How Tether quietly became one of the world’s biggest gold holders, and what it signals about the future of money

When we last wrote about stablecoins, we framed them as chips at a casino, and later as claw machine tokens in a rebuilt monetary arcade. They were becoming infrastructure quietly, steadily. But what happens when that infrastructure decides to hoard bullion?

Tether, the world’s largest stablecoin issuer, has quietly become one of the most aggressive gold buyers in the world. Not a central bank. Not a sovereign wealth fund. A crypto company with a token named after a rope.

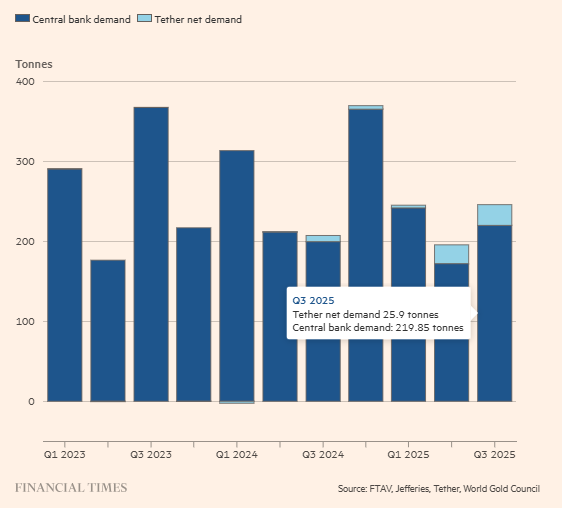

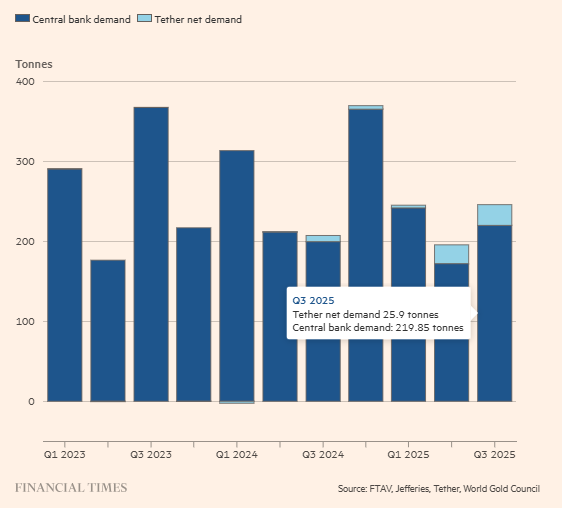

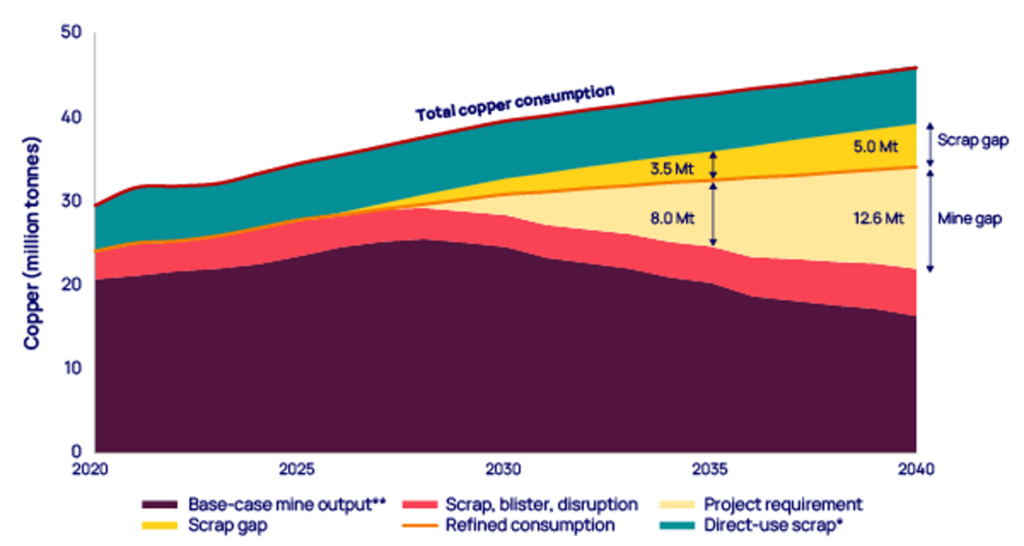

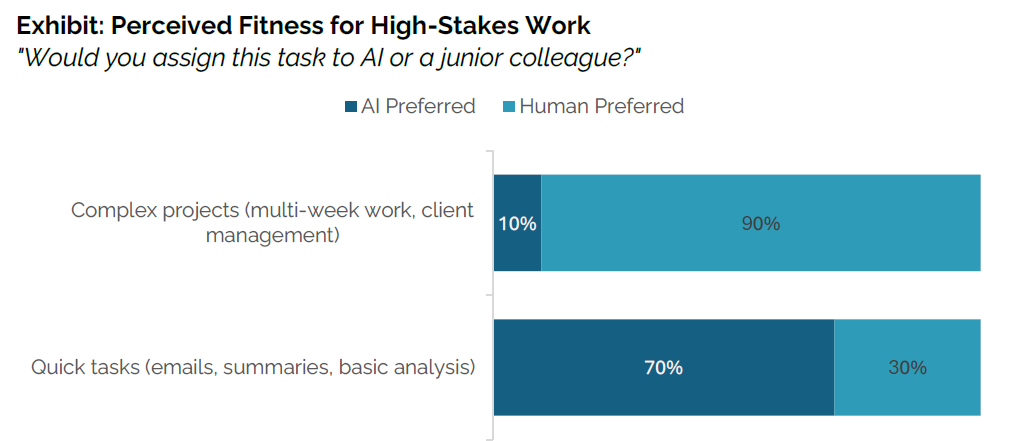

Gold purchases by quarter. Tether bought close to 12% of what the central banks were buying

Source: Financial Times

As of Q3 2025, Tether holds more than 116 tonnes of physical gold. That’s more than South Korea, Hungary, or Greece. According to Jefferies, that makes it the largest gold holder outside of central banks. Yes, probably bigger than your gold ETF. Bigger than most sovereigns. And with roughly $15 billion in projected profits this year, they’re just getting started.

It’s the most curious subplot in the financial system’s ongoing identity crisis: a crypto stablecoin company, built to track the U.S. dollar, is becoming one of the most aggressive buyers of the very metal that signals distrust in fiat.

It would be hilarious if it weren’t also brilliant.

That’s a Lot Of Gold

How can Tether afford to buy this much gold?

It starts with its business model. Tether issues USDT, a dollar-pegged token backed mostly by U.S. Treasury bills. The company earns interest on those bills but pays zero interest to USDT holders. In a world of 5% base rates and $112 billion in reserves, that spread is pure profit. We suppose they’re putting it to good use.

In Q3 2025 alone, Tether bought 26 tonnes of gold—nearly 12% of global central bank demand and about 2% of total gold demand. If Tether ploughs half its profits into bullion, that pace could double.

But it’s not just bars in a vault.

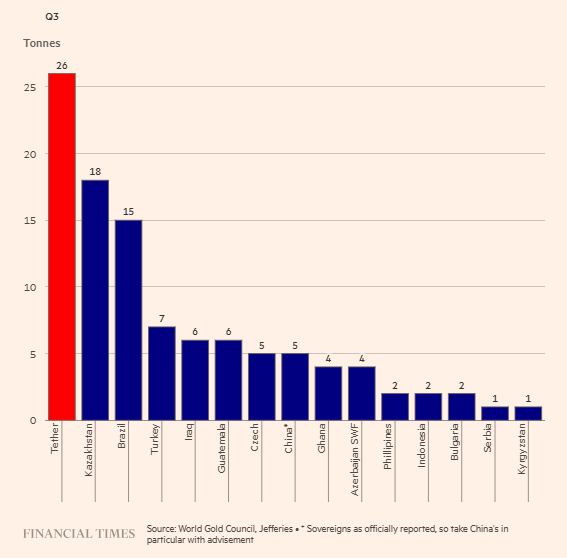

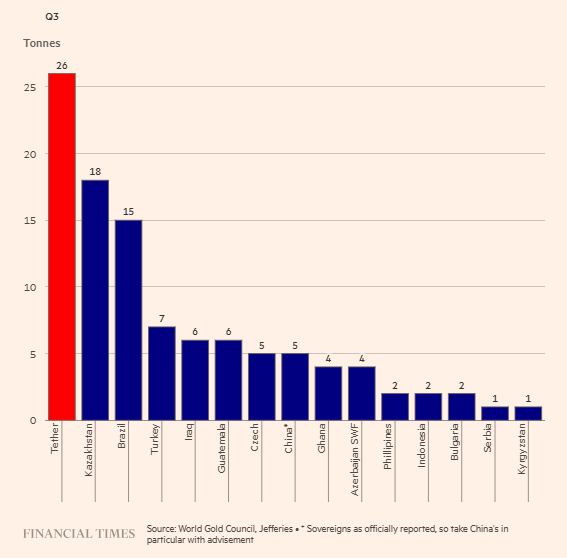

2025 net gold purchases, Tether vs select central banks

Source: Financial Times

Not Just Buying Gold but Building the Ecosystem

Tether has begun deploying capital across the gold supply chain, from streaming and royalty companies to talks with mining operators and refiners.

In June, it acquired a minority stake in Toronto-listed Elemental Altus for $105 million. Later in the year, it invested another $100 million as the firm merged with EMX Royalty.

Tether has also been in discussions with gold-mining investment vehicles such as Terranova Resources, although no deal has materialized yet.

The goal seems clear: Tether doesn’t just want to own gold. It wants gold exposure with leverage, cash flow, and upstream access. Think royalties, not just vaults.

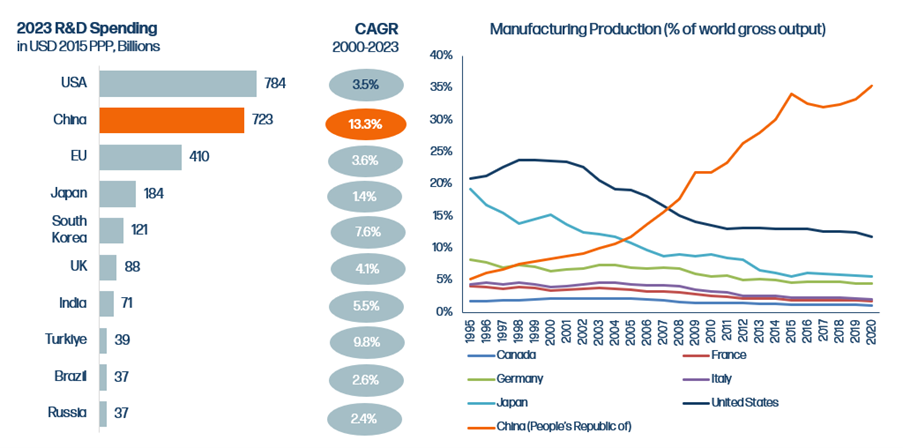

This echoes what we’ve seen in recent years in China, where companies like Xiaomi and BYD began as consumers of critical materials, then became stakeholders in upstream supply chains. It’s all part of building resilience into the foundation of your business.

From Fiat Peg to Metal Peg?

Tether’s relationship with gold isn’t new. It launched XAUt, its gold-backed stablecoin, in 2020. Each token represents one troy ounce of physical gold, stored in Swiss vaults.

For most of its existence, XAUt was a side project. But that may be changing.

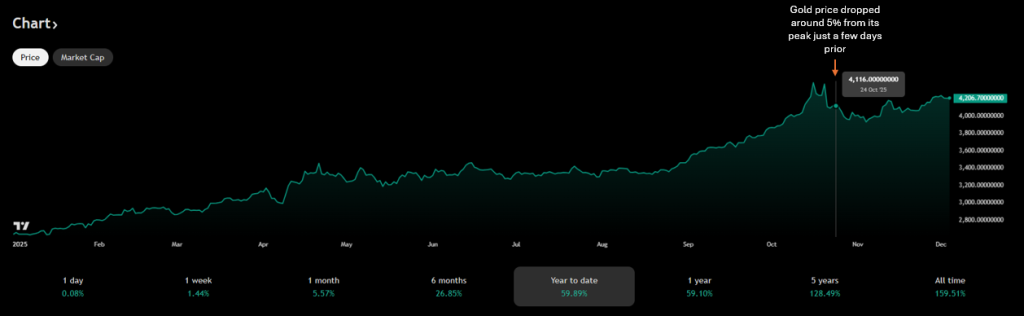

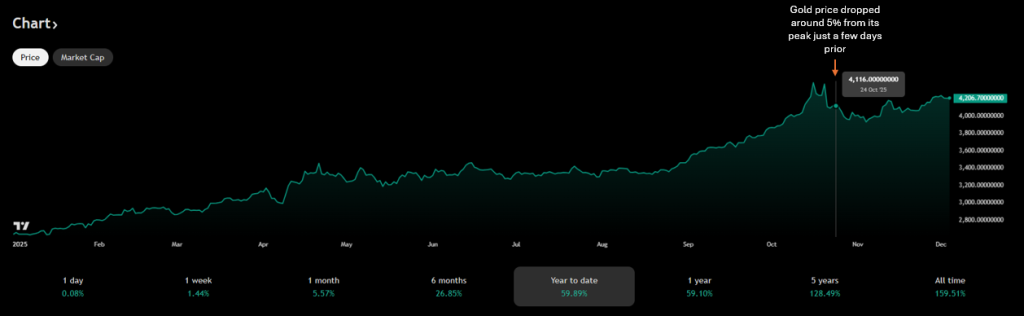

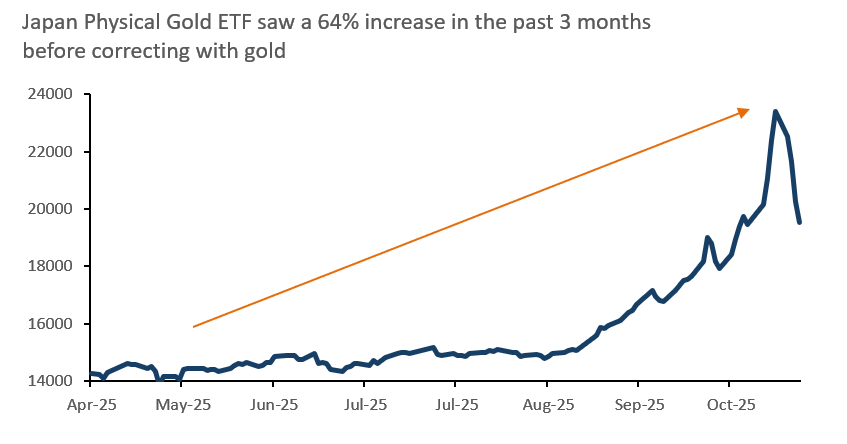

Despite gold price correction, Tether market cap increased by 0.54 billion indicating strong demand

Source: TradingView, Heyokha Research

Since August 2025, blockchain data suggests Tether added more than 275,000 ounces of gold to XAUt’s reserves. The token’s market cap has doubled over the past six months, now sitting between $1.5 to $2.1 billion.

XAUt and Paxos’ PAXG (another tokenized form of gold) together make up around 90% of the entire tokenized gold market, which is still small ($3–3.9 billion total), but growing. XAUt leads with about 49–54% market share.

Still, it’s early days. For all the hype, tokenized gold remains a tiny sliver of global gold markets, which settle over $60 billion daily.

But the use case is compelling.

Why Not Just Buy Gold Bars?

Good question. Here’s how XAUt stacks up:

Compared to physical gold, XAUt offers:

- 24/7 trading and near-instant blockchain transfers

- No need to arrange your own vault, insurance, or transport

- Fractional ownership—you can own 0.0001 ounces, not just 1 oz bars

But it also comes with:

- Counterparty risk (you trust Tether’s vaulting and audits)

- Tech risk (your wallet keys are your problem)

- Less “off-grid” resilience if you’re hedging against full systemic collapse

Compared to “digital gold” like ETFs or app-based gold accounts, XAUt:

- Gives you legal title to allocated bars

- Works natively with DeFi apps, DEXes, and crypto wallets

But:

- It lacks regulatory clarity and tax simplicity

- Wallet UX still scares off mainstream investors

It’s not better or worse. It’s built for a different user. If you already operate in crypto, XAUt feels like a natural extension. If your gold sits in a retirement account, it probably stays there.

The real question: will tokenized gold ever cross over?

We have explored this idea before in our blog, “Stablecoins: Genius or Just…Stable?”. We warned that stablecoins could evolve from dollar mirrors into asset-backed financial rails with their own monetary dynamics. If you ever need a refresher on how Stablecoins work, we got your back: “Stablecoins 101”.

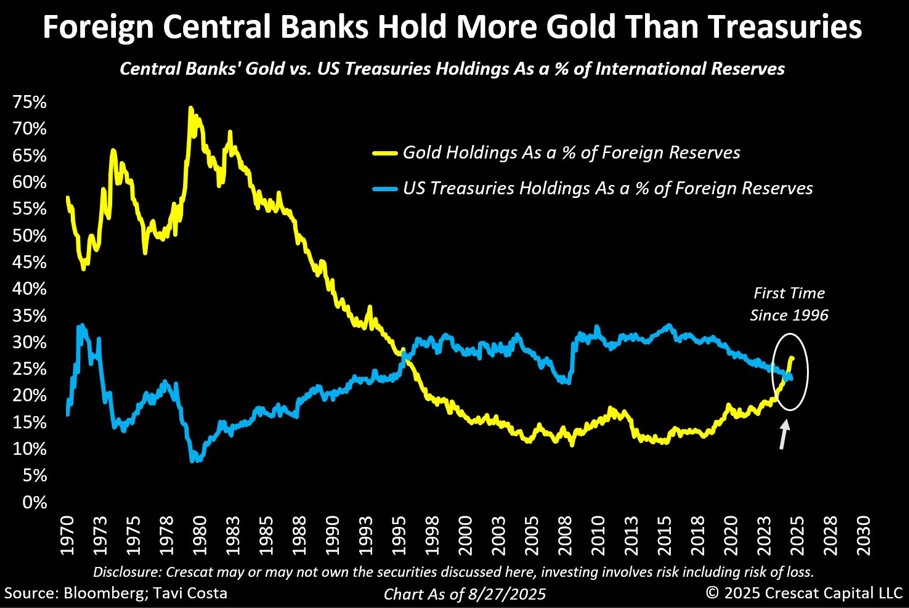

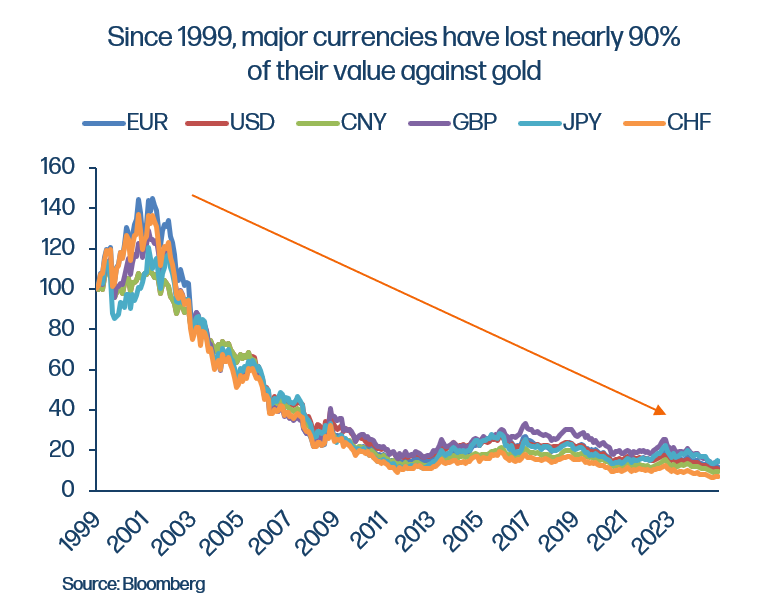

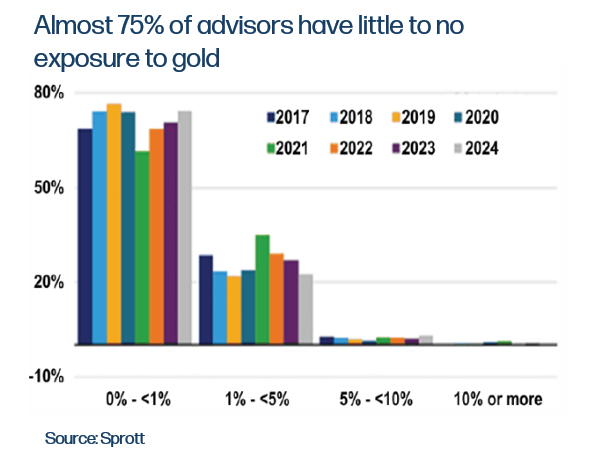

All this to circle back on a thesis we have also explored and have been harping on – fiat debasement pushes the appeal of gold higher. You can read our thoughts in depth in our “Gold: The Return of Real Money” report.

Tether, it turns out, is acting on that thesis with alarming precision. A crypto company built on fiat liquidity is quietly becoming a force in the real-asset world.

Final Thoughts: The Digital Dragon Hoards Gold

This story is far from over.

Tether’s bullion buying already moves markets at the margin. If its 2025 profit estimates hold and the company keeps scaling gold exposure, it could soon rival the annual net purchases of more central banks.

Whether XAUt becomes a widely used digital gold standard is still uncertain. But that’s not the point.

The point is this: while most stablecoin players are debating compliance frameworks, Tether is quietly building a gold-backed war chest, a commodity lending book, and upstream access to the world’s oldest monetary metal.

And when the next currency crisis hits, the company that started by pegging to fiat might just be the one holding the hardest collateral in town.

As we like to say at Heyokha: in a world of soft money and harder choices, real money has a way of resurfacing.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

How Tether quietly became one of the world’s biggest gold holders, and what it signals about the future of money

When we last wrote about stablecoins, we framed them as chips at a casino, and later as claw machine tokens in a rebuilt monetary arcade. They were becoming infrastructure quietly, steadily. But what happens when that infrastructure decides to hoard bullion?

Tether, the world’s largest stablecoin issuer, has quietly become one of the most aggressive gold buyers in the world. Not a central bank. Not a sovereign wealth fund. A crypto company with a token named after a rope.

Gold purchases by quarter. Tether bought close to 12% of what the central banks were buying

Source: Financial Times

As of Q3 2025, Tether holds more than 116 tonnes of physical gold. That’s more than South Korea, Hungary, or Greece. According to Jefferies, that makes it the largest gold holder outside of central banks. Yes, probably bigger than your gold ETF. Bigger than most sovereigns. And with roughly $15 billion in projected profits this year, they’re just getting started.

It’s the most curious subplot in the financial system’s ongoing identity crisis: a crypto stablecoin company, built to track the U.S. dollar, is becoming one of the most aggressive buyers of the very metal that signals distrust in fiat.

It would be hilarious if it weren’t also brilliant.

That’s a Lot Of Gold

How can Tether afford to buy this much gold?

It starts with its business model. Tether issues USDT, a dollar-pegged token backed mostly by U.S. Treasury bills. The company earns interest on those bills but pays zero interest to USDT holders. In a world of 5% base rates and $112 billion in reserves, that spread is pure profit. We suppose they’re putting it to good use.

In Q3 2025 alone, Tether bought 26 tonnes of gold—nearly 12% of global central bank demand and about 2% of total gold demand. If Tether ploughs half its profits into bullion, that pace could double.

But it’s not just bars in a vault.

2025 net gold purchases, Tether vs select central banks

Source: Financial Times

Not Just Buying Gold but Building the Ecosystem

Tether has begun deploying capital across the gold supply chain, from streaming and royalty companies to talks with mining operators and refiners.

In June, it acquired a minority stake in Toronto-listed Elemental Altus for $105 million. Later in the year, it invested another $100 million as the firm merged with EMX Royalty.

Tether has also been in discussions with gold-mining investment vehicles such as Terranova Resources, although no deal has materialized yet.

The goal seems clear: Tether doesn’t just want to own gold. It wants gold exposure with leverage, cash flow, and upstream access. Think royalties, not just vaults.

This echoes what we’ve seen in recent years in China, where companies like Xiaomi and BYD began as consumers of critical materials, then became stakeholders in upstream supply chains. It’s all part of building resilience into the foundation of your business.

From Fiat Peg to Metal Peg?

Tether’s relationship with gold isn’t new. It launched XAUt, its gold-backed stablecoin, in 2020. Each token represents one troy ounce of physical gold, stored in Swiss vaults.

For most of its existence, XAUt was a side project. But that may be changing.

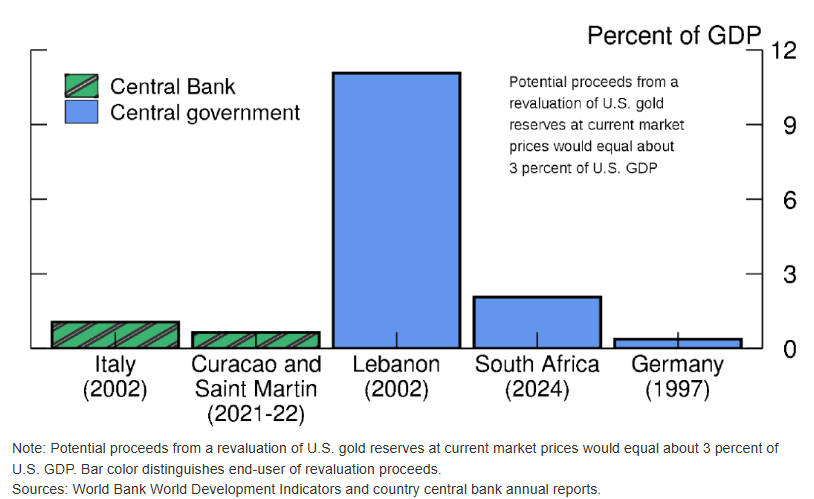

Despite gold price correction, Tether market cap increased by 0.54 billion indicating strong demand

Source: TradingView, Heyokha Research

Since August 2025, blockchain data suggests Tether added more than 275,000 ounces of gold to XAUt’s reserves. The token’s market cap has doubled over the past six months, now sitting between $1.5 to $2.1 billion.

XAUt and Paxos’ PAXG (another tokenized form of gold) together make up around 90% of the entire tokenized gold market, which is still small ($3–3.9 billion total), but growing. XAUt leads with about 49–54% market share.

Still, it’s early days. For all the hype, tokenized gold remains a tiny sliver of global gold markets, which settle over $60 billion daily.

But the use case is compelling.

Why Not Just Buy Gold Bars?

Good question. Here’s how XAUt stacks up:

Compared to physical gold, XAUt offers:

- 24/7 trading and near-instant blockchain transfers

- No need to arrange your own vault, insurance, or transport

- Fractional ownership—you can own 0.0001 ounces, not just 1 oz bars

But it also comes with:

- Counterparty risk (you trust Tether’s vaulting and audits)

- Tech risk (your wallet keys are your problem)

- Less “off-grid” resilience if you’re hedging against full systemic collapse

Compared to “digital gold” like ETFs or app-based gold accounts, XAUt:

- Gives you legal title to allocated bars

- Works natively with DeFi apps, DEXes, and crypto wallets

But:

- It lacks regulatory clarity and tax simplicity

- Wallet UX still scares off mainstream investors

It’s not better or worse. It’s built for a different user. If you already operate in crypto, XAUt feels like a natural extension. If your gold sits in a retirement account, it probably stays there.

The real question: will tokenized gold ever cross over?

We have explored this idea before in our blog, “Stablecoins: Genius or Just…Stable?”. We warned that stablecoins could evolve from dollar mirrors into asset-backed financial rails with their own monetary dynamics. If you ever need a refresher on how Stablecoins work, we got your back: “Stablecoins 101”.

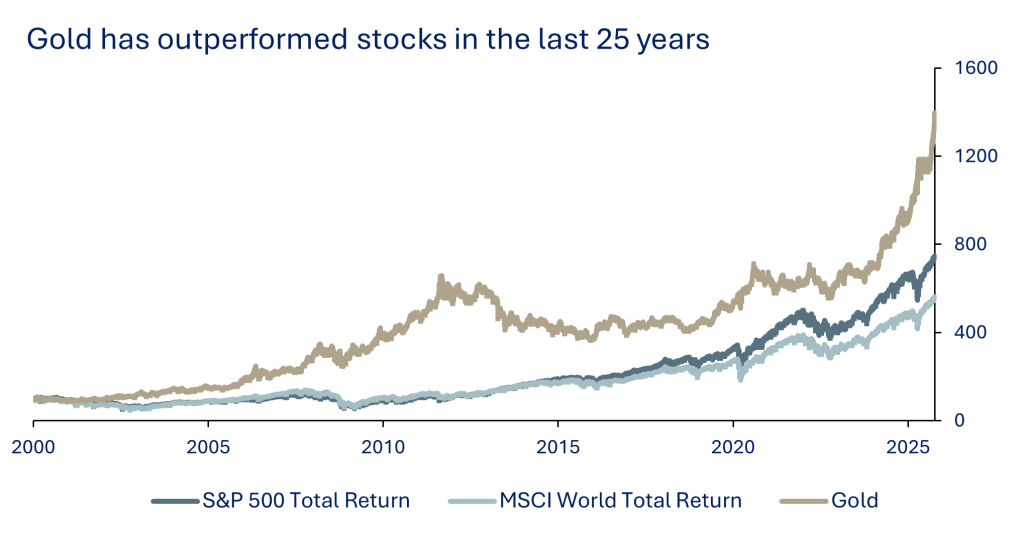

All this to circle back on a thesis we have also explored and have been harping on – fiat debasement pushes the appeal of gold higher. You can read our thoughts in depth in our “Gold: The Return of Real Money” report.

Tether, it turns out, is acting on that thesis with alarming precision. A crypto company built on fiat liquidity is quietly becoming a force in the real-asset world.

Final Thoughts: The Digital Dragon Hoards Gold

This story is far from over.

Tether’s bullion buying already moves markets at the margin. If its 2025 profit estimates hold and the company keeps scaling gold exposure, it could soon rival the annual net purchases of more central banks.

Whether XAUt becomes a widely used digital gold standard is still uncertain. But that’s not the point.

The point is this: while most stablecoin players are debating compliance frameworks, Tether is quietly building a gold-backed war chest, a commodity lending book, and upstream access to the world’s oldest monetary metal.

And when the next currency crisis hits, the company that started by pegging to fiat might just be the one holding the hardest collateral in town.

As we like to say at Heyokha: in a world of soft money and harder choices, real money has a way of resurfacing.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

A packed-filled exhibition hall with art lovers

A packed-filled exhibition hall with art lovers

We’ve all felt like this– ranging from manic euphoria to existential dread

We’ve all felt like this– ranging from manic euphoria to existential dread

Source: Bloomberg, normalized with factor 100

Source: Bloomberg, normalized with factor 100 This isn’t the first time Treasury has collaborated with artists to showcase Gold’s strength. Here is one by artist Naufal Abshar in his “Gold is King” artpiece for Treasury x Art Jakarta Gardens in 2024.

This isn’t the first time Treasury has collaborated with artists to showcase Gold’s strength. Here is one by artist Naufal Abshar in his “Gold is King” artpiece for Treasury x Art Jakarta Gardens in 2024.

Wiharja artistically captures the colorful atmosphere and warmth of Jakarta’s Chinatown

Wiharja artistically captures the colorful atmosphere and warmth of Jakarta’s Chinatown