Recently, the Indonesian seed maker BISI International (BISI), faced headwinds due to weather disruptions. With inadequate production and inventory levels, the company had little inventory to sell, almost entirely erasing net profit during the first half of 2018. Consequently, the stock price declined following the earnings result announcement.

“In the short run, the market is a voting machine; in the long run, however, it becomes a weighing machine.”

-Benjamin Graham-

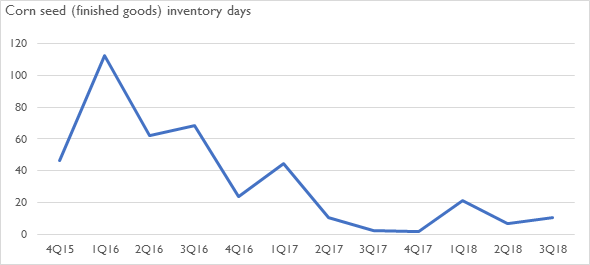

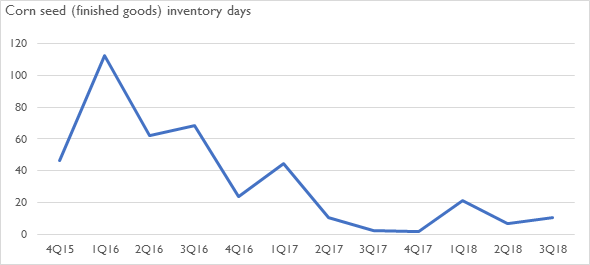

As illustrated by the chart below, BISI has near-zero corn seed inventory since the past year as production capacity can’t keep up with the strong demand growth. This explains the company’s earnings volatility in recent quarters; sales volume has been entirely dependent on production, whereas production volume is highly dependent on weather.

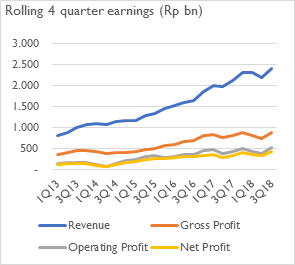

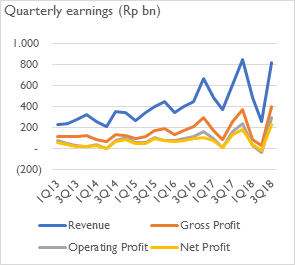

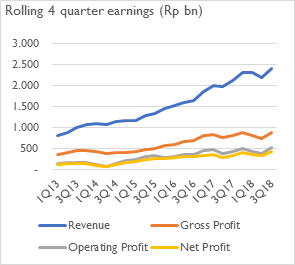

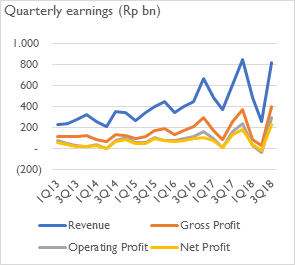

Historically, quarterly earnings have always been volatile. However, seasonally adjusted growth is very consistent on an annual basis, as illustrated by the rolling 4 quarter earnings chart below. We are seeing the same scenario this year; net profit in the single quarter of 3Q18 alone has exceeded last year’s nine months profit, fully compensating for the disruption in the past two quarters. Also, 4Q18 earnings will be helped by an increase in pesticide sales as a lagging effect from strong seed sales in the previous quarter.

Going forward, earnings volatility will become less of a concern. BISI acquired a processing facility from Monsanto in November 2017, increasing its production capacity by 60%. This will allow the company to ramp up production to maintain a healthier inventory level for times of unfavorable weather conditions.

But this is just the beginning of the story. Not only the short-term concerns are addressed, but the more important global trend and long-term outlook are also promising.

Additional corn demand from ethanol mandates

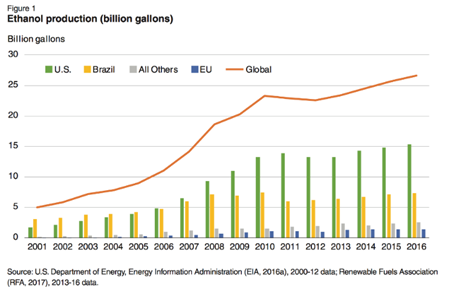

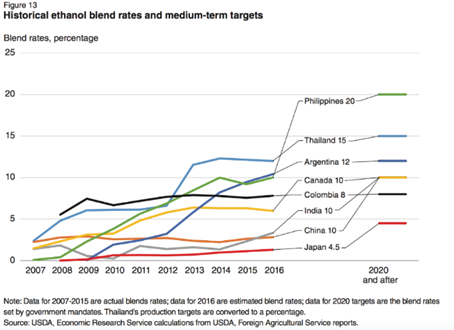

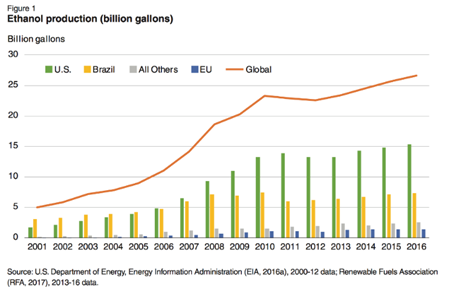

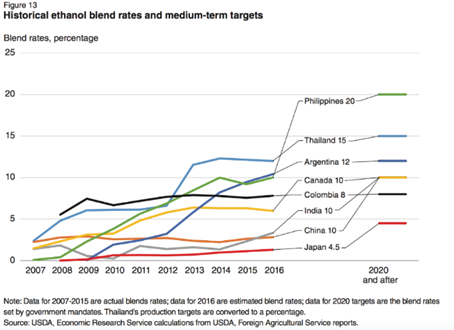

Helped by rising oil prices, we are seeing an increasing number of countries imposing higher ethanol mandates. Global ethanol production has surged by more than five-fold between 2001 and 2016 and the trend is not slowing down; many countries have medium-term targets to increase ethanol blend rates in fuel as illustrated by the chart below.

More importantly, in the past year, the two biggest economies of the world, the US and China, have announced new mandates for higher ethanol fuel content. In 2017, China announced its plan to impose 10% minimum ethanol content in fuel. Moreover, the US recently announced the plan to lift the ban on fuel with 15% ethanol content during summer months.

In total, these two mandates alone create an enormous 80mn tons of additional corn demand per year as the likely feedstock for ethanol. As a comparison, the US, as the top global producer, produces 371mn tons of corn, and Indonesia only produced 28mn tons in 2017.

Upside optionality from climate change

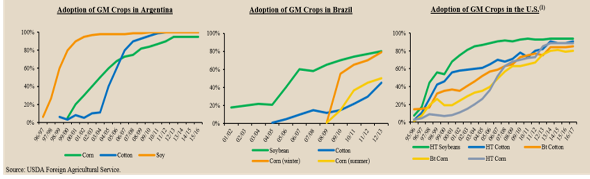

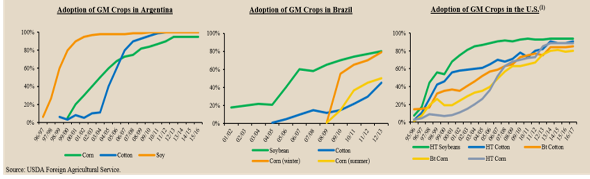

In the past 22 years, the increase in food production came almost entirely from yield improvement instead of farm area, mainly driven by GM seed adoption. However, there is a limit on GM seed adoption and we are seeing this rate plateau. Furthermore, climate change is weighing down crop yield.

A study by the US Proceedings of the National Academy of Sciences (PNAS) shows that for each degree Celsius increase in global temperature, corn yields are expected to decrease by 7.4%, wheat by 6%, rice by 3.2%, and soybean by 3.2%.

The top three corn and soybean exporting countries’ GMO seed adoption has now maxed out. Yield is set to be plateauing?

Source: US Department of Agriculture

Assuming that yield improvement is no longer a viable way to really increase production, then the growth should come from increased farm area or number of plantings; both suggest higher seed demand. Climate change also increases the frequency of extreme weather and the risk of food inflation.

Although we are not advocating that Indonesia will be among the top global corn exporters (since GM seed is not permitted), Indonesia is still a good candidate to become a corn exporter in the Southeast Asia market owing to the proximity compared to major corn exporters. In fact, Indonesia’s corn export has surged to $72.8mn in 10M18, from less than $1mn in 10M17.

Despite the positive developments, BISI is still under-appreciated

As the biggest corn seed producer in Indonesia, BISI will be a major beneficiary in the fast-growing industry. The company has a robust growth outlook, strong balance sheet, cash flow, and dividend generation, as well as attractive valuation.

Dividend payout ratio for the fiscal year 2017 was 74%, translating to a lucrative 6.25% yield while still maintaining a solid double-digit earnings growth outlook in the coming years.

Yet, its stock price is still under-appreciated by the market. Even after addressing concerns on earnings volatility, the stock price has not recovered. Considering its growth potential, valuation is very attractive at only 9x P/E.

The ‘what if’ question on Indonesian 2019 election

We are soon entering the 2019 election year for Indonesia. Since government policies play an important role in Indonesia’s agriculture sector, it is important to study how the industry will be impacted.

If President Jokowi manages to secure a second term, it is obvious that he will continue the reform agenda and we might even see the efforts accelerating. The infrastructure development under Jokowi administration is not yet over and we have yet to realize the full effect that it will bring.

Assuming the opposition wins, we can also safely assume that the agriculture sector will continue to grow rapidly considering the pro-agriculture policies based on the vision and mission statements. One major initiative is the target to add 2 million hectares of farmland to create food self-sufficiency.

Also specified in their mission statement is the effort to promote Indonesia’s ethanol industry, with the goal to create jobs and reduce the dependency of oil imports. This initiative will provide additional upside for corn demand as the likely feedstock for ethanol.

Hence, we can remain assured that Indonesia’s agriculture sector will continue to grow regardless of the election outcome.

Admin heyokha

Share

Recently, the Indonesian seed maker BISI International (BISI), faced headwinds due to weather disruptions. With inadequate production and inventory levels, the company had little inventory to sell, almost entirely erasing net profit during the first half of 2018. Consequently, the stock price declined following the earnings result announcement.

“In the short run, the market is a voting machine; in the long run, however, it becomes a weighing machine.”

-Benjamin Graham-

As illustrated by the chart below, BISI has near-zero corn seed inventory since the past year as production capacity can’t keep up with the strong demand growth. This explains the company’s earnings volatility in recent quarters; sales volume has been entirely dependent on production, whereas production volume is highly dependent on weather.

Historically, quarterly earnings have always been volatile. However, seasonally adjusted growth is very consistent on an annual basis, as illustrated by the rolling 4 quarter earnings chart below. We are seeing the same scenario this year; net profit in the single quarter of 3Q18 alone has exceeded last year’s nine months profit, fully compensating for the disruption in the past two quarters. Also, 4Q18 earnings will be helped by an increase in pesticide sales as a lagging effect from strong seed sales in the previous quarter.

Going forward, earnings volatility will become less of a concern. BISI acquired a processing facility from Monsanto in November 2017, increasing its production capacity by 60%. This will allow the company to ramp up production to maintain a healthier inventory level for times of unfavorable weather conditions.

But this is just the beginning of the story. Not only the short-term concerns are addressed, but the more important global trend and long-term outlook are also promising.

Additional corn demand from ethanol mandates

Helped by rising oil prices, we are seeing an increasing number of countries imposing higher ethanol mandates. Global ethanol production has surged by more than five-fold between 2001 and 2016 and the trend is not slowing down; many countries have medium-term targets to increase ethanol blend rates in fuel as illustrated by the chart below.

More importantly, in the past year, the two biggest economies of the world, the US and China, have announced new mandates for higher ethanol fuel content. In 2017, China announced its plan to impose 10% minimum ethanol content in fuel. Moreover, the US recently announced the plan to lift the ban on fuel with 15% ethanol content during summer months.

In total, these two mandates alone create an enormous 80mn tons of additional corn demand per year as the likely feedstock for ethanol. As a comparison, the US, as the top global producer, produces 371mn tons of corn, and Indonesia only produced 28mn tons in 2017.

Upside optionality from climate change

In the past 22 years, the increase in food production came almost entirely from yield improvement instead of farm area, mainly driven by GM seed adoption. However, there is a limit on GM seed adoption and we are seeing this rate plateau. Furthermore, climate change is weighing down crop yield.

A study by the US Proceedings of the National Academy of Sciences (PNAS) shows that for each degree Celsius increase in global temperature, corn yields are expected to decrease by 7.4%, wheat by 6%, rice by 3.2%, and soybean by 3.2%.

The top three corn and soybean exporting countries’ GMO seed adoption has now maxed out. Yield is set to be plateauing?

Source: US Department of Agriculture

Assuming that yield improvement is no longer a viable way to really increase production, then the growth should come from increased farm area or number of plantings; both suggest higher seed demand. Climate change also increases the frequency of extreme weather and the risk of food inflation.

Although we are not advocating that Indonesia will be among the top global corn exporters (since GM seed is not permitted), Indonesia is still a good candidate to become a corn exporter in the Southeast Asia market owing to the proximity compared to major corn exporters. In fact, Indonesia’s corn export has surged to $72.8mn in 10M18, from less than $1mn in 10M17.

Despite the positive developments, BISI is still under-appreciated

As the biggest corn seed producer in Indonesia, BISI will be a major beneficiary in the fast-growing industry. The company has a robust growth outlook, strong balance sheet, cash flow, and dividend generation, as well as attractive valuation.

Dividend payout ratio for the fiscal year 2017 was 74%, translating to a lucrative 6.25% yield while still maintaining a solid double-digit earnings growth outlook in the coming years.

Yet, its stock price is still under-appreciated by the market. Even after addressing concerns on earnings volatility, the stock price has not recovered. Considering its growth potential, valuation is very attractive at only 9x P/E.

The ‘what if’ question on Indonesian 2019 election

We are soon entering the 2019 election year for Indonesia. Since government policies play an important role in Indonesia’s agriculture sector, it is important to study how the industry will be impacted.

If President Jokowi manages to secure a second term, it is obvious that he will continue the reform agenda and we might even see the efforts accelerating. The infrastructure development under Jokowi administration is not yet over and we have yet to realize the full effect that it will bring.

Assuming the opposition wins, we can also safely assume that the agriculture sector will continue to grow rapidly considering the pro-agriculture policies based on the vision and mission statements. One major initiative is the target to add 2 million hectares of farmland to create food self-sufficiency.

Also specified in their mission statement is the effort to promote Indonesia’s ethanol industry, with the goal to create jobs and reduce the dependency of oil imports. This initiative will provide additional upside for corn demand as the likely feedstock for ethanol.

Hence, we can remain assured that Indonesia’s agriculture sector will continue to grow regardless of the election outcome.

Admin heyokha

Share