“Is artificial intelligence making us dumber?” This is a question that has been on many people’s minds as generative AI continues to grow in popularity. With its applications in fields such as music, art, and healthcare, AI is poised to change the world in exciting ways. But there are also concerns about its impact on human intelligence and critical thinking.

One of the primary concerns is that relying solely on AI-generated content could reduce opportunities for developing original ideas. For example, if individuals solely rely on AI-generated news articles for information, they may not be exposed to diverse perspectives and may have limited opportunities for critical thinking and independent analysis. Similarly, if artists solely use AI to generate their works, they may not be challenged to come up with original ideas and may become less creative over time.

On the other hand, proponents of generative AI argue that it has the potential to enhance human intelligence and drive innovation. To get a better understanding of this perspective, we sat down with Dr. Sarah Kim, a computer scientist and researcher at the MIT Media Lab. According to Dr. Kim, “AI has the ability to process massive amounts of data at speeds that are not possible for humans, leading to more informed decisions and new avenues for creativity.” She goes on to say, “AI-generated content can also serve as a starting point for human artists, inspiring them to create something truly unique.”

In conclusion, the use of generative AI presents both potential risks and benefits. It is up to us to ensure that this technology is used in a way that promotes the advancement of humanity while avoiding negative impacts on human intelligence and critical thinking. Whether AI makes us dumber or not ultimately depends on how we choose to use it.

ChatGPT, the generative AI model created by OpenAI, has caught our attention lately, and probably yours too. The tool has taken the internet by storm since its public launch for its ability to generate text that is coherent and appears to be written by a human. Our curiosity piqued, we just had to try it out for ourselves and see the extent of its capabilities. And guess what? This very article that you have just read was generated by ChatGPT (with our inputs).

We began the process by asking ChatGPT one question: “tell me two reasons why generative AI makes us dumber and two counterarguments”. Getting answers from ChatGPT is straightforward and easy but getting the answers in a desired format and style is less so. But with a little trial and error, we were able to get some pretty impressive results. It is important that describe your requests as detailed as possible to generate the answer you wanted. For example, we asked ChatGPT to suggest a clickbait title for us, we also asked it to add a short interview with a computer scientist to support the counterargument, especially with credentials and a professional name to make it convincing. However, we did notice that with multiple requests, the tool could forget some of your previous requests. So, would it make us dumber? It depends, depending on how you use the tool, I think the above article made a sound argument.

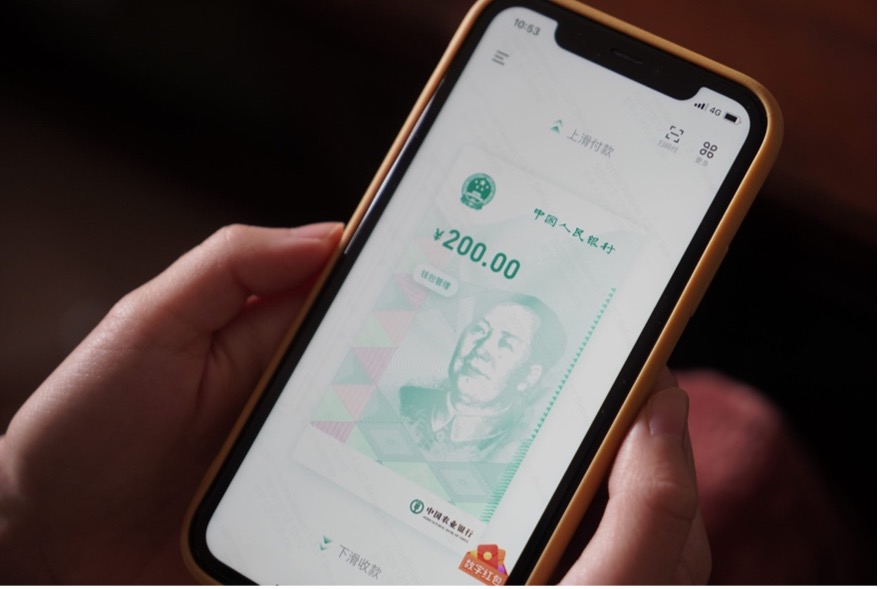

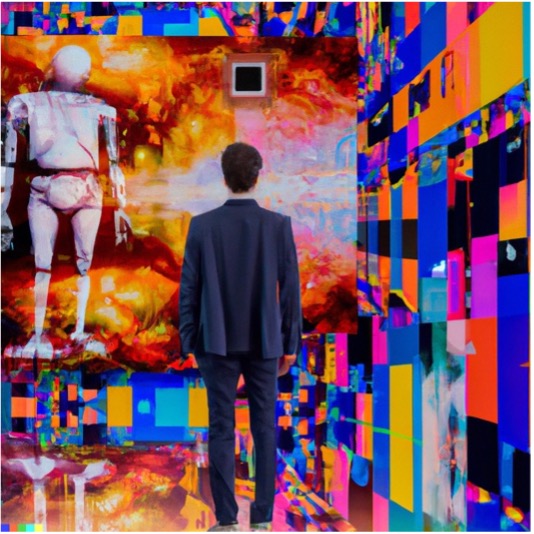

However, a more threatening concern that we wanted to highlight through this experience is how generative AI can create false but convincing information or ideas that can influence one’s beliefs and opinions. For instance, the computer scientist and researcher at the MIT Media Lab, Dr Sarah Kim, “we” interviewed does not exist, it is merely an identity invented by ChatGPT upon our request. Similarly for the image, it was created by DALL-E, the text-to-image model developed by Open-AI, with a text description suggested by ChatGPT so that we could create an image of Dr Sarah Kim that fits the context of the article. If misused, the spread of misinformation and false narratives can lead to dangerous consequences such as political propaganda and manipulation.

Surely the tool still has its limitations and biases, but overall, we are very impressed and amazed by its ability to take requests and return valuable outputs almost instantly. But while generative AI can bring many benefits, it’s important to keep in mind its potential negative implications and to always utilize the tool responsibly.

We end this blog with a rap song written by ChatGPT.

Verse 1:

Generative AI’s the latest buzz,

ChatGPT’s what everyone does.

A tool so smart and oh so fast,

Gives us answers that’ll last.

But is this technology so great,

Or will it lead to our cognitive fate?

Verse 2:

We tried it out, we put it to the test,

To see what answers it could suggest.

With a detailed description, it delivered,

Results that left us quite a shiver.

But beware, it’s not all sunshine,

Misuse can lead to false narratives, refine.

Outro:

Surely the tool still has its flaws,

But overall, we’re in awe.

Generative AI, it’s a thrill,

Just use it responsibly and all will be still.

Share

“Is artificial intelligence making us dumber?” This is a question that has been on many people’s minds as generative AI continues to grow in popularity. With its applications in fields such as music, art, and healthcare, AI is poised to change the world in exciting ways. But there are also concerns about its impact on human intelligence and critical thinking.

One of the primary concerns is that relying solely on AI-generated content could reduce opportunities for developing original ideas. For example, if individuals solely rely on AI-generated news articles for information, they may not be exposed to diverse perspectives and may have limited opportunities for critical thinking and independent analysis. Similarly, if artists solely use AI to generate their works, they may not be challenged to come up with original ideas and may become less creative over time.

On the other hand, proponents of generative AI argue that it has the potential to enhance human intelligence and drive innovation. To get a better understanding of this perspective, we sat down with Dr. Sarah Kim, a computer scientist and researcher at the MIT Media Lab. According to Dr. Kim, “AI has the ability to process massive amounts of data at speeds that are not possible for humans, leading to more informed decisions and new avenues for creativity.” She goes on to say, “AI-generated content can also serve as a starting point for human artists, inspiring them to create something truly unique.”

In conclusion, the use of generative AI presents both potential risks and benefits. It is up to us to ensure that this technology is used in a way that promotes the advancement of humanity while avoiding negative impacts on human intelligence and critical thinking. Whether AI makes us dumber or not ultimately depends on how we choose to use it.

ChatGPT, the generative AI model created by OpenAI, has caught our attention lately, and probably yours too. The tool has taken the internet by storm since its public launch for its ability to generate text that is coherent and appears to be written by a human. Our curiosity piqued, we just had to try it out for ourselves and see the extent of its capabilities. And guess what? This very article that you have just read was generated by ChatGPT (with our inputs).

We began the process by asking ChatGPT one question: “tell me two reasons why generative AI makes us dumber and two counterarguments”. Getting answers from ChatGPT is straightforward and easy but getting the answers in a desired format and style is less so. But with a little trial and error, we were able to get some pretty impressive results. It is important that describe your requests as detailed as possible to generate the answer you wanted. For example, we asked ChatGPT to suggest a clickbait title for us, we also asked it to add a short interview with a computer scientist to support the counterargument, especially with credentials and a professional name to make it convincing. However, we did notice that with multiple requests, the tool could forget some of your previous requests. So, would it make us dumber? It depends, depending on how you use the tool, I think the above article made a sound argument.

However, a more threatening concern that we wanted to highlight through this experience is how generative AI can create false but convincing information or ideas that can influence one’s beliefs and opinions. For instance, the computer scientist and researcher at the MIT Media Lab, Dr Sarah Kim, “we” interviewed does not exist, it is merely an identity invented by ChatGPT upon our request. Similarly for the image, it was created by DALL-E, the text-to-image model developed by Open-AI, with a text description suggested by ChatGPT so that we could create an image of Dr Sarah Kim that fits the context of the article. If misused, the spread of misinformation and false narratives can lead to dangerous consequences such as political propaganda and manipulation.

Surely the tool still has its limitations and biases, but overall, we are very impressed and amazed by its ability to take requests and return valuable outputs almost instantly. But while generative AI can bring many benefits, it’s important to keep in mind its potential negative implications and to always utilize the tool responsibly.

We end this blog with a rap song written by ChatGPT.

Verse 1:

Generative AI’s the latest buzz,

ChatGPT’s what everyone does.

A tool so smart and oh so fast,

Gives us answers that’ll last.

But is this technology so great,

Or will it lead to our cognitive fate?

Verse 2:

We tried it out, we put it to the test,

To see what answers it could suggest.

With a detailed description, it delivered,

Results that left us quite a shiver.

But beware, it’s not all sunshine,

Misuse can lead to false narratives, refine.

Outro:

Surely the tool still has its flaws,

But overall, we’re in awe.

Generative AI, it’s a thrill,

Just use it responsibly and all will be still.

Share