless force, adds to the challenge.

The loneliness of the open road is both daunting and liberating, giving you space to reflect on why you chose this challenge. The scenery, ever-changing yet consistently harsh, becomes a silent companion in your journey.

This is a common experience that extreme cyclists are all too familiar with.

In a world captivated by the grandeur of the Olympics and the Tour de France, it’s easy to overlook the extraordinary feats of endurance and resilience happening right in our backyard. Enter John Boemihardjo, an Indonesian cyclist whose journey embodies the indomitable human spirit. His story isn’t just a testament to perseverance; it’s a powerful parallel to the world of investments, where grit and strategy are key.

Then vs Now: John’s amazing health transformation

Initially weighing 103 kg, John dropped 28kg since starting to cycle

John’s journey into cycling began in 2013, under circumstances that would have deterred many. Diagnosed with a herniated disk and weighing 103 kg, he was advised by his chiropractor to take up cycling. What began as a health recommendation quickly morphed into a life-altering passion. John shed 28 kg, competed in his first race, and discovered a new zest for life. He has been unstoppable ever since.

With countless races under his belt, John’s recent feat in the East Java Journey this past March, an ultra-cycling event covering 1,500 km with a staggering 16,000 meters of elevation with a time limit of 156 hours stands out. He accomplished the course in just 101 hours, encompassing 4 full days and he shows no signs of stopping anytime soon.

East Java Journey, one of the hardest races John has ever done

The route spans across 4 cities of Surabaya, Madiun, Blitar, and Banyuwangi covering a total of 1500 km

Picture 1 (left): John with the backdrop of Mount Semeru

Picture 2 (right): full map course of the East Java Journey 1500

The Unbound Gravel race in America, one of the toughest gravel cycling events tested John. For context, it has a 43% DNF (Did Not Finish) rate given how difficult it is and John faced the challenge not once, but twice in 2021 and 2022!

Facing dehydration, mud, and the grueling task of hauling his bike through sludge, John’s relentless spirit shone through all 200 miles (320 km). He finished his 2022 race in just 13 hours and 34 minutes. Fast mortals typically finish in 12-16 hours and the majority nearly 20 hours long. On top of beating his previous year’s record of 16 hours and 13 minutes, he finished before sundown receiving the “Race the Sun” award. Talk about incredible growth!

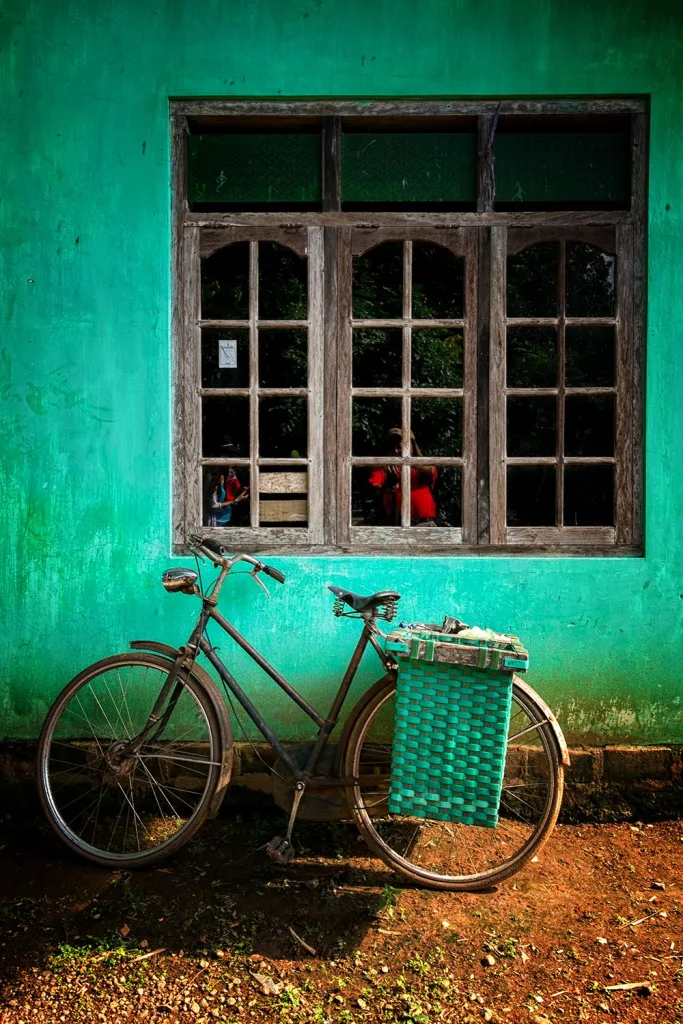

Snapshots from the Unbound Gravel race in Kansas, United States

Bikers haul through the 200 mile route facing inclement weather, gravel, and dirt roads that can become mud roads

Image credits: Unbound Gravel website and Life Time

As of last week – John has also completed the Bentang Java race which encompasses the whole of Java island. This race is a more challenging route that is entirely self-navigated and unsupported, meaning no help or assistance from third parties including friends, relatives, family, acquaintances or even the local residents in any form. Cyclists have to rely on themselves and bring their own necessities including clothes, spare equipment, water, food, and medicine from the start of the race or purchase along the day.

John finished in just 4 days 12 hours 16 minutes, placing 5th! His journey for this recent race is one for the books. Facing stomach pains mid-way that led to a fever, John had to make the tough decision to take longer rest times to keep going. On top of that, he also had instances where he got lost due to surprising dead-ends and lack of road infrastructure. “At one point, there was no road or another instance where there was one but it was totally covered in banana trees!”, John recounted. Despite not surpassing his target of less than 4 days, John was all smiles by the end citing his spirit to keep pushing and the valuable lesson to have a plan B and C if plan A doesn’t work out.

Bentang Java, an unsupported and unguided tour across Java

Participants depart from the westernmost province of Banten all the way east ending at Banyuwangi

John finishing 5th place wearing his custom jersey with our Heyokha logo!

When asked about his most challenging moments, John’s response was telling. “The body wants to stop, but the mind wants to keep going,” he said. This battle between mind and body is not just a cycling challenge—it’s a metaphor for the investment world. In the face of market volatility or business setbacks, the ability to push forward and keep a long-term perspective is crucial.

John’s cycling adventures offer profound lessons for investments and business. The negative split strategy in cycling—pacing oneself in the first half and accelerating in the second—mirrors the patience needed in investing. It’s about staying calm during market lows and seizing opportunities during the highs.

His adaptability in the Unbound Gravel races and Bentang Java, switching between offensive and defensive tactics, echoes the dynamic decision-making required in investment management. Knowing when to take risks and when to hold back is a skill that translates directly from the track to the boardroom.

All smiles galore at the finish line

John and fellow cyclist Edo Bawono finishing Unbound Gravel 2022 beating the sunrise under 14 hours

John’s mantra, “Buang pikiran menyerah, dan biasakan finish what you have started”, which translates to “Discard thoughts of giving up and always finish what you start”, encapsulates a mindset that resonates deeply with us. The patience, persistence, and pain resistance that make John a phenomenal cyclist are the same traits that define successful investors. Challenges are inevitable, but a resilient spirit makes all the difference. At Heyokha Brothers, we embody this spirit—constantly challenging conventional thinking and adapting to change to provide unparalleled investment perspectives and solutions.

In our fast-paced digital age, it’s easy to become overly focused on outcomes, overlooking the intrinsic beauty of the process. John Boemihardjo’s journey offers a refreshing counterbalance—a return to real experiences and the great outdoors, which aligns closely with Heyokha’s investment philosophy. We’re committed to harmonizing the digital and physical realms, fostering a sense of togetherness through shared experiences. Whether it’s a local cycling club or a family hike, these activities bring people together, much like a well-played game of Monopoly—minus the inevitable family feud over who gets to be the banker.

John’s mantra isn’t just a slogan; it’s a way of life that resonates with us. His journey embodies the resilience of the human spirit—the ability to persevere, adapt, and thrive amidst challenges. This resilience is crucial not only in sports or investments but in all aspects of life. Investing without a sense of adventure is like cycling without a bike: you’re not going far! So, when you find yourself lost in the digital abyss, remember that there’s a whole world out there waiting to be explored. The best investments are often those that bring you back to what truly matters—living, laughing, and loving the journey.

Tara Mulia and Chloe Yu

Admin heyokha

Share