Would you book a factory tour for your next vacation? For a growing number of tourists, the answer is a very enthusiastic yes.

In a world where selfie spots range from natural wonders to theme parks, it’s China’s EV factories, humanoid robot plants, and chip-making floors that are drawing crowds. What seems quirky at first glance is telling us something deeper: China’s industrial confidence is becoming visible, emotional, and contagious.

China’s Machines Go Public

The rise of industrial tourism in China might seem like a novel travel trend, but it’s more than that — it’s cultural signaling.

Xiaomi’s EV factory has opened its doors to influencers and visitors alike, drawing waves of attention. But the excursion proved incredibly popular, and Xiaomi quickly began scheduling significantly more slots. In July, the company said it will offer one tour every weekday and six tours most weekends, accommodating more than 1,100 visitors in total. When July registration opened, however, over 27,000 applications flooded in overnight, according to the Xiaomi app, so the chances of snagging a ticket remain slim.

Tourists in a car manufacturing factory. Source: Asia News

It’s not just Xiaomi. Nio, another leading EV maker in China, has been publicly showcasing one of its highly automated factories since late 2023. In 2024 alone, over 130,000 people visited the facility, where certain production lines like the body shop have achieved 100 percent automation.

What we’re seeing is the factory no longer being a black box — it’s a stage. And the audience is growing.

As we explored in Asia’s Factory Is Naming Its Price, manufacturing used to be about cost. Now it’s about control — over narrative and over price.

Xiaomi’s Strategy – Not Just PR, But Performance

All this industrial theater would ring hollow if it weren’t backed by real capability. But in Xiaomi’s case, it is.

With the launch of its SU7 electric sedan, Xiaomi is attempting to do to EVs what it did to smartphones: create high-spec, beautifully designed products at disruptive price points. The move wasn’t a pivot but a long game with years of ecosystem building, from user interfaces to IoT integration, which paved the way.

While Western automakers struggle with fragmented digital platforms, Xiaomi enters the EV market with native fluency in software, supply chain discipline, and a user base conditioned to expect more for less.

This evolution also signals a deeper truth: while the West often underestimates China’s capacity for reinvention, companies like Xiaomi are proving that innovation isn’t confined to Silicon Valley. The complacency of incumbents is being met with ambition, integration, and execution.

Just as sleek as a Porsche, but at a third of the price!

There was a time when brands like Porsche could command higher prices because they were much better cars — better engineered, faster, more reliable. The price premium was justified by superior performance.

That equation has flipped. Today, it is Chinese cars like Xiaomi’s SU7 Ultra that are not only better than Porsche on critical measures — range, technology, connectivity, integration — but also much less expensive. The performance gap has closed, and in some dimensions, reversed.

And this price difference is seen blatantly in phones too!

The most striking symbol of this shift: in July 2025, Ferrari, one of the most prestigious car manufacturers in the world, bought a Xiaomi SU7 Ultra to study and reverse engineer. What was once unthinkable is now reality: the icon of European automotive excellence looking to a Chinese upstart for lessons in how to build the future.

Xiaomi SU7 Ultra spotted at the Ferrari factory in Maranello, Italy

We called this shift in The Great Deflation Reversal: the return of pricing power—especially from Asia. Xiaomi’s EV play isn’t a detour. It’s the roadmap.

Policy as Engine – Strategic Scarcity

China’s rise in industrial confidence and competitiveness isn’t purely market-led — it’s policy-aligned.

The government’s “Made in China 2025” program has targeted strategic sectors such as semiconductors, green energy, and AI infrastructure, with an eye on capturing chokepoints and pushing domestic champions. This deliberate intervention has fostered vertically integrated giants capable of not just manufacturing, but shaping prices and standards.

In practical terms, this means engineered scarcity, whether through export controls on rare earths or encouraging homegrown substitution in critical tech. Lower-tier manufacturing may spill over into Southeast Asia, but the value-added layers — design, R&D, component monopolies — are staying onshore.

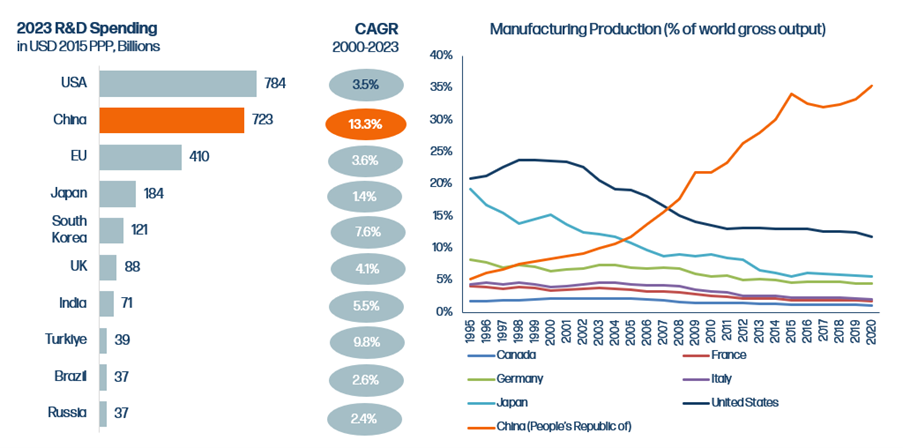

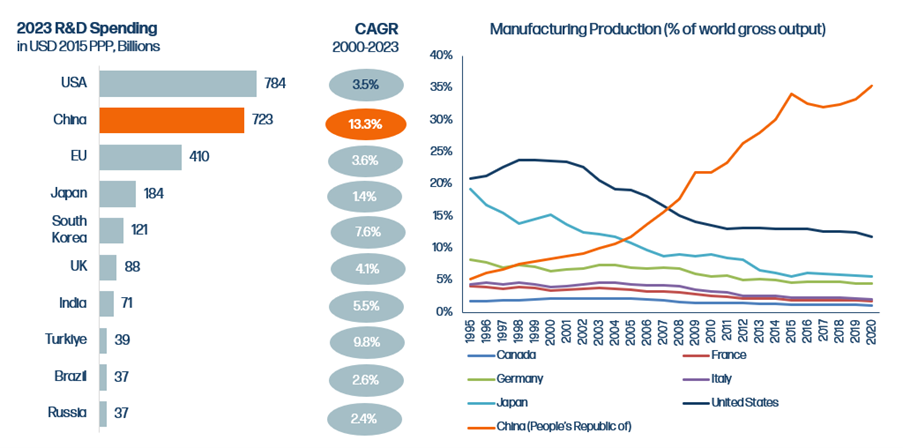

China is close to surpassing the U.S. in R&D spending and dominates in manufacturing production

This reshoring of strategic control flips the script. Rather than competing solely on price, Chinese firms now compete on indispensability.

We unpacked this in What’s the Price of Sovereignty?: in a world of fragmentation and friendshoring, the country that owns the blueprint, the supply chain, and the customer wins.

Closing Thoughts: Selfies Are Signals

Tourists don’t line up to see just any factory. They line up to see what they believe is the future.

What we’re witnessing is more than a PR stunt. It’s a shift in confidence and soft power. By making industrial capacity visible, emotionally resonant, and nationally celebrated, China is rewriting the rules of manufacturing prestige.

In a world of inflation, fragmentation, and geopolitical noise, this matters. The next economic era may not be led by who makes the loudest policy speech, but by who turns their production lines into aspirational experiences.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

Would you book a factory tour for your next vacation? For a growing number of tourists, the answer is a very enthusiastic yes.

In a world where selfie spots range from natural wonders to theme parks, it’s China’s EV factories, humanoid robot plants, and chip-making floors that are drawing crowds. What seems quirky at first glance is telling us something deeper: China’s industrial confidence is becoming visible, emotional, and contagious.

China’s Machines Go Public

The rise of industrial tourism in China might seem like a novel travel trend, but it’s more than that — it’s cultural signaling.

Xiaomi’s EV factory has opened its doors to influencers and visitors alike, drawing waves of attention. But the excursion proved incredibly popular, and Xiaomi quickly began scheduling significantly more slots. In July, the company said it will offer one tour every weekday and six tours most weekends, accommodating more than 1,100 visitors in total. When July registration opened, however, over 27,000 applications flooded in overnight, according to the Xiaomi app, so the chances of snagging a ticket remain slim.

Tourists in a car manufacturing factory. Source: Asia News

It’s not just Xiaomi. Nio, another leading EV maker in China, has been publicly showcasing one of its highly automated factories since late 2023. In 2024 alone, over 130,000 people visited the facility, where certain production lines like the body shop have achieved 100 percent automation.

What we’re seeing is the factory no longer being a black box — it’s a stage. And the audience is growing.

As we explored in Asia’s Factory Is Naming Its Price, manufacturing used to be about cost. Now it’s about control — over narrative and over price.

Xiaomi’s Strategy – Not Just PR, But Performance

All this industrial theater would ring hollow if it weren’t backed by real capability. But in Xiaomi’s case, it is.

With the launch of its SU7 electric sedan, Xiaomi is attempting to do to EVs what it did to smartphones: create high-spec, beautifully designed products at disruptive price points. The move wasn’t a pivot but a long game with years of ecosystem building, from user interfaces to IoT integration, which paved the way.

While Western automakers struggle with fragmented digital platforms, Xiaomi enters the EV market with native fluency in software, supply chain discipline, and a user base conditioned to expect more for less.

This evolution also signals a deeper truth: while the West often underestimates China’s capacity for reinvention, companies like Xiaomi are proving that innovation isn’t confined to Silicon Valley. The complacency of incumbents is being met with ambition, integration, and execution.

Just as sleek as a Porsche, but at a third of the price!

There was a time when brands like Porsche could command higher prices because they were much better cars — better engineered, faster, more reliable. The price premium was justified by superior performance.

That equation has flipped. Today, it is Chinese cars like Xiaomi’s SU7 Ultra that are not only better than Porsche on critical measures — range, technology, connectivity, integration — but also much less expensive. The performance gap has closed, and in some dimensions, reversed.

And this price difference is seen blatantly in phones too!

The most striking symbol of this shift: in July 2025, Ferrari, one of the most prestigious car manufacturers in the world, bought a Xiaomi SU7 Ultra to study and reverse engineer. What was once unthinkable is now reality: the icon of European automotive excellence looking to a Chinese upstart for lessons in how to build the future.

Xiaomi SU7 Ultra spotted at the Ferrari factory in Maranello, Italy

We called this shift in The Great Deflation Reversal: the return of pricing power—especially from Asia. Xiaomi’s EV play isn’t a detour. It’s the roadmap.

Policy as Engine – Strategic Scarcity

China’s rise in industrial confidence and competitiveness isn’t purely market-led — it’s policy-aligned.

The government’s “Made in China 2025” program has targeted strategic sectors such as semiconductors, green energy, and AI infrastructure, with an eye on capturing chokepoints and pushing domestic champions. This deliberate intervention has fostered vertically integrated giants capable of not just manufacturing, but shaping prices and standards.

In practical terms, this means engineered scarcity, whether through export controls on rare earths or encouraging homegrown substitution in critical tech. Lower-tier manufacturing may spill over into Southeast Asia, but the value-added layers — design, R&D, component monopolies — are staying onshore.

China is close to surpassing the U.S. in R&D spending and dominates in manufacturing production

This reshoring of strategic control flips the script. Rather than competing solely on price, Chinese firms now compete on indispensability.

We unpacked this in What’s the Price of Sovereignty?: in a world of fragmentation and friendshoring, the country that owns the blueprint, the supply chain, and the customer wins.

Closing Thoughts: Selfies Are Signals

Tourists don’t line up to see just any factory. They line up to see what they believe is the future.

What we’re witnessing is more than a PR stunt. It’s a shift in confidence and soft power. By making industrial capacity visible, emotionally resonant, and nationally celebrated, China is rewriting the rules of manufacturing prestige.

In a world of inflation, fragmentation, and geopolitical noise, this matters. The next economic era may not be led by who makes the loudest policy speech, but by who turns their production lines into aspirational experiences.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

A packed-filled exhibition hall with art lovers

A packed-filled exhibition hall with art lovers

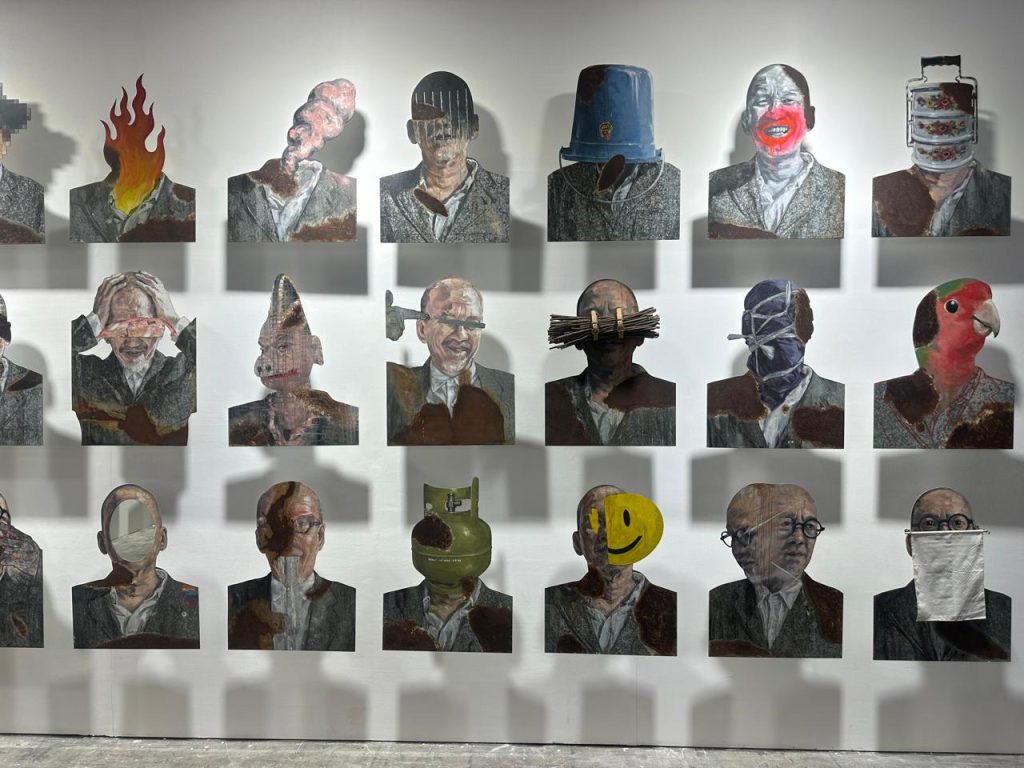

We’ve all felt like this– ranging from manic euphoria to existential dread

We’ve all felt like this– ranging from manic euphoria to existential dread

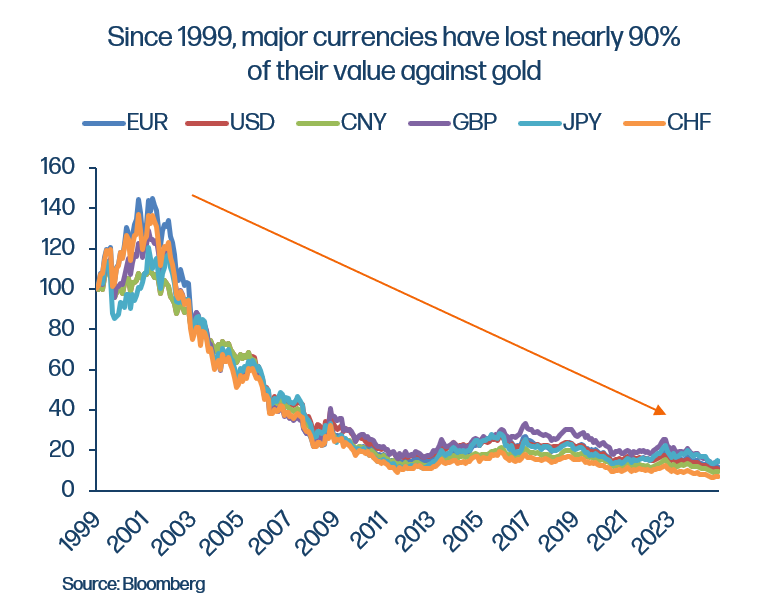

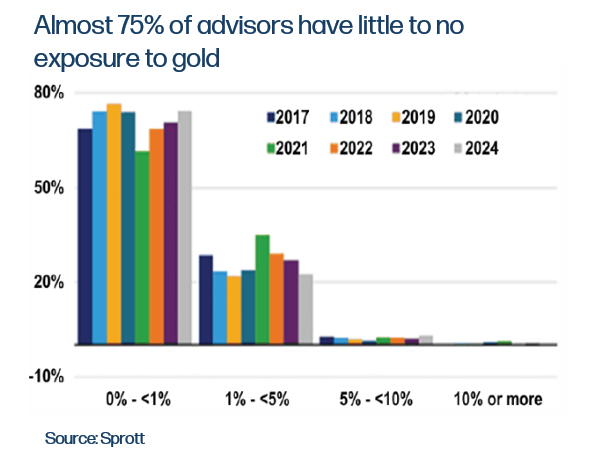

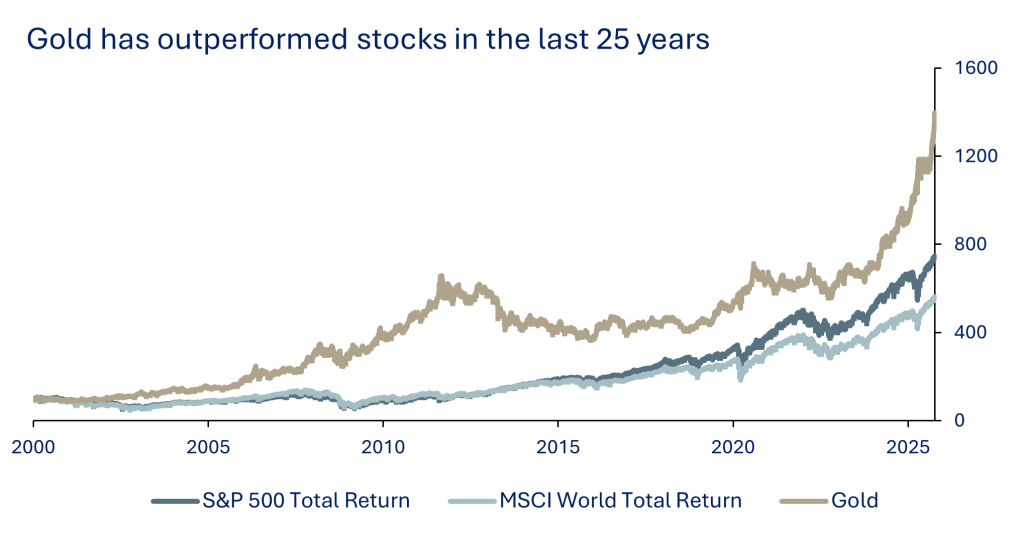

Source: Bloomberg, normalized with factor 100

Source: Bloomberg, normalized with factor 100 This isn’t the first time Treasury has collaborated with artists to showcase Gold’s strength. Here is one by artist Naufal Abshar in his “Gold is King” artpiece for Treasury x Art Jakarta Gardens in 2024.

This isn’t the first time Treasury has collaborated with artists to showcase Gold’s strength. Here is one by artist Naufal Abshar in his “Gold is King” artpiece for Treasury x Art Jakarta Gardens in 2024.

Wiharja artistically captures the colorful atmosphere and warmth of Jakarta’s Chinatown

Wiharja artistically captures the colorful atmosphere and warmth of Jakarta’s Chinatown