The Wars May Be Short. But the Questions They Raise Are Long.

Twelve days. That’s how long the latest round between Iran and Israel lasted. But while missiles fell, satellites blinked, and markets flinched — the bigger ripple was philosophical:

What does it mean to be sovereign in 2025?

Because today, it’s not just about having borders. It’s about:

- Who controls your power grid.

- Who supplies your fertilizers.

- And maybe even… who gets your TikTok algorithm.

When war breaks out, it’s never just over there. It’s in your wheat price, your energy bill, and your supply chain spreadsheet.

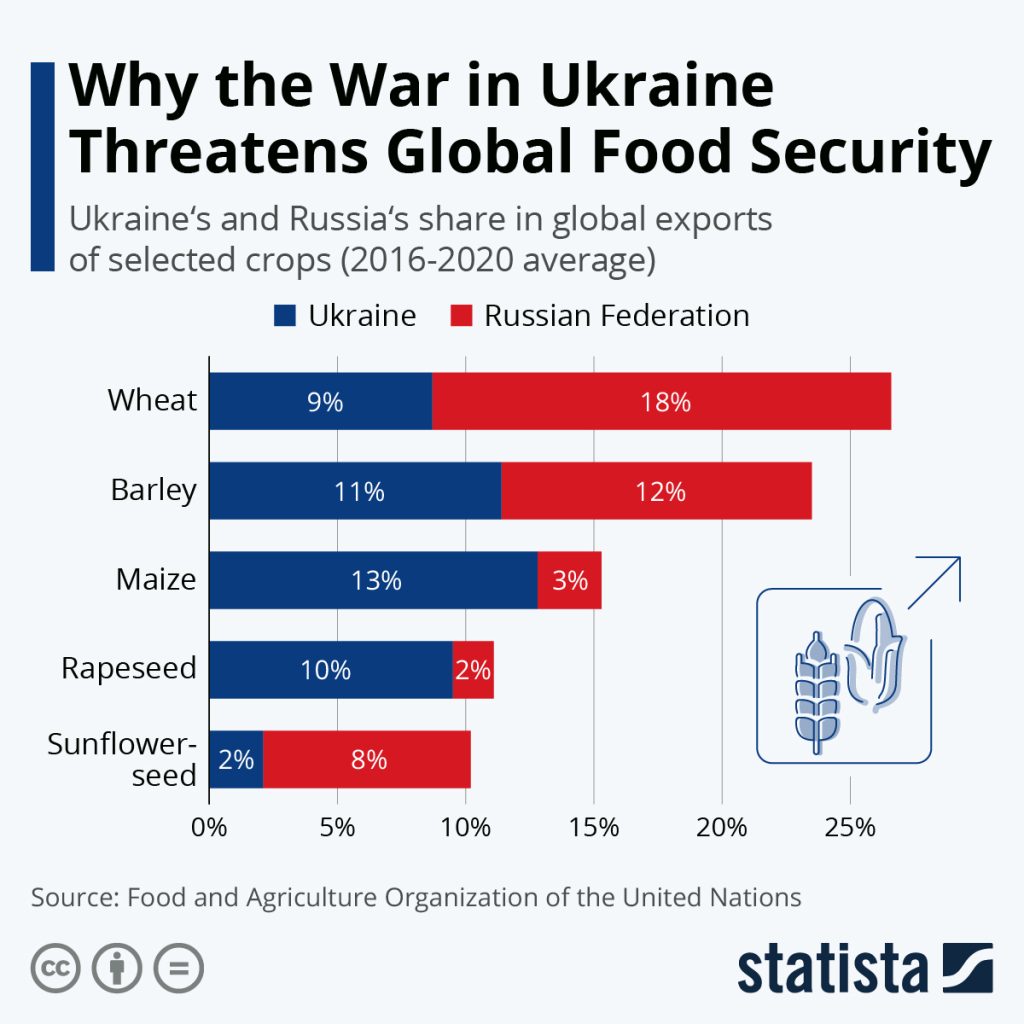

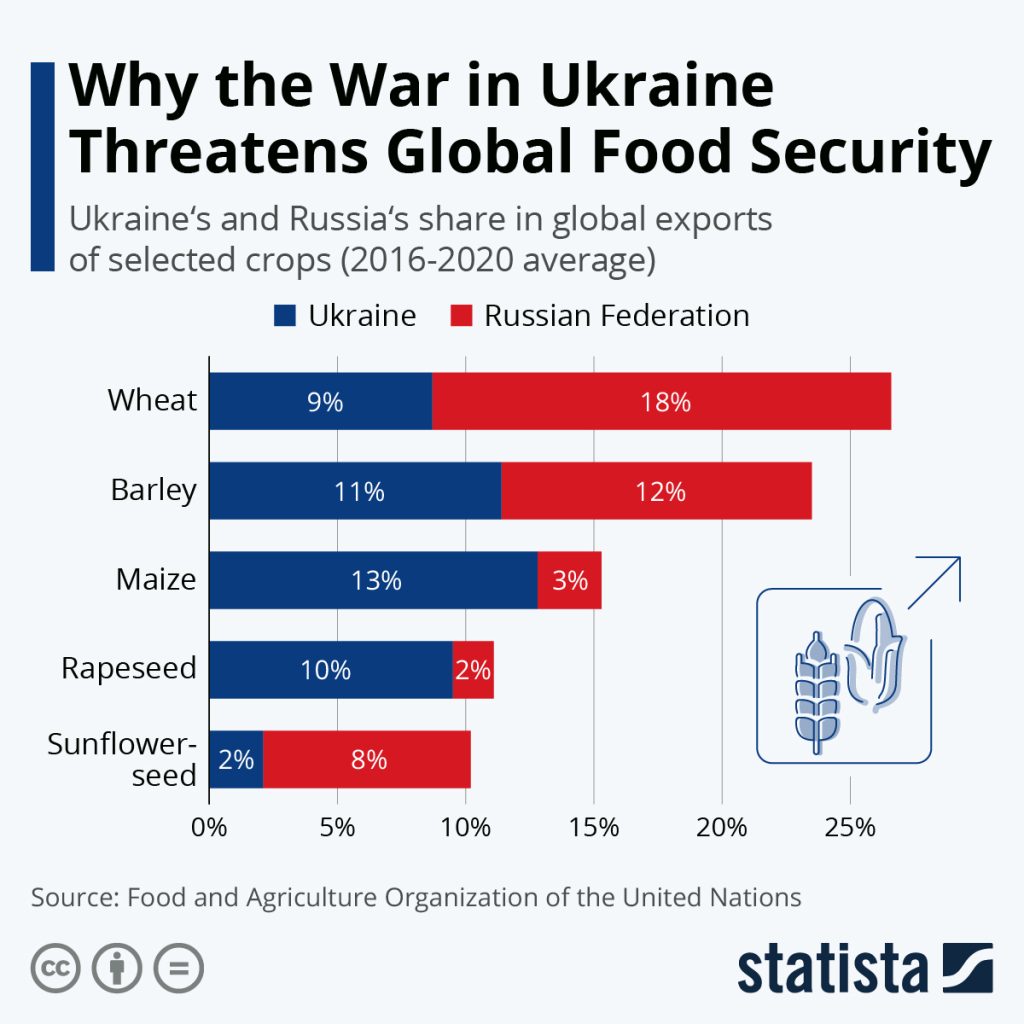

We saw this movie before — in 2022. Russia’s invasion of Ukraine turned ammonia into a geopolitical weapon and fertilizer into front-page news. In our past blog Rising Fertiliser and Food Prices: Who Will Be Spared? we warned that ammonia could become the canary in the commodity coal mine.

Well, the bird is still chirping. And the war drums haven’t stopped.

The Ghost of Fertilizer Past (Still Haunting the Present)

Let’s catch up.

When Russia turned off the gas taps to Europe, fertilizer plants went dark. Ammonia prices spiked. Food prices surged. Countries like Egypt scrambled for nitrogen. Farmers in Indonesia relying on fertilizers felt the heat in their wallets — even as we sat thousands of miles from the trenches.

20% of Ukraine’s farmland remains mined, occupied or unusable

Fast forward to 2025: Brent crude jumps above $80, fertilizer prices spike again, and the Strait of Hormuz — the artery for 40% of global urea and 20% of LNG — is back in headlines.

Norwegian fertilizer giant Yara warns: “The food system is fragile.”

They’re not kidding:

- Israel’s gasfields shut down → Egypt’s ammonia supply stalls.

- Iran shuts down its plants “for security reasons.”

- A fifth of global ammonia flows face disruption.

- One more misfire in the region and breakfast gets more expensive.

It’s not just food that’s vulnerable. It’s the whole latticework of modern sovereignty.

The New Arms Race

Back to Israel and Iran.

Beyond the rockets, the deeper question lingered quietly: what happens when sovereignty includes strategic capabilities like nuclear deterrence? It’s a reminder that power today isn’t just immediate — it’s long-term, layered, and loaded with implications.

And while the ceasefire held, the spending race didn’t stop. In fact, it accelerated.

The Numbers Are Loud:

- Global defense spend hit $2.7 trillion in 2024.

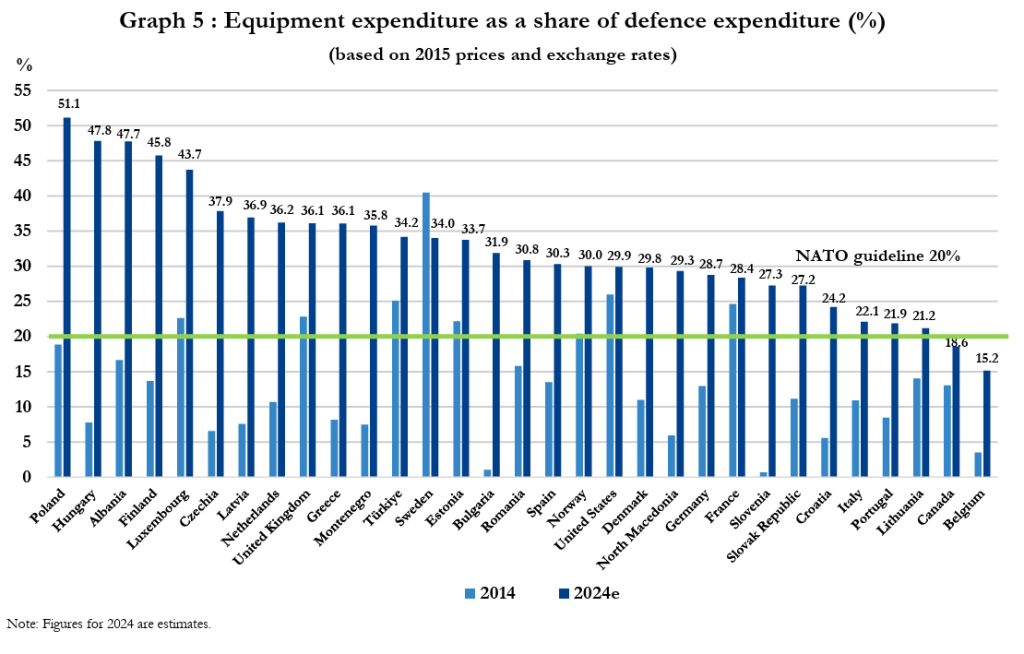

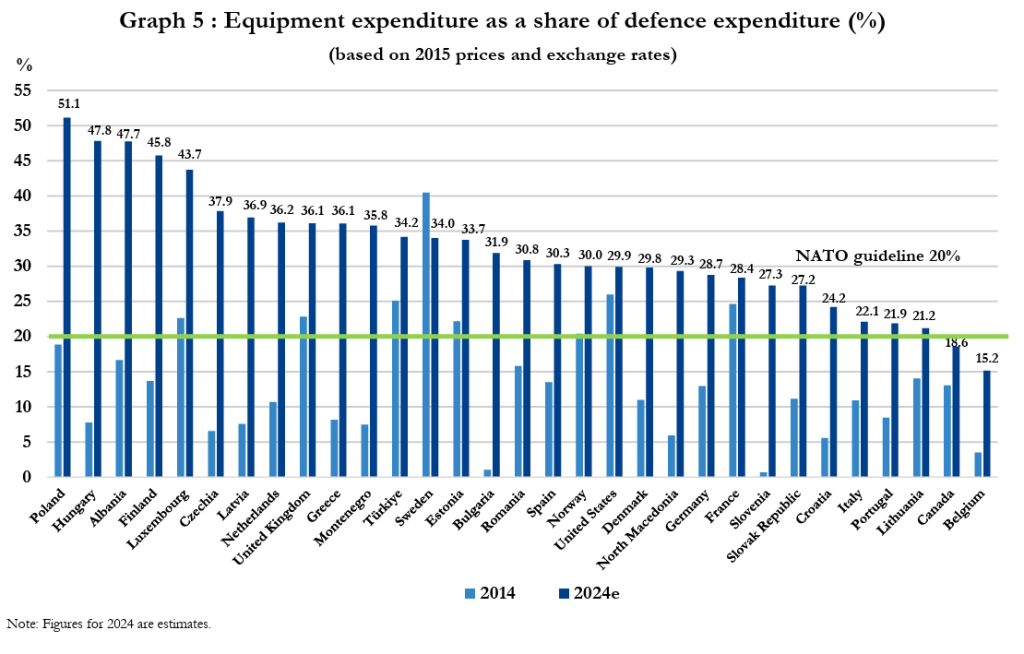

- NATO’s new pledge? A whopping 5% of GDP on defense. 20% of the defense expenditures will be devoted to major equipment spending.

- Russia’s defense budget? Up 38% YoY to $149 billion (7.1% of GDP).

- Even China’s chill 1.7% of GDP translates to an estimated $290 billion.

Even traditionally neutral countries are piling in as seen in Switzerland joining the European Sky Shield Initiative (ESSI), aiming to contribute to a pan-European air and missile defense system

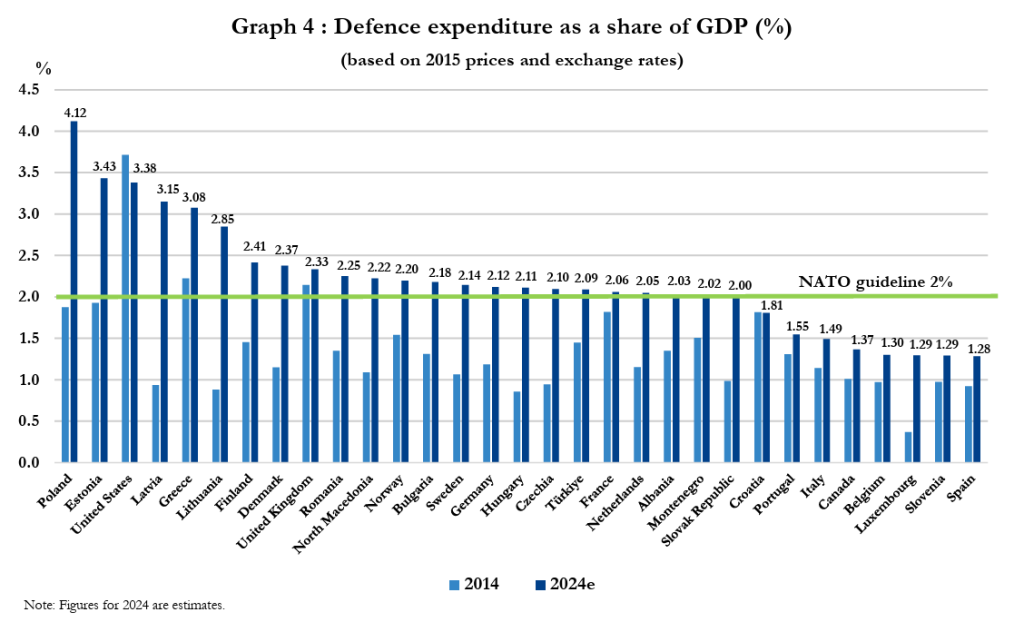

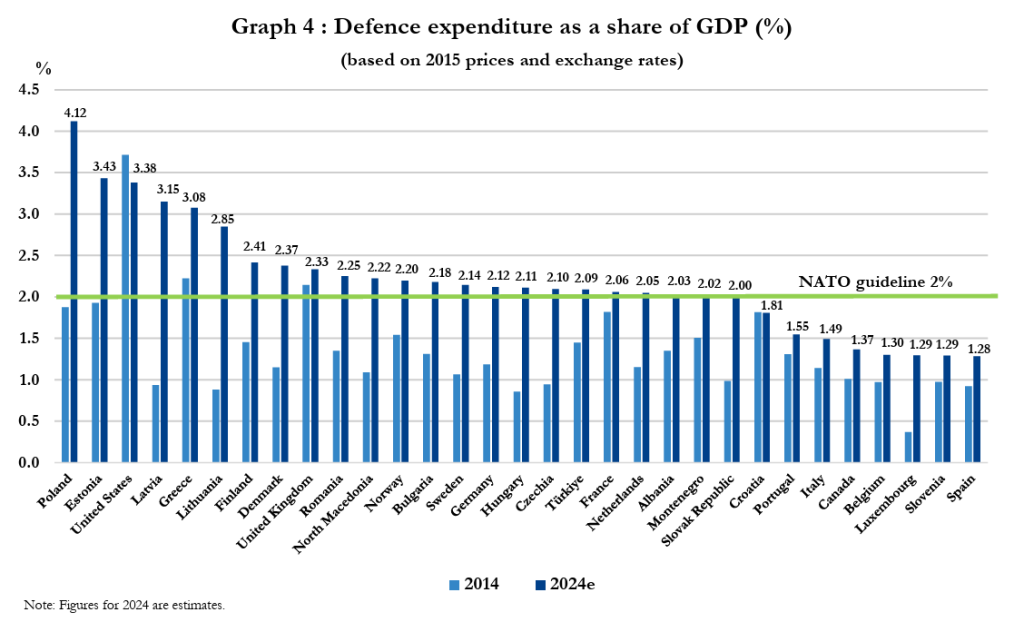

23 NATO countries have met or surpassed the 2% guideline – nearly 6-fold increase from just four in 2014

And 29 NATO countries have already surpassed their equipment expenditure guideline!

Source: NATO

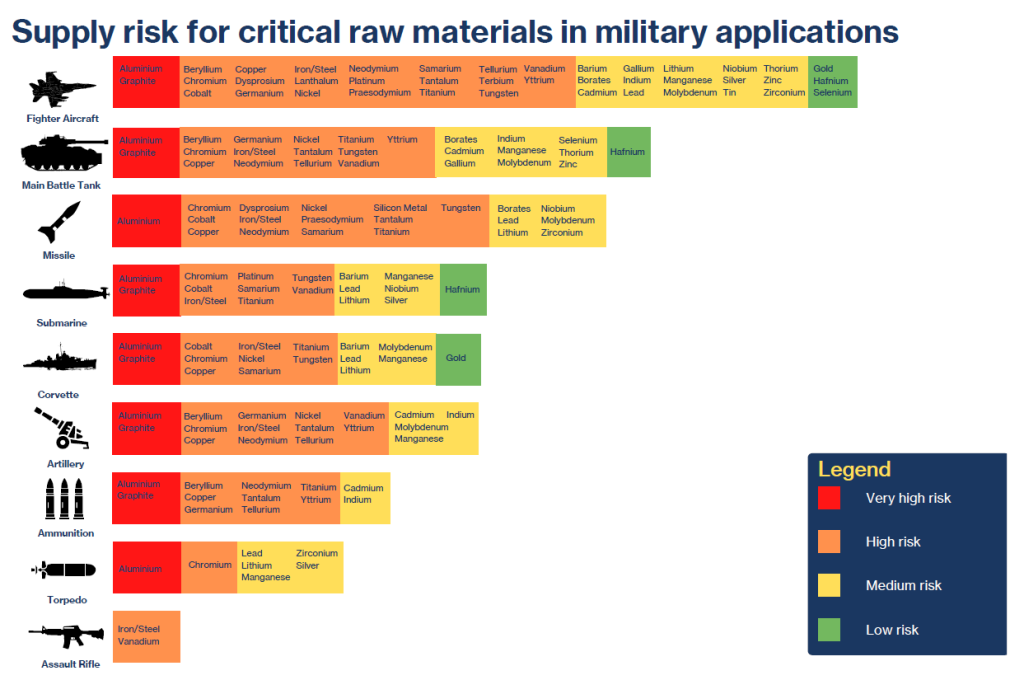

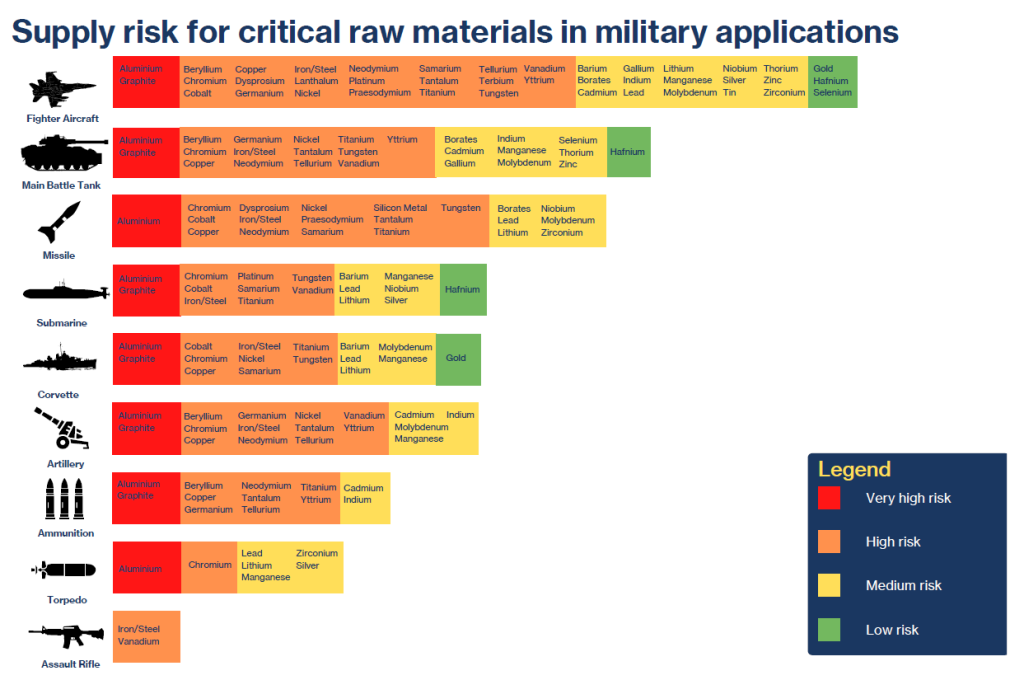

Translation? Defense is no longer just about tanks. It’s bullets, chips, rare earths, and energy security.

We’re not just funding armies. We’re rebuilding the idea of sovereignty through industrial might:

- Chips.

- Lasers.

- Satellites.

- And all the raw materials that make those possible.

Source: The Hague Centre for Strategic Studies

The F-16 Fighting Falcon, the most common fighter jet in the world, costs $25-70 million each!

Sovereignty Is a Supply Chain and Indonesia is a Link

In the Cold War, power was measured in nukes. In 2025? It’s measured in gallium, graphite, and rare earths — the obscure elements that quietly power everything from night vision goggles to missile guidance systems.

You can’t launch a drone strike without a critical mineral checklist.

And here’s the kicker: most of the world’s refining capacity sits in China. Gallium, graphite, and rare earths? All subject to export controls now. China may still dominate the refining process — with over 80% control over rare earth processing — but Indonesia is one of the few nations actually blessed with the raw ingredients. This makes us a crucial character in the geopolitical drama unfolding between the West and China.

Let’s talk nickel.

Indonesia’s got the world’s biggest stash. But instead of shipping it out raw (as we used to), we’re processing it here. We banned unprocessed exports, built refineries, and started climbing the value chain — like adults putting on our own oxygen masks first.

Indonesia is now one of the few places on earth where raw minerals meet refining ambition meets geopolitical non-alignment.

- China wants in — to lock up supply.

- The West wants in — to de-risk from China.

- Indonesia? Sitting in the middle, holding the rocks everyone wants.

The result? We’re not just a passive supplier. We’re a player.

Call it “strategic mineral non-alignment.” A sweet spot — if we play it wisely.

Danantara, Indonesia’s sovereign wealth fund, is making moves to invest more nickel down streaming projects

Food for Thought: What Really Makes a Country “Safe”?

It’s not just missiles anymore. Sovereignty now spans:

- Energy security (ask Germany).

- Fertilizer self-sufficiency (ask Egypt).

- Data governance (ask the EU).

- Rare earth access (ask the Pentagon).

The irony? While AI headlines steal the spotlight, it’s the boring stuff — beans, bandwidth, and bauxite — that determines who thrives when the world gets shaky.

Maybe in 2025, the price of sovereignty isn’t measured in warheads, but in warehouses.

Investor Takeaways: What to Watch

- Resilience > Efficiency

The “just-in-time” era is over. Countries and corporates alike are paying up for redundancy, not speed. - Defense Is the New ESG

What was once controversial is now compulsory. Defense capex is a new secular theme — from drones to defense semis to supply chain hardening. - Supply Chains = Strategy

Follow the materials. Gallium, ammonia, nickel — the commodity isn’t the story. The control of it is.

Final Thought: The Game Has Changed — But Are We Playing It?

The 12-day Israel-Iran flare-up may have faded from headlines. But its message is loud:

In a world of flash wars and fragile supply chains, sovereignty is no longer a given. It’s something you build. And defend. And fund — year after year.

So whether you’re a policymaker, a CEO, or a curious observer of markets, ask yourself:

“What part of my strategy still assumes the world is predictable?”

Because today’s sovereignty isn’t about waving a flag. It’s about owning your food, your fuel, and your future.

Tara Mulia

Admin heyokha

Share

The Wars May Be Short. But the Questions They Raise Are Long.

Twelve days. That’s how long the latest round between Iran and Israel lasted. But while missiles fell, satellites blinked, and markets flinched — the bigger ripple was philosophical:

What does it mean to be sovereign in 2025?

Because today, it’s not just about having borders. It’s about:

- Who controls your power grid.

- Who supplies your fertilizers.

- And maybe even… who gets your TikTok algorithm.

When war breaks out, it’s never just over there. It’s in your wheat price, your energy bill, and your supply chain spreadsheet.

We saw this movie before — in 2022. Russia’s invasion of Ukraine turned ammonia into a geopolitical weapon and fertilizer into front-page news. In our past blog Rising Fertiliser and Food Prices: Who Will Be Spared? we warned that ammonia could become the canary in the commodity coal mine.

Well, the bird is still chirping. And the war drums haven’t stopped.

The Ghost of Fertilizer Past (Still Haunting the Present)

Let’s catch up.

When Russia turned off the gas taps to Europe, fertilizer plants went dark. Ammonia prices spiked. Food prices surged. Countries like Egypt scrambled for nitrogen. Farmers in Indonesia relying on fertilizers felt the heat in their wallets — even as we sat thousands of miles from the trenches.

20% of Ukraine’s farmland remains mined, occupied or unusable

Fast forward to 2025: Brent crude jumps above $80, fertilizer prices spike again, and the Strait of Hormuz — the artery for 40% of global urea and 20% of LNG — is back in headlines.

Norwegian fertilizer giant Yara warns: “The food system is fragile.”

They’re not kidding:

- Israel’s gasfields shut down → Egypt’s ammonia supply stalls.

- Iran shuts down its plants “for security reasons.”

- A fifth of global ammonia flows face disruption.

- One more misfire in the region and breakfast gets more expensive.

It’s not just food that’s vulnerable. It’s the whole latticework of modern sovereignty.

The New Arms Race

Back to Israel and Iran.

Beyond the rockets, the deeper question lingered quietly: what happens when sovereignty includes strategic capabilities like nuclear deterrence? It’s a reminder that power today isn’t just immediate — it’s long-term, layered, and loaded with implications.

And while the ceasefire held, the spending race didn’t stop. In fact, it accelerated.

The Numbers Are Loud:

- Global defense spend hit $2.7 trillion in 2024.

- NATO’s new pledge? A whopping 5% of GDP on defense. 20% of the defense expenditures will be devoted to major equipment spending.

- Russia’s defense budget? Up 38% YoY to $149 billion (7.1% of GDP).

- Even China’s chill 1.7% of GDP translates to an estimated $290 billion.

Even traditionally neutral countries are piling in as seen in Switzerland joining the European Sky Shield Initiative (ESSI), aiming to contribute to a pan-European air and missile defense system

23 NATO countries have met or surpassed the 2% guideline – nearly 6-fold increase from just four in 2014

And 29 NATO countries have already surpassed their equipment expenditure guideline!

Source: NATO

Translation? Defense is no longer just about tanks. It’s bullets, chips, rare earths, and energy security.

We’re not just funding armies. We’re rebuilding the idea of sovereignty through industrial might:

- Chips.

- Lasers.

- Satellites.

- And all the raw materials that make those possible.

Source: The Hague Centre for Strategic Studies

The F-16 Fighting Falcon, the most common fighter jet in the world, costs $25-70 million each!

Sovereignty Is a Supply Chain and Indonesia is a Link

In the Cold War, power was measured in nukes. In 2025? It’s measured in gallium, graphite, and rare earths — the obscure elements that quietly power everything from night vision goggles to missile guidance systems.

You can’t launch a drone strike without a critical mineral checklist.

And here’s the kicker: most of the world’s refining capacity sits in China. Gallium, graphite, and rare earths? All subject to export controls now. China may still dominate the refining process — with over 80% control over rare earth processing — but Indonesia is one of the few nations actually blessed with the raw ingredients. This makes us a crucial character in the geopolitical drama unfolding between the West and China.

Let’s talk nickel.

Indonesia’s got the world’s biggest stash. But instead of shipping it out raw (as we used to), we’re processing it here. We banned unprocessed exports, built refineries, and started climbing the value chain — like adults putting on our own oxygen masks first.

Indonesia is now one of the few places on earth where raw minerals meet refining ambition meets geopolitical non-alignment.

- China wants in — to lock up supply.

- The West wants in — to de-risk from China.

- Indonesia? Sitting in the middle, holding the rocks everyone wants.

The result? We’re not just a passive supplier. We’re a player.

Call it “strategic mineral non-alignment.” A sweet spot — if we play it wisely.

Danantara, Indonesia’s sovereign wealth fund, is making moves to invest more nickel down streaming projects

Food for Thought: What Really Makes a Country “Safe”?

It’s not just missiles anymore. Sovereignty now spans:

- Energy security (ask Germany).

- Fertilizer self-sufficiency (ask Egypt).

- Data governance (ask the EU).

- Rare earth access (ask the Pentagon).

The irony? While AI headlines steal the spotlight, it’s the boring stuff — beans, bandwidth, and bauxite — that determines who thrives when the world gets shaky.

Maybe in 2025, the price of sovereignty isn’t measured in warheads, but in warehouses.

Investor Takeaways: What to Watch

- Resilience > Efficiency

The “just-in-time” era is over. Countries and corporates alike are paying up for redundancy, not speed. - Defense Is the New ESG

What was once controversial is now compulsory. Defense capex is a new secular theme — from drones to defense semis to supply chain hardening. - Supply Chains = Strategy

Follow the materials. Gallium, ammonia, nickel — the commodity isn’t the story. The control of it is.

Final Thought: The Game Has Changed — But Are We Playing It?

The 12-day Israel-Iran flare-up may have faded from headlines. But its message is loud:

In a world of flash wars and fragile supply chains, sovereignty is no longer a given. It’s something you build. And defend. And fund — year after year.

So whether you’re a policymaker, a CEO, or a curious observer of markets, ask yourself:

“What part of my strategy still assumes the world is predictable?”

Because today’s sovereignty isn’t about waving a flag. It’s about owning your food, your fuel, and your future.

Tara Mulia

Admin heyokha

Share

Microsoft Excel’s first commercial in 1990. Same cells. Same one guy doing all the work

Microsoft Excel’s first commercial in 1990. Same cells. Same one guy doing all the work

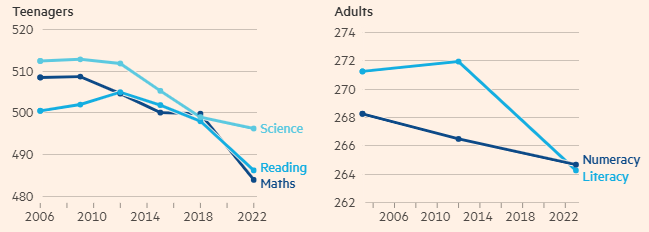

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey

Source: Financial Times, OECD, PISA PIAAC, and Adult Literacy and Lifeskills Survey