The Canvas Bag Theory of Markets

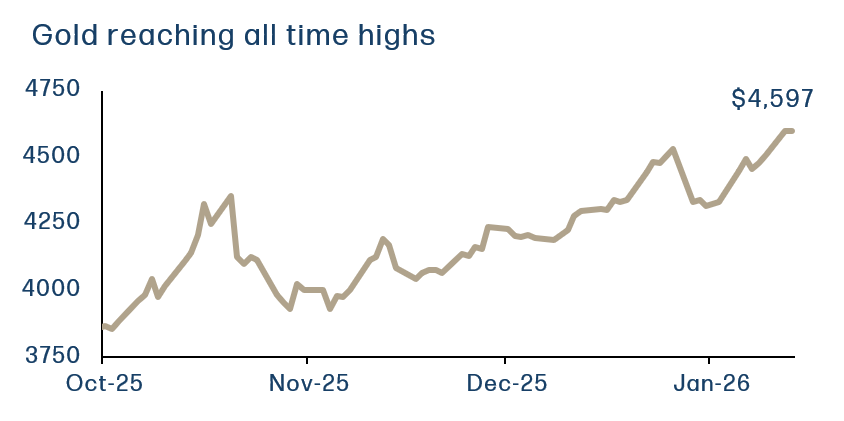

If you want to understand why gold just hit an All-Time High of $5,500, don’t look at the Federal Reserve’s balance sheet. Look at a $4.99 (IDR 83,000) canvas bag.

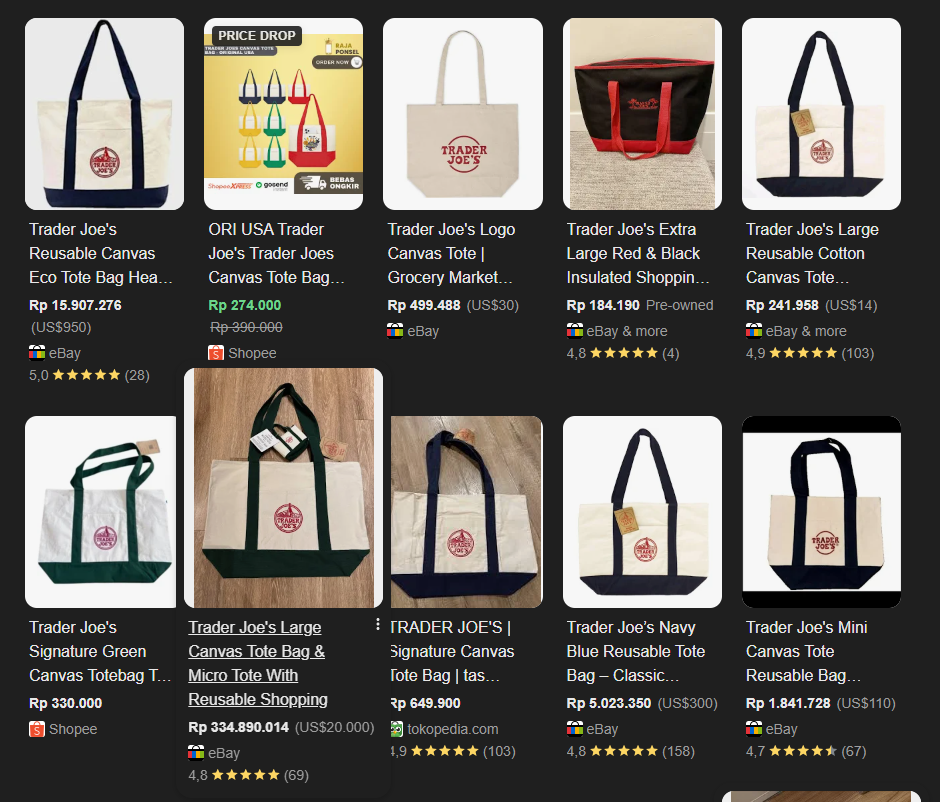

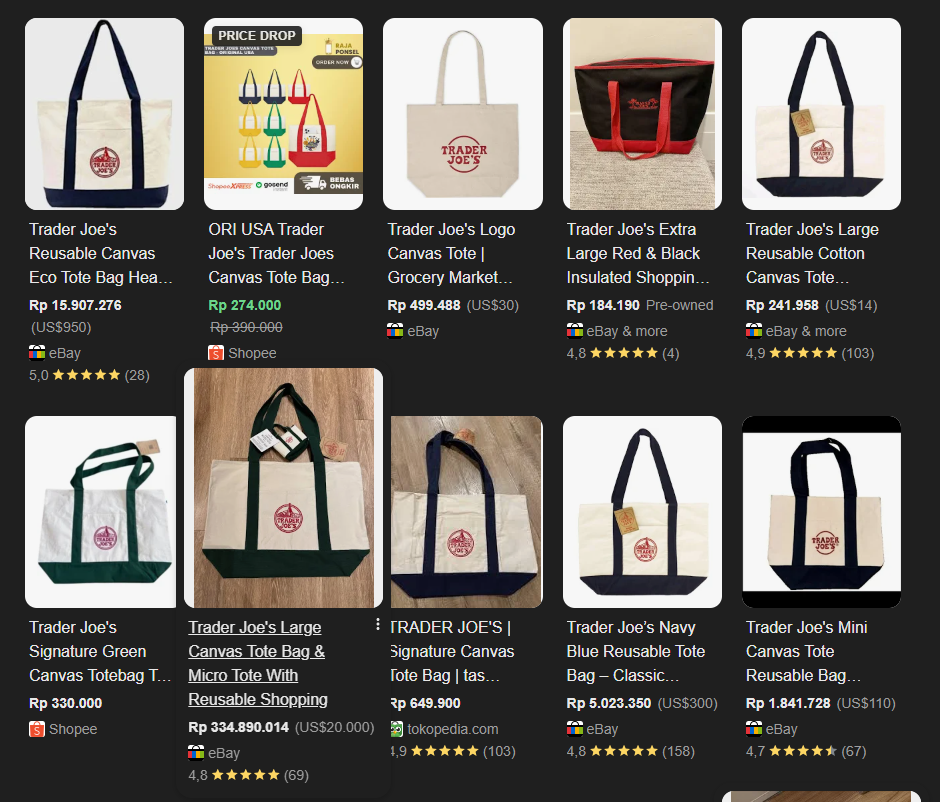

Last year, Trader Joe’s released a mini canvas tote bag. It was functional, simple, and cheap. It also caused grown adults to line up at 5:00 AM, fight in aisles, and resell them on eBay for $500. In London, Tokyo, and even close to home here in Jakarta, the bag became a status symbol. Why?

FOMO (Fear Of Missing Out).

It wasn’t about the canvas. It was about the crowd. When everyone else is running toward something, it’s very much human instinct to feel we should probably run that way too.

Even the normal tote bags are being sold upwards of $950. Now that’s a 200x return!

From Aisle 4 to Asset Class

This same psychological contagion is now bleeding into the gold market.

A few months ago, buying gold was for central banks and “doomsday preppers.” Today? It’s the topic that no one could stop talking about all day even during your most mundane routines. One of our team members shared his badminton buddies started asking if they should pile in. My grandpa who comes to visit every weekend also started asking if gold could go higher instead of what to eat for Sunday brunch.

We saw the preview of this last year in Asia and Australia. In Sydney, buyers at ABC Bullion were sleeping overnight on the pavement just to be first through the door when the shop opened. In China, young Gen Z buyers started buying “gold beans” (tiny gram-sized nuggets) because they stopped trusting savings accounts.

The gold beans that went viral in China. Very demure, Very cutesy, and Very Gen Z

Image source: Bloomberg

Here in Jakarta, there are recounts of people staying overnight in front of gold shops since 9pm to place their names in an queue honor system piece of paper

Image source: CNA

When people who have never owned an ounce of metal suddenly feel the itch to buy at all-time highs, it signals a shift. But it also signals danger. When you buy on emotion, you sell on panic.

Navigating the Vertigo

The question on everyone’s mind has shifted from “Should I buy?” to “Is it crashing?” now that we’ve seen a sharp correction.

Buying or holding at these heights feels unnatural. It feels dangerous. It gives you vertigo.

But let’s look at another feat of vertigo. Just this week, Alex Honnold (the climber from Free Solo) free-soloed the Taipei 101 building. No ropes. No safety net. Just him, 508 meters of glass and steel, and a crazy short 90-minute climb that the world watched with sweaty palms.

Images source: Netflix

To the average person, looking up at the 101st floor looks insane. It looks like a death wish. But to Honnold? It was just math, physics, and preparation. He didn’t climb it because he was reckless. He climbed it because he had studied the “bamboo boxes” of the structure. He knew exactly where the holds were, and more importantly, he knew what to do if he slipped.

Navigating this gold market requires that same “Honnold Preparation.”

The chart looks intimidating. The drop looks scary. But if you have done the homework, you realize that the fundamental structure hasn’t changed. You aren’t just reacting to a price tick; you are looking at a repricing of the dollar itself. As we wrote in our previous reports, when the currency is being debased, the price of real things has to go up even if the path there is bumpy.

If the Metal Scares You, Look at the Dirt

If buying the metal at these levels still gives you too much vertigo, there is another door open: the miners.

Think of gold mining like a neglected apple orchard. For years, investors ignored it, so no new trees were planted. Since 2018, production largely flatlined, but the high prices are finally acting as fertilizer. The latest data shows Q3 2025 mine production hit a quarterly record of 977 tonnes (up 2% year-on-year), putting 2025 on track to set a new all-time high for annual output.

Source: Heyokha Research

The orchard is waking up.

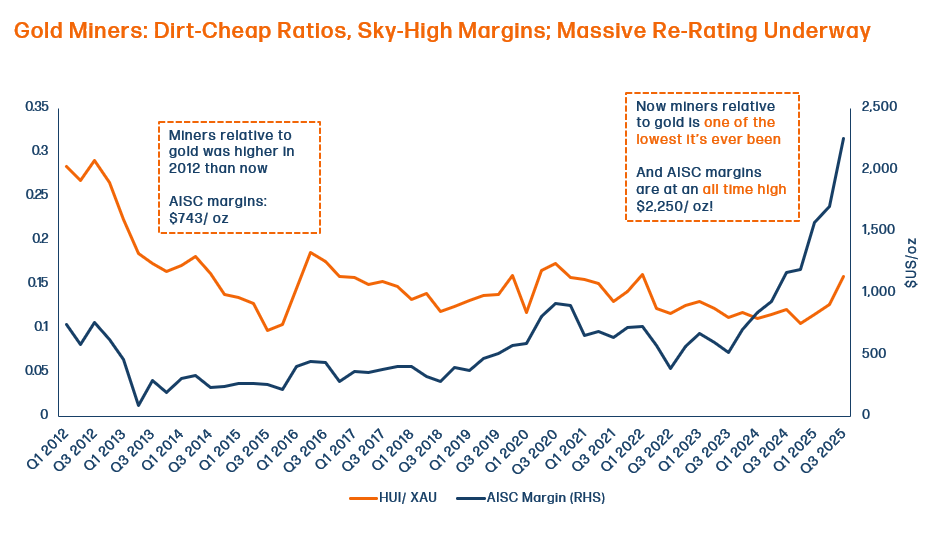

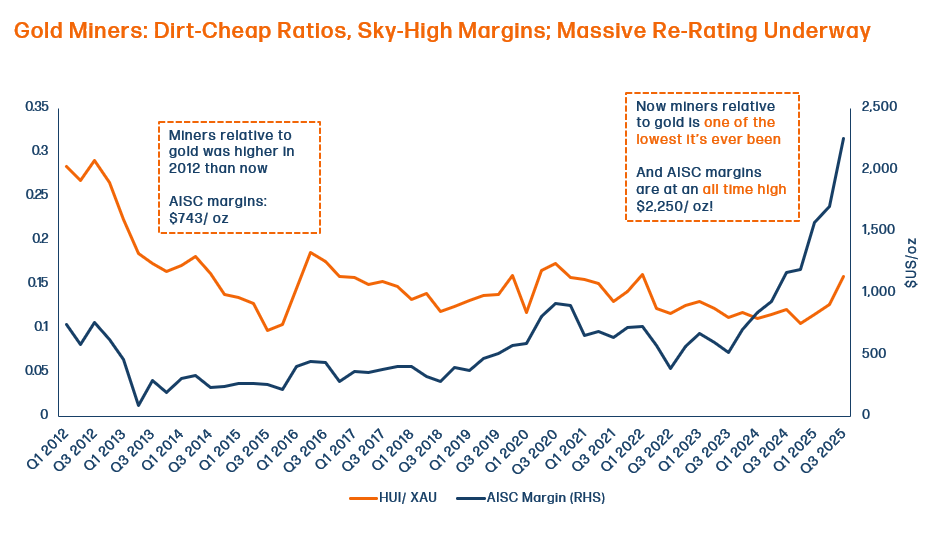

- The Margin Explosion: The Average All-In Sustaining Costs (AISC) for miners hover around $2,250/oz, making the math undeniable. With gold at $5,500, miners are pocketing a record spread of nearly $3,000 per ounce. A 1% rise in gold can now drive a 2–3% jump in miner valuations.

- The Hidden “Option” Value: Higher prices turn “waste rock” into “wealth.” Take Barrick Gold—their latest report showed a 23% jump in gold reserves (adding ~17 million ounces). They didn’t magically find new deposits; the higher price just made the old rock profitable to dig up.

While the crowd fights for physical bars, the smart money is quietly buying the companies that own the dirt.

Preparation Over Panic

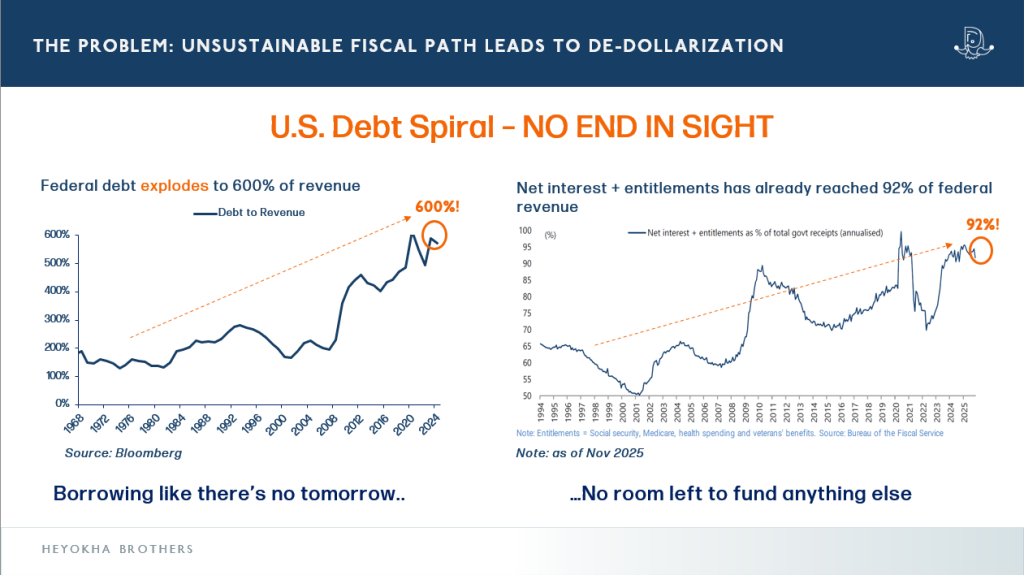

The old safety net of the 60/40 portfolio of stocks and bond is fraying. With U.S. interest payments now exceeding defense spending, bonds aren’t the safety rope they used to be.

If you are feeling that itch to buy or the urge to panic-sell because of the correction, don’t just follow the crowd with the tote bags. Do the prep.

Alex Honnold didn’t start climbing until he had mapped every inch of the route. You shouldn’t allocate capital until you’ve done the same.

- Read our deep dive: Gold: The Return of Real Money

You can access and browse all our past reports here:

The climb might look high, but the view from the top is worth it. Just don’t forget to bring your own bag.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share

The Canvas Bag Theory of Markets

If you want to understand why gold just hit an All-Time High of $5,500, don’t look at the Federal Reserve’s balance sheet. Look at a $4.99 (IDR 83,000) canvas bag.

Last year, Trader Joe’s released a mini canvas tote bag. It was functional, simple, and cheap. It also caused grown adults to line up at 5:00 AM, fight in aisles, and resell them on eBay for $500. In London, Tokyo, and even close to home here in Jakarta, the bag became a status symbol. Why?

FOMO (Fear Of Missing Out).

It wasn’t about the canvas. It was about the crowd. When everyone else is running toward something, it’s very much human instinct to feel we should probably run that way too.

Even the normal tote bags are being sold upwards of $950. Now that’s a 200x return!

From Aisle 4 to Asset Class

This same psychological contagion is now bleeding into the gold market.

A few months ago, buying gold was for central banks and “doomsday preppers.” Today? It’s the topic that no one could stop talking about all day even during your most mundane routines. One of our team members shared his badminton buddies started asking if they should pile in. My grandpa who comes to visit every weekend also started asking if gold could go higher instead of what to eat for Sunday brunch.

We saw the preview of this last year in Asia and Australia. In Sydney, buyers at ABC Bullion were sleeping overnight on the pavement just to be first through the door when the shop opened. In China, young Gen Z buyers started buying “gold beans” (tiny gram-sized nuggets) because they stopped trusting savings accounts.

The gold beans that went viral in China. Very demure, Very cutesy, and Very Gen Z

Image source: Bloomberg

Here in Jakarta, there are recounts of people staying overnight in front of gold shops since 9pm to place their names in an queue honor system piece of paper

Image source: CNA

When people who have never owned an ounce of metal suddenly feel the itch to buy at all-time highs, it signals a shift. But it also signals danger. When you buy on emotion, you sell on panic.

Navigating the Vertigo

The question on everyone’s mind has shifted from “Should I buy?” to “Is it crashing?” now that we’ve seen a sharp correction.

Buying or holding at these heights feels unnatural. It feels dangerous. It gives you vertigo.

But let’s look at another feat of vertigo. Just this week, Alex Honnold (the climber from Free Solo) free-soloed the Taipei 101 building. No ropes. No safety net. Just him, 508 meters of glass and steel, and a crazy short 90-minute climb that the world watched with sweaty palms.

Images source: Netflix

To the average person, looking up at the 101st floor looks insane. It looks like a death wish. But to Honnold? It was just math, physics, and preparation. He didn’t climb it because he was reckless. He climbed it because he had studied the “bamboo boxes” of the structure. He knew exactly where the holds were, and more importantly, he knew what to do if he slipped.

Navigating this gold market requires that same “Honnold Preparation.”

The chart looks intimidating. The drop looks scary. But if you have done the homework, you realize that the fundamental structure hasn’t changed. You aren’t just reacting to a price tick; you are looking at a repricing of the dollar itself. As we wrote in our previous reports, when the currency is being debased, the price of real things has to go up even if the path there is bumpy.

If the Metal Scares You, Look at the Dirt

If buying the metal at these levels still gives you too much vertigo, there is another door open: the miners.

Think of gold mining like a neglected apple orchard. For years, investors ignored it, so no new trees were planted. Since 2018, production largely flatlined, but the high prices are finally acting as fertilizer. The latest data shows Q3 2025 mine production hit a quarterly record of 977 tonnes (up 2% year-on-year), putting 2025 on track to set a new all-time high for annual output.

Source: Heyokha Research

The orchard is waking up.

- The Margin Explosion: The Average All-In Sustaining Costs (AISC) for miners hover around $2,250/oz, making the math undeniable. With gold at $5,500, miners are pocketing a record spread of nearly $3,000 per ounce. A 1% rise in gold can now drive a 2–3% jump in miner valuations.

- The Hidden “Option” Value: Higher prices turn “waste rock” into “wealth.” Take Barrick Gold—their latest report showed a 23% jump in gold reserves (adding ~17 million ounces). They didn’t magically find new deposits; the higher price just made the old rock profitable to dig up.

While the crowd fights for physical bars, the smart money is quietly buying the companies that own the dirt.

Preparation Over Panic

The old safety net of the 60/40 portfolio of stocks and bond is fraying. With U.S. interest payments now exceeding defense spending, bonds aren’t the safety rope they used to be.

If you are feeling that itch to buy or the urge to panic-sell because of the correction, don’t just follow the crowd with the tote bags. Do the prep.

Alex Honnold didn’t start climbing until he had mapped every inch of the route. You shouldn’t allocate capital until you’ve done the same.

- Read our deep dive: Gold: The Return of Real Money

You can access and browse all our past reports here:

The climb might look high, but the view from the top is worth it. Just don’t forget to bring your own bag.

Tara Mulia

For more blogs like these, subscribe to our newsletter here!

Admin heyokha

Share