According to the critics, a decline in terms of trade would indicate that farmers’ economic position is deteriorating and thus that the reform program is ineffective.

While such conclusion might be an intuitive one, it’s not necessarily the right one.

This is because the terms of trade as calculated by the Indonesian Statistics Agency BPS only signals the relative development of input and output prices, but tells nothing about sales quantity and input quality.

As such, it may not say much about farmers’ income either. Let us explain.

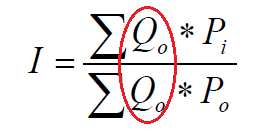

Farmers’ output and input price index is calculated based on Laspeyres price index, the formula is as follow:

Qo means the quantity is a constant factor hence increase in crops harvest does not affect the index.

For example, due to larger supply, a year with a good harvest may yield lower average sales prices as compared to the previous year.

This sales price decline would deteriorate the terms of trade. Yet, due to the higher quantity sold, the good harvest is likely to bring in more money for each farmer as compared to a bad harvest sold at higher prices due to shortage of supply.

Also, the terms of trade measure says nothing about the quality of the inputs. For example, the adoption of higher quality inputs – such as the more expensive, but higher yielding hybrid seeds – may increase input costs.

This would deteriorate the terms of trade. Yet, the higher production yields following the use of these higher quality inputs are not captured in the terms of trade calculation.

We believe the efforts made by the government are primarily aimed at improving the three drivers of production: the surface used for agriculture, yields per hectare and the number of plantings per year.

The terms of trade captures exactly none of these drivers. As such, we may quickly dismiss the usage of terms of trade as a suitable measure to assess the effectiveness of the government reform efforts in the agricultural sector.

BPS and The Indonesian Center for Agricultural Socio Economic and Policy Studies are fully aware that this metric does not measure farmer’s income and they are taking steps to improve the methodology to account for this.

Share

According to the critics, a decline in terms of trade would indicate that farmers’ economic position is deteriorating and thus that the reform program is ineffective.

While such conclusion might be an intuitive one, it’s not necessarily the right one.

This is because the terms of trade as calculated by the Indonesian Statistics Agency BPS only signals the relative development of input and output prices, but tells nothing about sales quantity and input quality.

As such, it may not say much about farmers’ income either. Let us explain.

Farmers’ output and input price index is calculated based on Laspeyres price index, the formula is as follow:

Qo means the quantity is a constant factor hence increase in crops harvest does not affect the index.

For example, due to larger supply, a year with a good harvest may yield lower average sales prices as compared to the previous year.

This sales price decline would deteriorate the terms of trade. Yet, due to the higher quantity sold, the good harvest is likely to bring in more money for each farmer as compared to a bad harvest sold at higher prices due to shortage of supply.

Also, the terms of trade measure says nothing about the quality of the inputs. For example, the adoption of higher quality inputs – such as the more expensive, but higher yielding hybrid seeds – may increase input costs.

This would deteriorate the terms of trade. Yet, the higher production yields following the use of these higher quality inputs are not captured in the terms of trade calculation.

We believe the efforts made by the government are primarily aimed at improving the three drivers of production: the surface used for agriculture, yields per hectare and the number of plantings per year.

The terms of trade captures exactly none of these drivers. As such, we may quickly dismiss the usage of terms of trade as a suitable measure to assess the effectiveness of the government reform efforts in the agricultural sector.

BPS and The Indonesian Center for Agricultural Socio Economic and Policy Studies are fully aware that this metric does not measure farmer’s income and they are taking steps to improve the methodology to account for this.

Share

Display with lights off (left); Display with lights on (right). Turning around yet preserving good old core value. Obviously, the product display looks much better with the lights on, but it also costs more. The store manager of Ramayana Cengkareng chooses to turn the lights on during the busy hours with meaningful traffic.

Display with lights off (left); Display with lights on (right). Turning around yet preserving good old core value. Obviously, the product display looks much better with the lights on, but it also costs more. The store manager of Ramayana Cengkareng chooses to turn the lights on during the busy hours with meaningful traffic. Imitative innovation unlikely to solve problems in the best possible way Back to the takeaway from the conference, one common “imitative innovation” that we observe during the conference is that many incumbents talked about their apps as a way to embark on DBT.

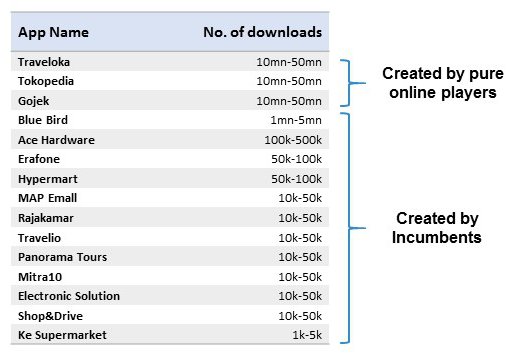

Imitative innovation unlikely to solve problems in the best possible way Back to the takeaway from the conference, one common “imitative innovation” that we observe during the conference is that many incumbents talked about their apps as a way to embark on DBT. Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.

Note: digital companies are way better at getting their apps downloaded. The app of taxi company Blue Bird was popular compared to those of traditional companies, obviously very decent although nowhere close to the tech companies such as Go-Jek.