Markets aren’t just driven by cold, hard numbers—they thrive on drama, narratives, and sometimes, sheer comedic timing. In a twist that’s almost poetic, Donald Trump’s iconic bestseller, The Art of the Deal, has shot back to the top of Amazon’s charts, precisely as Trump unleashes yet another tariff tornado. Coincidence? We think not. It’s almost as if investors are flipping through the pages looking for clues.

“The Art of the Deal” shoots up in first place. Coming close in second? The same deal

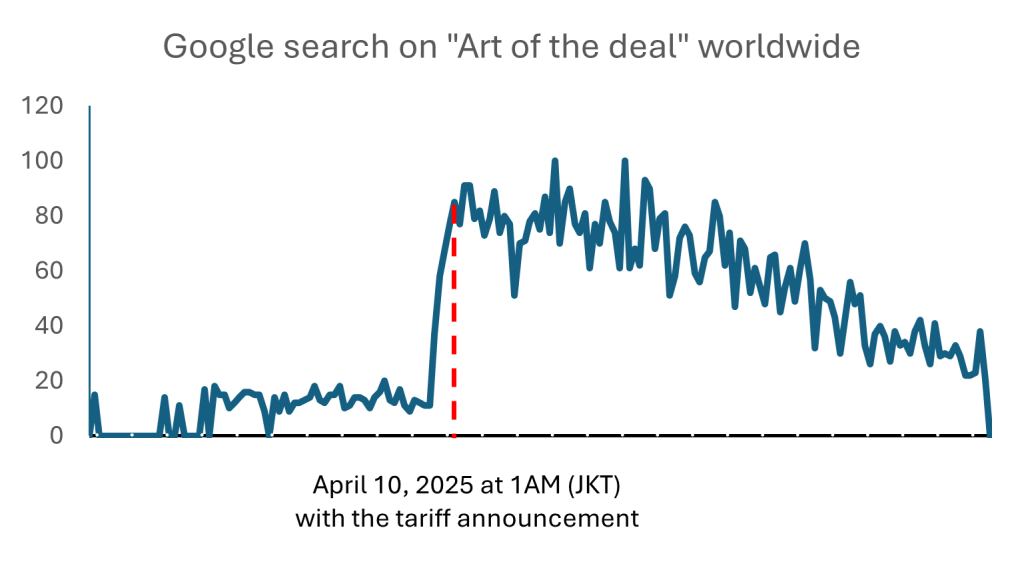

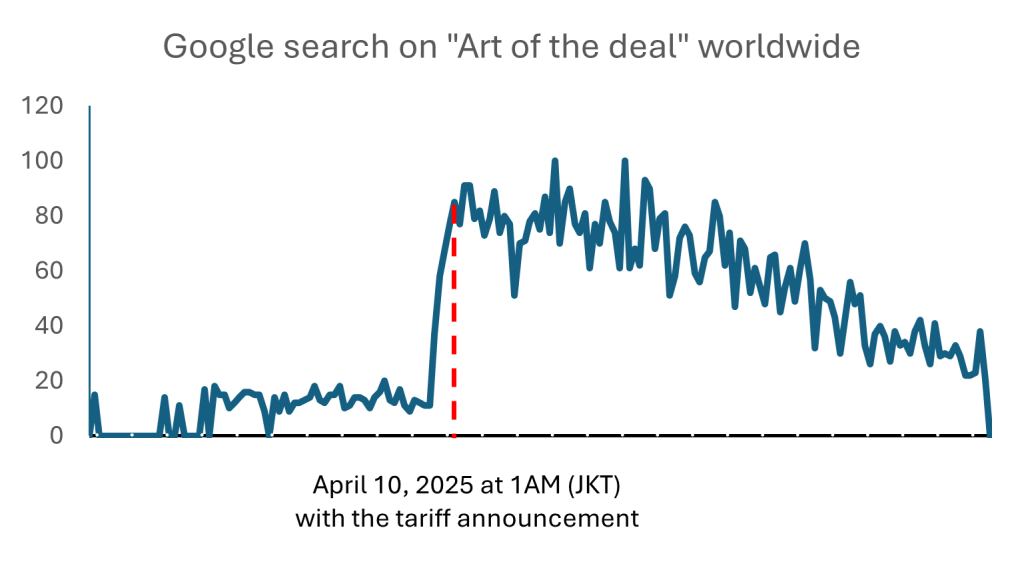

Seems like it’s not just Amazon users, people truly are searching for answers in Google

Seems like it’s not just Amazon users, people truly are searching for answers in Google

Tariffs? Again? (Quickly, because you know already and it’s changing every second anyway):

Trump’s latest trade war moves are bigger, louder, and more bewildering than ever. If fully enacted, these tariffs would hit about US$1 trillion in global trade. Notably, potential spikes in U.S. bond yields could drive refinancing costs up by nearly $900 billion, a number Trump probably wouldn’t describe as “beautiful.”

Goodbye Safe Havens, Hello Reality Check

Here’s something intriguing: investors, usually quick to grab U.S. Treasuries and U.S. dollars at the faintest whiff of trouble, are avoiding them like leftover sushi at a gas station. Rather than flocking to these classic safe havens, markets are selling off both Treasuries and the dollar.

But hold your conclusions—this bond sell-off might not necessarily signal a broader loss of faith in U.S. safe havens. Hedge funds with significant short positions might be the culprits, potentially even including Japan or China, who hold the largest and second largest holdings of U.S. Treasuries at $1.079 trillion and $706.8 billion respectively. Such strategic selling could have sent a strong message, prompting Trump to reconsider his aggressive tariff stance.

So why the sudden pause from Trump? If you crunch the numbers, the revenue from new tariffs wouldn’t offset the soaring refinancing costs of rising bond yields. Essentially, Trump might have inadvertently created a panic without tangible economic benefit, leading to this pause. His plan might have originally been to push investors from equities to bonds, driving yields down. But markets seldom follow such neat scripts. As Trump wisely noted in The Art of the Deal, “The worst thing you can possibly do in a deal is seem desperate to make it.” Maybe the bond market caught him looking a bit too eager, prompting a quick recalculation.

Distrust and the End of American Exceptionalism?

While it’s too early to confidently declare the end of American financial dominance, there’s a growing suspicion that investor trust in U.S. fiscal policy is beginning to fray, a topic we suspect and covered extensively in our recent report.

Q3 2024 Special Report on De-dollarization found in our website

Could it be the US is losing its financial “comfort blanket” status? With net interest payments and entitlements now gobbling up a staggering 96% of federal receipts, maybe creditors are starting to wonder if Uncle Sam is running out of couch cushions to shake loose for spare change.

The game is shifting. Trump recently said he’s “watching the bond market” and described it as “beautiful.” But beauty, Mr. Trump, is in the eye of the bondholder, and they seem increasingly nervous.

And it’s not just the money game that’s changing; global power dynamics are shifting too. This is the first time since 1945 that the rule-based order is under significant strain. China is centralizing and solidifying its role as America’s prime challenger, while the US responds with nationalist policies. This rivalry threatens the international order, complicating collaboration that the U.S. has been building since the end of World War 2 on existential threats like climate change, pandemics, and cyber security. But hey, why worry about global crises when there’s real estate in Greenland to talk about? As Trump wrote himself in the book, “Location is everything”. We should have known it’s simply prime real estate for him.

Trump’s transactional approach—think buying Greenland or reclaiming the Panama Canal—reflects a divided American electorate. One half cheers nationalism; the other yearns for liberal internationalism. Meanwhile, mounting debt, military spending, and stagnant wages have fractured the political center, turning global leadership into a spectacle.

Calm Before the CAPEX Storm?

While the tariff tornado seems to have momentarily calmed, businesses are stuck wondering: How do you plan long-term investments when policy changes faster than Trump’s Twitter mood? Perhaps the answer lies in reading the “Art of the Deal” (1987) Granted this book was published in the 90s, but hey, people rarely change right? Unanswered questions linger, and that uncertainty might be the new normal.

Viral AI image: Essential reading for President Xi

Speaking of Confidence… China’s Feeling Pretty Good!

Ironically, amidst Trump’s tariff tempest, China appears surprisingly calm. Xi Jinping’s government has spent years reducing its economic dependence on America, now directing less than 15% of its exports to America—down from nearly 20% in 2017, and recent domestic economic boosts have cushioned the blow. Heck, China’s prime minister recently bragged about an animated film, Ne Zha 2, smashing box-office records beating every Disney and Pixar film —apparently a stronger economic indicator than we thought.

Ne Zha 2 is the first animated movie to pass $2 billion at the global box office

Beijing’s matching tariff strategy is textbook game theory: whatever the U.S. does, China mirrors, seeking equilibrium in escalating tensions.

But China’s boldness could have another layer: it might be leveraging its massive Treasury holdings to signal its capability and willingness to cause disruption. If hedge fund selling is indeed partly influenced by China, it’s clear Beijing is signaling to Trump: “We can cause panic too.”

Now, Back to Trump and Roy Cohn’s Playbook

Trump’s mentor, the infamous Roy Cohn, laid out three strategies: attack relentlessly, deny everything, and always claim victory. Trump’s recent comments echo this playbook perfectly.

Roy Cohn and Donald Trump played by Jeremy Strong and Sebastian Stan in the film “The Apprentice”

Attack, Attack, Attack: Trump lashed out on social media, accusing China of economic exploitation, recently tweeting: “China continues its theft! They must pay!”

Admit Nothing, Deny Everything: When economists warned tariffs were hurting Americans, Trump tweeted dismissively, “Tariffs are great! They’re filling our coffers!”

Always Claim Victory, Never Admit Defeat: Trump recently boasted, “China is begging to negotiate, tariffs working beautifully!” Meanwhile, economists nervously glanced at GDP forecasts.

Wrapping It All Up

So, what’s the moral of this chaotic tale? Trump’s tariffs are doing more than rattling markets—they’re reshaping global economic confidence and challenging America’s longstanding financial dominance. And while Trump watches the bond market thinking it’s a masterpiece, the rest of us might want to buckle up—because this is less beautiful and more… abstract art.

With the bond market now more comedy than classic, investors might find themselves laughing to cope—because in today’s world, humor might just be the best investment strategy available.

Tara Mulia

Admin heyokha

Share

Markets aren’t just driven by cold, hard numbers—they thrive on drama, narratives, and sometimes, sheer comedic timing. In a twist that’s almost poetic, Donald Trump’s iconic bestseller, The Art of the Deal, has shot back to the top of Amazon’s charts, precisely as Trump unleashes yet another tariff tornado. Coincidence? We think not. It’s almost as if investors are flipping through the pages looking for clues.

“The Art of the Deal” shoots up in first place. Coming close in second? The same deal

Seems like it’s not just Amazon users, people truly are searching for answers in Google

Seems like it’s not just Amazon users, people truly are searching for answers in Google

Tariffs? Again? (Quickly, because you know already and it’s changing every second anyway):

Trump’s latest trade war moves are bigger, louder, and more bewildering than ever. If fully enacted, these tariffs would hit about US$1 trillion in global trade. Notably, potential spikes in U.S. bond yields could drive refinancing costs up by nearly $900 billion, a number Trump probably wouldn’t describe as “beautiful.”

Goodbye Safe Havens, Hello Reality Check

Here’s something intriguing: investors, usually quick to grab U.S. Treasuries and U.S. dollars at the faintest whiff of trouble, are avoiding them like leftover sushi at a gas station. Rather than flocking to these classic safe havens, markets are selling off both Treasuries and the dollar.

But hold your conclusions—this bond sell-off might not necessarily signal a broader loss of faith in U.S. safe havens. Hedge funds with significant short positions might be the culprits, potentially even including Japan or China, who hold the largest and second largest holdings of U.S. Treasuries at $1.079 trillion and $706.8 billion respectively. Such strategic selling could have sent a strong message, prompting Trump to reconsider his aggressive tariff stance.

So why the sudden pause from Trump? If you crunch the numbers, the revenue from new tariffs wouldn’t offset the soaring refinancing costs of rising bond yields. Essentially, Trump might have inadvertently created a panic without tangible economic benefit, leading to this pause. His plan might have originally been to push investors from equities to bonds, driving yields down. But markets seldom follow such neat scripts. As Trump wisely noted in The Art of the Deal, “The worst thing you can possibly do in a deal is seem desperate to make it.” Maybe the bond market caught him looking a bit too eager, prompting a quick recalculation.

Distrust and the End of American Exceptionalism?

While it’s too early to confidently declare the end of American financial dominance, there’s a growing suspicion that investor trust in U.S. fiscal policy is beginning to fray, a topic we suspect and covered extensively in our recent report.

Q3 2024 Special Report on De-dollarization found in our website

Could it be the US is losing its financial “comfort blanket” status? With net interest payments and entitlements now gobbling up a staggering 96% of federal receipts, maybe creditors are starting to wonder if Uncle Sam is running out of couch cushions to shake loose for spare change.

The game is shifting. Trump recently said he’s “watching the bond market” and described it as “beautiful.” But beauty, Mr. Trump, is in the eye of the bondholder, and they seem increasingly nervous.

And it’s not just the money game that’s changing; global power dynamics are shifting too. This is the first time since 1945 that the rule-based order is under significant strain. China is centralizing and solidifying its role as America’s prime challenger, while the US responds with nationalist policies. This rivalry threatens the international order, complicating collaboration that the U.S. has been building since the end of World War 2 on existential threats like climate change, pandemics, and cyber security. But hey, why worry about global crises when there’s real estate in Greenland to talk about? As Trump wrote himself in the book, “Location is everything”. We should have known it’s simply prime real estate for him.

Trump’s transactional approach—think buying Greenland or reclaiming the Panama Canal—reflects a divided American electorate. One half cheers nationalism; the other yearns for liberal internationalism. Meanwhile, mounting debt, military spending, and stagnant wages have fractured the political center, turning global leadership into a spectacle.

Calm Before the CAPEX Storm?

While the tariff tornado seems to have momentarily calmed, businesses are stuck wondering: How do you plan long-term investments when policy changes faster than Trump’s Twitter mood? Perhaps the answer lies in reading the “Art of the Deal” (1987) Granted this book was published in the 90s, but hey, people rarely change right? Unanswered questions linger, and that uncertainty might be the new normal.

Viral AI image: Essential reading for President Xi

Speaking of Confidence… China’s Feeling Pretty Good!

Ironically, amidst Trump’s tariff tempest, China appears surprisingly calm. Xi Jinping’s government has spent years reducing its economic dependence on America, now directing less than 15% of its exports to America—down from nearly 20% in 2017, and recent domestic economic boosts have cushioned the blow. Heck, China’s prime minister recently bragged about an animated film, Ne Zha 2, smashing box-office records beating every Disney and Pixar film —apparently a stronger economic indicator than we thought.

Ne Zha 2 is the first animated movie to pass $2 billion at the global box office

Beijing’s matching tariff strategy is textbook game theory: whatever the U.S. does, China mirrors, seeking equilibrium in escalating tensions.

But China’s boldness could have another layer: it might be leveraging its massive Treasury holdings to signal its capability and willingness to cause disruption. If hedge fund selling is indeed partly influenced by China, it’s clear Beijing is signaling to Trump: “We can cause panic too.”

Now, Back to Trump and Roy Cohn’s Playbook

Trump’s mentor, the infamous Roy Cohn, laid out three strategies: attack relentlessly, deny everything, and always claim victory. Trump’s recent comments echo this playbook perfectly.

Roy Cohn and Donald Trump played by Jeremy Strong and Sebastian Stan in the film “The Apprentice”

Attack, Attack, Attack: Trump lashed out on social media, accusing China of economic exploitation, recently tweeting: “China continues its theft! They must pay!”

Admit Nothing, Deny Everything: When economists warned tariffs were hurting Americans, Trump tweeted dismissively, “Tariffs are great! They’re filling our coffers!”

Always Claim Victory, Never Admit Defeat: Trump recently boasted, “China is begging to negotiate, tariffs working beautifully!” Meanwhile, economists nervously glanced at GDP forecasts.

Wrapping It All Up

So, what’s the moral of this chaotic tale? Trump’s tariffs are doing more than rattling markets—they’re reshaping global economic confidence and challenging America’s longstanding financial dominance. And while Trump watches the bond market thinking it’s a masterpiece, the rest of us might want to buckle up—because this is less beautiful and more… abstract art.

With the bond market now more comedy than classic, investors might find themselves laughing to cope—because in today’s world, humor might just be the best investment strategy available.

Tara Mulia

Admin heyokha

Share

Valerine Chandrakesuma, founder of WeDoo, showcasing her latest plastic extrusion machine

Valerine Chandrakesuma, founder of WeDoo, showcasing her latest plastic extrusion machine WeDoo’s machine workshop

WeDoo’s machine workshop

Waste made into beautiful art – Wedoo’s collaboration with artist Aharimu

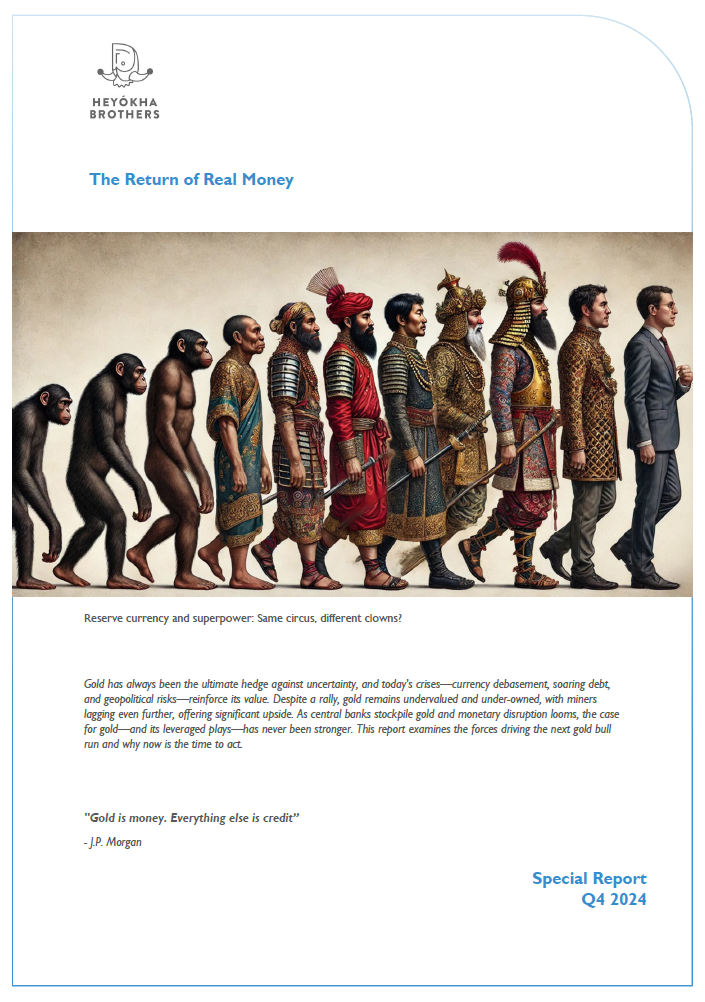

Waste made into beautiful art – Wedoo’s collaboration with artist Aharimu